Federal Reserve

3 historically accurate Bitcoin on-chain metrics are flashing ‘bottom’

Bitcoin (BTC) and other riskier assets slipped on Oct. 21 as traders scrutinized macro indicators that suggest the Federal Reserve would continue to hike rates. Nonetheless, the BTC/USD pair remains rangebound inside the $18,000–$20,000 price range, showing a strong bias conflict in the market. BTC price holding above $18K since June Notably, BTC’s price has been unable to dive deeper below $18,000 since it first tested the support level in June 2022. As a result, some analysts believe that the cryptocurrency is bottoming out, given it has already corrected by over 70% from its record high of $69,000, established almost a year ago. BTC/USD daily price chart. Source: TradingView “During the 2018 bear market, BTC saw a max drawdown from peak to trough of 84%, lasting 364 days, wh...

Cardano price chart paints ‘Burj Khalifa’ with 7-month losing streak — More losses ahead?

Cardano (ADA) price is in the process of painting its seventh red monthly candle in a row as the token fell to its lowest level since February 2021. The trend saw ADA’s price rising nearly 800% to $3.16 between February 2021 and September 2021, followed by a complete wipeout of those gains entering October 2022. Amusingly, the entire price action took the shape of the “Burj Khalifa,” the world’s tallest skyscraper in Dubai. Ada Khalifa pic.twitter.com/KE2SxTO3bN — Trader_J (@Trader_Jibon) October 19, 2022 ADA price eyes 35% price crash The ADA price correction began primarily in the wake of a similar downtrend across the cryptocurrency market, led by the Federal Reserve’s aggressive interest rate hikes to tame rising inflation. Even an optimistic Cardano netwo...

Bitcoin trader predicts $18K return within days as stocks wilt post-CPI

Bitcoin (BTC) cooled near $19,200 after the Oct. 14 Wall Street open as stocks struggled to preserve their “bear trap.” BTC/USD 1-hour candle chart (Bitstamp). Source: TradingView Analyst: “Abandon all hope” for asset price rebound Data from Cointelegraph Markets Pro and TradingView followed BTC/USD as it came off one-week highs on the day to circle $19,300. The pair had seen intense volatility on the back of United States economic data the day prior, this sparking hundreds of millions of dollars in liquidations from both long and short positions. Now, after turning the tables and adding almost $2,000 in 24 hours, Bitcoin was again losing momentum as U.S. equities turned red on the day. At the time of writing, the S&P 500 was down 1.9%, while the Nasdaq Composite Index trad...

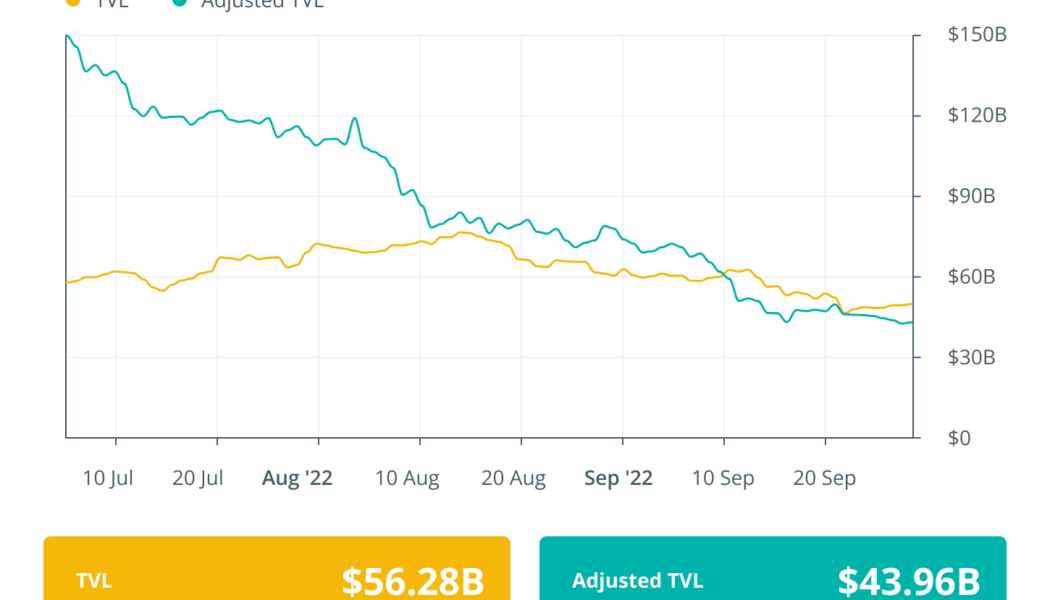

DeFi needs appropriate regulation before moving to retail, says Fed Chair: Finance Redefined

Welcome to Finance Redefined, your weekly dose of essential decentralized finance (DeFi) insights — a newsletter crafted to bring you significant developments over the last week. United States Federal Reserve chairman Jerome Powell has given his verdict on the evolution of the DeFi market, claiming there is a definite need for robust regulation before the nascent market could expand to retail. Maple Finance CEO believes that separating the risk from lending saved DeFi from the market crash. He added that crypto lending has operated as intended through the crypto winter because of the transparency. Members of the Ooki DAO are discussing various ways to respond to the recent lawsuit filed by the Commodity Futures Trading Commission. Another interesting turn of events from the DeFi ecosystem ...

Ethereum risks another 10% drop versus Bitcoin as $15.4M exits ETH investment funds

Ethereum’s Merge on Sep. 15 turned out to be a sell-the-news event, which looks set to continue. Notably, Ether (ETH) dropped considerably against the U.S. dollar and Bitcoin (BTC) after the Merge. As of Sep. 22, ETH/USD and ETH/BTC trading pairs were down by more than 20% and 17%, respectively, since Ethereum’s switch to Proof-of-Stake (PoS. ETH/USD and ETH/BTC daily price chart. Source: TradingView What’s eating Ether bulls? Multiple catalysts contributed to Ether’s declines in the said period. First, ETH’s price fall against the dollar appeared in sync with similar declines elsewhere in the crypto market, driven by Federal Reserve’s 75 basis points (bps) rate hike. Second, Ethereum faced a lot of flak for becoming too centralized ...

Jerome Powell is prolonging our economic agony

Can we all agree that the Federal Reserve has a plan to combat runaway inflation? They do. Chair Jerome Powell has all but admitted it. After tempering his comments before previous rate hikes, allowing wiggle room which gave way to market rebounds, Powell has left no bones about this one. It is necessary to wreak some havoc on the economy and put downward pressure on the labor markets and wage increases to stop the creep of inflation. Whether you buy into that logic or if you believe — like Elon Musk — that such movements could result in deflation — doesn’t matter. All that matters is what those voting on the rate hikes believe, and there’s plenty of evidence that they won’t stop until the rate is over 4%. Wednesday’s rate increase of 75 basis points only moves us in that direction. This i...

‘FED sledgehammer’ will further batter BTC, ETH prices — Bloomberg analyst

The United States Federal Reserve’s inflation “sledgehammer” is about to batter the prices of Bitcoin (BTC) and Ether (ETH) down even further, before reaching back to new all-time highs in 2025, according to Bloomberg analyst Mike McGlone. Ahead of the latest Fed interest rate hike to be announced this week, the market is expecting a minimum of a 75-basis-point increase, however some fear it could be as high as 100 basis points, which would represent the biggest rate hike in 40 years. Speaking with financial news outlet Kitco News on Saturday, McGlone, senior commodity strategist of Bloomberg Intelligence, suggested that further market carnage is on the cards for BTC, ETH and the broader crypto sector as Fed’s actions will continue to dampen investor sentiment: “We have to turn over to the...

XRP price risks 30% decline despite Ripple’s legal win prospects

Ripple (XRP) price was wobbling between profits and losses on Sept. 19 despite hopes that Ripple would eventually win its long-running legal battle against the U.S. Securities and Exchange Commission (SEC). Ripple and the SEC both agreed to expedite the lawsuit on Friday to get an answer on whether $XRP is a security or not. From the updates of the case, it sounds like it’s in the favor of @Ripple pic.twitter.com/SAyl4VLxdM — Jeff Sekinger (@JeffSekinger) September 19, 2022 Fed spoils SEC vs. Ripple euphoria The XRP/USD pair dropped by over 1% to $0.35 while forming extremely sharp bullish and bearish wicks on its Sept. 19 daily candlestick. In other words, its intraday performance hinted at a growing bias conflict among traders. XRP/USD daily price chart. Source: TradingView The inde...

Crypto market bloodbath leads to $432M in liquidation

The crypto market turmoil entered the third week of September as most of the cryptocurrencies started the week on a bearish note. The total crypto market cap dipped below $1 trillion again, with several cryptocurrencies recording a double-digit downfall over the past 24 hours. The ongoing bearish turmoil has led to nearly half a billion in liquidations for the leverage crypto traders over the past 24 hours. Data from Coinglass highlight that 130,087 traders were liquidated with a total liquidations value of $431.51 million. Bitcoin (BTC) leverage traders lost $44.5 million, followed by Ether (ETH) traders with a total liquidation of $8.39 million. Long traders made a significant chunk of losses on majority of the exchanges with the average difference between the amount of long and short li...

Goldman Sachs’ bearish macro outlook puts Bitcoin at risk of crashing to $12K

A sequence of macro warnings coming out of the Goldman Sachs camp puts Bitcoin (BTC) at a risk of crashing to $12,000. Bitcoin in “bottom phase?” A team of Goldman Sachs economists led by Jan Hatzius raised their prediction for the speed of Federal Reserve benchmark rate hikes. They noted that the U.S. central bank would increase rates by 0.75% in September and 0.5% in November, up from their previous forecast of 0.5% and 0.25%, respectively. Fed’s rate-hike path has played a key role in determining Bitcoin’s price trends in 2022. The period of higher lending rates — from near zero to the 2.25-2.5% range now — has prompted investors to rotate out of riskier assets and seek shelter in safer alternatives like cash. Bitcoin has dropped by almost 60% year-to-date and is...

White House publishes ‘first-ever’ comprehensive framework for crypto

Following President Joe Biden’s executive order on Ensuring Responsible Development of Digital Assets, federal agencies came up with a joint fact sheet on 6 principal directions for crypto regulation in the United States. It sums up the content of 9 separate reports, which have been submitted to the president to “articulate a clear framework for responsible digital asset development and pave the way for further action at home and abroad.” The fact sheet was published on the White House official website on Sept. 16, and consists of 7 sections: (1) Protecting Consumers, Investors, and Businesses; (2) Promoting Access to Safe, Affordable Financial Services; (3) Fostering Financial Stability; (4) Advancing Responsible Innovation; (5) Reinforcing Our Global Financial Leadership and Competitiven...

Hot CPI report puts a dent in Bitcoin and Ethereum rally, stocks also lose ground

Crypto and stock markets are feeling the pain after the Sept. 13 inflation report printed an unexpectedly hot figure that showed headline inflation rising by 0.1% month-over-month. Even with gas prices falling to multi-month lows and a cooling housing market, core inflation saw a 0.6% month-over-month bump and year-to-year inflation sits at 8.3%. This chart from @TheTerminal shows why this #CPI number is so disappointing. The contribution of energy has declined, as expected; but services inflation is now rising sharply. Not what the #FOMC will have wanted to see. pic.twitter.com/BsfwFsuyD5 — John Authers (@johnauthers) September 13, 2022 While market participants and investors had estimated the next Federal Reserve interest hike to be a hefty 0.75 basis points, many also subscribed to a lo...