Federal Reserve

The US Federal Reserve is making some analysts bullish on Bitcoin again

Signs of a steady Bitcoin (BTC) price recovery emerged earlier this week as investors shifted away from the U.S. dollar on weaker-than-expected economic data. In detail, Bitcoin’s drop last week to below $33,000 met with a healthy buying sentiment that pushed its per token rate to as high as $39,300 on Feb. 1. As of Thursday, BTC’s price dipped below $37,000 but was still up 13% from its local bottom. Meanwhile, the U.S. dollar index (DXY), which measures the greenback’s strength against a basket of top foreign currencies, rose to 97.441 last Friday, logging its best level since July 2020. However, the index corrected by nearly 1.50% to over 96.00 by Feb. 3. DXY vs. BTC/USD daily price chart. Source: TradingView Some market analysts saw the dollar’s renewed weakness...

Can Ethereum price reach $4K after a triple-support bounce?

Ethereum’s native token Ether (ETH) looks ready to continue its ongoing rebound move toward $4,000, according to a technical setup shared by independent market analyst Wolf. Classic bullish reversal pattern in the works? The pseudonymous chart analyst discussed the role of at least three support levels in pushing the ETH price up by nearly 30% from its local bottom of $2,160. These price floors included a 21-month exponential moving average, the 0.786 Fib level of a Fibonacci retracement graph drawn from $1,716-swing low to $4,772-swing high, and the lower boundary of an ascending triangle pattern. ETH/USD daily price chart featuring the three-supports. Source: TradingView Wolf noted that the triple-support scenario could push Ether price to $3,330. In doing so, ...

Terra (LUNA) at risk of 50% drop if bearish head-and-shoulders pattern plays out

Terra (LUNA) may fall to nearly $25 per token in the coming weeks as a head-and-shoulders (H&S) setup develops, indicating a 50% price drop, according to technical analysis shared by CRYPTOPIKK. H&S patterns appear when the price forms three peaks in a row, with the middle peak (called the “head”) higher than the other two (left and right shoulders). All three peaks come to a top at a common price floor called the “neckline.” Traders typically look to open a short position when the price breaks below the H&S neckline. However, some employ a “two-day” rule where they wait for the second breakout confirmation when the price retests the neckline from the downside as resistance, before entering a short position. Meanwhile, the ideal short ta...

Polygon (MATIC) sees a strong oversold bounce after $250B crypto market rebound

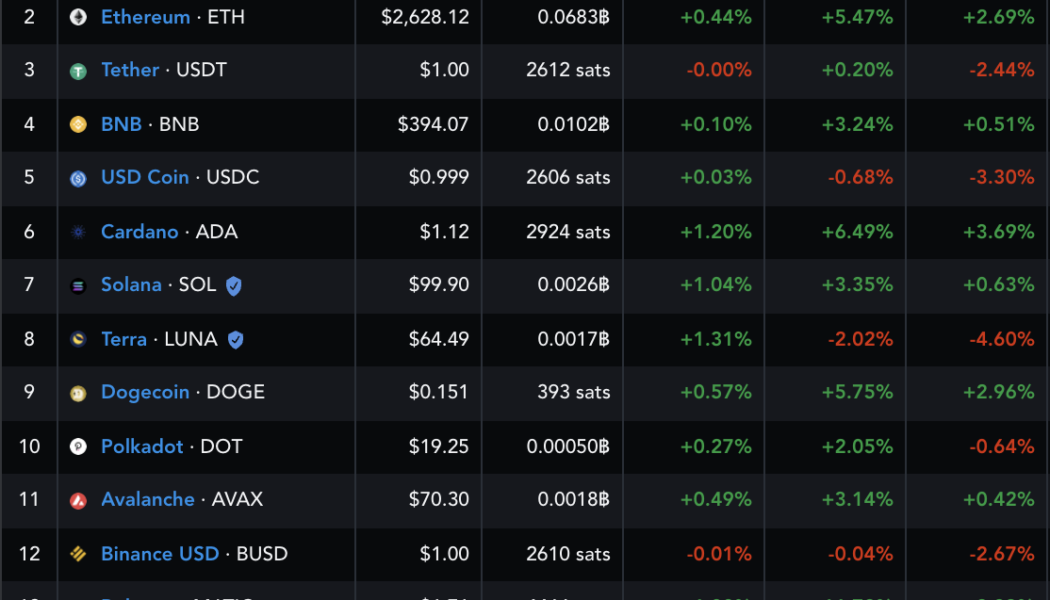

Polygon (MATIC) emerged as one of the best performers among high-ranking cryptocurrencies on Jan. 26 as the price rose nearly 17% to reach an intraday high at $1.825. The gains surfaced amid a synchronous rebound across the crypto market that started on Jan. 24. In detail, investors and traders poured in over $250 billion across digital assets, benefiting Bitcoin (BTC), Ether (ETH) and many others in the process. Performance of the top-fifteen cryptocurrencies in the last 15 days. Source: TradingView Polygon, a secondary scaling solution for the Ethereum blockchain, also cashed in on the crypto market rebound. The valuation of its native token, MATIC, rose from as low as $9.77 billion on Jan.24 to as high as $13.58 billion two days later. Meanwhile, its price jumped from $1....

Ethereum bulls aim to flip $2.8K to support before calling a trend reversal

The dire predictions calling for the onset of an extended bear market may have been premature as prices appear to be in recovery mode on Jan. 26 following a signal from the U.S. Federal Reserve that interest rates will remain near 0% for the time being. After the Fed announcement from, prices across the cryptocurrency market began to rise with Bitcoin (BTC) up 4.11% and making a strong push for $39,000. This sparked a wave of momentum that helped to lift a majority of tokens in the market, but at the time of writing BTC price has pulled back to the $37,000 zone. Data from Cointelegraph Markets Pro and TradingView shows that the top smart contract platform Ethereum (ETH) also responded positively to the rise in bullish sentiment as its price climbed 8.11% on the 24-hour chart to hit a...

Law Decoded: First-mover advantage in a CBDC conversation, Jan. 10–17

Last week saw an unlikely first move in the opening narrative battle around a prospective U.S. central bank digital currency: Congressperson Tom Emmer came forward with an initiative to legally restrict the Federal Reserve’s capacity to issue a retail CBDC and take on the role of a retail bank. This could be massively consequential as we are yet to see a similarly sharp-cut expression of an opposing stance. As a matter of fact, it is not even clear whether other U.S. lawmakers have strong opinions on the matter other than, perhaps, condemning privately issued stablecoins as a digital alternative to the dollar. By framing a potential Fed CBDC as a privacy threat first, Emmer could tilt the conversation in the direction that is friendly to less centralized designs of digital money. Below is ...

President Biden taps economists for Fed governors’ seats, Sarah Bloom Raskin as vice chair for supervision

The White House has officially tapped former Fed governor Sarah Bloom Raskin to serve as the vice chair for supervision for the Federal Reserve, as well as economists Lisa Cook and Philip Jefferson to fill two empty seats on its board of governors. In a Friday announcement, U.S. President Joe Biden said he had nominated Cook, an Obama-era economic adviser and Michigan State University faculty member, as well as Jefferson, a former research economist for the Fed, to the board of governors in addition to Raskin. Jefferson and Cook will take two of the vacant seats in the group of seven governors, with Jerome Powell and Lael Brainard nominated to serve as chair and vice-chair, respectively. According to the president, the three nominees have the “experience, judgment and integrity to lead the...

‘Most bullish macro backdrop in 75 years’ — 5 things to watch in Bitcoin this week

Bitcoin (BTC) starts a new week in a strange place — one which is eerily similar to where it was this time last year. After what various sources have described as an entire twelve months of “consolidation,” BTC/USD is around $42,000 — almost exactly where it was in week two of January 2021. The ups and downs in between have been significant, but essentially, Bitcoin remains in the midst of a now familiar range. The outlook varies depending on the perspective — some believe that new all-time highs are more than possible this year, while others are calling for many more consolidatory months. With crypto sentiment at some of its lowest levels in history, Cointelegraph takes a look at what could change the status quo on shorter timeframes in the coming days. Will $40,700 hold? Bitcoin saw a tr...

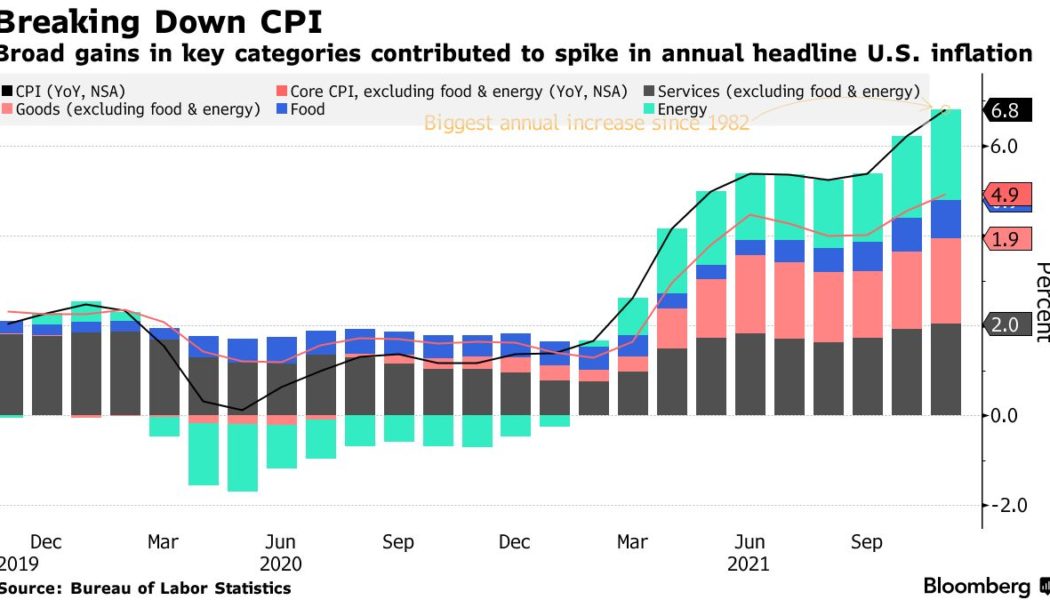

Bitcoin crash ahead? Expert warns higher inflation could whip BTC price to $30K

Bitcoin (BTC) may end up falling to as low as $30,000 if the U.S. inflation data to be released on Wednesday comes any higher than forecasted, warns Alex Krüger, founder of Aike Capital, a New York-based asset management firm. The market expects the widely-followed consumer price index (CPI) to rise 7.1% for the year through December and 0.4% month-over-month. This surge highlights why the U.S. Federal Reserve officials have been rooting for a faster normalization of their monetary policy than anticipated earlier. U.S. headline inflation. Source: Bureau of Labor Statistics, Bloomberg Further supporting their preparation is a normalizing labor market, including a rise in income and falling unemployment claims, according to data released on Jan. 7. “Crypto assets are at the furthest en...

Will this time be different? Bitcoin eyes drop to $35K as BTC price paints ‘death cross’

Bitcoin (BTC) formed a trading pattern on Jan. 8 that is widely watched by traditional chartists for its ability to anticipate further losses. In detail, the cryptocurrency’s 50-day exponential moving average (50-day EMA) fell below its 200-day exponential moving average (200-day EMA), forming a so-called “death cross.” The pattern appeared as Bitcoin underwent a rough ride in the previous two months, falling over 40% from its record high of $69,000. BTC/USD daily price chart. Source: TradingView Death cross history Previous death crosses were insignificant to Bitcoin over the past two years. For instance, a 50-200-day EMA bearish crossover in March 2020 appeared after the BTC price had fallen from nearly $9,000 to below $4,000, turning out to be lagging than predictive. ...

BTCS stock jumps 44% after announcing first-ever dividend payable in Bitcoin

On Wednesday, Nasdaq Composite logged its biggest daily loss since February last year. But for one of its listed companies, the day turned out to be extremely bullish. Blockchain stock soars The share value of BTCS Inc. (BTCS), a blockchain technology company, surged nearly 44% to $4.36 at the New York closing bell, thus becoming the third-best performer on Nasdaq after Lixte Biotechnology (LIXT) and Mainz Biomed BV (MYNZ). Top Nasdaq performers as of Jan. 5, 2022’s close. Source: TheStockMarketWatch.com In contrast, Nasdaq plunged 3.3% Wednesday, its losses driven primarily by the release of the minutes of the Federal Open Market Committee (FOMC) meeting in mid-December last year. In detail, the minutes revealed the Federal Reserve officials’ intention to rais...

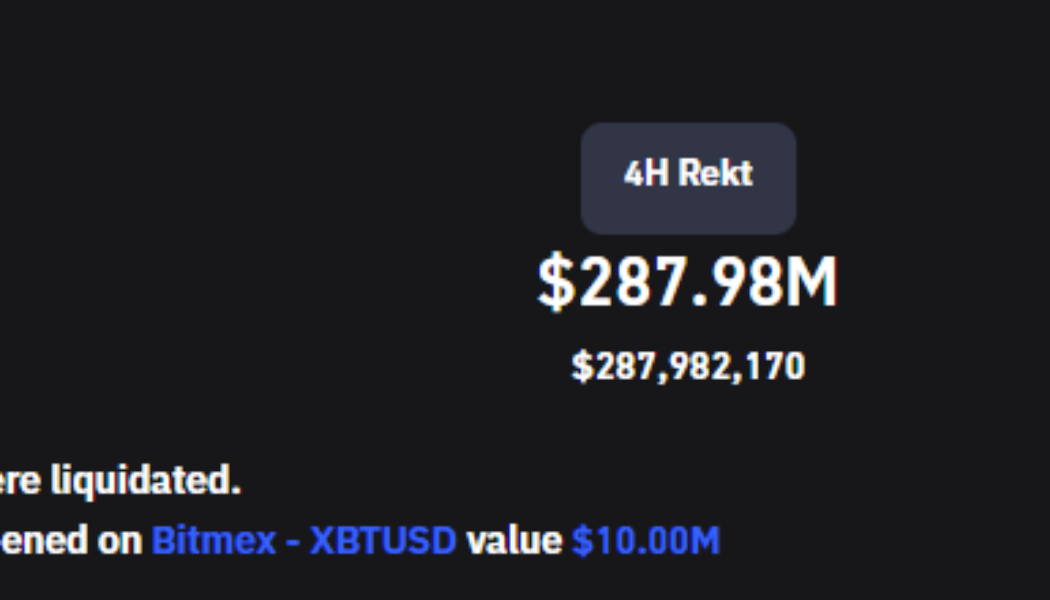

Bitcoin price drops to $43.7K after Fed minutes re-confirm plans to hike rates

Bitcoin (BTC) and the wider cryptocurrency market fell under as equities markets pulled back at the closing bell after minutes from the Federal Reserve’s December FOMC meeting showed that the regulator is committed to decreasing its balance sheet and increasing interest rates in 2022. As stock markets corrected, BTC price followed suit by dropping below $44,000, setting off a cascade of liquidations that reached $222 million in less than an hour. Total liquidations. Source: Coinglass Data from Cointelegraph Markets Pro and TradingView shows that after oscillating around support at $46,000 for the past couple of days, Bitcoin was hit with a wave of selling that pulled the price to an intraday low of $43,717. BTC/USDT 4-hour chart. Source: TradingView Based on the current situati...