Financial Services

Société Générale progresses in crypto space with digital asset services registration

The French stock market regulator, the Autorité des Marchés Financiers (AMF), approved France’s Société Générale bank as a digital assets service provider (DASP) on Sept. 27. Société Générale joined international operators such as Voyager, Bitpanda, Binance and Etoro as registered DASPs. The bank did not announce its approval. Société Générale’s digitally focused Forge subsidiary was registered to provide digital assets custody, the purchase/sale of digital assets for legal tender and the trading of digital assets against other digital assets. The French bank announced in June that it was partnering with Metaco, a digital asset management and infrastructure provider, to develop its digital asset custody operations. Registration is mandatory for companies to carry out those activities...

Fireblocks records $100M+ revenue in subscriptions amid bear market

Fireblocks, a New York-based blockchain security service provider, made over $100 million in Annual Recurring Revenue (ARR) this year, confirming the rising interest in the crypto ecosystem that contradicts negative investor sentiments. ARR relates to the recurring revenue earned by a company based on subscriptions. As a software-as-a-service provider, Fireblocks witnessed overwhelming interest in decentralized finance, blockchain and Web3 technologies. The reason behind increased revenue amid an ongoing bear market can be attributed to an overall change in mindset, as companies and investors seem more inclined toward exploring crypto use cases rather than chasing market volatility for a quick buck. Sharing insights into its growing customer base, Fireblocks co-founder and CEO Michael Shau...

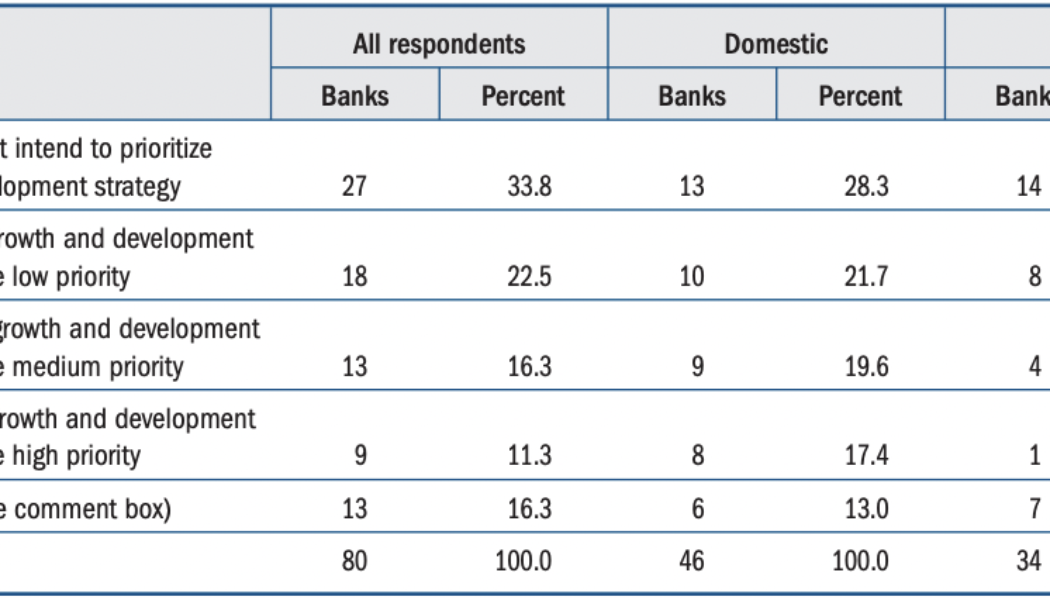

56% of banks say DLT and crypto are ‘not a priority’ in near future — Fed survey

A survey conducted by the Federal Reserve Board of the United States suggested that the majority of officials at major banks did not consider crypto-related products and services a priority in the near future. According to the results of a Fed survey released on Friday, more than 56% of senior financial officers from 80 banks said distributed ledger technology and crypto products and services were “not a priority” or were “a low priority” for their growth and development strategy for the next two years, while roughly 27% said they were a medium or high priority. However, roughly 40% of respondents in the survey said the technology was a medium or high priority for their banks for the next two to five years. Results of Fed survey from May 2022. Source: Federal Reserve Answers from surveyed ...

Mukuru Expands its Services

We use cookies on our website to give you the most relevant experience by remembering your preferences and repeat visits. By clicking “Accept All”, you consent to the use of ALL the cookies. However, you may visit “Cookie Settings” to provide a controlled consent.

The crypto industry needs a crypto capital market structure

The past few weeks have been interesting and have surfaced what we in the financial services industry call matters requiring attention, or MRAs. An MRA describes a practice that deviates from sound governance, internal controls and risk management principles. These matters that require attention have the potential to adversely affect the industry and increase the risk profile. I have always focused on technology and innovation-led business models — systems and interconnected elements of blockchain-powered business networks — redefining the transaction systems that power many industries, including financial services. A growing number of naysayers have become vocal about recent events, which have revealed extensive mismanagement, ill-defined and misgoverned systems, and general misrepr...

Deloitte and NYDIG set up alliance to help businesses adopt Bitcoin

Professional services giant Deloitte is getting increasingly serious about Bitcoin (BTC) amid the ongoing market downturn, setting up a major initiative to promote BTC adoption. Deloitte has partnered with the Bitcoin-focused financial services firm, New York Digital Investment Group (NYDIG), to help companies of all sizes implement digital assets. According to a joint announcement on Monday, NYDIG and Deloitte are launching a strategic alliance to create a centralized approach for clients seeking advice to adopt Bitcoin products and services. The companies will work together to enable blockchain and digital asset-based services across multiple areas involving Bitcoin-related products, including banking, loyalty and rewards programs, employee benefits and others. According to the announcem...

United Bank for Africa (UBA) Redeems $500-Million 5-year Eurobond

We use cookies on our website to give you the most relevant experience by remembering your preferences and repeat visits. By clicking “Accept All”, you consent to the use of ALL the cookies. However, you may visit “Cookie Settings” to provide a controlled consent.

United Bank for Africa (UBA) Redeems $500-Million 5-year Eurobond

We use cookies on our website to give you the most relevant experience by remembering your preferences and repeat visits. By clicking “Accept All”, you consent to the use of ALL the cookies. However, you may visit “Cookie Settings” to provide a controlled consent.

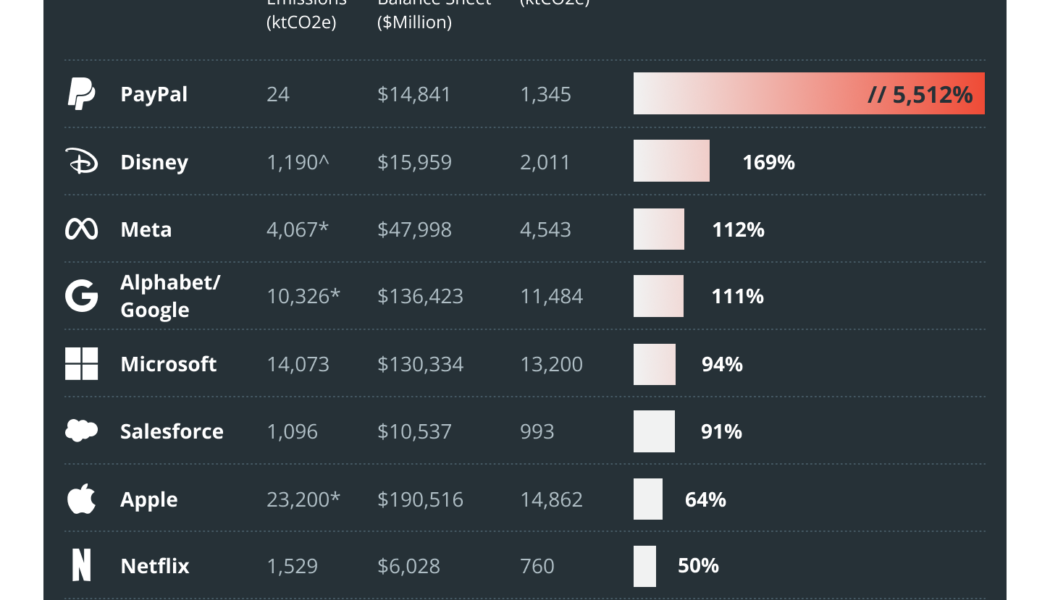

Bitcoin and banking’s differing energy narratives are a matter of perspective

The Carbon Bankroll Report was released on May 17 as a collaboration among the Climate Safe Lending Network, The Outdoor Policy Outfit and Bank FWD. The collaboration made it possible to calculate the emissions generated due to a company’s cash and investments, such as cash, cash equivalents and marketable securities. The report revealed that for several large companies, such as Alphabet, Meta, Microsoft and Salesforce, the cash and investments are their largest source of emissions. The energy consumption of the flagship proof-of-work (PoW) blockchain network, Bitcoin, has been a matter of debate in which the network and its participants, especially miners, are criticized for contributing to an ecosystem that might be worsening climate change. However, recent findings have also brought the...

Florida Rep. Donalds introduces Financial Freedom Act companion bill in the House

Rep. Byron Donalds, a Florida Republican, introduced the Financial Freedom Act into the United States House of Representatives on Friday to prevent the U.S. Department of Labor from limiting the types of investments that can be included in Americans’ self-directed 401(k) retirement plans. The bill is the companion to Alabama Sen. Tommy Tuberville’s May 5 Senate bill. The Financial Freedom Act was introduced as a reaction to a U.S. Department of Labor (DOL) compliance report dated March 10 that raised objections to the inclusion of cryptocurrencies in 401(k) retirement plans. That report warned the department’s Employee Benefits Security Administration “expects to conduct an investigative program aimed at plans that offer participant investments in cryptocurrencies and related products, and...