Federal Reserve

US central bank digital currency commenters divided on benefits, unified in confusion

In January, the United States Federal Reserve Board of Governors released a discussion paper on a potential U.S. central bank digital currency (CBDC) titled “Money and Payments: The U.S. Dollar in the Age of Digital Transformation.” The comment period for the paper ended May 20, with the Fed receiving over 2,000 pages of comments from individuals alongside responses from leading stakeholders. Cointelegraph read a selection of shareholder responses to the Fed paper, and it quickly became apparent that there are plenty of confidently stated opinions but little agreement among them. The main points of commonality are in the places they are all perplexed. The Fed wants to know Appropriately for its purpose, the Fed paper provides a broad overview of central bank digital currencies and CBDC-adj...

BNB price risks 40% drop as SEC launches probe against Binance

Binance Coin (BNB) price dropped by nearly 7.3% on June 7 to below $275, its lowest level in three weeks. What’s more, BNB price could drop by another 25%–40% in 2022 as its parent firm, Binance, faces allegations of breaking securities rules and laundering billions of dollars in illicit funds for criminals. Bad news twice in a row BNB was issued as a part of an initial coin offering (ICO) in 2017 that amassed $15 million for Binance. The token mainly behaves as a utility asset within the Binance ecosystem, primarily enabling traders to earn discounts on their trading activities. Simultaneously, BNB also functions as a speculative financial asset, which has made it the fifth-largest cryptocurrency by market capitalization. BNB market capitalization was $45.42 billion as of June ...

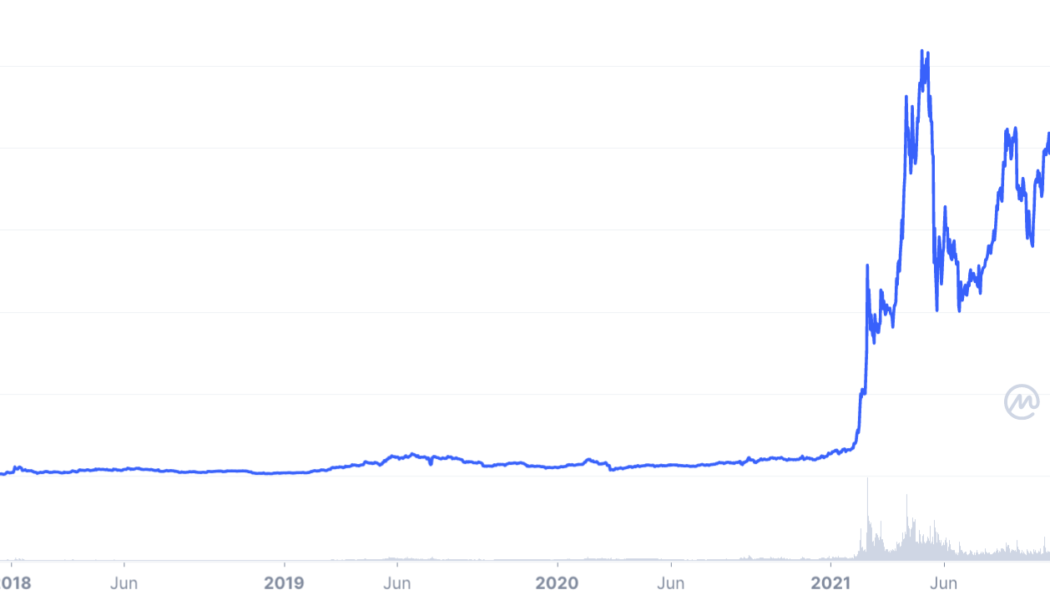

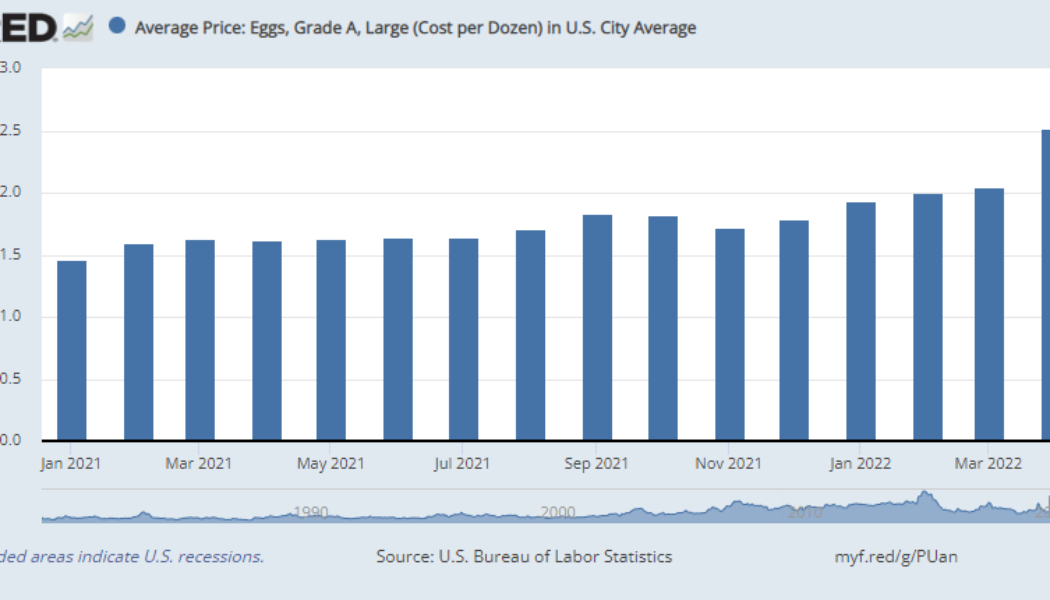

Fed forgets long-term dollar devaluation when pricing eggs in BTC

The St. Louis Federal Reserve stirred up a mix of amusement and curiosity from the crypto community on Tuesday, May 7, after publishing a post showing how the cost of eggs in Bitcoin (BTC) has fluctuated over the last 14-months compared to the U.S. dollar. On June 6, the Fed research arm posted a blog post titled “Buying eggs with bitcoins – a look at currency-related price volatility.” The FRED Blog compares egg prices in U.S. dollars vs. bitcoins. Check out the post to see which prices are more stable https://t.co/Qfy9w8zgBk pic.twitter.com/qpFH4ny33S — St. Louis Fed (@stlouisfed) June 6, 2022 The post initially features a graph showing the historical price of eggs in U.S. dollars for every month since January 2021, noting that the prices fluctuated between $1.47 and $2.52 ov...

Is Solana a ‘buy’ with SOL price at 10-month lows and down 85% from its peak?

Solana’s (SOL) price dropped on June 3, bringing its net paper losses down to 85% seven months after topping out above $260. SOL price fell by more than 6.5% intraday to $35.68, after failing to rebound with conviction from 10-month lows. Now sitting on a historically significant support level, the SOL/USD pair could see an upside retracement in June, eyeing the $40-$45 area next, up around 25% from today’s price. SOL/USD daily price chart. Source: TradingView 60% SOL price decline ahead? However, a rebound scenario is far from guaranteed and Solana faces headwinds from trading in lockstep with Bitcoin (BTC), the top cryptocurrency (by market cap) that typically influences trends across the top altcoins. Notably, the weekly correlation coefficient between BTC and SO...

Fed governor explains who needs crypto regulation and why demand for it is growing

Regulation is needed to open the crypto ecosystem to a larger public, United States Federal Reserve Board Governor Christopher Waller told an audience at the SNB-CIF Conference on Cryptoassets and Financial Innovation in Zurich, Switzerland. Financial intermediaries can help manage risk for new crypto users, but cannot eliminate it, Waller said, and new and fast-growing financial products need public confidence to survive. The banking official used historical examples to show the relationship between technical innovation, regulation and the amassing of fortunes. “New technology — and a lack of clear rules — meant some new fortunes were made, even as others were lost,” Waller said. Experienced investors know how to operate in unregulated marketplaces and may not need or want regulation, Wal...

NY Fed president urges colleagues to prepare for coming digital payment transformation

Get ready for a fundamental change in money and payments, John Williams, president and CEO of the Federal Reserve Bank of New York, told central bank officials, academics and financial industry leaders from around the world on Wednesday. Williams delivered the opening remarks at an invitation-only workshop on monetary policy implementation co-hosted by the New York Fed and Columbia University. The central banker dismissed much of the digital asset space with a single-sentence observation that not all cryptocurrencies are backed by non-crypto assets. Central bank digital currencies (CBDCs) and stablecoins backed by safe, liquid assets have the potential for innovation, he continued. Related: The United States turns its attention to stablecoin regulation Williams did not elaborate on the pos...

Billionaire Bill Miller calls Bitcoin ‘insurance’ against financial catastrophe

Bill Miller the billionaire founder and Chief Investment Officer of investment firm Miller Value Partners, has said he considers Bitcoin (BTC) an “insurance policy against financial catastrophe.” Appearing on an episode of the “Richer, Wiser, Happier” podcast on May 24 Miller backed the cryptocurrency as a means for those caught in conflict to still access financial products. He used the collapse of financial infrastructure in Afghanistan after the US withdrawal in August 2021 as an example. “When the US pulled out of Afghanistan, Western Union stopped sending remittances there or taking them from Afghanistan, but if you had Bitcoin, you were fine. Your Bitcoin is there. You can send it to anybody in the world if you have a phone.” Miller said examples of how the crypto can function as ins...

Brazil’s Federal Revenue now requires citizens to pay taxes on like-kind crypto trades

Brazil’s Federal Reserve (RFB) has declared that Brazilian investors in the crypto-asset market must pay income tax on transactions that involve the like-kind exchange of cryptocurrencies; for example, Bitcoin (BTC) for Ethereum (ETH). The RFB’s declaration was published in the Diário Oficial da União and was the result of a consultation made by a citizen of the country to the regulator. At the end of last year, the group issued an opinion in which it claimed that trading between cryptocurrency pairs is taxable even if there is no conversion to the real (Brazil’s national currency). Although it does not specify what can be understood as “profit,” since in the exchange of one crypto asset for another there is no capital gain in fiat currency, it points out...

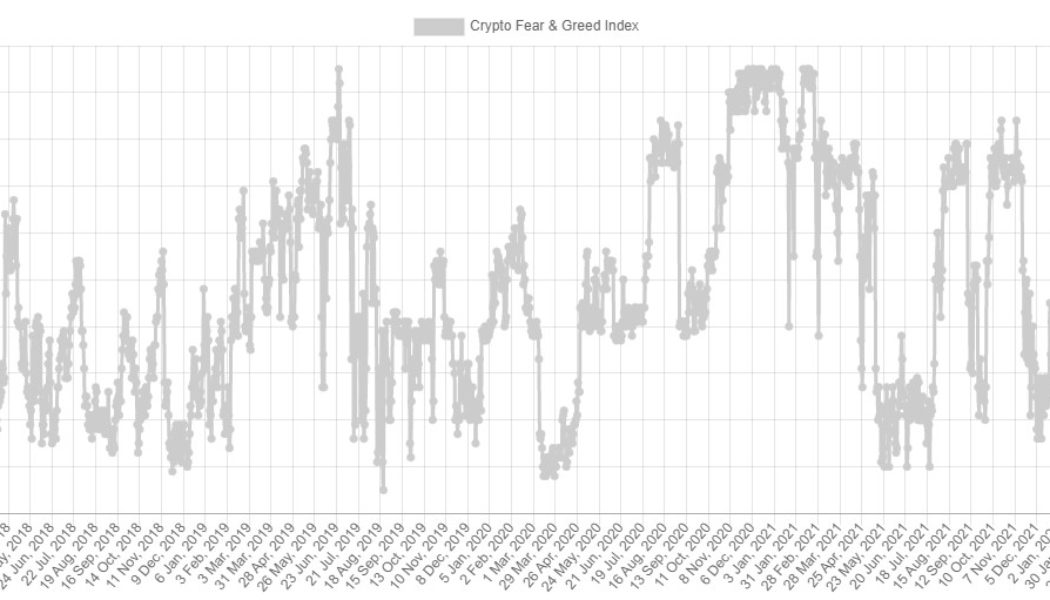

‘Extreme fear’ grips Bitcoin price, but analysts point to signs of a potential reversal

The cryptocurrency market settled into a holding pattern on May 25 after traders opted to sit on the sidelines ahead of the midday Federal Open Market Committee (FOMC) meeting where the Federal Reserve signaled that it intends to continue on its path of raising interest rates. According to data from Alternative.me, the Fear and Greed Index seeing its longest run of extreme fear since the market crash in Mach 2020. Crypto Fear & Greed Index. Source: Alternative Data from Cointelegraph Markets Pro and TradingView shows that the price action for Bitcoin (BTC) has continued to compress into an increasingly narrow trading range, but technical analysis indicators are not providing much insight on what direction a possible breakout could take. BTC/USDT 1-day chart. Source: TradingView Here’s ...

Low inflation or bust: Analysts say the Fed has no choice but to continue raising rates

As economic conditions continue to worsen, financial experts worldwide are increasingly placing the blame at the feet of the United States Federal Reserve after the central bank was slow to respond to rising inflation early on. Financial markets are currently experiencing their worst stretch of losses in recent history, and it doesn’t appear that there is any relief in sight. May 24 saw the tech-heavy Nasdaq fall another 2%, while Snap, a popular social media company, shed 43.1% of its market cap in trading on May 23. This past couple of months have been absolutely brutal for the markets… 8 consecutive weeks of red candles in the #SPX, #NASDAQ and #BTC… no significant bounces pic.twitter.com/hgU2VwIoxh — Crypto Phoenix (@CryptoPheonix1) May 24, 2022 Much of the recent turmoil again c...

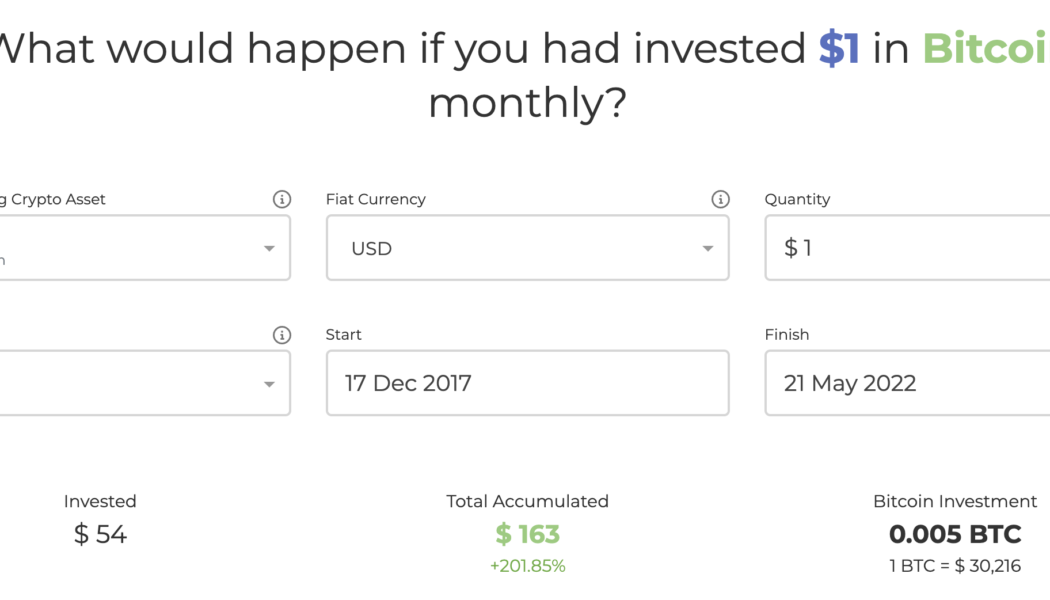

Dollar Cost Averaging or Lump-sum: Which Bitcoin strategy works best regardless of price?

Bitcoin (BTC) has declined by more than 55% six months after it reached its record high of $69,000 in November 2021. The massive drop has left investors in a predicament about whether they should buy Bitcoin when it is cheaper, around $30,000, or wait for another market selloff. The more you look at prior $BTC price history the more one can think it’s not the bottom After 190 days from the all-time high, Bitcoin still had another 150 to 200 days until it hit bottom last couple of cycles (red box) If time is any indicator, could be another 6 to 8 months pic.twitter.com/C1YHnfOzxC — Rager (@Rager) May 20, 2022 This is primarily because interest rates are lower despite Federal Reserve’s recent 0.5% rate hike. Meanwhile, cash holdings among the global fund managers have surged ...

Dollar Cost Averaging or Lump-sum: Which Bitcoin strategy works best regardless of price?

Bitcoin (BTC) has declined by more than 55% six months after it reached its record high of $69,000 in November 2021. The massive drop has left investors in a predicament about whether they should buy Bitcoin when it is cheaper, around $30,000, or wait for another market selloff. The more you look at prior $BTC price history the more one can think it’s not the bottom After 190 days from the all-time high, Bitcoin still had another 150 to 200 days until it hit bottom last couple of cycles (red box) If time is any indicator, could be another 6 to 8 months pic.twitter.com/C1YHnfOzxC — Rager (@Rager) May 20, 2022 This is primarily because interest rates are lower despite Federal Reserve’s recent 0.5% rate hike. Meanwhile, cash holdings among the global fund managers have surged ...