Financial Services

Decentralized credit scores: How can blockchain tech change ratings

The concept of lending and borrowing is as old as time itself. Regarding finances, while some individuals have more than enough for themselves, others barely have enough to get by. As long as there is this imbalance in finance distribution, there will always be a need to borrow and a desire to lend. Lending involves giving out a resource on credit with the condition of it being returned upon an agreed period of time. In this case, such resources would be money or any financial asset. The lender could be an individual, a financial institution, a firm or even a country. Whichever the case may be, the lender, oftentimes, needs a sort of assurance that their resources would be returned to them upon the agreed time. Certain criteria qualify a borrower to take a loan. Among these are the borrowe...

Looking to take out a crypto loan? Here’s what you need to know

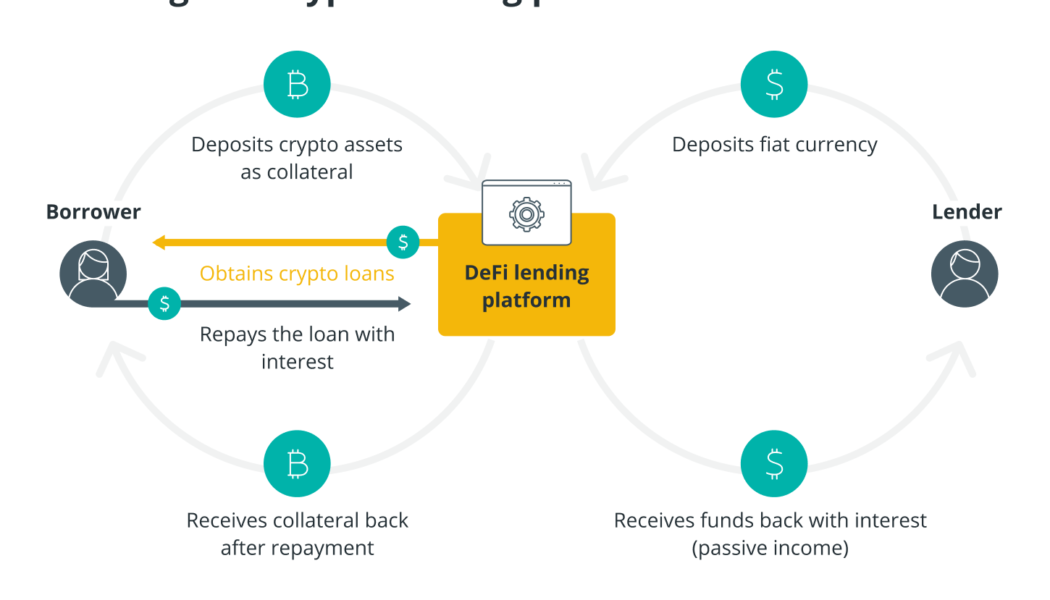

Loans based on cryptocurrencies have become a mainstay of the decentralized finance (DeFi) universe ever since the smart contract-based lending/borrowing platforms began offering the service to crypto users. The Ethereum network, the first blockchain that scaled the smart contract functionality, sees most of the total value locked (TVL) on DeFi protocols dominated by cryptocurrency lending platforms. According to data from DeFi Pulse, the top 4 of 10 DeFi protocols are lending protocols that account for $37.04 billion in TVL, just 49% of TVL of the entire DeFi market on the Ethereum blockchain. Ethereum leads in terms of being the most utilized blockchain for the DeFi market and the TVL on the network. Maker and Aave are the biggest players here, with a TVL of $14.52 billion and $11.19 bil...

MultiChoice Zambia Partners with MTN Mobile Money

We use cookies on our website to give you the most relevant experience by remembering your preferences and repeat visits. By clicking “Accept All”, you consent to the use of ALL the cookies. However, you may visit “Cookie Settings” to provide a controlled consent.

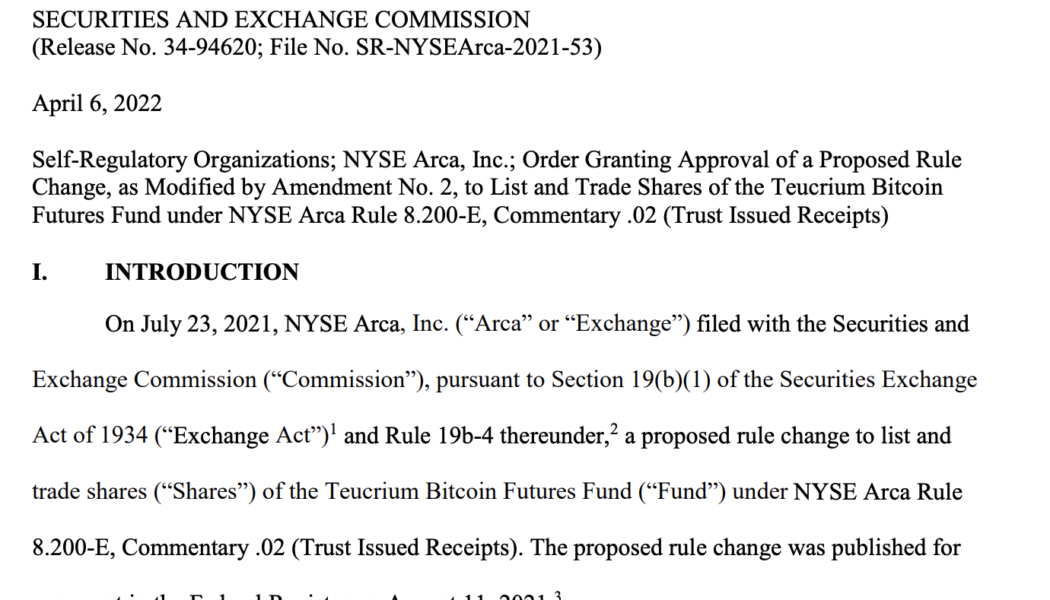

Grayscale CEO pleads Bitcoin spot ETF as SEC backs third BTC Futures ETF

Institutional investors rejoice, there is one more way to gain exposure to Bitcoin (BTC). The United States Securities and Exchange Commission (SEC) announced overnight the approval of a fourth Bitcoin futures exchange-traded fund (ETF). Fund group Teucrium is behind the most recently approved Bitcoin Futures ETF. The ETF joins a growing number of approved futures ETFs, complementing ProShares, Valkyrie, and VanEck Bitcoin Futures ETFs. The SEC filing for the Teucrium ETF. Source: SEC.gov Every Bitcoin spot ETF has been rejected to date, however, for one invested observer, the way in which the approval was made could be a boon for expectant spot investors. The plot thickens on the path to $GBTC’s spot #Bitcoin #ETF conversion… — Sonnenshein (@Sonnenshein) April 7, 2022 In a Tweet thread, G...

In defense of crypto: Why digital currencies deserve a better reputation

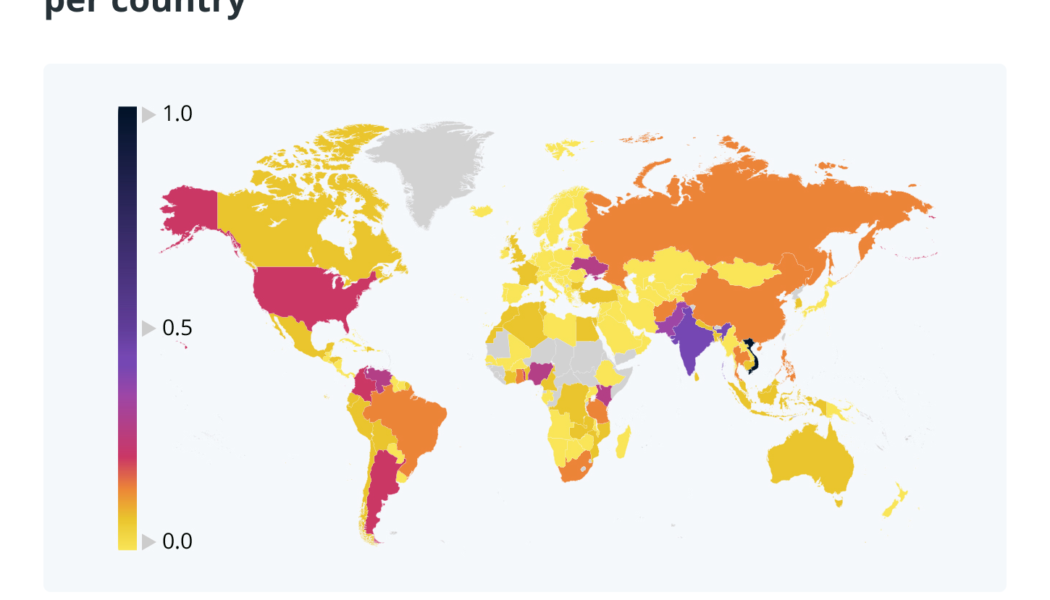

Ever since its inception and throughout its turbulent journey toward mainstream acceptance, crypto has elicited both enthusiasm and trepidation in equal measure. After the unfair battering it has received over the years, the time has come to defend digital currencies. Unfortunately for crypto, first impressions count. Bitcoin (BTC) initially gained a tawdry reputation in its early years as the currency of choice for illicit activities — favored by dark web users, ransomware hackers, drug traffickers and money launderers worldwide. But, the world has changed since the first Bitcoin was mined in January 2009. There are now more than 18 million of them in circulation, and more than 90,000 people have $1 million or more stashed away in Bitcoin, according to cryptocurrency data-tracking firm Bi...

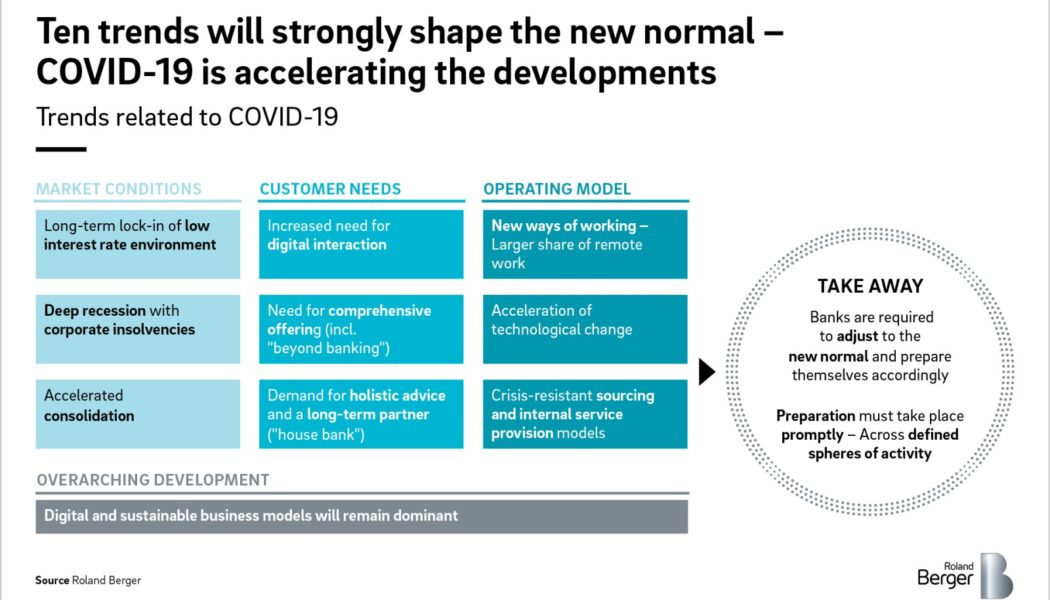

3 Crucial Reasons Why Financial Services Need to Accelerate Digital

Image sourced from Planful. “Go digital or go dark” – Companies that fail to heed this advice, irrespective of sector, run a great risk in the age of technological revolution. Consumers prioritise convenience and will often not see the need to step out of their houses to use a service that could be achieved with a few taps on their phones. Add to that a pandemic that has led to even further restrictions and the need to embrace digital ways of doing business becomes clearer. Historically, digital transformation has been a process that happens over the course of several years. COVID-19 has dramatically accelerated that timeline. Companies were forced to adapt in order to survive, with financial services having to evolve quicker than most. That’s because every business relies on payments and ...

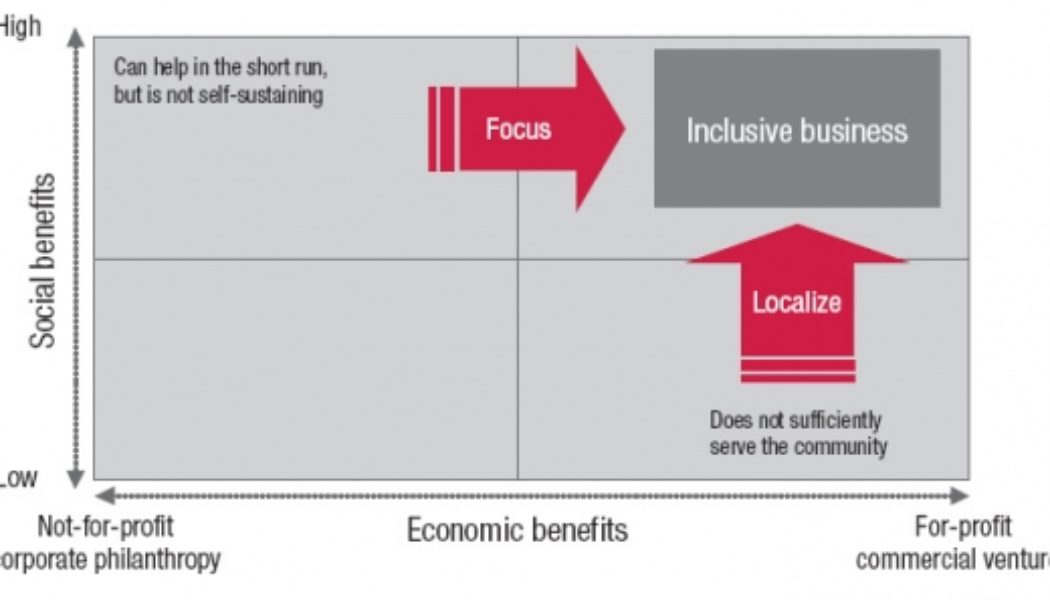

SMS Solutions Could Be Essential for an Inclusive Business Strategy

South African companies must take care not to inadvertently deepen the existing digital divide. Although COVID-19 and related lockdowns have accelerated a growing trend towards the digital economy such as artificial intelligence, in an unequal society such as South Africa, many consumers find it difficult to access data-intensive apps and processes. This makes it vital for local businesses to include different forms of technology in their business strategies to ensure their operations are running inclusively. An effective way to do this is by including SMS solutions in customer processes. Once seen as a luxury, mobile phones are now in the hands of 95% of South Africans, according to Geopoll, with data-hungry smartphones accounting for 91% of devices. However, data prices in South Africa a...

5 Pivotal Topics to be Discussed at the DFA 2021 – Register Now!

We use cookies on our website to give you the most relevant experience by remembering your preferences and repeat visits. By clicking “Accept All”, you consent to the use of ALL the cookies. However, you may visit “Cookie Settings” to provide a controlled consent. You Deserve to Make Money Even When you are looking for Dates Online. So we reimagined what a dating should be. It begins with giving you back power. Get to meet Beautiful people, chat and make money in the process. Earn rewards by chatting, sharing photos, blogging and help give users back their fair share of Internet revenue.

NCC boss: Over $70 billion spent on telecoms infrastructure in Nigeria

Vox Media Over $70 billion have been invested in telecommunications infrastructure deployment in Nigeria since the liberalisation of the industry in 2001. The Executive Vice Chairman of the Nigerian Communications Commission, NCC, Prof Umar Garba Danbatta, who made this known said the amount represented a larger chunk of local and Foreign Direct Investment (FDI) attracted into the sector within the period. Danbatta made the remarks on Thursday while delivering the Bullion Lecture 2021 Edition organised by the Centre for Financial Journalism (CFJ), Lagos. According to him, the investment in infrastructures has boosted the economy and provided more opportunities for more Nigerians have access to telecoms services. “Today, the number of active telephone lines being used by Nigerians has signi...

CIBN urges banks to strengthen cyber-security

The Chartered Institute of Bankers of Nigeria (CIBN) has urged the banks to strengthen their cyber-security architecture in order to prevent attacks by fraudsters. President/Chairman of Council of the institute, Mr. Bayo Olugbemi, made the call while delivering his remarks at the 2020 CIBN Fellowship Investiture in Lagos, at the weekend. The CIBN at its investiture formally conferred its honorary fellowship awards on 19 distinguished bankers in recognition of their contributions to the banking industry and the economy; 77 associates as elected Fellows while 105 senior management staff of banks and the academia became Honorary Senior Members of the institute at the event with the theme: ‘Financial Services in a post COVID 19 Environment: Strategic Imperative’. Some that were conferred with ...