FTX Token

FTX profited from Sam Bankman-Fried’s inflated coins: Report

Sam Bankman-Fried, the former CEO of the FTX crypto exchange, used his influence in the crypto industry to inflate some coins prices through a coordinated strategy with FTX’s sister company, Alameda Research, a New York Times report claimed on Jan. 18. As a way to keep FTX and the companies under its umbrella profitable, Bankman-Fried allegedly approached developers behind projects, insisting that they make their trading debuts on the exchange’s platform. Following that, the report claimed, Alameda Research would buy some of these freshly listed coins to raise their value. Bankman-Fried thenallegedly relied on his popularity to advertise the projects and persuade the crypto community to invest in these “Samcoins.” As a result, Alameda appeared to be in a stronger position than it actually ...

Sam Bankman-Fried to reportedly plead not guilty to criminal charges

Former FTX CEO Sam Bankman-Fried (SBF), currently free on a $250 million bail bond, will reportedly plead not guilty to the alleged FTX and Alameda-related financial frauds in court on Jan. 3. SBF was arrested in the Bahamas at the request of the U.S. government under suspicion of defrauding investors and misappropriation of funds held on the FTX crypto exchange. Following a court hearing on Dec. 22, SBF was released on bail and is slated to appear on court on Jan.3 before U.S. District Judge Lewis Kaplan in Manhattan. During the hearing, SBF is expected to enter a plea of not guilty to the criminal charges, according to a Reuters report. On Dec. 13, the SEC charged the former FTX CEO with violating the anti-fraud provisions of the Securities Act of 1933 and the Securities Exchange Act of ...

FTX customers file class-action lawsuit to get priority reparations

While the government agencies are queuing to sue the FTX and its founder Sam Bankman-Fried, the group of former customers made an effort to get their money back first. A class lawsuit initiated by four individuals demands priority access to frozen funds of the company for its customers, not investors. The lawsuit was filed on Dec. 27 in the United States Bankruptcy Court for the District of Delaware. Four plaintiffs claim to be representing the whole class of former FTX customers, which might amass up to 1 million individuals. What the lawsuit seeks to obtain are the priority rights to return digital assets held by FTX US or FTX.com to its customers. The plaintiffs emphasize that the FTX User Agreement did not permit the platform to use customer funds for its own purposes, including ...

Sam Bankman-Fried found ‘chilling’ in JFK airport lounge on $250M bail bond

The momentary arrest of former FTX CEO Sam Bankman-Fried (SBF) can be attributed to the efforts taken by the crypto community to aid investigations and track down the whereabouts of the infamous entrepreneur. While SBF eventually escaped prison time via a $250 million bail bond, the community continues to monitor his every move publicly. Just three days after being released on a personal recognizance bond, a crypto community member allegedly spotted SBF “chilling” in a John F. Kennedy International Airport lounge. The supporting images were shared on Twitter by @litcapital, which shows SBF sitting on a lounge chair with access to a laptop and mobile phone. Sam Bankman-Fried found at the JFK airport lounge. Source: Twitter Based on the pictures, other community members confirmed that SBF’s ...

Democrats to reportedly return over $1M of SBF’s funding to FTX victims

Following the arrest of former FTX CEO Sam Bankman-Fried (SBF), three prominent Democratic groups have reportedly decided to return over $1 million to investors that lost their funds due to misappropriation. On Dec. 16, the Democratic National Committee (DNC), the Democratic Senatorial Campaign Committee (DSCC) and the Democratic Congressional Campaign Committee (DCCC) pledged to return SBF’s political donations after the entrepreneur was charged with eight counts of financial crimes. A DNC spokesperson reportedly confirmed this decision when speaking to a media outlet, the Verge: “Given the allegations around potential campaign finance violations by Bankman-Fried, we are setting aside funds in order to return the $815,000 in contributions since 2020. We will return as soon as we receive p...

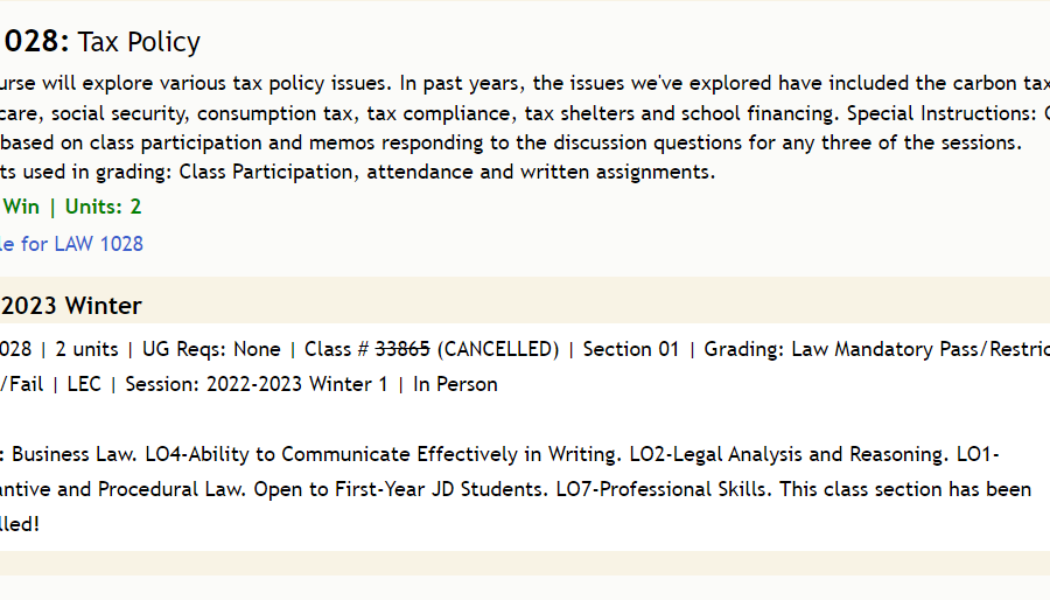

Sam Bankman-Fried’s parents no longer on the Stanford Law School roster

The domino effect of FTX CEO Sam Bankman-Fried’s actions came full circle as his reputation began impacting the professional lives of his parents — Stanford Law professors Joseph Bankman and Barbara Fried. SBF’s father, Bankman, had to cancel his winter session course on tax policy, which according to The Standford Daily, was at a time when the family was accused of acquiring an FTX-owned $16.4 million vacation home before the crypto exchange’s collapse. Stanford Law professor Joseph Bankman’s tax policy course was canceled. Source: explorecourses.stanford.edu On the other hand, SBF’s mother, Fried, was surprisingly not even listed as an instructor for any of the courses. While this event coincides with FTX’s fallout, where Fried became a focal point of discussion owing to her ...

FTT investors’ claims to be investigated for securities laws violations

To help out the recently duped investors of FTX Tokens (FTT), shareholder rights litigation firm — Schall Law Firm — has taken up the task of investigating the investors’ claims against FTX for violations of the securities laws. It is estimated that over one million people have lost their life savings owing to the financial fraud committed by FTX CEO Sam Bankman-Fried. To help the investors legally recoup losses, the law firm plans to investigate FTX for issuing misleading statements or failing to disclose crucial information. In an official statement, Schall Law Firm highlighted how various media publications uncovered the cracks within FTX-Alameda operations, eventually leading to the crash of FTX’s in-house FTT tokens. The law firm advised all FTT investors to participate in the drive b...

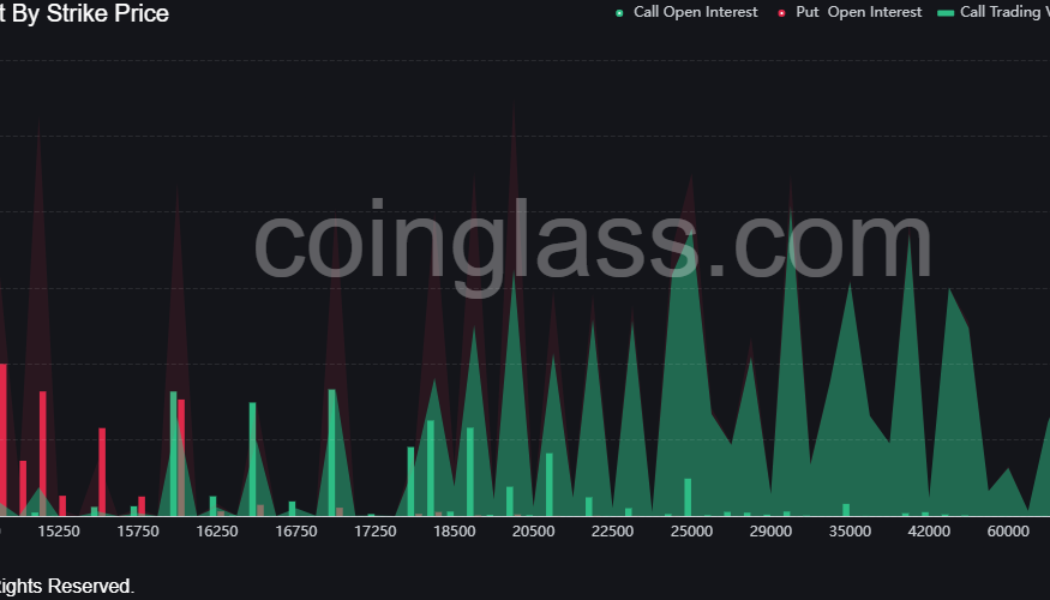

Why is Bitcoin price down today?

Bitcoin (BTC) price accelerated its sell-off on Nov. 21 to hit a new yearly low at $15,654. The move follows a market-wide decline that was catalyzed by investors running for the hills in fear that the FTX-induced contagion would infect every corner of the crypto sector. Stocks also closed the day in the red, with the tech-heavy Nasdaq down 1% and the S&P 500 losing 0.42% on the back of investors’ concerns about rising interest rates. Data from Coinglass shows over $100 million in leverage longs were liquidated on Nov. 20 and Nov. 21 as investors fear an accelerated sell-off if Digital Currency Group (DCG) and BlockFi fail to secure funding and are forced to declare bankruptcy. BTC open interest by strike price. Coinglass Some analysts are betting on Bitcoin price declining below...

Bankrupt crypto exchange FTX begins strategic review of global assets

As part of the recent bankruptcy filing, the defunct crypto exchange FTX, along with 101 of the 130 affiliated companies, announced the launch of a strategic review of their global assets. The review is an attempt to maximize recoverable value for stakeholders. FTX, at the time led by CEO Sam Bankman-Fried (SBF), filed for Chapter 11 bankruptcy on Nov. 11 after being caught misappropriating user funds. The bankruptcy filing sought to cushion the losses of stakeholders connected to FTX and affiliated companies, a.k.a FTX debtors. 1/ Sharing a Press Release issued early today – FTX launches strategic review of its global assets. Text below (and link). https://t.co/wxz9MYnXrn — FTX (@FTX_Official) November 19, 2022 FTX debtors are in talks with financial services firm Perella Wein...

South Korea investigates crypto exchanges for listing native tokens

Native cryptocurrencies turned out to be the biggest factor contributing to the demise of numerous exchanges and ecosystems this year, most recently during the FTX collapse. Korea’s financial authority, Korea Financial Intelligence Unit (KoFIU), took notice of the same as it launched a probe into crypto exchanges in relation to listing their in-house, self-issued tokens. Crypto exchange FTX and its 130 affiliate firms recently filed for bankruptcy due to a price crash of its in-house token, FTX Token (FTT). While Korean crypto exchanges are barred from issuing native tokens, KoFIU’s probe into the same is to ensure regulatory adherence for investor’s safety, according to a local report. Initial investigations revealed that all crypto exchanges performed lawful operations across South...

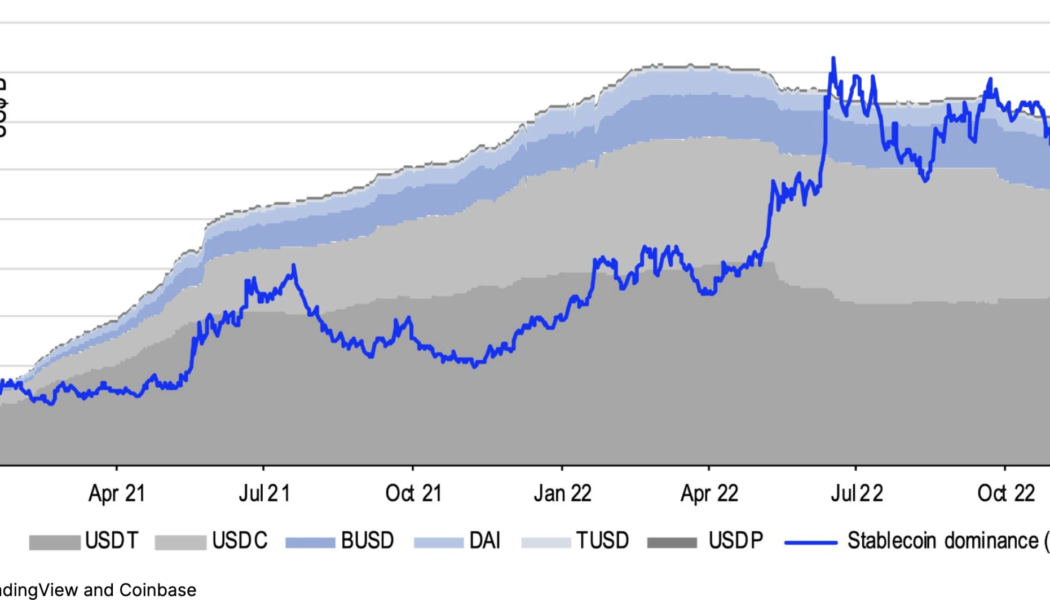

FTX crisis could extend crypto winter to the end of 2023: Report

The FTX crisis has deterred investor confidence and created a liquidity crisis in the crypto market, which could very well extend the crypto winter until the end of 2023, according to a new report. A research report from Coinbase analyzing the fallout in the crypto ecosystem in the wake of the FTX collapse noted that the implosion of the world’s third-largest crypto exchange has created a liquidity crisis that may contribute to an extended crypto winter. Many institutional investors in FTX had their investments stuck on the platform after it filed for bankruptcy on Nov. 11. The FTX implosion has also deterred investors and large buyers away from the crypto ecosystem. Coinbase highlighted that the stablecoin dominance has reached a new high of 18%, indicating that the liquidity crisis might...

Binance to liquidate its entire FTX Token holdings after ‘recent revelations’

The CEO of cryptocurrency exchange Binance, Changpeng “CZ” Zhao, said his company will liquidate the entirety of its position in FTX Token (FTT), the native token of competing exchange FTX. In a Nov. 6 tweet, Zhao said the decision was made after “recent revelations that have came to light.” In a later tweet, CZ explained the FTT liquidation was “just post-exit risk management” referring to lessons learned from the fall of Terra Luna Classic (LUNC) and how it impacted market players. He also added “we won’t support people who lobby against other industry players behind their backs.” Liquidating our FTT is just post-exit risk management, learning from LUNA. We gave support before, but we won’t pretend to make love after divorce. We are not against anyone. But we won’t supp...

- 1

- 2