Federal Reserve

Fed adds a new layer of bureaucracy for US banks engaging in crypto asset activities

The United States Federal Reserve Board issued a letter Tuesday to its supervisory officers, staff and the banks they supervise regarding activities with crypto assets. The letter covers the preliminary steps a bank must go through before engaging in activities with crypto and instructs banks to notify the board before proceeding with those activities. The letter, signed by the directors of the regulatory and community affairs divisions, applies to all banks supervised by the Fed with no threshold of minimum assets. It begins with a warning about the risks associated with crypto, specifically mentioning evolving technology and its governance, Anti-Money Laundering and transparency and the stability of assets such as stablecoin. The Fed is monitoring banks’ activities, the letter noted: “Gi...

Is Bitcoin really a hedge against inflation?

While Bitcoin (BTC) has failed in countering this year’s rampant global inflation, it should still be considered as an inflation hedge, says Steven Lubka, the managing director of private consumers at Swan Bitcoin. According to Lubka, Bitcoin works well as a hedge against rising prices when inflation is caused by monetary expansion. It is less effective when inflation is caused by the disruption of the food supply and energy, which he sees as the leading cause of this year’s rampant inflation. [embedded content] “In a world where the price of goods is going up because there’s been a radical loss of abundance, Bitcoin isn’t going to protect investors from that,” Lubka said. He also points out that Bitcoin is a better hedge against inflat...

Is Bitcoin really a hedge against inflation?

While Bitcoin (BTC) has failed in countering this year’s rampant global inflation, it should still be considered as an inflation hedge, says Steven Lubka, the managing director of private consumers at Swan Bitcoin. According to Lubka, Bitcoin works well as a hedge against rising prices when inflation is caused by monetary expansion. It is less effective when inflation is caused by the disruption of the food supply and energy, which he sees as the leading cause of this year’s rampant inflation. [embedded content] “In a world where the price of goods is going up because there’s been a radical loss of abundance, Bitcoin isn’t going to protect investors from that,” Lubka said. He also points out that Bitcoin is a better hedge against inflat...

Solana (SOL) price is poised for a potential 95% crash — Here’s why

Solana (SOL) price rallied by approximately 75% two months after bottoming out locally near $25.75, but the token’s splendid upside move is at risk of a complete wipeout due to an ominous bearish technical indicator. A major SOL crash setup surfaces Dubbed a “head-and-shoulders (H&S),” the pattern appears when the price forms three consecutive peaks atop a common resistance level (called the neckline). Notably, the middle peak (head) comes to be higher than the other two shoulders, which are of almost equal height. Head and shoulders patterns resolve after the price breaks below their neckline. In doing so, the price falls by as much as the distance between the head’s peak and the neckline when measured from the breakdown point, per a rule of technical analysis....

Solana (SOL) price is poised for a potential 95% crash — Here’s why

Solana (SOL) price rallied by approximately 75% two months after bottoming out locally near $25.75, but the token’s splendid upside move is at risk of a complete wipeout due to an ominous bearish technical indicator. A major SOL crash setup surfaces Dubbed a “head-and-shoulders (H&S),” the pattern appears when the price forms three consecutive peaks atop a common resistance level (called the neckline). Notably, the middle peak (head) comes to be higher than the other two shoulders, which are of almost equal height. Head and shoulders patterns resolve after the price breaks below their neckline. In doing so, the price falls by as much as the distance between the head’s peak and the neckline when measured from the breakdown point, per a rule of technical analysis....

Crypto Biz: Elon Musk: The ultimate crypto tourist

Elon Musk’s Tesla proved to be the ultimate paper hands after the electric vehicle maker sold 75% of its Bitcoin (BTC) holdings in the second quarter. I say, good riddance. The cult of personality isn’t good for Bitcoin, and neither is a technologist who treats the asset as his plaything. As far as we are aware, Musk hasn’t sold any of his personal Bitcoin stash and Tesla still has an estimated 10,800 BTC on its books. Still, the less we have to hear about Musk and Bitcoin, the better. In this week’s Crypto Biz, we chronicle Tesla’s sale of BTC, KuCoin’s fight against fake news and Cathie Wood’s sale of Coinbase stock. Tesla reports $64M profit from Bitcoin sale Tesla’s decision to sell most of its Bitcoin wasn’t as boneheaded as it appeared at first. The company scored a $64 million...

Fed demands Voyager remove ‘false’ claims deposits are FDIC insured

Cypto lender Voyager Digital has been directed to remove “false and misleading” statements that its user’s deposit accounts are FDIC insured. In a joint letter written on July 28 by Seth Rosebrockfrom & Jason Gonzalez, Assistant General Counsel at the Federal Reserve and the Federal Deposit Insurance Corporation (FDIC) to Voyager Digital, the authors said the representations “likely misled and were relied upon” by customers who placed funds with Voyager who now no longer have access to it. “These representations are false and misleading and, based on the information we have to date, it appears that the representations likely misled and were relied upon by customers who placed their funds with Voyager and do not have immediate access to their funds.” The Fed and FDIC allege that V...

3 Bitcoin trading behaviors hint that BTC’s rebound to $24K is a ‘fakeout’

Bitcoin (BTC) price rallied toward $24,200 on July 28 after a near 10.5% surge that began a day earlier. The gains appeared after Federal Reserve Chairman Jerome Powell signaled intentions to slow down their prevailing tightening spree. They prompted some Bitcoin analysts to predict short-term upside continuation, with CryptoHamster seeing BTC at $26,000 next. It seems that the downside breakout was a false one, and the bullish flag has been validated. Let’s see how fast $BTC can reach those targets. #bitcoin $BTCUSD $ETH $ETHUSD #ビットコイン #биткойн #比特币 https://t.co/v6x4Ka23L7 pic.twitter.com/nKoEV8440X — CryptoHamster (@CryptoHamsterIO) July 28, 2022 But BTC’s potential to recover entirely from its ongoing bearish slumber appears low for at least three key reasons. Bitcoin bulls...

Will the Fed prevent BTC price from reaching $28K? — 5 things to know in Bitcoin this week

Bitcoin (BTC) enters a new week with a question mark over the fate of the market ahead of another key United States monetary policy decision. After sealing a successful weekly close — its highest since mid-June — BTC/USD is much more cautious as the Federal Reserve prepares to hike benchmark interest rates to fight inflation. While many hoped that the pair could exit its recent trading range and continue higher, the weight of the Fed is clearly visible as the week gets underway, adding pressure to an already fragile risk asset scene. That fragility is also showing in Bitcoin’s network fundamentals as miner strain becomes real and the true cost of mining through the bear market shows. At the same time, there are encouraging signs from some on-chain metrics, with long-term investors still re...

Ethereum’s bearish U-turn? ETH price momentum fades after $1.6K rejection

Ethereum’s native token Ether (ETH) tumbled on July 26, reducing hopes of an extended price recovery. The ETH/USD pair dropped by roughly 5%, followed by a modest rebound to over $1,550. Ethereum gets rejected at $1,650 These overnight moves liquidated over $80 million worth of Ether positions in the last 24 hours, data from CoinGlass reveals. ETH/USD hourly price chart. Source: TradingView The seesaw action also revealed an underlying bias conflict among traders who have been stuck between two extremely opposite market fundamentals. The first is the euphoria surrounding Ethereum’s potential transition to proof-of-stake in September, which has helped Ether’s price to recover 45% month-to-date. However, this bullish hype is at odds with macroeconomic headwinds, namel...

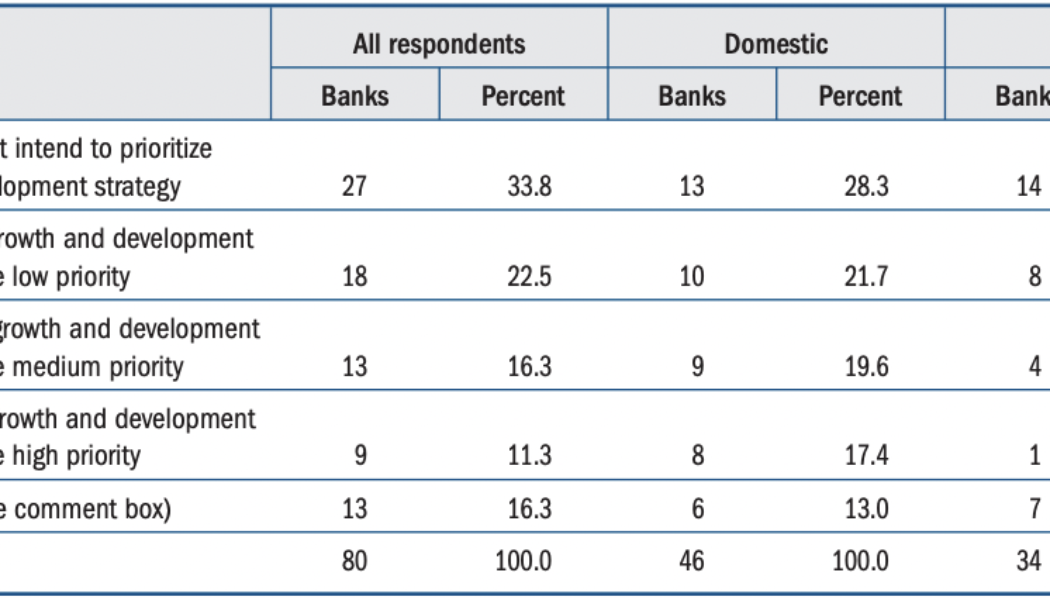

56% of banks say DLT and crypto are ‘not a priority’ in near future — Fed survey

A survey conducted by the Federal Reserve Board of the United States suggested that the majority of officials at major banks did not consider crypto-related products and services a priority in the near future. According to the results of a Fed survey released on Friday, more than 56% of senior financial officers from 80 banks said distributed ledger technology and crypto products and services were “not a priority” or were “a low priority” for their growth and development strategy for the next two years, while roughly 27% said they were a medium or high priority. However, roughly 40% of respondents in the survey said the technology was a medium or high priority for their banks for the next two to five years. Results of Fed survey from May 2022. Source: Federal Reserve Answers from surveyed ...

US Senate confirms Michael Barr as Fed vice chair for supervision

The United States Senate has confirmed the nomination of law professor Michael Barr to become the next vice chair for supervision for the Federal Reserve. In a 66-28 vote on the Senate floor on Wednesday, U.S. lawmakers confirmed Barr as vice chair for supervision of the Federal Reserve System for four years, filling the last seat on the seven-member board of governors. Barr, who was on the advisory board of Ripple Labs from 2015 to 2017, also served as the Treasury Department’s assistant secretary for financial institutions under former President Barack Obama, and taught courses on financial regulation at the University of Michigan. As vice chair for supervision, Barr will be responsible for developing policy recommendations for the Fed as well as overseeing the supervision and regulation...