Financial Derivatives

CTFC looks at expanded authority to regulate crypto, for less than a 10% budget increase

The U.S. Commodity Futures Trading Commission, or CFTC, has released its Fiscal Year 2023 (FY2023) budget request, seeking $365 million. This marks a 9.9% increase over the previous year and 20% over FY2021. The commission regulates the country’s derivatives market and has been increasingly active in recent years in policing financial products that incorporate cryptocurrencies. According to the agency’s request document, the CTFC focuses on digital asset custodian risk, ensuring secure storage, as well as on accounting. The agency has its own staff of certified public accountants due to the lack of guidance on digital asset accounting from sectoral oversight bodies. In addition, the agency ensures derivative clearing organizations “employ strong segregation of duty processes and proc...

Here’s why the SEC keeps rejecting spot Bitcoin ETF applications

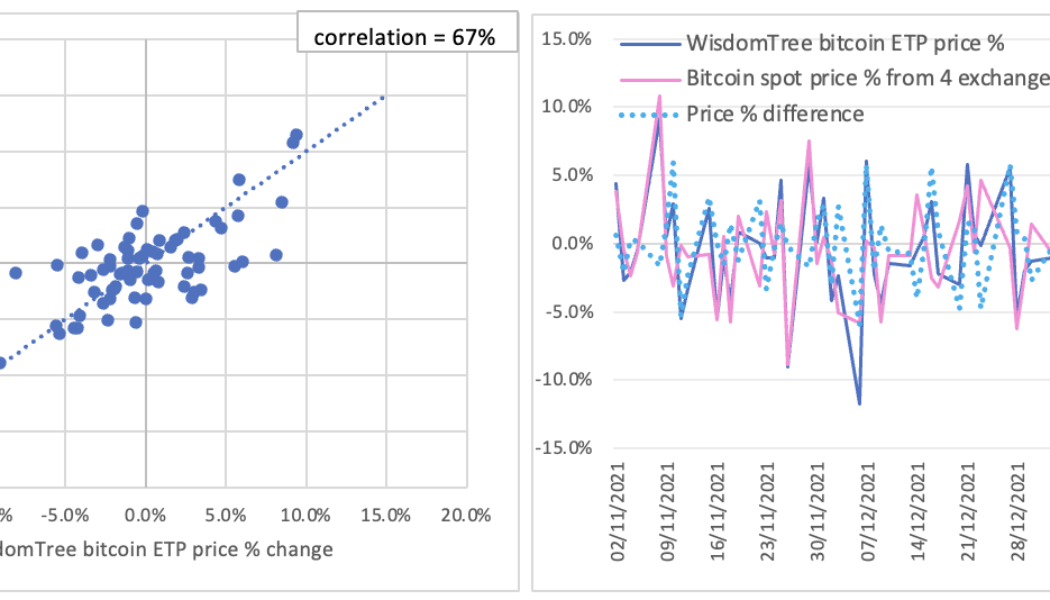

It is not the first time the U.S. Securities and Exchange Commission (SEC) rejected proposals for a Bitcoin spot exchange traded product (ETP), but efforts continue to be made by different financial institutions. The recent attempt made by Cboe BZX Exchange on Jan. 25 to list the Fidelity Wise Origin Bitcoin Trust as a Bitcoin ETP has also failed. The SEC letter published on Feb. 8 pointed out that the exchange has not met its burden to demonstrate the fund is “designed to prevent fraudulent and manipulative acts” and “to protect investors and the public interest”. Although proposals of Bitcoin spot ETPs have never been approved by the SEC and such products are not available in the U.S. market, they do exist in the European market. By investigating the prices of these ETPs traded in ...