Forex

Naira stable at parallel, official market

Nigeria’s naira remained stable against the U.S. dollar at the unofficial market on Friday, data posted on abokiFX .com, a website that collates parallel market rates in Lagos showed. The data posted showed that the naira closed at N485.00 at the black market, the same rate it exchanged hands with the greenback in the previous session on Thursday. Similarly, the local unit remained stable at the official market. Data posted on the FMDQ Security Exchange window where forex is officially traded showed that the domestic unit again closed at N410.00 at the trading session of the NAFEX window on Friday. Friday’s performance came to be as forex supply slumped significantly. The naira experienced an intraday high of N394.00 and a low of N436.40 before closing at N410.00 on Friday, the same rate i...

Wheat farmers bemoan $6.1 billion annual import, laud CBN restriction on forex for importers

The Wheat Farmers Association of Nigeria (WFAN) says about $6.1 billion is spent yearly to import wheat into Nigeria. The President of the association, Alhaji Salim Muhammad, made this known at a news conference on Wheat Forex in Abuja on Thursday. Muhammad commended the Central Bank of Nigeria (CBN) over the policy that placed wheat on Forex restriction. He described it as an impressive policy and a welcome development. According to him, Nigeria consumes 5 million metric tons of wheat per annum, while a meagre 420,000 tons is produced locally. He said that in view of numerous challenges that plagued local production, the policy would enable the government to unlock the unrealised potentials in the wheat sub-sector. “The forex restriction policy will give relevant stakeholders the confiden...

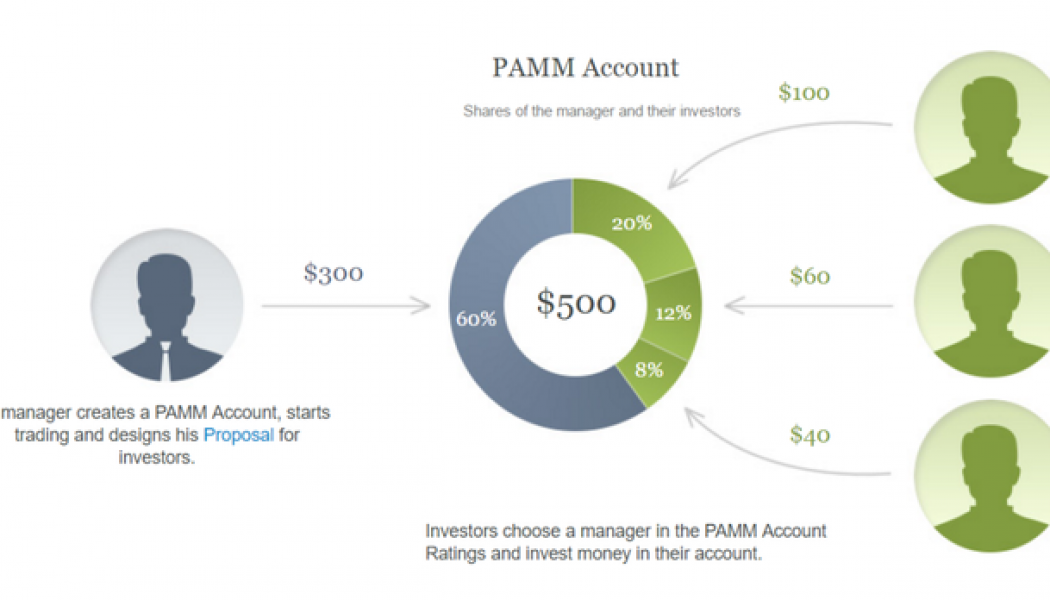

What are PAMM accounts?

Forex is a virtual market, not restricted to any location, be it London or Johannesburg. This trading platform is available 24 hours a day, as the world’s banks operate in different time zones. This is the key difference between Forex and the “traditional” stock exchange. All you need to work on the financial market is a stable Internet connection and access to the platform offered by the intermediary. For most clients, a prime broker represents such a guarantee. All rights and responsibilities of the client and the intermediary are stipulated in the contract. Forex exchange rates change rapidly during the trading day. Positive or negative tendency is shaped by various factors, such as global political changes, economic performance, policy of national financial institutions and...

- 1

- 2