Federal Reserve

President Biden announces former Ripple adviser as pick for Fed vice chair for supervision

Following the withdrawal of former Federal Reserve Board governor Sarah Bloom Raskin, United States President Joe Biden has announced his intention to nominate former Obama administration official and law professor Michael Barr as the central bank’s vice chair for supervision. In a Friday announcement, the White House said Barr was Biden’s pick to supervise the Federal Reserve and set the regulatory agenda for its leadership. Barr was on the advisory board of Ripple Labs from 2015 to 2017, served as the Treasury Department’s assistant secretary for financial institutions under former President Barack Obama, and taught courses on financial regulation at the University of Michigan. According to the White House, he was “a key architect” of the Dodd-Frank Act — legislation that continues to in...

Ethereum price ‘bullish triangle’ puts 4-year highs vs. Bitcoin within reach

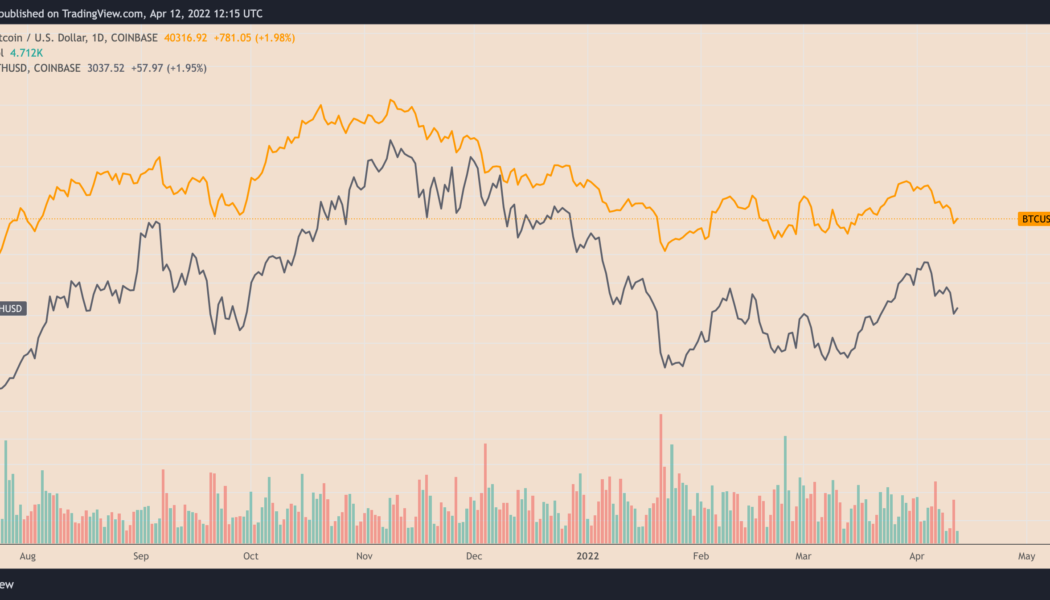

Ethereum’s native token Ether (ETH) has dropped about 17% against the U.S. dollar in the last two weeks. But its performance against Bitcoin (BTC) has been less painful with the ETH/BTC pair down 4.5% over the same period. The pair’s down-move appears as both ETH/USD and BTC/USD drop nearly in lockstep while reacting to the Federal Reserve’s potential to hike rates by 50 basis points and slash its balance sheet by $95 billion per month. The latest numbers released on April 12 show that consumer prices rose 8.5% in March, the most since 1981. BTC/USD vs. ETH/USD daily price chart. Source: TradingView ETH/BTC triangle breakout Several technicals remain bullish despite ETH/BTC dropping in the last two weeks. Based on a classic continuation pattern, the pair still l...

BTC stocks correlation ‘not what we want’ — 5 things to know in Bitcoin this week

Bitcoin (BTC) starts the second week of April with a whimper as bulls struggle to retain support above $40,000. After a refreshingly low-volatility weekend, the latest weekly close saw market nerves return, and in classic style, BTC/USD fell in the final hours of April 10. There is a feeling of being caught between two stools for the average hodler currently — macro forces promise major trend shifts but are being slow to play out. At the same time, “serious” buyer demand is also absent from crypto assets more broadly. However, those on the inside show no hint of doubt about the future, as evidenced by all-time high Bitcoin network fundamentals and more. The combination of these opposing factors is price action that simply does not seem to know where to go next. Can something change in the ...

Ted Cruz introduces companion to Emmer’s bill to exclude Fed retail CBDC digital currency issue

Texas Sen. Ted Cruz introduced companion legislation into the U.S. Senate on Wednesday for Minnesota Rep. Tom Emmer’s bill prohibiting the Federal Reserve from issuing central bank digital currency, or CBDC, directly to individuals, Emmer announced. Emmer introduced the House bill Jan. 18. Fellow Republican Cruz’ legislation could potentially speed up passage or rejection of the bill by allowing it to be considered in both chambers of Congress at the same time. Emmer, co-chair of the Congressional Blockchain Caucus, motivated his bill by concern a retail CBDC that forced consumers to open accounts with the Federal Reserve Bank could “be used as a surveillance tool that Americans should never tolerate from their own government,” according to the lawmaker. Emmer said in January, “Requi...

Law Decoded: Arab States of the Gulf open up to digital asset services, March 14–21

Last week got off to an antsy start as the clause that many interpreted as a direct route to ban proof-of-work-(PoW)-based cryptocurrencies made a sudden comeback to the draft of the European Union’s key directive on digital assets. Many in the crypto policy space got immediate flashbacks to other instances of harmful last-minute additions to must-pass legislation days and hours before the vote. It all ended well, though, as the Committee on Economic and Monetary Affairs voted against the draft that contained the hostile language. Over in the United States, monetary policy kept growing more political, as evidenced by Sarah Bloom Raskin, President Joe Biden’s pick for the Federal Reserve’s vice chair for supervision, being forced to withdraw her nomination due to a Senate gridlock. Ukrainia...

Biden’s pick for Fed vice chair for supervision withdraws amid Republican objections

Former Federal Reserve Board governor Sarah Bloom Raskin has withdrawn her name for consideration as the central bank’s vice chair for supervision in an attempt to allow other nominations to move forward. According to a Tuesday tweet from Washington Post journalist Seung Min Kim, Raskin sent a letter to U.S. President Joe Biden withdrawing as his nominee for the next vice chair for supervision of the Federal Reserve, citing “relentless attacks by special interests.” The letter referred to Republican lawmakers who, she said, have “held hostage” her nomination since February. “Their point of contention was my frank public discussion of climate change and the economic costs associated with it,” said Raskin. “It was — and is — my considered view that the perils of climate change must be added ...

Biden to sign executive order on crypto, authorize all-government effort to consolidate regulation

Later today, U.S. President Joe Biden will sign a long-anticipated executive order on digital assets. Despite fears that the order may resound a regulatory clampdown on the industry, the language of the document is fairly favorable, the key focus being the coordination and consolidation of various agencies’ efforts within a unified national policy. The order designates six key areas of the federal government’s involvement with the digital asset ecosystem — consumer and investor protection, financial stability, financial inclusion, responsible innovation, the United States’ global financial leadership and combating illicit financial activity — and directs specific agencies to lead in designated policy and enforcement domains. The Department of the Treasury will take the lead in developing p...

3 reasons why Bitcoin can rally back to $60K despite erasing last week’s gains

Bitcoin (BTC) plunged to below $38,000 on Monday, giving up all the gains it had made last week, which saw BTC/USD rally over $45,000. BTC back below $40K as oil soars The losses appeared primarily in part due to selloffs across the risk-on markets, led by the 18% rise in international oil benchmark Brent crude to almost $139 per barrel early Monday, its highest level since 2008. Nonetheless, Bitcoin’s inability to offer a hedge against the ongoing market volatility also raised doubts over its “safe haven” status, with its correlation coefficient with Nasdaq Composite reaching 0.87 on Monday. BTC/USD weekly price chart featuring its correlation with Nasdaq and Gold. Source: TradingView Conversely, Bitcoin’s correlation with its top rival gold came to be minus 0...

Bitcoin a ‘good bet’ if Fed continues easing to avoid a recession — analyst

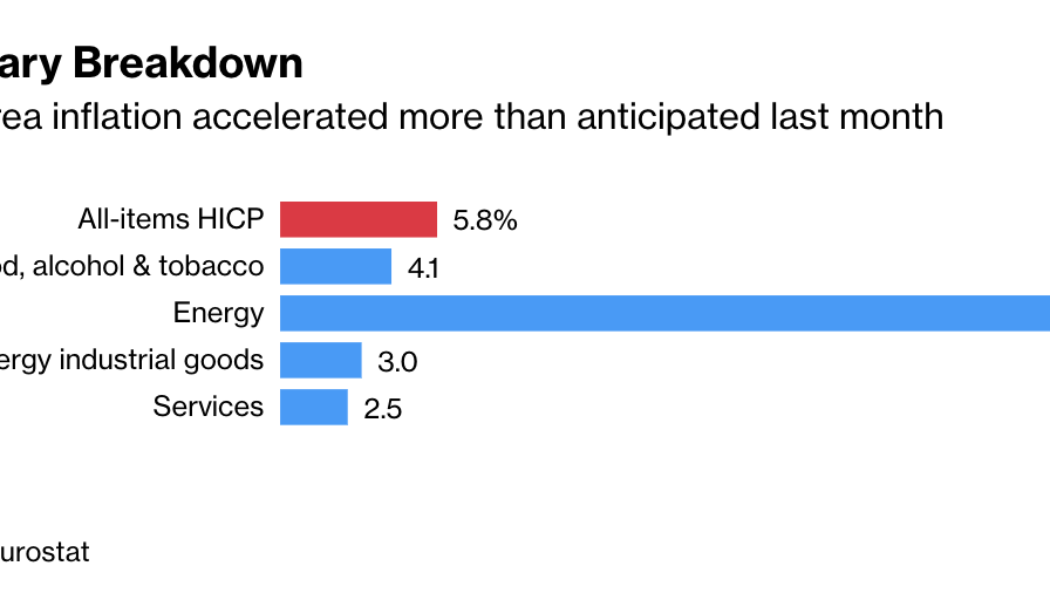

Bitcoin (BTC) has the potential to become a “good bet” for investors if the Federal Reserve does everything it can to keep the U.S. economy afloat against impending recession risks, according to popular analyst Bitcoin Jack. The independent market analyst pitted the flagship cryptocurrency, often called “digital gold” by its enthusiasts, against the prospects of further quantitative easing by the U.S. central bank, noting that the ongoing military standoff between Ukraine and Russia had choked the supply chain of essential commodities, such as oil and wheat, resulting in higher global inflation. For instance, consumer prices in Europe jumped 5.8% year-over-year in February compared to 5.1% in the previous month, greater than the median economist forecast of 5.6% in ...

Analysts say bulls will aim for $48K now that Bitcoin’s ‘accumulation phase’ has begun

Investor sentiment across the cryptocurrency ecosystem has seen a significant shift in the positive direction over the past week, despite events in the wider world. Currently, Bitcoin (BTC) is back above $43,500 and many altcoins are also witnessing double-digit gains. Crypto Fear & Greed index. Source: Alternative The ongoing conflict in Ukraine and recent actions taken by governments to limit access to banking services may have helped to shine a light on the value of holding cryptocurrencies, which offers some protection against uncontrollable events and what some might perceive as government overreach. Data from Cointelegraph Markets Pro and TradingView shows that the price of BTC has oscillated between $43,350 and $45,400 on March 2 as the world awaits some form of resolution to th...

Bitcoin price spike to $39K leads traders to say ‘the panic is over for a few days’

Global financial markets and crypto markets were pummeled over the past 24-hours as the invasion of Ukraine by Russian forces sent investors scrambling and sell-offs took place across most asset classes. Data from Cointelegraph Markets Pro and TradingView shows that the price of Bitcoin (BTC) hit a low of $34,333 in the early trading hours on Feb. 24, shortly after the Ukraine incursion began, and has since climbed its way back to $38,500 after an unexpected short-squeeze may have rapped bearish investors on the knuckles. BTC/USDT 1-day chart. Source: TradingView Here’s a look at what several analysts are saying about BTC price and how the ongoing conflict could impact crypto markets in the short-term. BTC in a “great buy area” Bitcoin’s collapse on the night of Feb. 23 was not unexp...