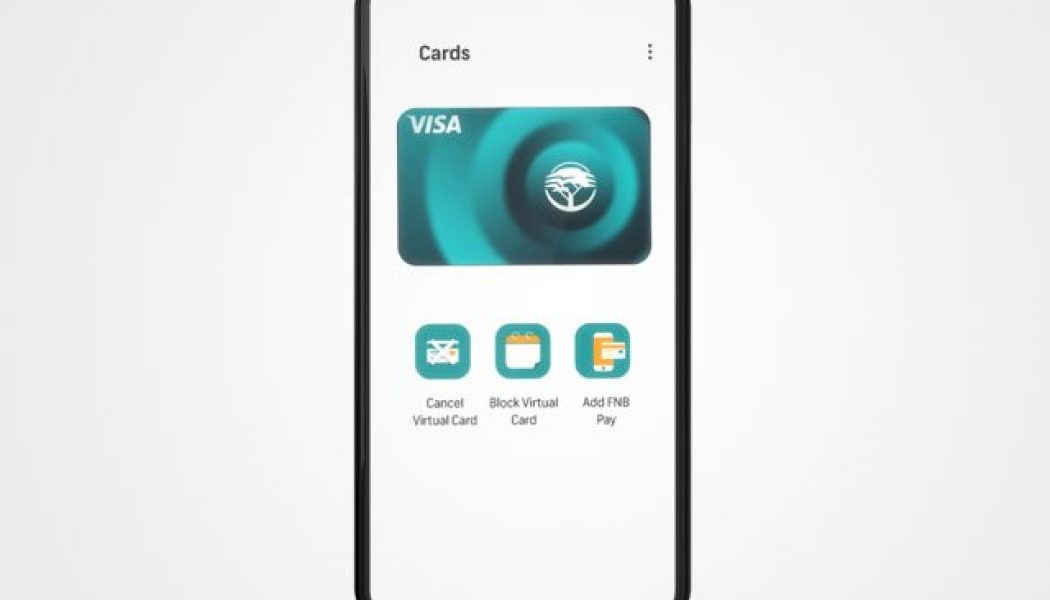

FNB Virtual Card

Streaming Subscriptions Jump Up by 70% in South Africa

We use cookies on our website to give you the most relevant experience by remembering your preferences and repeat visits. By clicking “Accept All”, you consent to the use of ALL the cookies. However, you may visit “Cookie Settings” to provide a controlled consent.

FNB Posts Interim Results, Sees Robust Increase in Profits

We use cookies on our website to give you the most relevant experience by remembering your preferences and repeat visits. By clicking “Accept All”, you consent to the use of ALL the cookies. However, you may visit “Cookie Settings” to provide a controlled consent.

6 New Ways You Can Tap & Pay with FNB’s Virtual Card

We use cookies on our website to give you the most relevant experience by remembering your preferences and repeat visits. By clicking “Accept All”, you consent to the use of ALL the cookies. However, you may visit “Cookie Settings” to provide a controlled consent. You Deserve to Make Money Even When you are looking for Dates Online. So we reimagined what a dating should be. It begins with giving you back power. Get to meet Beautiful people, chat and make money in the process. Earn rewards by chatting, sharing photos, blogging and help give users back their fair share of Internet revenue.

7 Benefits of Virtual Cards for Businesses

Virtual bank cards are set to take businesses across a new digital frontier, improving banking safety parameters while offering a convenient payment experience. Lauren Deva, Pillar Head for Commercial Transactional Pillar at FNB Commercial, says the move towards virtual cards in South Africa is an essential one for the digital transformation journey of businesses. Moreover, it coincides with the phasing out of cheques, which are no longer accepted as a valid payment method. With that in mind, here are 7 key benefits of Virtual Cards for businesses: Businesses can easily facilitate business-to-business payments. The Virtual Card removes the need for individual corporate cards as it can be safely used by multiple people and the CVV constantly updates. Considerably reduces the risk of on...

FNB Launches Virtual Card Service

FNB has launched its virtual card service to all individual and business customers. The Virtual Card is accessible via the FNB App and the RMB Private Banking apps. With this service, customers no longer need to rely on a physical card at merchants that have Tap-to-Pay functionality as they can either use an Android smart device or an Apple device where the merchant accepts QR Code payments. “Customers can immediately load the Virtual Card on their FNB and/or RMB Private Bank profile and link it to a debit, credit or fusion account at no additional cost to shop safely and conveniently,” says FNB. These customers are also able to create multiple virtual cards for dedicated transactions at no extra cost. /* custom css */ .tdi_3_166.td-a-rec-img{ text-align: left; }.tdi_3_166.td-a-rec-img img...

Use of Digital Payments is Growing Rapidly in South Africa

Sourced from Htxt.Africa The accelerating rate at which retail merchants are enabling consumers to pay digitally at point of sale is said to be fueling the growth of digital payments in South Africa. This is according to FNB, which revealed that its Scan-to-Pay and Tap-to-Pay functionality on the FNB APP recorded the highest month-on-month usage growth in August 2020 since launch. The Bank states that month-on-month transaction volumes on Scan-to-Pay – which allows users to scan a QR Code to make secure payments at a physical point of sale or on an online merchant website – grew by 36% in August while values increased by 39%. Similarly, month-on-month usage of Tap-to-Pay functionality – which allows users to pay for goods by simply tapping their smartphone to pay at a point of sale – incre...