Federal Reserve

Solana’s weekend bounce risks turning into a bull trap — Can SOL price fall to $60 next?

A rebound move witnessed in the Solana (SOL) market this weekend exhausted midway as its price dropped below the $90 level from a high of $96 on Feb. 21. In doing so, SOL price technicals are now risking a classic bearish reversal setup. Solana price risks dropping to $60 Dubbed head-and-shoulders (H&S), the technical pattern emerges when the price forms three peaks in a row atop a common support level (called a neckline). As it typically turns out, the pattern’s middle peak, called a “head,” comes longer than the other two peaks, called theleft and right shoulders, which come to be of similar heights. The H&S pattern tends to send the prices lower—at length equal to the maximum distance between the head and the neckline—once they decisively break below its ...

‘Coin days destroyed’ spike hinting at BTC price bottom? 5 things to watch in Bitcoin this week

Bitcoin (BTC) heads into the last week of February lower but showing signs of strength as a key support level holds. After a nervous few days on macro and crypto markets alike, BTC/USD is below $40,000, but signs are already there that a comeback could be what starts the week off in the right direction. The situation is far from easy — concerns over inflation, United States monetary policy and geopolitical tensions are all in play, and with them, the potential for stocks to continue suffering. Further cues from the Federal Reserve will be hot property in the short term, with March expected to be when the first key interest rate hike is announced and delivered. Could it all be a storm in a teacup for Bitcoin, which on a technical basis is stronger than ever? Cointelegraph presents five fact...

Can Bitcoin break out vs. tech stocks again? Nasdaq decoupling paints $100K target

A potential decoupling scenario between Bitcoin (BTC) and the Nasdaq Composite can push BTC price to reach $100,000 within 24 months, according to Tuur Demeester, founder of Adamant Capital. Bitcoin outperforms tech stocks Demeester depicted Bitcoin’s growing market valuation against the tech-heavy U.S. stock market index, highlighting its ability to break out every time after a period of strong consolidation. “It may do so again within the coming 24 months,” he wrote, citing the attached chart below. BTC/USD vs. Nasdaq Composite weekly price chart. Source: Tuur Demeester, StockCharts.com BTC’s price has grown from a mere $0.06 to as high as $69,000 more than a decade after its introduction to the market, as per data tracked by the BraveNewCoin Liquid Index fo...

Fed’s Lael Brainard hints at US playing a lead role in development of CBDCs

Lael Brainard, a member of the Federal Reserve’s Board of Governors, encouraged the United States to be a leader in research and policy regarding central bank digital currencies, or CBDCs, due to potential international developments. In remarks prepared for the U.S Monetary Policy Forum in New York on Friday, Brainard said the People’s Bank of China’s pilot program for its digital yuan could have implications on the dollar’s dominance in cross-border payments and payment systems. However, a digital dollar could allow people around the world to continue to rely on its fiat counterpart. “It is prudent to consider how the potential absence or issuance of a U.S. CBDC could affect the use of the dollar in payments globally in future states where one or more major foreign currencies are is...

Crypto ‘best place’ to store wealth during Fed rate hike: Pantera CEO

The CEO and founder of leading blockchain venture fund Pantera Capital, Dan Morehead, stated that digital assets will be the “best place” to store capital following the potential fallout of interest rate hikes from the U.S. Federal Reserve. Investors across stock and crypto markets are currently fixated on the direction the Fed might take to combat rising inflation which topped 7.5% as of this month. Bitcoin and crypto markets have often moved in correlation to trends in the stock market, however, Morehead argued in his Feb. 16 newsletter that bonds, stocks, and real estate will cop the brunt of the Fed‘s “massive policy U-turn,” in relation to hiking interest rates. Despite the crypto market suffering a downturn since late 2021, the CEO suggested that digital assets will be the “best plac...

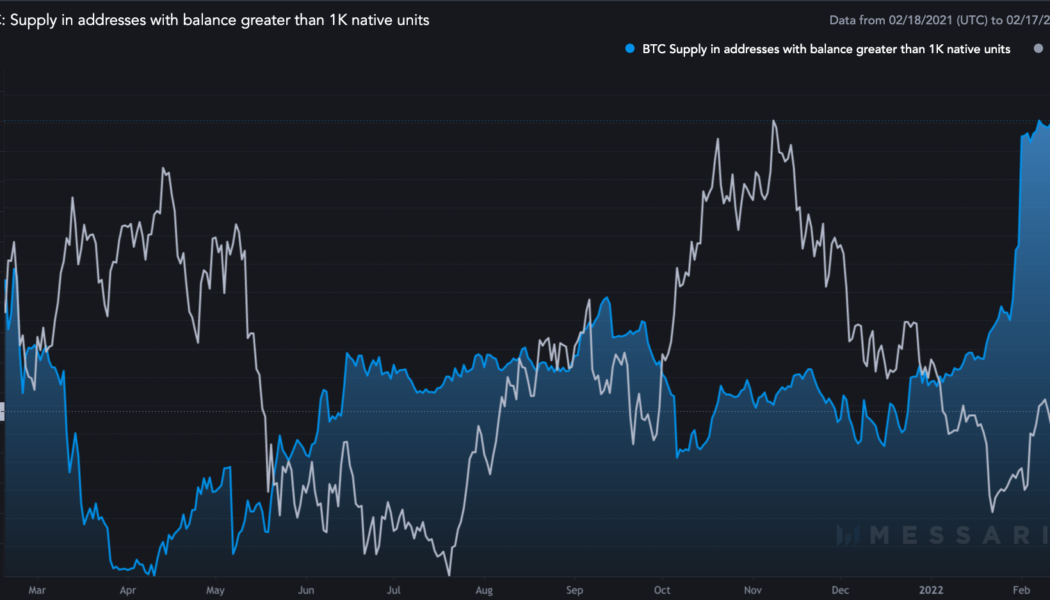

Bitcoin ‘whales’ and ‘fishes’ pause accumulation as markets weigh March 50bps hike odds

An uptick in Bitcoin (BTC) supply to whales’ addresses witnessed across January appears to be stalling midway as the price continues its intraday correction toward $42,000, the latest data from CoinMetrics shows. Whales, fishes take a break from Bitcoin The sum of Bitcoin being held in addresses whose balance was at least 1,000 BTC came to be 8.10 million BTC as of Feb. 16, almost 0.12% higher month-to-date. In comparison, the balance was 7.91 million BTC at the beginning of this year, up 2.4% year-to-date. Bitcoin supply in addresses with balance greater than 1,000 BTC. Source: CoinMetrics, Messari Notably, the accumulation behavior among Bitcoin’s richest wallets started slowing down after BTC closed above $40,000 in early February. Their supply fluctuated with...

Bitcoin extends decline below $42K ahead of fresh Fed comments on inflation

Bitcoin (BTC) fell further with stocks on the Wall Street open Thursday as nervous markets awaited further U.S. economic policy cues and battled geopolitical tensions. BTC/USD 1-hour candle chart (Bitstamp). Source: TradingView Macro conditions stay grim for stocks, crypto Data from Cointelegraph Markets Pro and TradingView showed BTC/USD losing the $42,000 mark for the first time in several days at the start of trading. The Fed and tensions over Ukraine had already formed a backdrop to lackluster market performance both in crypto and beyond, with that trend staying firmly in force on the day. With the likelihood increasing that a rate hike could come from the U.S. next month, attention was on James Bullard, president of the St. Louis Fed, ahead of a statement due less than an hour fr...

Bitcoin price is ‘likely starting the next push up’ if $42K holds as support

The cryptocurrency market remains in a state of flux as investors are once again focused on what steps the U.S. Federal Reserve might take to combat rising inflation and markets wobble as the situation in Ukraine remains tense. Data from Cointelegraph Markets Pro and TradingView shows that the price of Bitcoin (BTC) has hovered around the $44,000 support level and traders are hopeful that an inverse head and shoulders chart pattern will lead to a sustained bullish breakout. BTC/USDT 1-day chart. Source: TradingView Here’s a survey of what several analysts in the market are keeping an eye on moving forward as global issues from inflation to war continue to make their presence felt in the cryptocurrency market. On-Balance Volume shows a bullish reversal Insight into what may lie ahead for Bi...

Fed never did it: US Senate Banking head lashes out at Super Bowl crypto ads

The Super Bowl advertisements by crypto companies, including Coinbase, FTX and several others, ruled social media and news headlines for their out-of-the-box approach. However, United States Senate Banking Committee Chief Sherrod Brown was not impressed and blasted the ad-makers for not including appropriate warnings and risks involved. Brown, during the Tuesday Senate hearing on stablecoins, brought in the topic of popular crypto advertisements that aired during the Super Bowl. He said most of these ads failed to tell people about the downsides of investing in cryptocurrencies. The companies failed to mention the wild price swings and prevalent scams that occur in the market or the fact that the crypto market is not as well regulated as the traditional ones. Super Bowl advertisement ...

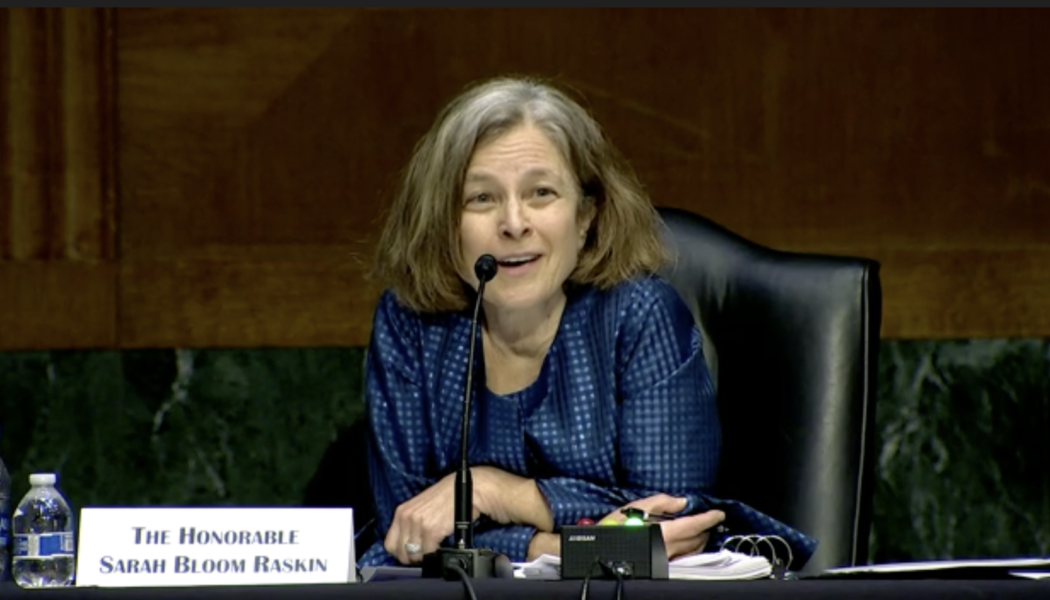

Concerns over Fed nominee may stop Senate from confirming Biden’s picks: Report

Members of the U.S. Senate Banking committee have reportedly divided along party lines regarding President Joe Biden’s pick of Sarah Bloom Raskin as vice chair for supervision for the Board of Governors at the Federal Reserve. According to a Tuesday report from Reuters, Senator Pat Toomey, the ranking member on the Senate Banking Committee, said he had asked the 12 Republican senators on the committee to not attend a meeting in which members were expected to vote on President Biden’s nominees for the Fed. Toomey reportedly said that Democratic leadership can proceed with “five of the six nominees” put forth by the President and expect Republican support — with the exception of Raskin. Republicans’ boycott is reportedly due to concerns over allegations that the prospective Fed vice chair fo...

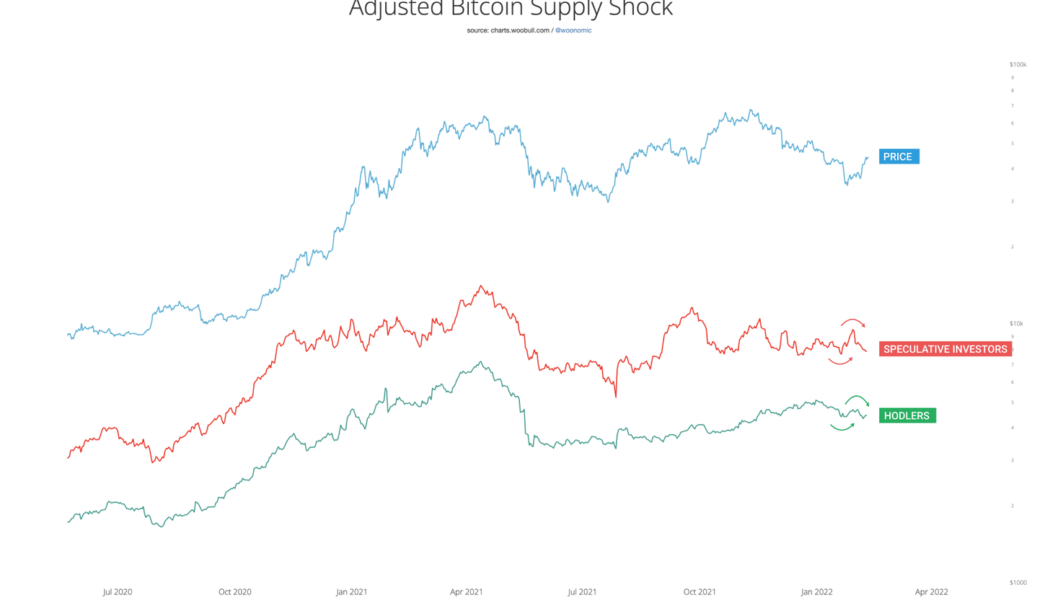

Bitcoin on-chain data hints at institutions ‘deploying capital’ at expense of ‘hodlers’

“Sophisticated passive buying” on Bitcoin (BTC) spot exchanges coincides with the trend of BTC leaving exchanges to cold storage. Adjusted Bitcoin supply shock. Source: Willy Woo The price recovery witnessed in the Bitcoin market across the last two weeks coincided with a rise in hodlers and speculative investors selling their coins, according to data provided by researcher Willy Woo. Nonetheless, BTC’s price ability to withstand the selling pressure meant there was buying pressure coming from elsewhere. As Cointelegraph reported earlier this week, so-called Bitcoin whales are accumulating BTC at current price levels. “This selling is contrasted by exchange data showing sophisticated passive buying on spot exchanges and movement of coins to whale-controlled wallets,...

Ethereum eyes $3.5K as ETH price reclaims pandemic-era support with 40% rebound

Ethereum’s native token Ether (ETH) looks poised to hit $3,500 in the coming sessions as it reclaimed a historically strong support level on Feb. 5. Ethereum price back above key trendline ETH price rising above its 50-week exponential moving average (50-week EMA; the red wave in the chart below) means the price also inched above $3,000, a psychological support level that may serve as the ground for Ether’s next leg up. ETH/USD weekly price chart. Source: TradingView The 50-week EMA was instrumental in maintaining Ether’s bullish bias across 2020 and 2021. For instance, it served as a strong accumulation zone during the market correction in the second and third quarters last year, pushing ETH price from around $1,700 to as high as $4,951 (data from Binance). As a result, ...