Federal Reserve

Biden’s pick for Fed vice chair for supervision calls for congressional action on stablecoins

Michael Barr, a law professor and former advisory board member of Ripple Labs who is United States President Joe Biden’s pick for vice chair for supervision at the Federal Reserve, called for U.S. lawmakers to regulate stablecoins in an effort to address “financial stability risks.” In a confirmation hearing before the Senate Banking Committee on Thursday, Barr said innovative technologies including cryptocurrencies had “some potential for upside in terms of economic benefit” but also “some significant risks,” citing the need for a regulatory framework on stablecoins to prevent the risk of runs. Barr added that the Fed potentially releasing a central bank digital currency was an issue that required “a lot more thought and study,” echoing Fed chair Jerome Powell’s views concerning due dilig...

US Senate confirms Jerome Powell for another four years as Fed chair

The United States Senate has confirmed the nomination of Jerome Powell as the chair of the board of governors of the Federal Reserve System until 2026. In an 80–19 landslide vote on the Senate floor on Thursday, U.S. lawmakers confirmed Powell as chair of the Federal Reserve, a position he held from February 2018 until February 2022, when he was named chair pro tempore until a confirmation vote could be secured. Powell was one of four Fed nominees awaiting a full Senate vote following weeks of delays due, in part, to partisan obstructionism — Republican lawmakers in the Senate Banking Committee boycotted a meeting in February that would have likely sent Powell’s nomination to the Senate for a vote earlier. However, some of United States President Joe Biden’s nominations for the Fed have re...

The Fed cites its concern about stablecoins in its latest Financial Stability Report

The United States Federal Reserve Board released its semiannual Financial Stability Report on Monday. The report points to the volatility on commodities markets brought on by the Russian invasion of Ukraine, the spread of the omicron variant of COVID-19 and “higher and more persistent than expected” inflation as sources of instability. Stablecoins and some types of money market funds were singled out in the report and noted to be prone to runs. According to the Fed, stablecoins have an aggregate value of $180 billion, with 80% of that amount represented by Tether (USDT), USD Coin (USDC), and Binance USD (BUSD). They are backed by assets that may lose value or become illiquid during stress, leading to redemption risks, and those risks may be exacerbated by a lack of transparency, the centra...

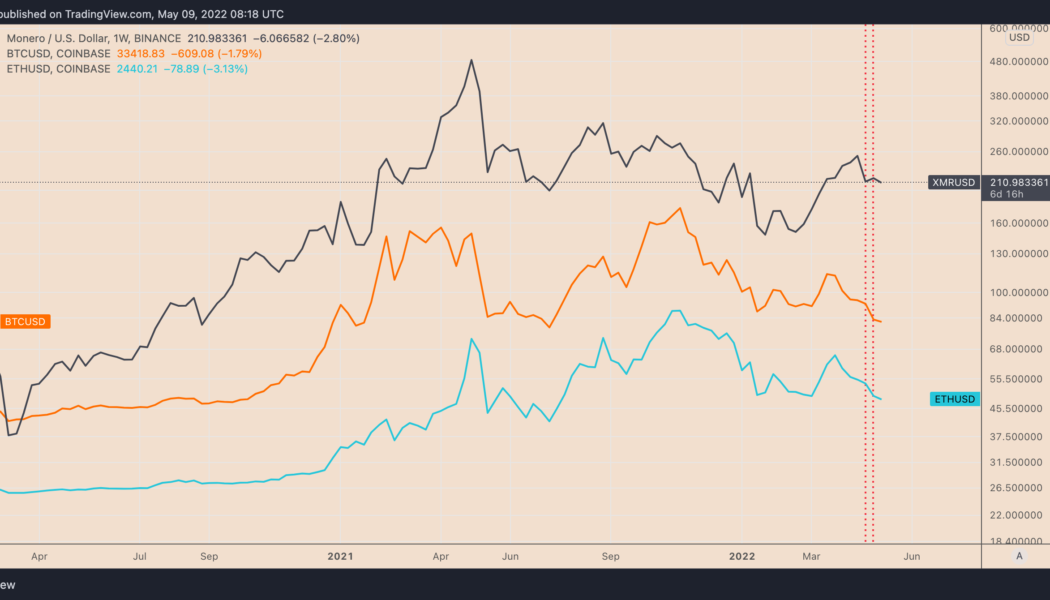

Monero avoids crypto market rout, but XMR price still risks 20% drop by June

Monero (XMR) has shown a surprising resilience against the United States Federal Reserve’s hawkish policies that pushed the prices of most of its crypto rivals — including the top dog Bitcoin (BTC) — lower last week. XMR price closed the previous week 2.37% higher at $217, data from Binance shows. In comparison, BTC, which typically influences the broader crypto market, finished the week down 11.55%. The second-largest crypto, Ether (ETH), also plunged 11% in the same period. XMR/USD vs. BTC/USD vs. ETH/USD weekly price chart. Source: TradingView While the crypto market wiped off $163.25 billion from its valuation last week, down nearly 9%, Monero’s market cap increased by $87.7 million, suggesting that many traders decided to seek safety in this privacy-focused coin. XMR near ...

Crypto Biz: The real reason crypto hodlers should care about the Federal Reserve, April 28–May 4, 2022

Wall Street’s slow embrace of crypto means we all have to start watching the Federal Reserve again. Cointelegraph parsed through the latest Federal Open Market Committee (FOMC) policy statement on Wednesday to try and uncover some nuggets of useful information. You can think of it as an exercise in financial esoterics to uncover the hidden meaning behind the Fed’s decision-making. As it turns out, the decision to raise interest rates by 50 basis points was already expected, so the actual FOMC document provided very little new information. But, Fed Chair Jerome Powell sparked a late rally in crypto and stocks on Wednesday when he said 75 basis-point increases aren’t on the table. You wanted the institutions to adopt crypto, didn’t you? Now, the asset class is trading almost in lockstep with...

‘Someone is blowing up’ — Bitcoin sees 2022 volume record amid hopes capitulation is over

Bitcoin (BTC) dipping below $36,000 “smells like capitulation,” one trader says as suspicion mounts over United States stock markets. In a tweet on May 6, Cointelegraph contributor Michaël van de Poppe suggested that the BTC price was at least giving “serious signals.” Analyst: Stocks saw “forced liquidation” After plunging to 10-week lows in line with equities on the May 5 Wall Street trading session, Bitcoin bounced at levels last seen in February. The downturn in both crypto and stocks, which followed an initial bounce the day prior on the back of expected rate hikes by the Federal Reserve, appeared to be more than traders bargained for. The S&P 500 finished the day down 3.5%, while the Nasdaq 100 ended down 5%. Outside stocks, U.S. 10-year Treasury futures shed 1%, a rare comb...

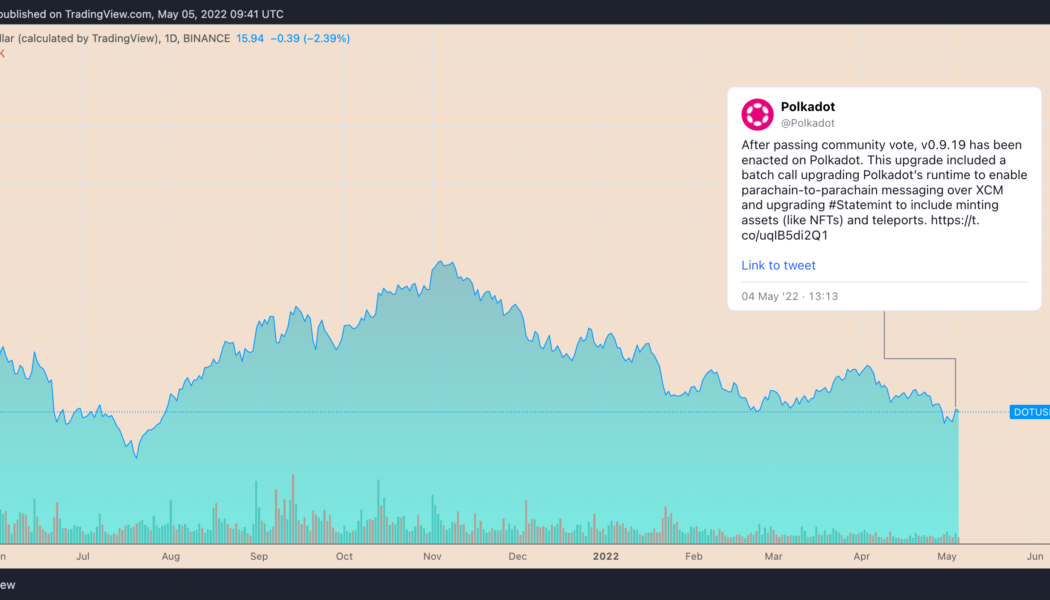

DOT rallies 12% in a day as Polkadot gears up to solve a major blockchain hacking problem

Polkadot (DOT) price ticked higher in the past 24 hours on anticipations that its new cross-chain communications protocol would solve a long-standing problem in the blockchain sector. DOT price gains 12% on XCM launch Bulls pushed DOT’s price to $16.44 on May 5 from $14.72 a day before, gaining a little over 12% as they assessed the launch of XCM, a messaging system that allows parachains — individual blockchains that operate in parallel inside the Polkadot ecosystem — to communicate with each other. DOT/USD daily price chart. Source: TradingView As Cointelegraph reported, future updates in the XCM protocol would see parachains exchanging messages without relying on Polkadot’s central blockchain, the Relay Chain. That expects to eliminate bridge hacks that have cost the in...

Bitcoin nervously awaits Fed as Paul Tudor Jones says ‘clearly don’t own’ stocks, bonds

Bitcoin (BTC) kept investors guessing on May 3 as markets awaited May 4’s Federal Reserve comments. BTC/USD 1-hour candle chart (Bitstamp). Source: TradingView Tudor Jones says “no thanks” to stocks, bonds Data from Cointelegraph Markets Pro and TradingView showed BTC/USD hovering just above $38,000 at May 3’s Wall Street open. The pair had stayed practically static over 24 hours to the time of writing as volatility in stocks dictated the mood. Amid multiple calls for a “capitulation” style event to hit both crypto and TradFi markets, there was an eerie sense of calm leading up to the Federal Open Markets Committee (FOMC) meeting, with news on U.S. rate hikes to follow. Everyone is waiting for Jerome Powell to come up tomorrow to have a speech...

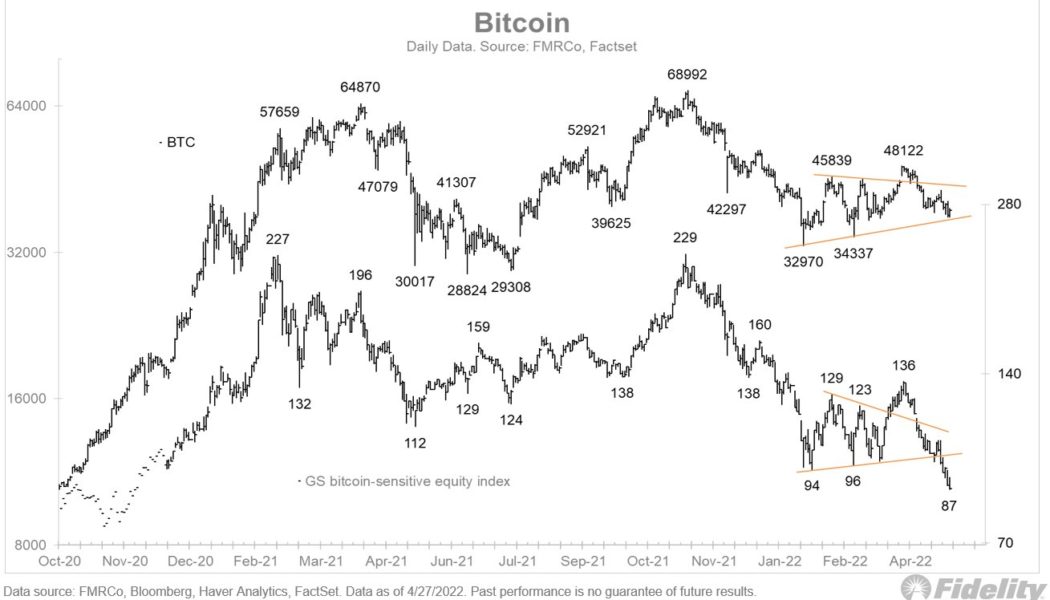

Fed ‘will determine the fate of the market’ — 5 things to know in Bitcoin this week

Bitcoin (BTC) starts a new week with much to make up for after its worst April performance ever. The monthly close placed BTC/USD firmly within its established 2022 trading range, and fears are already that $30,000 or even lower is next. That said, sentiment has improved as May begins, and while crypto broadly remains tied to macro factors, on-chain data is pleasing rather than panicking analysts. With a decision on United States economic policy due on May 4, however, the coming days may be a matter of knee-jerk reactions as markets attempt to align themselves with central bank policy. Cointelegraph takes a look at the these and other factors set to shape Bitcoin price activity this week. Fed back in the spotlight Macro markets are — as is now the standard — on edge this week as another U....

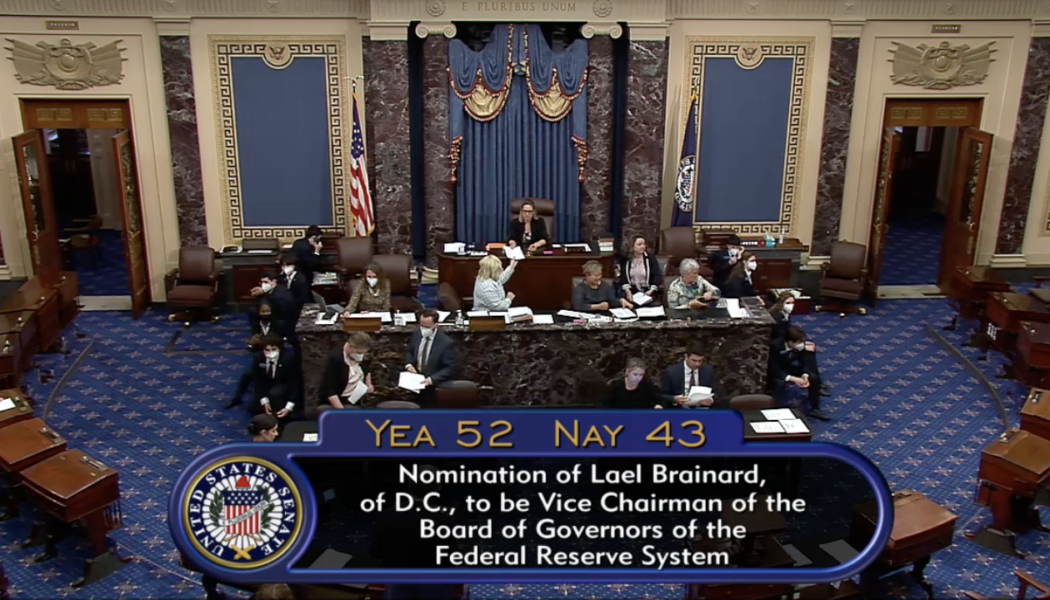

US Senate confirms Lael Brainard as Fed vice chair

After weeks of delays due, in part, to partisan obstructionism, the United States Senate has confirmed the nomination of Lael Brainard, a member of the Federal Reserve’s board of governors, as the next vice chair of the central bank. In a 52–43 vote on the Senate floor on Tuesday, U.S. lawmakers confirmed Brainard a vice chair of the Federal Reserve for four years, potentially beyond her term as a governor ending in January 2026. Brainard was one of four nominees waiting for approval since Republican lawmakers in the Senate Banking Committee boycotted a February committee, which would have sent the prospective Fed vice chair’s nomination to the full Senate. In addition to Brainard, the Senate will likely soon vote on the nominations of prospective Fed chair Jerome Powell, who h...

Could XRP price lose another 70% by Q3?

Ripple (XRP) continued its correction trend on April 25, falling by 5.5% to reach $0.64, its lowest level since Feb. 28. More XRP price downside ahead? The plunge increased the possibility of triggering a bearish reversal setup called descending triangle. While these patterns form usually during a downtrend, their occurrences following strong bullish moves usually mark the end of the uptrend. XRP has been in a similar trading channel since April 2022, bounded by two trendlines: a lower horizontal and an upper downward sloping. The pattern now nears its resolve as XRP pulls back toward the support trendline that’s also coinciding with the 50-week exponential moving average (50-week EMA; the blue wave), five weeks after testing the upper trendline as resistance. XRP/USD weekl...