fintech

Old but gold: Can digital assets become part of Americans’ retirement plans?

On March 11, the United States Department of Labor warned employers that sponsor 401(k) retirement plans to “exercise extreme care” when dealing with cryptocurrencies and other digital assets, even threatening to pay extra legal attention to retirement plans with significant crypto investments. Its rationale is familiar to any crypto investor: The risk of fraud aside, digital assets are prone to volatility and, thus, may pose risks to the retirement savings of America’s workers. On the other hand, we are seeing established players in the retirement market taking steps toward crypto. For one, retirement investment platform ForUsAll decided last year to implement crypto as an investment option for 401(k) fixed retirement accounts in partnership with Coinbase. Is this the beginning of a large...

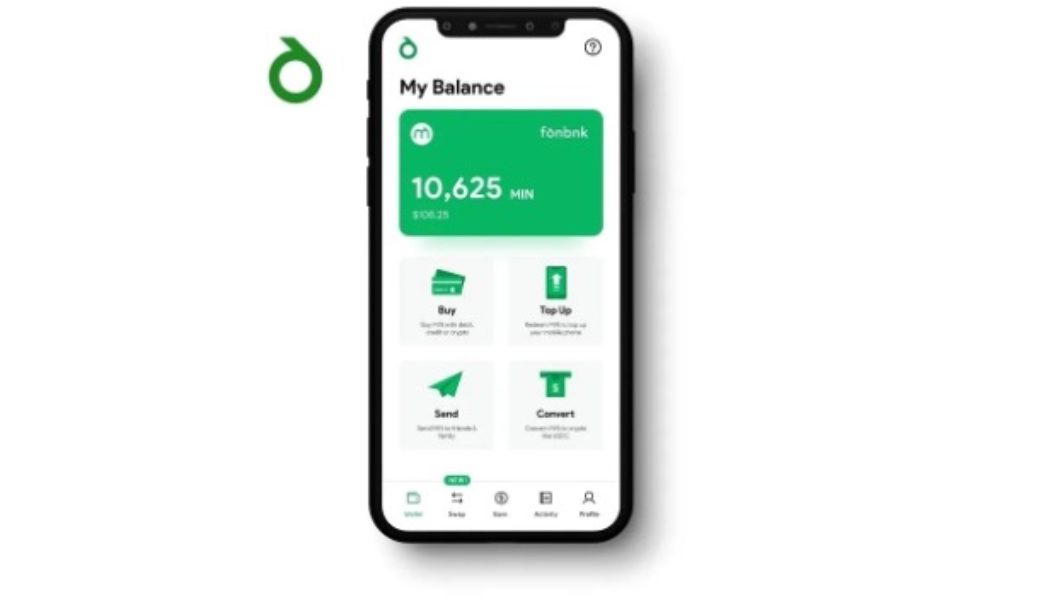

Horizon – A Unique Mobile Payment Innovation Seeking to Foster Financial Inclusion

We use cookies on our website to give you the most relevant experience by remembering your preferences and repeat visits. By clicking “Accept All”, you consent to the use of ALL the cookies. However, you may visit “Cookie Settings” to provide a controlled consent.

The Rise of Digital Wallet-Based Apps in Africa

We use cookies on our website to give you the most relevant experience by remembering your preferences and repeat visits. By clicking “Accept All”, you consent to the use of ALL the cookies. However, you may visit “Cookie Settings” to provide a controlled consent.

Former DJ and Electronic Music Producer Sells “Unicorn” Fintech Company for $1.1 Billion

Royalties, shmoyalties. Miguel Santos, a fintech entrepreneur and former DJ, has cashed out on his innovative company, Technisys. Santos recently sold the banking technology company to SoFi Technologies, a publicly traded digital personal finance giant, for $1.1 billion. Conceived more than 20 years ago, Technisys will now provide cloud-based digital banking solutions for SoFi. Santos may be best known for his role as founder and CEO of Technisys, but he’s also a longtime DJ and house music producer. Santos has an affinity for techno and melodic house music, often attending shows featuring the likes of electronic music legends such as Hernan Cattaneo, Solomun and more. Check out one of his own DJ mixes, which was recorded and uploaded in 2021, below. Recommended Articles Accord...