FOMC

BTC price sees ‘double top’ before FOMC — 5 things to know in Bitcoin this week

Bitcoin (BTC) begins a key week of internal and macroeconomic events still trading above $20,000. After its highest weekly close since mid-September, BTC/USD remains tied to higher levels within a macro trading range. The bulls have been keen to shift the trend entirely, while warnings from more conservative market participants continue to call for macro lows to enter next. So far, a tug-of-war between the two parties is what has characterized BTC price action, and any internal or external triggers have only had a temporary effect. What could change that? The first week of November contains a key event that has the potential to shape price behavior going forward — a decision by the United States Federal Reserve on interest rate hikes. In addition to other macroeconomic data, this will form...

Bitcoin price dives pre-FOMC amid warning $17.6K low was not the bottom

Bitcoin (BTC) dropped to weekly lows at the Aug. 17 Wall Street open as upcoming Federal Reserve comments unsettled risk assets. BTC/USD 1-hour candle chart (Bitstamp). Source: TradingView Dollar climbs as Fed minutes due Data from Cointelegraph Markets Pro and TradingView tracked a more than 2% daily decline in BTC/USD, which hit $23,325 on Bitstamp. Already showing signs of weakness, the pair slid further as United States equities began trading, hours before the Federal Open Markets Committee (FOMC) was due to release minutes from its latest meeting. While not involving a decision on interest rates, the meeting was cued to give an insight into the Fed’s thinking in terms of the next rate tweak due in September. “The important event tonight with the FOMC minutes, through which information...

Bitcoin struggles to flip $24K to support, but data shows pro traders stacking sats

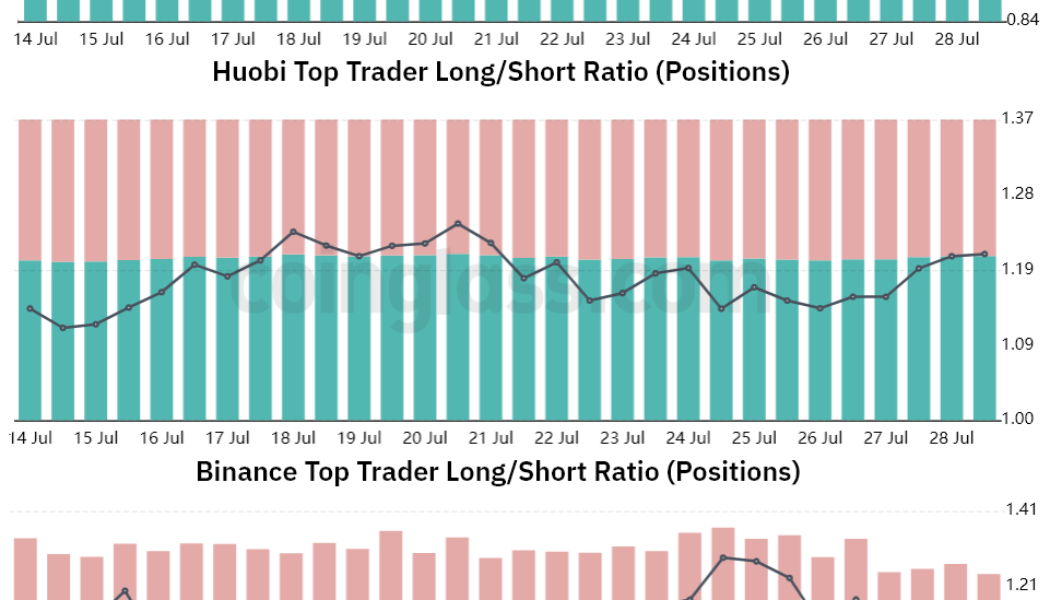

Bitcoin (BTC) rallied on the back of the United States Federal Reserve’s decision to hike interest rates on July 27. Investors interpreted Federal Reserve chairman Jeremy Powell’s statement as more dovish than the previous FOMC committee meeting, suggesting that the worst moment of tight economic policies is behind us. Another positive news for risk assets came from the U.S. personal consumption expenditures price (PCE) index, which rose 6.8% in June. The move was the biggest since January 1982, reducing incentives for fixed income investments. The Federal Reserve focuses on the PCE due to its broader measure of inflation pressures, measuring the price changes of goods and services consumed by the general public. Additional positive news came from Amazon after the e-commerce giant re...

Bitcoin heads into FOMC day on 24-hour highs amid concern over $24.3K top

Bitcoin (BTC) attempted to claw back losses on July 27 as a macro day of reckoning arrived for risk assets. BTC/USD 1-hour candle chart (Bitstamp). Source: TradingView Analysis: $24,300 resistance “not a good sign” Data from Cointelegraph Markets Pro and TradingView confirmed a 24-hour high for BTC/USD prior to the Wall Street open on July 27. The pair had sunk below $21,000 in the first portion of the week, heightening nervousness among traders already wary of potential headwinds from the United States Federal Reserve. Likely chop for equities going into FOMC which expected $BTC and crypto chop around also today pic.twitter.com/GDj0GwlDXy — Rager (@Rager) July 26, 2022 July 27 is set to reveal the Federal Open Markets Committee‘s (FOMC) next base rate hike, expectations flitting between 7...