fintech news

Ericsson Aims to Enable Financial Inclusion and Development Across Africa

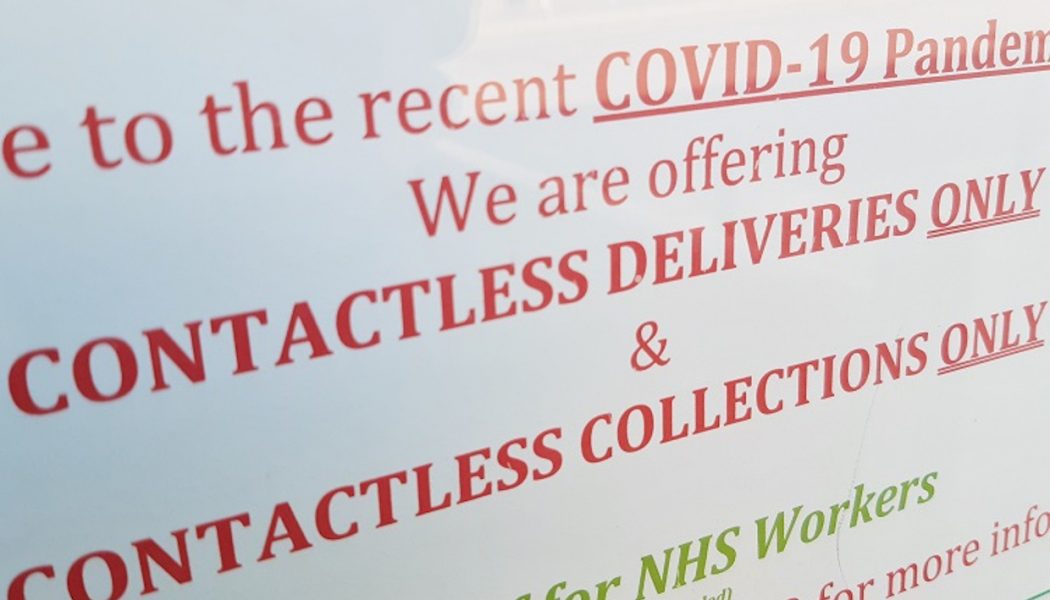

As the world grapples with the COVID-19 health crisis, the desire for mobile money and contactless payments is on the rise to avoid infections and disease transmission. With mobile money, customers can make payments anywhere at any time with their mobile devices connected to the Internet which decreases exposure to physical money, Point of Sales (PoS) terminals and Automated Teller Machines (ATM)– especially with high volumes of micropayments. The freedom to send, spend and receive money with a mobile phone is quickly becoming an essential part of life for billions of people. It is said that more money remains digital – promoting further digital transactions circulating in the system – rather than being cashed-out – which is great progress towards a cashless society. In 2019, GSMA recorded...

Cashless and Contactless Payments Beyond COVID-19

The emergence of COVID-19 has made the need for digitising payments more critical than ever before and for this to be a success, electronic payments need to offer similar benefits to those afforded by cash. Globally, economies are in various stages of development having either started developing, replaced or are busy replacing daily batch payment systems with real-time systems that execute payments in seconds with the flexibility to meet the needs of the future digital economy. The drive towards digital payments and lowering the reliance on cash is not new to South Africa’s payments market. There are several mechanisms already in place to enable this and banks, card companies, fintechs and retailers are all involved in rolling out digital, non-touch payment mechanisms. Contactless cards us...