Finance

Tiktok Owner ByteDance Offers to Buy Back $3B in Outstanding Shares

TikTok owner ByteDance Ltd. could spend as much as $3 billion to buy back shares from investors after the company scrapped its plans to go public this year, the Wall Street Journal reported on Friday, citing a memo sent to ByteDance investors. The China-based company offered to repurchase investors’ existing shares for up to $176.94 per share, a move that would value ByteDance at close to $300 billion, much higher than previously reported, according to the WSJ. While the company did not provide a reason for the share repurchase in its memo, the move would provide liquidity to some of its long-term shareholders, offering some recompense for the scrapped IPO plans, the WSJ reported. ByteDance indefinitely shelved plans for an initial public offering in the U.S. or Hong Kon...

South African Philip Belamant Champions Local Investment As Double-Unicorn Zilch Continues Growth

We use cookies on our website to give you the most relevant experience by remembering your preferences and repeat visits. By clicking “Accept All”, you consent to the use of ALL the cookies. However, you may visit “Cookie Settings” to provide a controlled consent.

Five Top Tips on Saving Money

We use cookies on our website to give you the most relevant experience by remembering your preferences and repeat visits. By clicking “Accept All”, you consent to the use of ALL the cookies. However, you may visit “Cookie Settings” to provide a controlled consent.

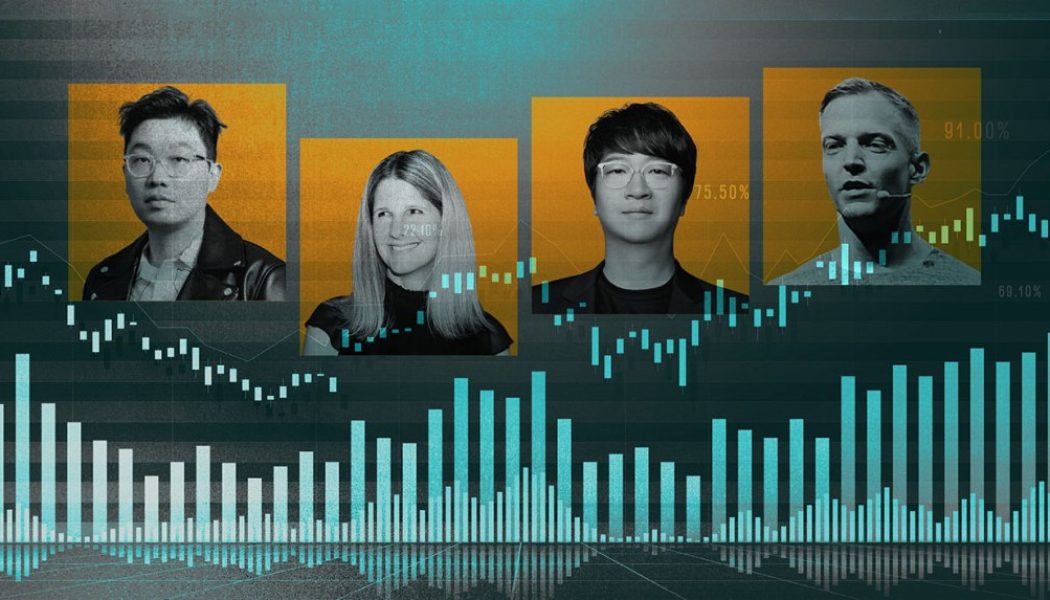

The Ledger: How Do Music Executives’ Pay Compare to Other Entertainment Leaders?

The Ledger is a weekly newsletter about the economics of the music business sent to Billboard Pro subscribers. An abbreviated version of the newsletter is published online. Music industry executives at publicly traded companies are paid well – but they’re not the only ones. As Billboard reported in the inaugural Money Makers list of music’s highest-paid executives and stockholders at publicly traded companies, 10 business leaders earned nearly or more than $9 million in 2021. Of those, most of their compensation came from stock awards and stock options, not base salary or performance bonuses. For example, only 5% of SiriusXM CEO Jennifer Witz’s $32.6 million total compensation came from a guaranteed salary. As is common practice among publicly traded corporations, SiriusXM tied most of Wit...

The Complex Financial Challenges of NFTs in South Africa

We use cookies on our website to give you the most relevant experience by remembering your preferences and repeat visits. By clicking “Accept All”, you consent to the use of ALL the cookies. However, you may visit “Cookie Settings” to provide a controlled consent.

Music’s Most Compensated: 5 Top Money Makers You May Not Know

Kang Hyo-won, Yoon Seok-jun (aka Yenzo Loon) and Kim Shin-gyu are hardly marquee names in the music business, but they accounted for three of its five largest paydays in 2021, according to Billboard Pro‘s inaugural Executive Money Makers ranking — a breakdown of executive compensation and stock ownership at publicly traded companies. All three are valued members of HYBE, the South Korean entertainment giant behind BTS, Tomorrow X Together, NewJeans and other K-pop acts, and in 2016, their efforts turning the company into a global success were rewarded with stock options that netted them the equivalent of tens of millions of dollars when the company went public last year. Stock options are often used to incentivize and reward employees when a company is privately held. In a statement to Bil...

Music’s Top Money Makers: The Highest-Paid Executives and Stockholders at Publicly Traded Companies

Kang Hyo-won is not a marquee name in the music industry. The South Korean producer is better known as Pdogg, the studio wizard behind hits by K-pop supergroup BTS and other acts on the roster of Korean entertainment company HYBE. Because Kang played a key role in HYBE’s global success, his employer gave him 128,000 stock options in 2016 that turned into about $35 million when Kang exercised them. (All currency conversions to U.S. dollars in this story are based on the average 2021 exchange rate.) That made Kang the second-highest-paid music industry executive last year among those whose earnings are publicly disclosed. Yoon Seok-jun (aka Lenzo Yoon) and Kim Shin-gyu, co-CEO of HYBE America and chief artist management officer, respectively, also benefited from HYBE going public. Yoon nette...

Africa’s Financial Industry Gears up for Digital Finance Africa 2022

We use cookies on our website to give you the most relevant experience by remembering your preferences and repeat visits. By clicking “Accept All”, you consent to the use of ALL the cookies. However, you may visit “Cookie Settings” to provide a controlled consent.

The Ledger: Buying Into the K-Pop Craze Just Got Less Risky for US Investors

The Ledger is a weekly newsletter about the economics of the music business sent to Billboard Pro subscribers. An abbreviated version of the newsletter is published online. An exchange-traded fund, or ETF, focused on Korean music started trading on the NYSE Arca exchange on Thursday, giving American investors a means to buy shares of companies that trade on exchanges in South Korea. But the ETF stands out for another reason: a bundle of K-pop stocks will carry less risk than standalone companies that rely on dozens of labels, each with a handful of top artists as well as deep catalogs. Trading under the aptly named ticker KPOP, the ETF includes the stocks of 30 corporations, including several music companies: HYBE, the home of K-pop megastars BTS and up-and-coming acts Tomorrow X Together ...