FED

Data suggests traders view $46,000 as Bitcoin’s final line in the sand

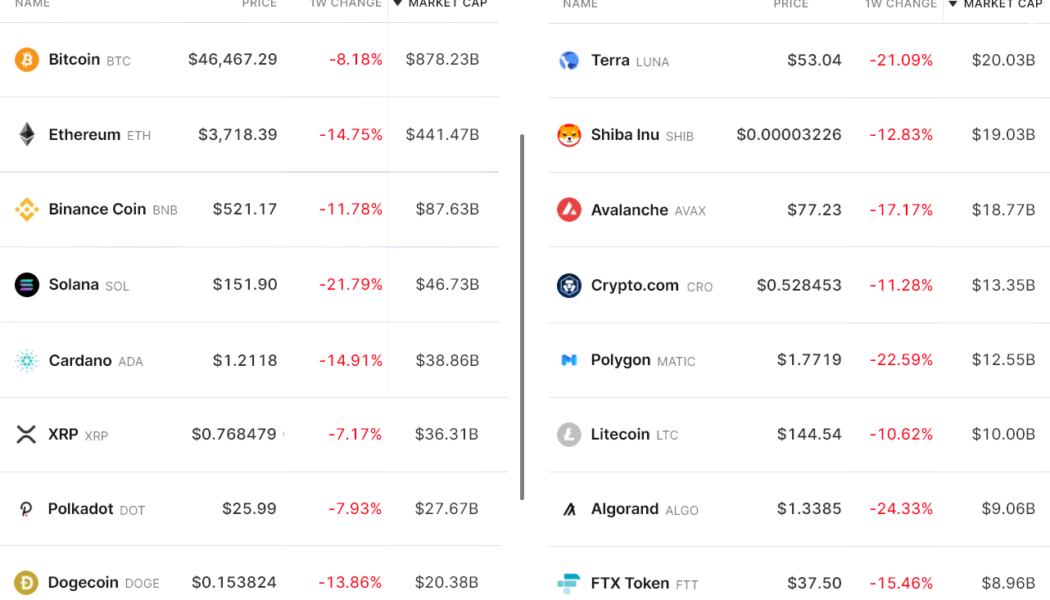

Dec. 13 will likely be remembered as a “bloody Monday” after Bitcoin (BTC) price lost the $47,000 support, and altcoin prices dropped by as much as 25% within a matter of moments. When the move occurred, analysts quickly reasoned that Bitcoin’s 8.5% correction was directly connected to the Federal Open Market Committee (FOMC) meeting, which starts on Dec. 15. Investors are afraid that the Federal Reserve will eventually start tapering, which simply put, is a reduction of the Federal Reserve’s bond repurchasing program. The logic is that a revision of the current monetary policy would negatively impact riskier assets. While there’s no way to ascertain such a hypothesis, Bitcoin had a 67% year-to-date gain until Dec. 12. Therefore, it makes sense for investors to pocket those profits a...