FNB south Africa

FNB Records Nearly 2 Million Virtual Card Users Just 1 Year After Launch

We use cookies on our website to give you the most relevant experience by remembering your preferences and repeat visits. By clicking “Accept All”, you consent to the use of ALL the cookies. However, you may visit “Cookie Settings” to provide a controlled consent.

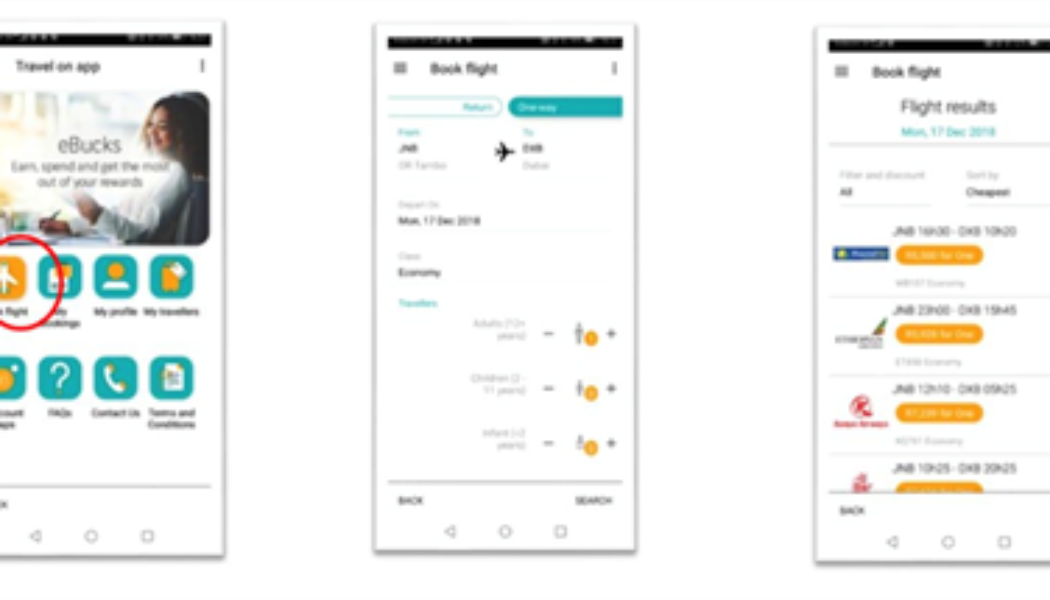

Get Up to 40% Off When You Book a Flight on the FNB App

We use cookies on our website to give you the most relevant experience by remembering your preferences and repeat visits. By clicking “Accept All”, you consent to the use of ALL the cookies. However, you may visit “Cookie Settings” to provide a controlled consent. You Deserve to Make Money Even When you are looking for Dates Online. So we reimagined what a dating should be. It begins with giving you back power. Get to meet Beautiful people, chat and make money in the process. Earn rewards by chatting, sharing photos, blogging and help give users back their fair share of Internet revenue.

FNB Adds New Smart ID Collection Points in KwaZulu-Natal

Sourced from Htxt.Africa /* custom css */ .tdi_4_d94.td-a-rec-img{ text-align: left; }.tdi_4_d94.td-a-rec-img img{ margin: 0 auto 0 0; } FNB in partnership with the Department of Home Affairs (DHA) has added the FNB Cornubia branch in KwaZulu-Natal, South Africa, to the list of branches where customers can collect their Smart ID cards and passports. The bank’s customers in the province can now apply via the Department of Home Affairs’ online booking system and are be able to collect their Smart IDs and Passports at FNB’s Cornubia branch. “We are thrilled to add yet another branch outside of Gauteng to expand our reach,” says Chief Executive of FNB Points of Presence, Lee-Anne van Zyl. /* custom css */ .tdi_3_534.td-a-rec-img{ text-align: left; }.tdi_3_534.td-a-rec-img img{ margin: 0 auto 0...

Contactless Payment Methods Beat Traditional Options for the First Time

Sourced from Htxt.Africa South African bank, FNB has revealed that contactless payments have surpassed Chip and PIN contact payments for the first time ever among its Credit, Debit, Fusion, and Virtual Card users. The Bank attributes the behavioural shift (from chip contact to contactless) to consumer’s preference and awareness of safer, convenient, and quicker means to pay at a Point-of-Sale. “This is a remarkable milestone for the financial services industry, and it augurs well for efforts to improve safety and convenience in the payments network,” says Raj Makanjee, Payments Executive at FNB. “With over 10 million contactless cards in the hands of our customers and 200 000 Virtual Cards activated, we are delighted to see our customers pioneering what we believe to be the future of payme...

FNB Expects 10% eCommerce Transaction Boost on Black Friday

FNB says that it is expecting a 10% increase in the total number of eCommerce transactions over Black Friday and Cyber Monday – as many consumers who participate in Black Friday may opt to shop online instead of going into brick and mortar stores. This is comparable to 2019 where Black Friday weekend transaction volumes on FNB POS (Point of Sale) devices grew by 32% compared to 2018, while eCommerce transactions grew over 30%. FNB also says that its merchants have also upped their game by investing in their platforms to ensure a seamless sales experience, regardless of the types of devices used by consumers when shopping. One such example is increased support for QR Code payments, where the customer opts to checkout through simply scanning the presented QR Code to pay. FNB Virtual Cr...

FNB Virtual Credit Card Delayed, Confirms CEO

FNB Card CEO, Chris Labuschagne has revealed that the bank will delay the launch of its virtual credit cards until 2021 – a strategic move that is said to “ensure that the launch process goes as smoothly as possible for its customers”. “FNB is excited to confirm that it has successfully completed the pilot of its Virtual Card. In order to enable a seamless transition for customers, the Bank has decided to delay the launch of its Virtual Card to 2021,” say Labuschagne in a statement to My Broadband. “We are excited at the prospect of offering exceptional customer experience and a convenient and safer way to help customers manage money.” The bank unveiled the virtual credit cards – along with debit cards – earlier this year. Raj Makanjee, FNB Payments Executive ...

Why Consumers should be Cautious when Entering Banking Details Online

The fast pace of digital progress in the financial world has made it easier than ever for people to transact, make purchases, and manage their money online. For most people, speed and convenience are two of the most important benefits that a digital transaction offers, and many businesses invest significantly into developing digital processes that make such fast and easy transactions possible for their online customers. One example of this digital transactional enablement is a process called screen-scraping. Put simply, this is the process of copying information shown on a digital screen like a computer or mobile device, so that it can be used in another digital screen or process. Ravi Shunmugam, CEO of EFT Product House for FNB, explains that there are various examples of screen-scraping ...

- 1

- 2