fintech

How Bankingly is Transforming Africa’s Fintech Industry with Simple, Smart Solutions

We use cookies on our website to give you the most relevant experience by remembering your preferences and repeat visits. By clicking “Accept All”, you consent to the use of ALL the cookies. However, you may visit “Cookie Settings” to provide a controlled consent.

The birth of ‘Ethereum killers’: Can they take Ethereum’s throne?

Ethereum has proven to be a formidable force. While its major issues have spawned other coins aimed at addressing them, Ethereum looks to shed its old skin with the release of Ethereum 2.0. Despite the fact that Ethereum was created six years after Bitcoin (BTC) and the introduction of blockchain technology, the digital asset Ether (ETH) has grown to be the second most valuable cryptocurrency in terms of market capitalization, surpassing coins such as Litecoin (LTC), Ripple (XRP), Dash (DASH) and Monero (XMR), which were launched before it. The technology behind the Ethereum blockchain is the primary reason for its meteoric rise. Vitalik Buterin, the Canadian-Russian programmer and co-founder of Ethereum, explained to Business Insider that the Ethereum blockchain is intended to address Bit...

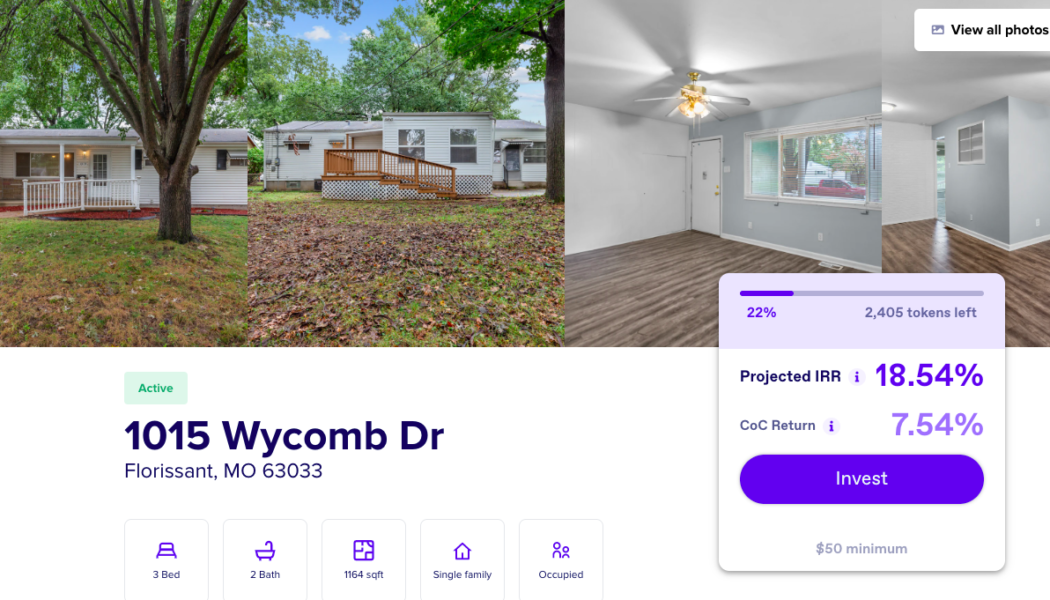

Web3 solutions aim to make America’s real estate market more accessible

America’s housing market may soon be facing its next bubble as home prices across the country continue to be fueled by demand, speculation and lavish spending that could result in a collapse. Moreover, many homeowners are opting to stay put due to climbing mortgage rates, creating a housing shortage. Data from the Federal National Mortgage Association, commonly known as Fannie Mae, found that 92% of homeowners think their current home is affordable. Yet, findings further show that 69% of the general population, consisting of both homeowners and renters, believe it’s becoming too difficult to find affordable housing. Web3 and the real-estate market While the fate of the United States housing market remains unclear, the rise of Web3 business models based around nonfungible tokens (NFTs...

Decentralized credit scores: How can blockchain tech change ratings

The concept of lending and borrowing is as old as time itself. Regarding finances, while some individuals have more than enough for themselves, others barely have enough to get by. As long as there is this imbalance in finance distribution, there will always be a need to borrow and a desire to lend. Lending involves giving out a resource on credit with the condition of it being returned upon an agreed period of time. In this case, such resources would be money or any financial asset. The lender could be an individual, a financial institution, a firm or even a country. Whichever the case may be, the lender, oftentimes, needs a sort of assurance that their resources would be returned to them upon the agreed time. Certain criteria qualify a borrower to take a loan. Among these are the borrowe...

Paysend Partners with Afrimoney to Enable Transfers to West Africa

We use cookies on our website to give you the most relevant experience by remembering your preferences and repeat visits. By clicking “Accept All”, you consent to the use of ALL the cookies. However, you may visit “Cookie Settings” to provide a controlled consent.

The Philippines’ top payment provider adds crypto to its mobile app

Philippines-based major fintech company PayMaya has reportedly launched a new cryptocurrency feature on its app, following in the footsteps of PayPal, Venmo and others. According to TechInAsia, PayMaya users will be able to trade, purchase, and spend digital assets using their accounts. This is also part of PayMaya’s aim to offer a comprehensive crypto package for anybody interested in entering the market. With the new feature, PayMaya intends to make it simpler for Filipinos to learn about and use cryptocurrencies, as per the report. Furthermore, it will eliminate the necessity for users to register with cryptocurrency exchanges, create a crypto wallet, and go through other KYC hoops. PayMaya is the Philippines’ largest provider of digital payments. It’s also a virtual m...

In the US, public-private state associations form networks of support for crypto businesses

When you think of a crypto-friendly U.S. state, Washington is hardly the first to come to mind. Yet, a lot has been happening on the ground in the Pacific Northwest lately. Washington Governor Jay Inslee signed a bill, SB5544, into law on March 30. The new legislation creates a working group of seven state officials and eight trade association leaders to examine “various potential applications of and policies for blockchain technology” and report to the governor in December 2023. Republican state Senator Sharon Brown, one of the sponsors of the legislation, said, “By creating the Washington Blockchain Work Group, we are sending a clear message that Washington is ready to start working with the private sector to advance this technology for the benefit of all Washington residents, empl...

Celebrity tokens: Signs of rising crypto adoption in Indonesia

Cryptocurrency investments in Indonesia have seen considerable growth between 2020-2022, with 4% of the country’s population having invested in crypto. In 2021, crypto transaction volumes surpassed $34 billion, according to Indonesia’s Commodity Futures Trading Regulatory Agency. This growth has formed a new mindset toward crypto investment, especially in the mainstream media. One example of cryptocurrencies’ growing appeal in the mainstream is the participation of Indonesian celebrities and influencers. Crypto adoption among celebrities Celebrities and influencers in Indonesia seem to have become much more involved in Indonesia’s crypto investment industry since 2021. Many have become brand ambassadors for exchanges and crypto projects to help promote them and essentially raise the tradin...

Indonesia’s cryptocurrency community in 2022: An overview

Crypto is the next big thing in Indonesia. According to the Ministry of Trade, transactions for currencies like Bitcoin (BTC) grew over 14 times from a total of 60 trillion rupiahs ($4.1 billion) in 2020 to a total of 859 trillion rupiahs ($59.83 billion) in 2021. It’s getting to the point where crypto is becoming more popular than traditional stock. Vice Minister of Trade Jerry Sambuaga stated that more than 11 million Indonesians bought or sold crypto in 2021. In comparison, according to the Indonesian Central Securities Depository, the total number of portfolio investors — indicated by the number of single investor identities — reached 7.35 million in 2021. Even so, 11 million crypto investors is still only about 4% of Indonesia’s total population, meaning there’s still plenty of room t...

Visa launches immersion program to help creators build their business with NFTs

Visa announced the official launch of the Visa Creator Program, a one-year product strategy and mentorship program for entrepreneurs working in art, music, fashion and film who seek to accelerate their small business through nonfungible tokens, or NFTs. According to Visa, the goal of the Creator Program is to bring together a global cohort of digital creators and empower them via education of blockchain technology and NFT commerce. Originally announced in October, 2021, the program’s first Visa Creator is Micah Johnson, creator of the Aku World NFT community. Johnson is a former professional baseball player who retired after multiple injuries to become a visual artist in 2018. The NFT character Aku is a young Black astronaut who has grown to ink his own film...

From taxes to electricity, blockchain adoption is growing in Austria

Austria has been actively transforming into an attractive location for providers of blockchain-based products, with the government itself experimenting with the technology and trying to create a legal basis upon which companies can use it. With regard to blockchain-based applications in the economy, however, Austria is still in the experimental phase, with most firms still running pilot projects. Still, politicians and economists alike see potential for select industries. Public administration reform via blockchain The Austrian government is quite open to blockchain innovations, cryptocurrencies aside, and has supported various projects in the public and private sectors. In 2019, a consortium of public administration institutions founded the Austrian Public Service Blockchain (APSB)....