Finance

Will Crypto Enter The Mainstream In Africa?

Cryptocurrencies are garnering interest across the globe, and have been for the last decade, but it is in Africa in which many are starting to think that these new digital currencies will take off with vigour. The reason for this could well be that Africa finds itself in a rather unique monetary situation, along with an equally unique technological one. Mobile and crypto, the perfect combination Whereas in Europe and North America Internet connectivity took off mainly through fixed-line broadband, Africa has been at the forefront of truly mobile-first Internet infrastructure. While cities are indeed rolling out fixed-line broadband, the vast majority of Africans get online through their data connection solely on their mobile phone. This has lead to a situation where 5G is expected to...

Understanding African Markets During COVID-19

Sourced from iStock. We are living in unprecedented times. COVID-19 has swept throughout the world, and governments globally have taken drastic measures to stop the spread in an attempt to save lives. In February 2020, as African countries watched Asia and Europe begin the implementation of lockdown, a study by Survey54, an automated mobile-led data collection platform, found that approximately 80% of Africans interviewed felt almost immune to the virus as they were yet to hear of any confirmed cases on the continent. This did not last long and by Mid-March, lockdown procedures were initiated across Africa. Despite the swift response, lockdown came with many challenges that drastically affected a continent which heavily depends on the informal sector. With roughly 90% of Africans now conce...

Cashless and Contactless Payments Beyond COVID-19

The emergence of COVID-19 has made the need for digitising payments more critical than ever before and for this to be a success, electronic payments need to offer similar benefits to those afforded by cash. Globally, economies are in various stages of development having either started developing, replaced or are busy replacing daily batch payment systems with real-time systems that execute payments in seconds with the flexibility to meet the needs of the future digital economy. The drive towards digital payments and lowering the reliance on cash is not new to South Africa’s payments market. There are several mechanisms already in place to enable this and banks, card companies, fintechs and retailers are all involved in rolling out digital, non-touch payment mechanisms. Contactless cards us...

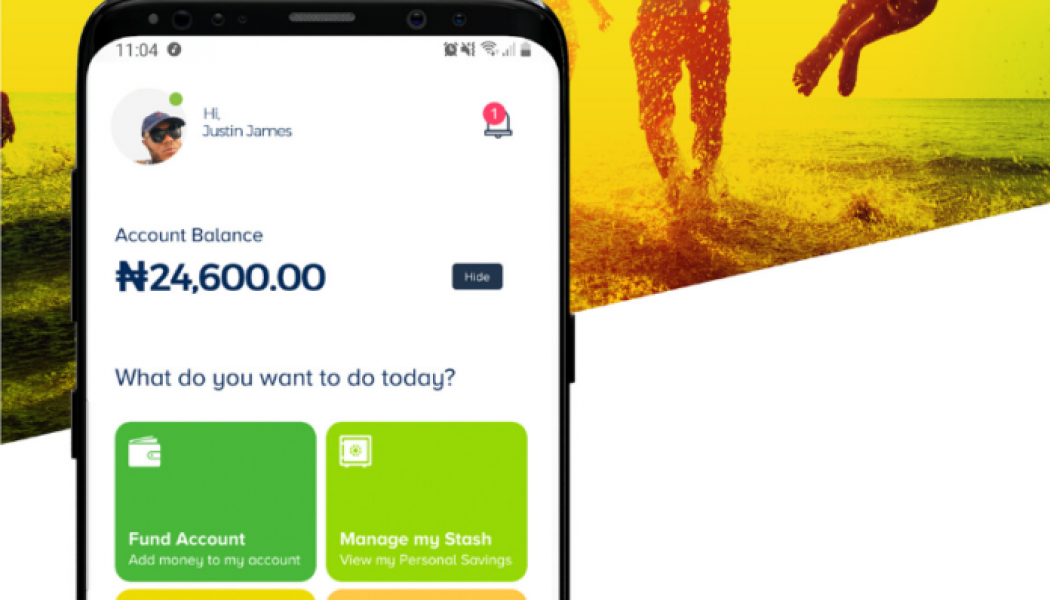

How Lockdown has Highlighted the Benefits of Remote Banking

Sourced from Innovation Village. The advantages of digital transacting over other modes of banking have been highlighted by the lockdown. Although banking remotely has been gaining ground in South Africa long before the lockdown, the limitations on physical movement imposed by the lockdown have given online and mobile banking a significant boost. The current environment will most likely see more people opt for digital banking platforms. This is confirmed by a recent Nielsen syndicated study on the impact of COVID-19 on consumer behaviour in South Africa, which reports that 37% of South Africans say they are shopping and transacting more online. “Apart from being more convenient, digital banking and shopping are cheaper than traditional channels. The lockdown and its effect on the economy h...

Coronavirus: Nigeria issues fresh directives to banks, offices

The National Coordinator of the Presidential Task Force on COVID-19, Sani Aliyu, has asked banks and offices to start adjusting their structure, as the federal government ponders lifting restrictions. Aliyu stated this during PTF’s daily briefing on Thursday. He reiterated the 8 am to 2 pm working hours and need to adhere to physical distancing. “For banks and other financial institutions as well as offices, now is the opportunity to start adjusting to the new life post-COVID, as we lift restrictions over the next few weeks. “We are therefore asking banks and offices to make allowance for physical distancing measures both inside and outside their premises, to ensure staff working in the offices are limited to not more than 50% capacity and to encourage online banking as well as working fro...

Central bank reschedules MPC meeting over holidays

The Central Bank of Nigeria (CBN) has rescheduled it’s Monetary Policy Committee (MPC) meeting from Monday and Tuesday May 25 and 26 to Thursday, May 28. The CBN Director, Corporate Communications Department, Mr. Isaac Okorafor, made this known in a statement in Abuja on Thursday. Okorafor explained that the rescheduling of the meeting was due to the declaration of May 25 and May 26 as public holidays by the Federal Government to commemorate the Eid-el Fitr. He said for the avoidance of doubt, CBN had put necessary machinery in place for the meeting to now hold for only one day on account of the ongoing COVID-19 national lockdown. He added that this step taken was also to align this meeting with the extant rules of the Presidential Task Force (PTF) on COVID-19 and advisories from other rel...

Nigeria begins sale of N150 billion sovereign Sukuk at 11.2 percent

The Federal Government on Thursday began the sale of its third tranche 7-year N150 billion Sovereign Sukuk, the Debt Management Office (DMO) said. The offer circular, which was obtained from its website, said the seven year Islamic Sukuk, referred to as Ijarah, was at a rental rate of 11.2 per cent and would be due in June 2027. The bond, which was aimed at funding key road infrastructure across the six geo-political zones, was payable semi-annually. Subscription for the bond, guaranteed by the government, would close on June 2. The circular said subscribers could purchase N1,000 per unit subject to a minimum subscription of N10,000 and in multiples of N1,000 thereafter with First Bank and Islamic wealth manager, Lotus Capital managing the sale. The DMO said it qualified as securities in w...

To Emerge from COVID-19 Businesses Will have to “Re-Think” Traditional Models

Sourced from Tech Loot Traditional models of business funding need a re-think if South Africa’s small businesses and entrepreneurs are to emerge from the financially crippling “winter of coronavirus” into a spring of growth and rejuvenation. Accepting that downturns, recessions and economic crises are inevitable, one needs to shift the focus into building “Zebra” companies – sustainable businesses with steady growth, strong balance sheets and cash flows, and able to withstand downturns – rather than “Unicorns that will die without the next round of funding”, says University of Stellenbosch Business School (USB) Senior Extraordinary Lecturer, Daniel Strauss. “In the past, we had a mindset of ‘or’ – we either had a traditional SMME that was funded through debt or we had a start-up that was f...