Finance tech

How CFOs & CIOs are Funding Digital Transformation with OPEX, not CAPEX

Zakhe Khuzwayo, co-founder and CFO at InnoVent. CFOs and CIOs, collaborating to drive the accelerated digital transformation necessitated by rapid technology advances and COVID-19, now have a smart alternative to traditional financing and management of IT assets that boosts business efficiencies and competitiveness. Rapid technology advances driving the 4IR (Fourth Industrial Revolution), as well as the impact of COVID-19, has accelerated digital transformation in organisations, transforming IT overnight from a back-end support function into an essential enabler for all business operations. Such a shift requires greater access to top technology, resulting in IT spending reaching an all-time high as organisations swop offices for work-from-home and virtual meetings; physical shops for e-com...

Confidence Rebounds in SA as Consumers Embrace eCommerce & Contactless Payments

We use cookies on our website to give you the most relevant experience by remembering your preferences and repeat visits. By clicking “Accept All”, you consent to the use of ALL the cookies. However, you may visit “Cookie Settings” to provide a controlled consent. You Deserve to Make Money Even When you are looking for Dates Online. So we reimagined what a dating should be. It begins with giving you back power. Get to meet Beautiful people, chat and make money in the process. Earn rewards by chatting, sharing photos, blogging and help give users back their fair share of Internet revenue.

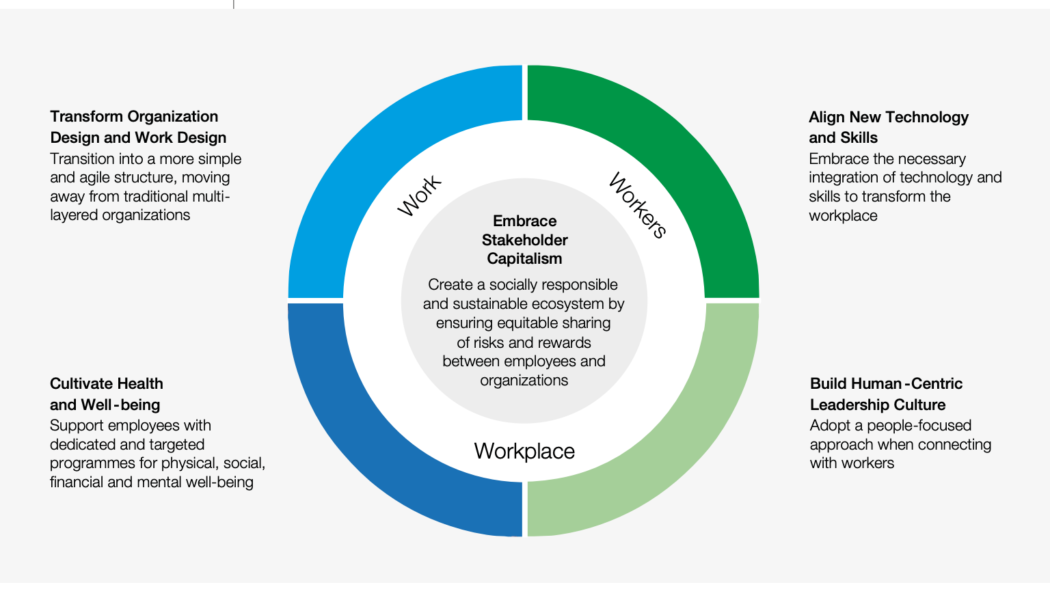

Doing Business in a Post-Lockdown World

Sourced from Business News Daily At the beginning of March, few anticipated the significant impact the COVID-19 pandemic would have on the lives of all South Africans. As the gradual easing of the strict lockdown conditions continues, thoughts turn to how companies will begin their recovery. Ian McAlister, GM of CRS Technologies, looks at what to expect. From Friday 1 May, South Africa transitioned to Level 4 lockdown conditions which will result in several more industries resuming operations, albeit in a limited capacity. And while all the details around operational issues are still to be confirmed, expectations are that at least 1.5 million South Africans will be returning to work. In part, this is designed to get the economy back up and running following several weeks of virtual non-act...