Finance

Vinyl Prices Might Seem High Today, But They Were Worse in 1978

As far as albums go, 1978 was one for the record books. The Saturday Night Fever and Grease soundtracks topped the Billboard 200 album chart for a combined 36 weeks. Fleetwood Mac’s Rumours, released in 1977, was the No. 1 album in the U.S. the first two weeks of the year. Billy Joel’s 52nd Street topped the chart for the final seven weeks of the year. The Rolling Stone’s Some Girls and Boston’s Don’t Look Back each topped the chart for two weeks. It was also a notable year for another reason: In 1978, vinyl records were more expensive than any other time since the RIAA began tracking sales in 1973. That year, the average retail sale price of a vinyl EP/LP was $7.32 – equal to $30.18 in today’s dollars when adjusted for inflation. That was the second-highest vinyl sales year in U.S. histor...

Proven Consult Partners with Leading Insurance Firm in Africa to Provide Intelligent Business Automation

We use cookies on our website to give you the most relevant experience by remembering your preferences and repeat visits. By clicking “Accept All”, you consent to the use of ALL the cookies. However, you may visit “Cookie Settings” to provide a controlled consent.

How a DAO for a bank or financial institution will look like

DAOs can provide several services for banks, including asset management, compliance and lending. Banks today are already using blockchain technology for things like payment, clearing and settlement, trade finance, identity and syndicated loans, according to The Financial Times. However, there are still many unexplored areas in banking where a DAO-based model might be useful: Fundraising In the crypto world, initial coin offerings (ICOs) are breaking down the barrier between access to capital and traditional services like capital-raising firms. Likewise, banks can use DAOs to raise capital from a wider pool of investors via ICOs. Loans and Credit Using decentralized technology in banking can eliminate the need for gatekeepers in the lending industry. DAOs provide more secure ways for people...

Sweeping layoffs, hiring and firing as crypto prices take a massive downturn

Many in the crypto world have been glued to their screens with eyes dead set on financial conditions this week. That isn’t the case for everyone though, as thousands are suddenly experiencing thewoes of sudden unemployment. Words of encouragement and sympathy also poured out across Twitter and LinkedIn consoling individuals released from their responsibilities. Some expressed frustration, confusion and anger while others expressed gratitude, renewed vision and reflections. My heart is with those recently laid off. I too have been one of the lucky ones to be spared by massive layoffs on days where friends have been let go. This privileged situation has its own anxiety, displacement and upheaval. Sorry you’re going through this moment. — Matt Murray (@vintageneon) June 16, 2022 As...

Are Cryptocurrencies Set to Soar in Africa in 2022?

We use cookies on our website to give you the most relevant experience by remembering your preferences and repeat visits. By clicking “Accept All”, you consent to the use of ALL the cookies. However, you may visit “Cookie Settings” to provide a controlled consent.

How To Pay Freely In Nigeria

We use cookies on our website to give you the most relevant experience by remembering your preferences and repeat visits. By clicking “Accept All”, you consent to the use of ALL the cookies. However, you may visit “Cookie Settings” to provide a controlled consent.

Music Stocks and Cryptocurrencies Hit by Recession, Inflation Fears

Music and other entertainment stocks fell sharply on Monday (June 13), following a string of worrisome events and expectations the Federal Reserve will make a substantial rate hike to slow inflation. The S&P 500 declined 3.9%, putting the index in bear market territory — down more than 20% from its high in January. The Nasdaq declined 4.7%. Radio broadcaster Cumulus Media fell 20.3% to $9.17, the largest decline of any music-related stock on Monday. Cumulus is “thinly traded and has high leverage,” Noble Capital Markets’ Michael Kupinsky tells Billboard in an email response. “Both are issues when [the stock is] out of favor and the market has its sights on an economic downturn.” Radio stocks had the worst day among music-related companies on Monday as four leading companies’ stocks dro...

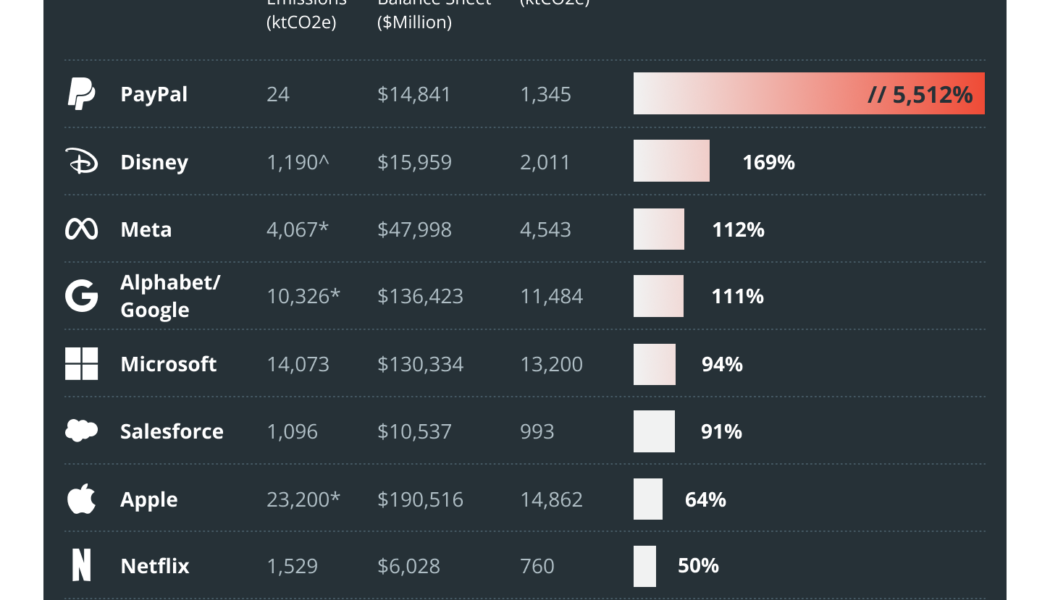

Bitcoin and banking’s differing energy narratives are a matter of perspective

The Carbon Bankroll Report was released on May 17 as a collaboration among the Climate Safe Lending Network, The Outdoor Policy Outfit and Bank FWD. The collaboration made it possible to calculate the emissions generated due to a company’s cash and investments, such as cash, cash equivalents and marketable securities. The report revealed that for several large companies, such as Alphabet, Meta, Microsoft and Salesforce, the cash and investments are their largest source of emissions. The energy consumption of the flagship proof-of-work (PoW) blockchain network, Bitcoin, has been a matter of debate in which the network and its participants, especially miners, are criticized for contributing to an ecosystem that might be worsening climate change. However, recent findings have also brought the...

Is It Profitable to Swap ETH to XNO?

We use cookies on our website to give you the most relevant experience by remembering your preferences and repeat visits. By clicking “Accept All”, you consent to the use of ALL the cookies. However, you may visit “Cookie Settings” to provide a controlled consent.