FTX Token

3Commas issues security alert as FTX deletes API keys following hack

Automated crypto trading bot provider 3Commas issued a security alert after identifying certain FTX API keys being used to perform unauthorized trades for DMG cryptocurrency trading pairs on the FTX exchange. 3Commas and FTX conducted a joint investigation in relation to reports from users of unauthorized trades on the DMG trading pairs on FTX. The duo identified that hackers used new 3Commas accounts to perform the DMG trades adding that “The API keys were not taken from 3Commas but from outside of the 3Commas platform.” A subsequent investigation found fradulent websites posing as 3Commas were being used to phish API keys as users linked their FTX accounts. The FTX API keys were then used to perform the unauthorized DMG trades. 3Commas further suspects that hackers used 3rd-party browser...

British regulator lists FTX crypto exchange as ‘unauthorized’ firm

The Financial Conduct Authority (FCA), the chief financial regulator in the United Kingdom, issued a warning to Bahama-based crypto exchange FTX, claiming it operates without authorization. The company joined a growing list of unregistered cryptocurrency-related businesses that continue to outweigh those signed up with the FCA. A warning note, dated Sept. 16, claims that the firm “may be providing financial services or products in the UK without authorization.” Addressing the potential customers, the FCA notes that they won’t be able to get their money back or seek the protection of the Financial Services Compensation Scheme “if things go wrong.” By the end of August, the list of crypto companies registered with the FCA included 37 entities, with the Crypto.com becoming the latest to...

FTX revenue reportedly grew 1000% in one year, leaked documents reveal

FTX was among the many crypto exchanges with a front-row seat to witness the crypto hype of 2021, back when Bitcoin (BTC) and other cryptocurrencies hit their all-time highs. Driven by massive customer onboarding, partnerships, sponsorships and other factors, FTX’s revenue reportedly grew 1000% in 2021 — revealed internal documents. Audited financials of FY 2020-2021 show FTX witnessing a 1000% increase in revenue — growing from $90 million in 2020 to $1.2 billion in 2021, claimed CNBC alleging access to the documents. The revenue breakdown discloses a 1842.85% increase in operating income for FTX, from $14 million to $272 million in one year. The crypto exchange amassed $388 million in net income, a 2182.35% increase from last year’s $17 million. FTX has reportedly made $270 million in th...

Top 5 cryptocurrencies to watch this week: BTC, ETH, MATIC, FTT, ETC

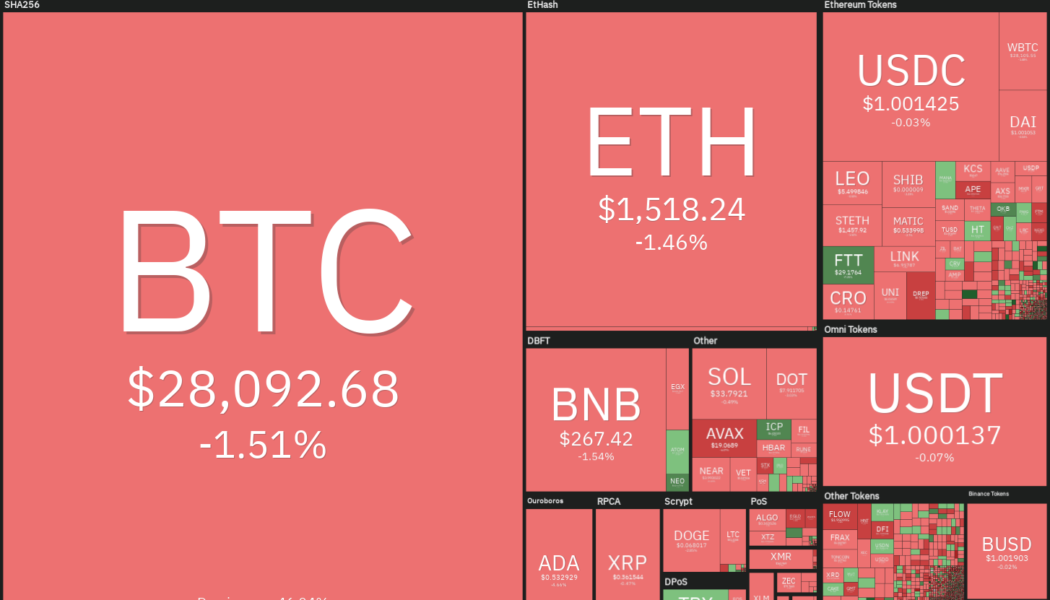

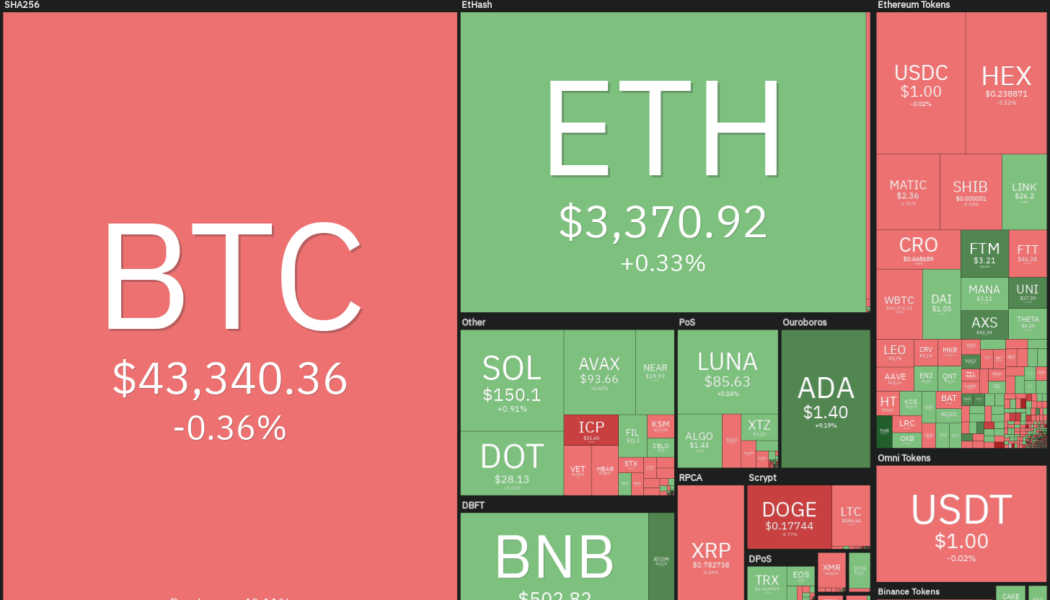

The United States equities markets recovered from their intra-week lows last week, suggesting demand exists at lower levels. On similar lines, Bitcoin (BTC) also recovered from $18,910 last week, indicating that traders may be getting back into risky assets. However, analysts remain divided in their opinion on the recovery in Bitcoin. While some believe that the relief rally is a bull trap, others expect the up-move to retest the crucial resistance at the 200-week moving average ($22,626). Crypto market data daily view. Source: Coin360 The current bear phase has damaged sentiment as seen from the Crypto Fear and Greed Index, which has remained in the “extreme fear” zone since May 6. According to Philip Swift, creator of on-chain analytics platform LookIntoBitcoin, the time spent...

Top 5 cryptocurrencies to watch this week: BTC, FTT, XTZ, KCS, HNT

Bitcoin (BTC) is threatening to drop to its worst weekly close since December of 2020. The crypto markets are in are held firmly in a vice grip and the selling accelerated following a higher-than-expected inflation report from the United States on June 10. It is not only the crypto markets that are facing the brunt, even U.S. equities markets finished the week ending June 10 with sharp losses. Risky assets may remain volatile in the near term as traders await the outcome of the U.S. Federal Open Market Committee meeting on June 14 and June 15. Crypto market data daily view. Source: Coin360 Bloomberg Intelligence senior commodities strategist Mike McGlone warned that if the stock markets continue to drop, then it will signal that most assets may have seen their peak exuberance in the ...

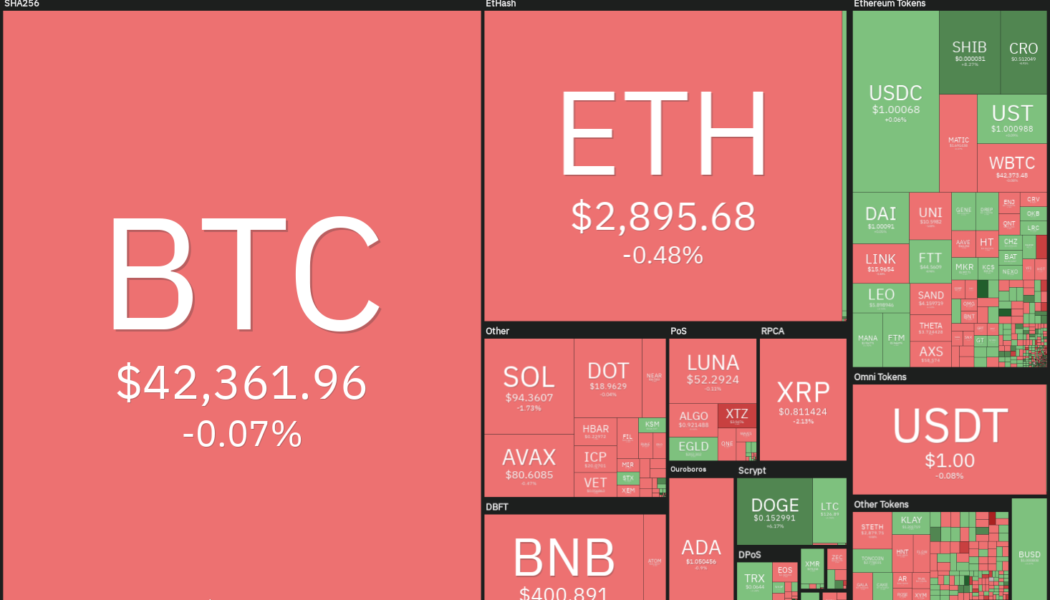

Top 5 cryptocurrencies to watch this week: BTC, NEAR, FTT, ETC, XMR

Bitcoin (BTC) dropped from a high of $47,200 on April 5 to a low of $42,107 on April 8, indicating possible selling by short-term traders who may have preferred to lock in their profits. However, the price action is still stuck in a tight range during the weekend, indicating that supply and demand are in balance. Although the Crypto Fear & Greed Index is in the fear zone, Bitcoin whales on crypto exchange Bitfinex remained unfazed and continued to purchase BTC. Interestingly, one large investor continued to buy $1 million of Bitcoin every day, without attempting to time the market, using the strategy of dollar-cost averaging. Crypto market data daily view. Source: Coin360 Another whale that utilized the dip to add more Bitcoin to its existing stockpile was Terra. This week, the wallet ...

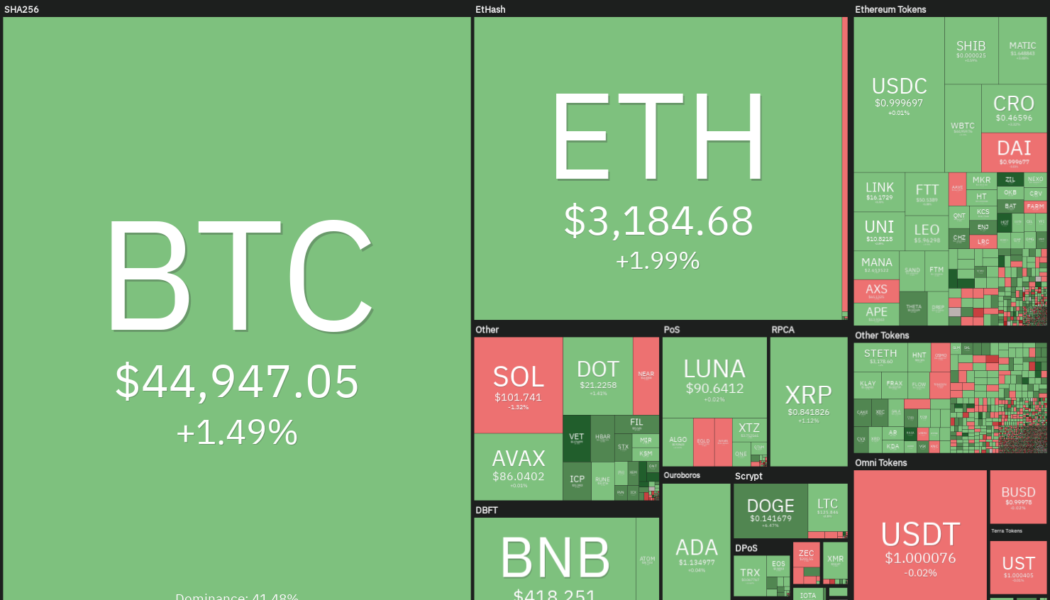

Top 5 cryptocurrencies to watch this week: BTC, ADA, AXS, LINK, FTT

Bitcoin (BTC) is attempting to notch its second successive weekly gains and end at the highest weekly closing price year-to-date. According to on-chain data from Glassnode, the recovery in Bitcoin’s price was driven by demand in the spot markets. This is likely to cheer the bulls because history suggests that spot market demand leads to sustained upside. Another positive sign is the strong demand for the ProShares Bitcoin Strategy exchange-traded fund (BITO) in the past two weeks, which pushed its exposure to a record high. Arcane Research said the strong inflows “suggest that Bitcoin appetite through traditional investment vehicles is increasing.” Crypto market data daily view. Source: Coin360 Along with Bitcoin, the broader crypto space is also attracting investors. According to re...

Top 5 cryptocurrencies to watch this week: BTC, XRP, CRO, FTT, THETA

Bitcoin (BTC) has given back some of its recent gains, but on-chain data resource Ecoinometrics said that whales are accumulating because they believe the price is attractive from a long-term perspective. On the downside, analyst Willy Woo believes that $33,000 is a strong bottom for Bitcoin. Popular Twitter trader Credible Crypto citing data from PlanC said that the odds of Bitcoin declining below $30,000 are poor. Crypto market data daily view. Source: Coin360 Fidelity Digital Assets Head of Research Chris Kuiper believes that Bitcoin’s downside risk could be minimal when compared to other digital assets, but it could rally substantially if it manages to replace gold as a store of value. Could Bitcoin and altcoins stage a recovery after the recent pullback? Let’s study th...

Top 5 cryptocurrencies to watch this week: BTC, NEAR, ATOM, FTM, FTT

Bitcoin (BTC) has stopped its decline and is attempting a recovery along with select altcoins. Some traders have been fearing a massive sell-off in Bitcoin but Capriole CEO Charles Edwards said that Bitcoin’s worst crashes have happened “due to miner capitulation (December 2018 and March 2020), when BTC fell below production costs.” However, the current production cost of Bitcoin was $34,000, which is well below the current price. In a sign that institutional investors remain bullish on the crypto sector even after the recent fall, Cathie Wood’s Ark Invest bought 6.93 million shares of the special purchase acquisition company that will merge with Circle, the principal operator of USD Coin (USDC) and the second-largest stablecoin in terms of market capitalization. Crypto market data d...

- 1

- 2