Federal Reserve

AI altcoins are pumping — Is this the beginning of the next bull market? The Market Report

This week on The Market Report, the resident experts at Cointelegraph discuss what artificial intelligence (AI) altcoins are, what their potential benefits are, how they work, and whether they can be a catalyst for a 2023 bull market. We start off this week’s show with the latest news in the markets: BTC price 3-week highs greet US CPI — 5 things to know in Bitcoin this week Bitcoin (BTC) starts a new week on a promising footing, with BTC price action near one-month highs — but can it last? The move precedes a conspicuous macroeconomic week for crypto markets, with the December 2022 Consumer Price Index (CPI) print due from the United States. Jerome Powell, chair of the Federal Reserve, will also deliver a speech on the economy, with inflation on everyone’s radar. Inside the...

Macroeconomic data points toward intensifying pain for crypto investors in 2023

Undoubtedly, 2022 was one of the worst years for Bitcoin (BTC) buyers, primarily because the asset’s price dropped by 65%. While there were some explicit reasons for the drop, such as the LUNA-UST crash in May and the FTX implosion in November, the most important reason was the U.S. Federal Reserve policy of tapering and raising interest rates. Bitcoin’s price had dropped 50% from its peak to lows of $33,100 before the LUNA-UST crash, thanks to the Fed rate hikes. The first significant drop in Bitcoin’s price was due to growing market uncertainty around potential rate hike rumors in November 2021. By January 2022, the stock market had already started showing cracks due to the increasing pressure of imminent tapering, which also negatively impacted crypto prices. BTC/USD daily price chart. ...

US will see new ‘inflation spike’ — 5 things to know in Bitcoin this week

Bitcoin (BTC) begins the first week of 2023 in an uninspiring place as volatility stays away — along with traders. After failing to budge throughout the Christmas and new year break, BTC price action remains locked in a narrow range. Having sealed yearly losses of nearly 65% in 2022, Bitcoin has arguably seen a classic bear market year, but for the time being, few are actively predicting a recovery. The situation is complex for the average hodler, who is watching for macro triggers courtesy of the United States Federal Reserve and economic policy impact on dollar strength. Prior to Wall Street returning on Jan. 3, Cointelegraph takes a look at the factors at play when it comes to BTC price performance in the coming week and beyond. Bitcoin traders fear new lows amid flatlining price Bitcoi...

‘Wave lower’ for all markets? 5 things to know in Bitcoin this week

Bitcoin (BTC) starts the week before Christmas with a whimper as a tight trading range gives BTC bulls little cheer. A weekly close just above $16,700 means BTC/USD remains without major volatility amid a lack of overall market direction. Having seen erratic trading behavior around the latest United States macroeconomic data print, the pair has since returned to an all-too-familiar status quo. What could change it? That is the question on every analyst’s lips as markets limp into Christmas with little to offer. The reality is tough for the average Bitcoin hodler — BTC is trading below where it was two years and even five years ago. “FUD” is hardly in short supply thanks to FTX fallout and concerns over Binance. At the same time, there are signs that miners are recovering, while on-chain in...

The Federal Reserve’s pursuit of a ‘reverse wealth effect’ is undermining crypto

The Federal Reserve’s strategy to hike interest rates may continue, making it difficult for the crypto industry to bounce back. For crypto assets to become the hedge against inflation, the industry needs to explore ways to decouple crypto from traditional markets. Decentralized finance (DeFi) can perhaps offer a way out by breaking away from legacy financial models. How Federal Reserve policies are affecting crypto In the 1980s, Paul Volcker, the chairman of the Federal Reserve Board, introduced the interest hiking policy to control inflation. Volcker raised interest rates to over 20%, forcing the economy into a recession by reducing people’s purchasing capacity. The strategy worked, and the Consumer Price Index (CPI) went down from 14.85% to 2.5%. Even now, the Federal Reserve continues t...

BTC price shakes off Binance ‘FUD’ as analysts eye Q1 2023 Bitcoin bottom

Bitcoin (BTC) stayed steady near $17,000 at the Dec. 12 Wall Street open as news involving Binance failed to spark BTC price downside. BTC/USD 1-hour candle chart (Bitstamp). Source: TradingView Factors line up to “scare” Bitcoin trade Data from Cointelegraph Markets Pro and TradingView showed BTC/USD avoiding fresh volatility as United States markets opened. Having traded sideways throughout the weekend, the pair offered few cues to analysts, who were waiting for U.S. macroeconomic data to shake up the status quo. This, in the form of the November Consumer Price Index (CPI) print, would nonetheless be a pivotal moment for crypto assets, they agreed, with the potential for significant upside and downside hinging on the numbers, due Dec. 13. Subsequent events involving the Feder...

FX spot settlement in 10 seconds: NY Fed releases results of wholesale CBDC research

The Federal Reserve Bank of New York Innovation Center has released a report on the first phase of its Project Cedar wholesale central bank digital currency (wCBDC) Nov. 4. The Fed still has no plans to issue a CBDC, NY Fed executive vice president and head of markets Michelle Neal said at a presentation in Singapore, but it has investigated foreign exchange spot settlement “from the perspective of the Federal Reserve.” Its prototype wCBDC, intended for use by financial institutions rather than the public, was able to implement transactions dramatically faster and more securely than the current standard. A foreign exchange spot transaction was chosen as the use case for the 12-week first phase of Project Cedar because of its relative simplicity and that type of transaction is often used as...

Bitcoin price hits $20.8K as volatility ensues over Fed 75-point rate hike

Bitcoin (BTC) saw instant volatility on Nov. 2 as the United States Federal Reserve enacted a fourth consecutive 0.75% interest rate hike. BTC/USD 1-hour candle chart (Bitstamp). Source: TradingView Fed hints more hikes to com Data from Cointelegraph Markets Pro and TradingView showed BTC/USD initially dropping to $20,200 before momentarily rebounding to $20,800. The Fed confirmed the 0.75% hike, which marks its most intensive hiking schedule in forty years, in a statement. “The Committee seeks to achieve maximum employment and inflation at the rate of 2 percent over the longer run. In support of these goals, the Committee decided to raise the target range for the federal funds rate to 3-3/4 to 4 percent,” it stated. “The Committee anticipates that ongoing increases in the target range wil...

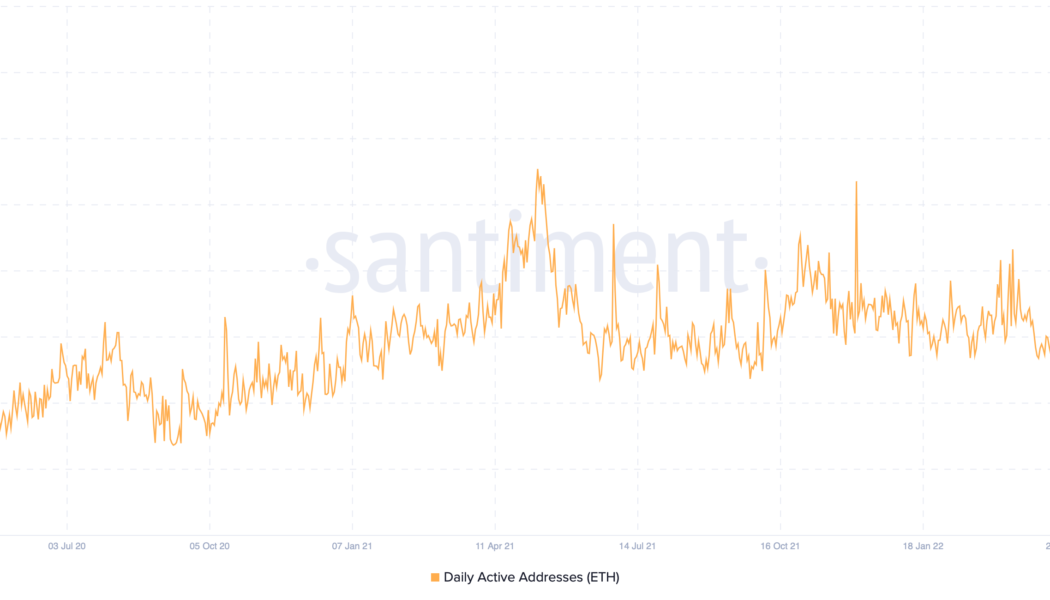

Will ETH price crash to $750? Ethereum daily active addresses plunge to 4-month lows

Ethereum has witnessed a substantial drop in its daily active address (DAA) count over the last four months, raising fears about more downside for Ether (ETH) price in the coming weeks. Stagnant Ethereum price spooks investors The number of Ether DAA dropped to 152,000 on Oct. 21, its lowest level since June, according to data provided by Santiment. In other words, the plunge showed fewer unique Ethereum addresses interacting with the network. Ethereum daily active address count on a daily timeframe. Source: Santiment Interestingly, the drop comes after Ether’s 80%-plus correction from its November 2021 high of around $4,850. This coincidence could mean two things: Ethereum users decided to leave the market and/or paused their interaction with the blockchain network after the market’s...

Bitcoin price hits 1-week lows as Fed rate hike rumors unsettle market

Bitcoin (BTC) dipped further below $19,000 on Oct. 21 as rumors circulated over the United States Federal Reserve. BTC/USD 1-hour candle chart (Bitstamp). Source: TradingView Fed still on track for major November rate hike Data from Cointelegraph Markets Pro and TradingView showed BTC/USD abruptly dropping before the Wall Street open, hitting lows of $18,660 on Bitstamp. A recovery took the pair higher, and it was attempting reclaim $19,000 as support at the time of writing. The action came as commentators claimed the Fed was softening its policy on rate hikes ahead of the Nov. 1–2 Federal Open Market Committee (FOMC) meeting. Citing mainstream media quotations from Fed officials, they suggested that the November hike could be the last 75-basis-point adjustment, with smaller ones following...