fintech

Alameda Research liquidators lost $72K during fund consolidation attempt

The liquidators of Alameda Research continue to encounter obstacles in their efforts to recover funds for creditors. Crypto analytics firm Arkham disclosed on Twitter that the liquidators lost $72,000 worth of digital assets on the decentralized finance (DeFi) lending platform Aave while trying to consolidate funds into a single multisignature wallet. The liquidators were attempting to close a borrow position on Aave but instead removed extra collateral used for the position, putting the assets at risk of liquidation. Arkham reported that over nine days, the loan was liquidated twice for a total of 4.05 Wrapped Bitcoin (WBTC), which creditors will now not be able to recoup. This resulted in the liquidation of around 4 WBTC, $72K at current prices. When positions are forcibly closed on...

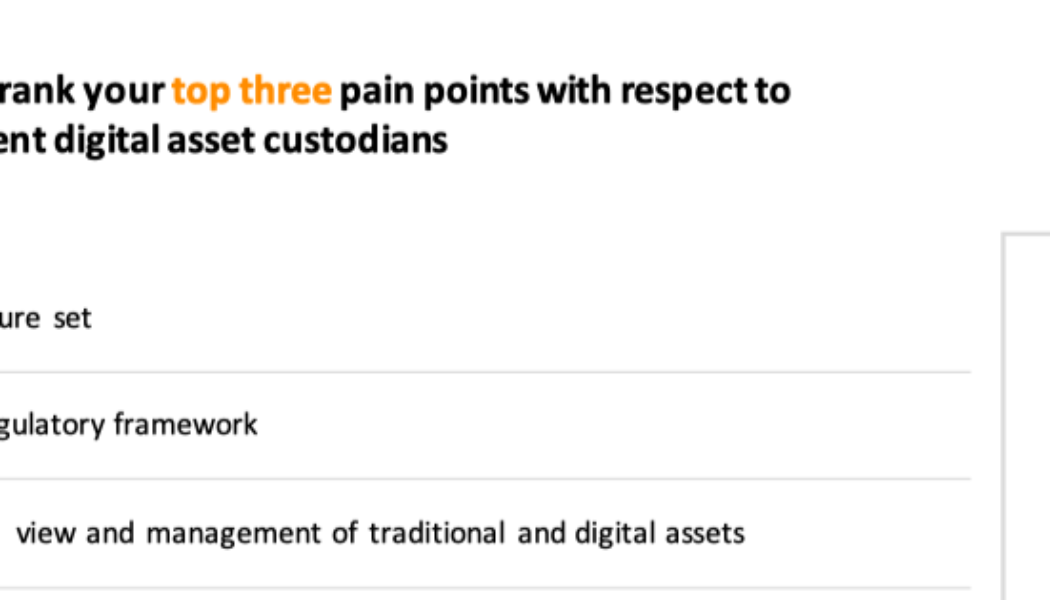

Banks still show interest in digital assets and DeFi amid market chaos

The cryptocurrency sector is the Wild Wild West in comparison to traditional finance, yet a number of banks are showing interest in digital assets and decentralized finance (DeFi). This year in particular has been notable for banks exploring digital assets. Most recently, JPMorgan demonstrated how DeFi can be used to improve cross-border transactions. This came shortly after BNY Mellon — America’s oldest bank — announced the launch of its Digital Asset Custody Platform, which allows select institutional clients to hold and transfer Bitcoin (BTC) and Ether (ETH). The Clearing House, a United States banking association and payments company, stated on Nov. 3 that banks “should be no less able to engage in digital-asset-related activities than nonbanks.” Banks aware of potential While ba...

OCC makes its staff available for fintech-related discussions

The United States Office of the Comptroller of the Currency, or OCC, has announced its representatives will be available on a one-to-one basis to discuss financial technology. In a Nov. 3 announcement, the OCC said entities considering fintech products and services, partnerships with banks, or concerns “related to responsible innovation in financial services” have the opportunity for one-hour meetings with its staff between Dec. 14-15. The government office said it will screen requests and proposed topics of discussions and announce virtual meeting times. The OCC announcement followed the department saying it planned to establish an Office of Financial Technology starting in 2023 in an effort to gain a “deep understanding of financial technology and the financial technology landscape.” The...

Singapore bank DBS uses DeFi to trade FX and state securities

DBS Bank, a major financial services group in Asia, is applying decentralized finance (DeFi) for a project backed by Singapore’s central bank. DBS has started a trading test of foreign exchange (FX) and government securities using permissioned, or private, DeFi liquidity pools, the firm announced on Nov. 2. The development is part of Project Guardian, a collaborative cross-industry effort pioneered by the Monetary Authority of Singapore (MAS). Conducted on a public blockchain, the trade included the purchase and sale of tokenized Singapore government securities (SGS), the Singapore dollar (SGD), Japanese government bonds and the Japanese yen (JPY). The project has shown that trading on a private DeFi protocol enables simultaneous operations of instant trading, settlement, clearing and cust...

Africa’s Financial Industry Gears up for Digital Finance Africa 2022

We use cookies on our website to give you the most relevant experience by remembering your preferences and repeat visits. By clicking “Accept All”, you consent to the use of ALL the cookies. However, you may visit “Cookie Settings” to provide a controlled consent.

GameFi investors are now prioritizing fun factor over money: Survey

GameFi, the fusion of gaming and decentralized finance (DeFi), attracts a set of investors that tend to choose projects based on their use case rather than money-generating potential. The GameFi ecosystem attracts GenZ investors and gaming enthusiasts. As a result, it stands as an entry point for numerous first-time investors. A ChainPlay survey participated by 2428 GameFi investors revealed that 75% of the respondents joined the crypto space solely because of GameFi. 3 in 4 respondents joined cryptocurrency because of GameFi. Source: ChainPlay While roughly half of the investors joined the GameFi space initially for profits, 89% of GameFi investors succumbed to Crypto Winter 2022 — with 62% of them losing more than 50% of their profits. GameFi profits are decreasing. Source: ChainPlay How...

Binance gives security assurances in Philippine senate banking committee hearing

Binance representatives participated in a hearing of the Philippine Senate Banking Committee, according to a report in the local press Wednesday. Bangko Sentral ng Pilipinas deputy governor Chuchi Fonacier, the country’s Security Exchange Commission (SEC) chair Emilio Aquino, and members of FinTech Alliance Philippines and the Cagayan Economic Zone Authority also took part in that hearing. The hearing was devoted to fintech innovation and consumer protection, according to the report. Fonacier discussed a sandbox approach to regulation, and Aquino talked about digital asset security. Binance was represented by APAC director Leon Foong and Philippines general manager Kenneth Stern, who told the hearing about the exchange’s security and Know Your Customer process. Stern said at the hearing: “...

Why Innovation in the Financial Sector Will Continue to Benefit SMEs in SA

We use cookies on our website to give you the most relevant experience by remembering your preferences and repeat visits. By clicking “Accept All”, you consent to the use of ALL the cookies. However, you may visit “Cookie Settings” to provide a controlled consent.