Financial Systems

Western Union may be planning to expand its digital offerings far beyond remittances

Western Union may be preparing to offer crypto-related services, judging from trademark applications filed by the company last week. This is the latest of several attempts the company has made to enter the cryptoverse. So far, it has had limited success. Western Union filed for three trademarks on Oct. 18. According to trademark attorney Mike Kondoudis, activities covered by the applications include managing wallets; exchanging digital assets and commodities derivatives; issuing tokens of value and brokerage and insurance services. Western Union is a major provider of cross-border remittance services, and it showed its interest and uncertainty in cryptocurrency early. It partnered with Ripple to settle payments of remittances in 2015, but that partnership remained in the test phase three y...

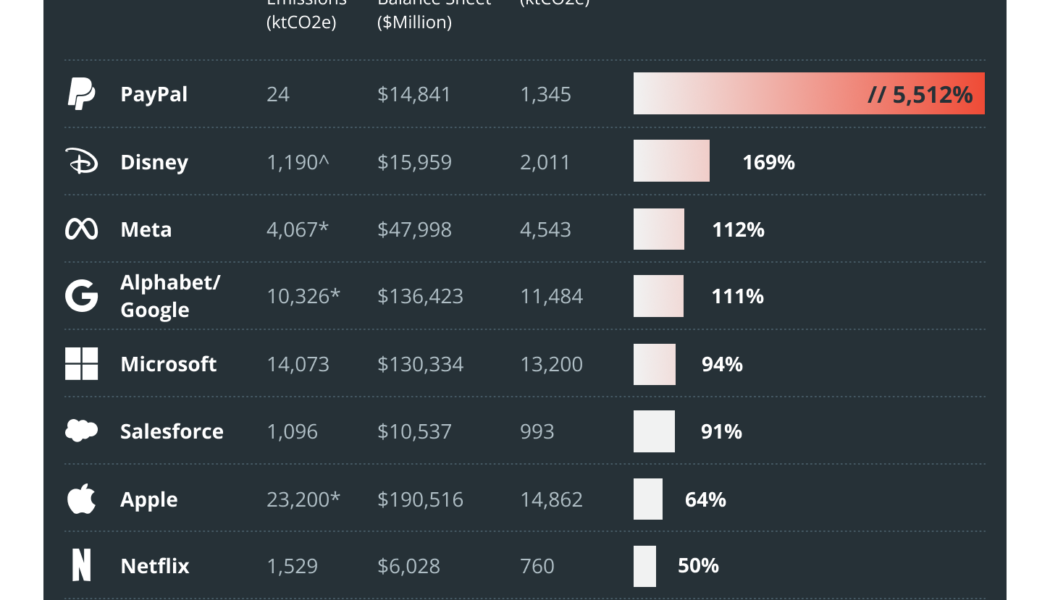

Bitcoin and banking’s differing energy narratives are a matter of perspective

The Carbon Bankroll Report was released on May 17 as a collaboration among the Climate Safe Lending Network, The Outdoor Policy Outfit and Bank FWD. The collaboration made it possible to calculate the emissions generated due to a company’s cash and investments, such as cash, cash equivalents and marketable securities. The report revealed that for several large companies, such as Alphabet, Meta, Microsoft and Salesforce, the cash and investments are their largest source of emissions. The energy consumption of the flagship proof-of-work (PoW) blockchain network, Bitcoin, has been a matter of debate in which the network and its participants, especially miners, are criticized for contributing to an ecosystem that might be worsening climate change. However, recent findings have also brought the...

Decentralized credit scores: How can blockchain tech change ratings

The concept of lending and borrowing is as old as time itself. Regarding finances, while some individuals have more than enough for themselves, others barely have enough to get by. As long as there is this imbalance in finance distribution, there will always be a need to borrow and a desire to lend. Lending involves giving out a resource on credit with the condition of it being returned upon an agreed period of time. In this case, such resources would be money or any financial asset. The lender could be an individual, a financial institution, a firm or even a country. Whichever the case may be, the lender, oftentimes, needs a sort of assurance that their resources would be returned to them upon the agreed time. Certain criteria qualify a borrower to take a loan. Among these are the borrowe...

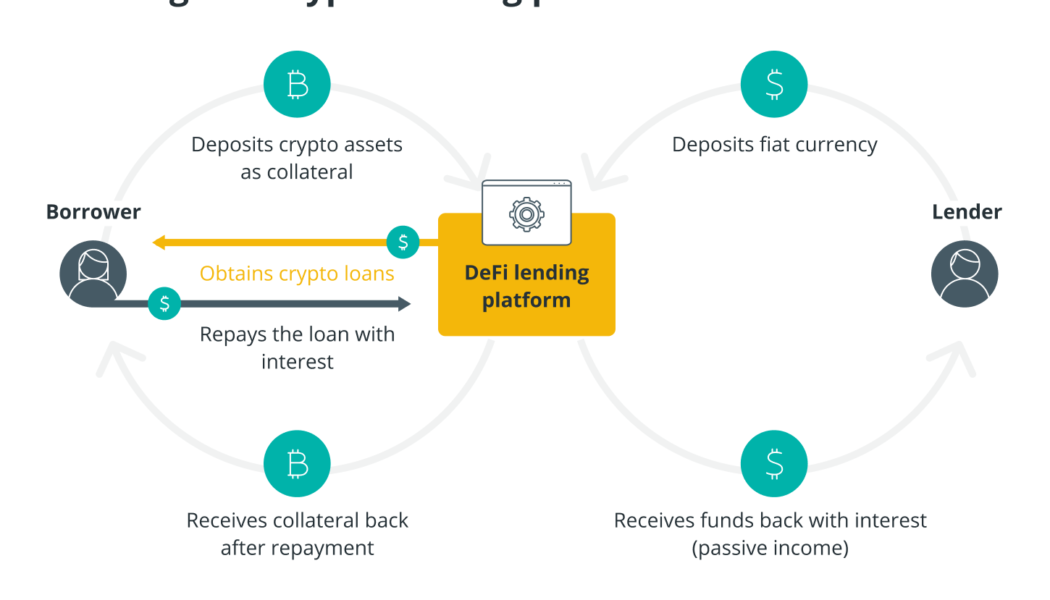

Looking to take out a crypto loan? Here’s what you need to know

Loans based on cryptocurrencies have become a mainstay of the decentralized finance (DeFi) universe ever since the smart contract-based lending/borrowing platforms began offering the service to crypto users. The Ethereum network, the first blockchain that scaled the smart contract functionality, sees most of the total value locked (TVL) on DeFi protocols dominated by cryptocurrency lending platforms. According to data from DeFi Pulse, the top 4 of 10 DeFi protocols are lending protocols that account for $37.04 billion in TVL, just 49% of TVL of the entire DeFi market on the Ethereum blockchain. Ethereum leads in terms of being the most utilized blockchain for the DeFi market and the TVL on the network. Maker and Aave are the biggest players here, with a TVL of $14.52 billion and $11.19 bil...

Future of finance: US banks partner with crypto custodians

Grayscale Investments’ latestreport “Reimagining the Future of Finance” defines the digital economy as “the intersection of technology and finance that’s increasingly defined by digital spaces, experiences, and transactions.” With this in mind, it shouldn’t come as a surprise that many financial institutions have begun to offer services that allow clients access to Bitcoin (BTC) and other digital assets. Last year, in particular, saw an influx of financial institutions incorporating support for crypto-asset custody. For example, Bank of New York Mellon, or BNY Mellon, announced in February 2021 plans to hold, transfer and issue Bitcoin and other cryptocurrencies as an asset manager on behalf of its clients. Michael Demissie, head of digital assets and advanced solutions at BNY ...