fraud

Crypto community weighs in on SBF’s ‘apology tour’

The former CEO of FTX, Sam “SBF” Bankman-Fried, has seemingly begun to embark on an apology tour to redeem his image a month after the sudden implosion of FTX, which revealed that the exchange had been improperly using customer and investor funds. OnNov. 30, Bankman-Fried made his first live public appearance since the collapse of FTX — answering a number of questions during the DealBook Summit in New York. During the interview, Bankman-Fried claimed to have “unknowingly commingled funds” between Alameda and customer funds at FTX. He shared: “I unknowingly commingled funds. […] I was frankly surprised by how big Alameda’s position was, which points to another failure of oversight on my part and failure to appoint someone to be chiefly in charge of that.” In another interv...

SBF’s lawyers terminate FTX representation due to conflicts of interest

Paul, Weiss, the law firm backing FTX CEO Sam Bankman-Fried (SBF) amid bankruptcy, renounced representing the entrepreneur, citing a conflict of interest. The decision to withdraw from representation after SBF’s tweets were found to disrupt the law firm’s reorganization efforts. Starting Nov. 14, SBF published a series of tweets that amassed extensive attention across Crypto Twitter. The move, however, sparked speculations that the cryptic tweets were used to distract bots from noticing concurrently deleted tweets. While no ill-intent could be concluded, Paul, Weiss attorney Martin Flumenbaum believed that SBF’s “incessant and disruptive tweeting” was negatively impacting the reorganization efforts: “We informed Mr. Bankman-Fried several days ago, after the filing of the FTX bankruptcy, th...

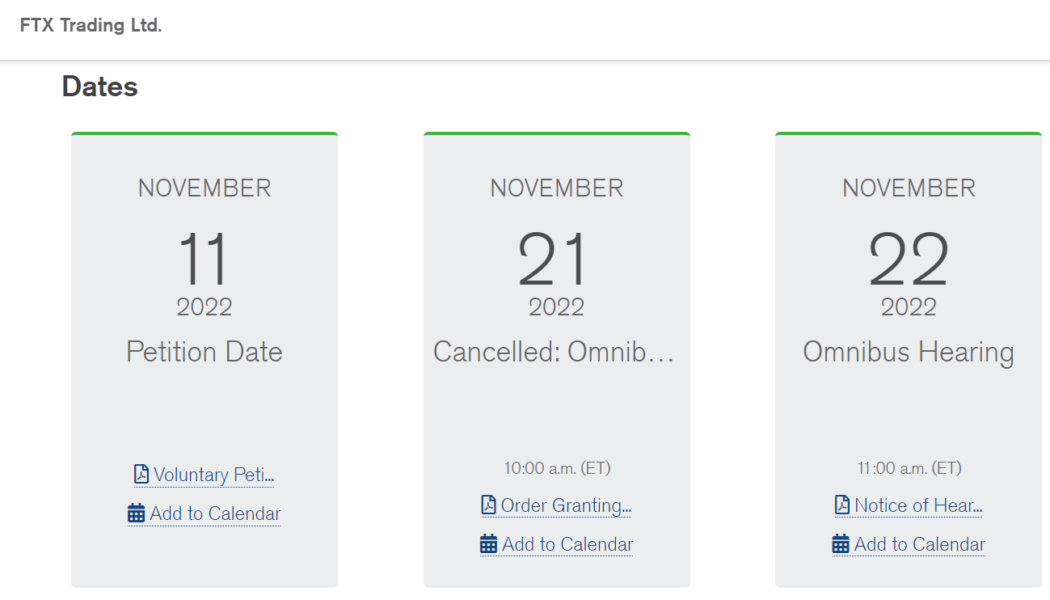

Bankrupt crypto exchange FTX begins strategic review of global assets

As part of the recent bankruptcy filing, the defunct crypto exchange FTX, along with 101 of the 130 affiliated companies, announced the launch of a strategic review of their global assets. The review is an attempt to maximize recoverable value for stakeholders. FTX, at the time led by CEO Sam Bankman-Fried (SBF), filed for Chapter 11 bankruptcy on Nov. 11 after being caught misappropriating user funds. The bankruptcy filing sought to cushion the losses of stakeholders connected to FTX and affiliated companies, a.k.a FTX debtors. 1/ Sharing a Press Release issued early today – FTX launches strategic review of its global assets. Text below (and link). https://t.co/wxz9MYnXrn — FTX (@FTX_Official) November 19, 2022 FTX debtors are in talks with financial services firm Perella Wein...

Crypto scammers are using black market identities to avoid detection: CertiK

Crypto scammers have been accessing a “cheap and easy” black market of individuals willing to put their name and face on fraudulent projects — all for the low price of $8, blockchain security firm CertiK has uncovered. These individuals, described by CertiK as “Professional KYC actors” would, in some cases, voluntarily become the verified face of a crypto project, gaining trust in the crypto community prior to an “insider hack or exit scam.” Other uses of these KYC actors include using their identities to open up bank or exchange accounts on behalf of the bad actors. According to a Nov. 17 blog post, CertiK analysts were able to find over 20 underground marketplaces hosted on Telegram, Discord, mobile apps, and gig websites to recruit KYC actors for as low as $8 for simple “gigs” lik...

Terra Labs, Luna Guard commission audit to defend against allegations of misusing funds

The Luna Foundation Guard (LFG) and Terraform Labs (TFL) commissioned a technical audit of their efforts to defend the price of TerraUSD (UST) between May 8 and 12, 2022. The audit was intended to answer “allegations posed in social media” about the fate of funds transferred during efforts to defend the UST dollar peg, according to the LFG blog. The audit found that LFG spent 80,081 Bitcoins (BTC) and $49.8 million in stablecoins (about $2.8 billion at the time) to defend the UST peg. That was consistent with what LFG indicated in its tweets on May 16. In addition, TFL spent $613 million to defend the peg. The audit was conducted by U.S. consulting firm JS Held. LFG concluded that the audit results show there was no misuse of funds and no funds were used to benefit insiders. Furthermo...

Industry exec explains why NFT fraud protection falls on brand and not marketplaces

Nonfungible token (NFT) marketplaces should commit to combat fraudulent NFTs, but brands are far more responsible for protecting NFT investors, according to one industry executive. Brands that issue NFTs should be taking the first step to protecting themselves and potential investors from fraud, BrandShield CEO Yoav Keren said in an interview with Cointelegraph on Oct. 12. According to Keren, it’s more straightforward for a brand to recognize NFTs that were not released by the company itself rather than marketplaces like OpenSea or Rarible. NFT marketplaces usually have fewer insights into which brands are creating NFTs when they are launching and other details, the CEO noted. Although marketplaces should not be negligent of the reality of NFT fraud, it’s still a must for brands to keep th...

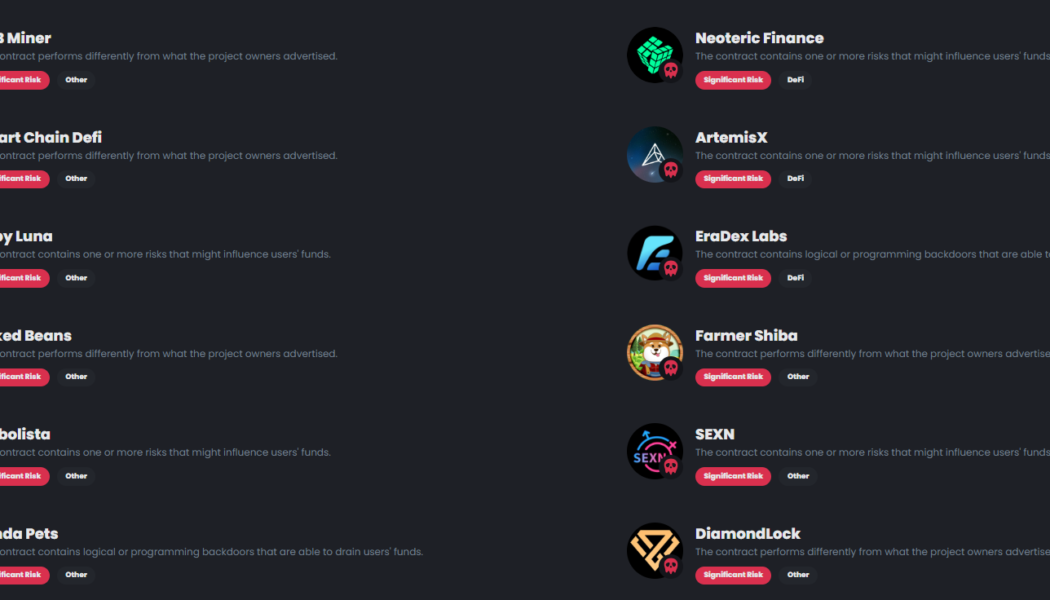

Pandas, cyborgs, dogs, koalas dominate BNB Chain Red Alarm flag list

BNB Chain, a blockchain network created by crypto exchange Binance, identified over 50 on-chain projects that pose a significant risk to the users. A mix of crypto spin-offs resembling Dogecoin (DOGE) and Binance and others dedicated to pandas, cyborgs and koalas made the list as untrustworthy and high-risk projects. BNB Chain’s Red Alarm feature, which was implemented to protect investors from potential rug pulls and scams, flagged projects based on two main criteria — if the contract performs differently from what the project owners advertised or if the contract shows risks that might influence users’ funds. Speaking to Cointelegraph, Gwendolyn Regina, Investment Director at BNB Chain, said that the Red Alarm system analyzed 3,300 contracts just in July, adding that the company con...

Fed demands Voyager remove ‘false’ claims deposits are FDIC insured

Cypto lender Voyager Digital has been directed to remove “false and misleading” statements that its user’s deposit accounts are FDIC insured. In a joint letter written on July 28 by Seth Rosebrockfrom & Jason Gonzalez, Assistant General Counsel at the Federal Reserve and the Federal Deposit Insurance Corporation (FDIC) to Voyager Digital, the authors said the representations “likely misled and were relied upon” by customers who placed funds with Voyager who now no longer have access to it. “These representations are false and misleading and, based on the information we have to date, it appears that the representations likely misled and were relied upon by customers who placed their funds with Voyager and do not have immediate access to their funds.” The Fed and FDIC allege that V...