FED

Fed reverse repo reaches $2.3T, but what does it mean for crypto investors?

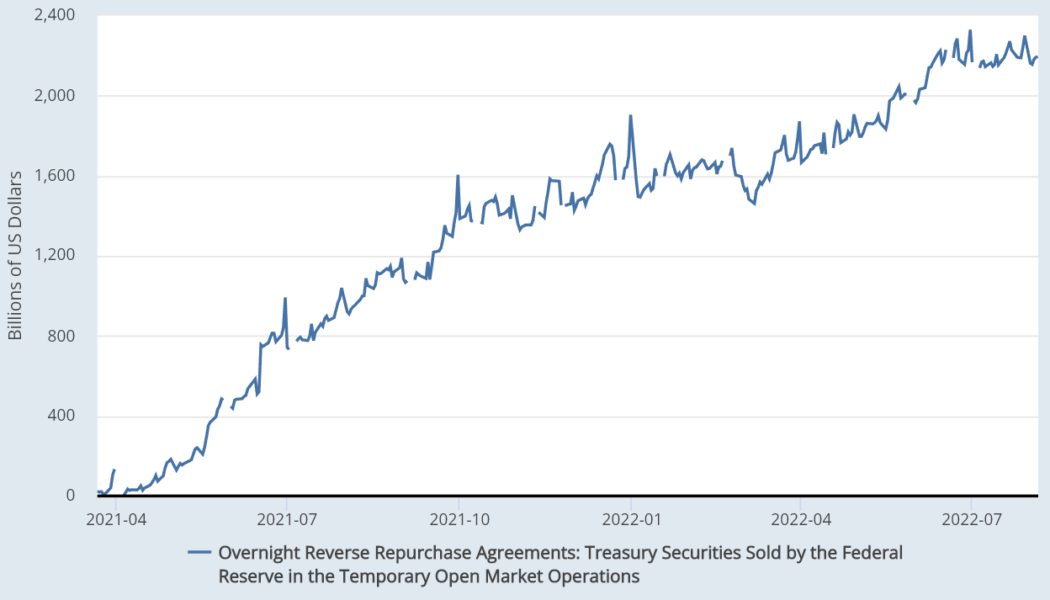

The U.S. Federal Reserve (FED) recently initiated an attempt to reduce its $8.9 trillion balance sheet by halting billions of dollars worth of treasuries and bond purchases. The measures were implemented in June 2022 and coincided with the total crypto market capitalization falling below $1.2 trillion, the lowest level seen since January 2021. A similar movement happened to the Russell 2000, which reached 1,650 points on June 16, levels unseen since November 2020. Since this drop, the index has gained 16.5%, while the total crypto market capitalization has not been able to reclaim the $1.2 trillion level. This apparent disconnection between crypto and stock markets has caused investors to question whether the Federal Reserve’s growing balance sheet could lead to a longer than expecte...

Will Ethereum Merge hopium continue, or is it a bull trap?

Ethereum is outperforming the broader cryptocurrency market as the highly anticipated Merge approaches, but the bigger picture is still largely bearish. Ethereum (ETH) has gained a whopping 48% over the past seven days, outperforming its big brother Bitcoin, which has only managed to achieve 19% in the same period. It’s also up 66% from its market cycle bottom of $918 on June 19, reaching its current price of $1549. However, the current Ethereum rally could be a bull trap with the macroeconomic clouds darkening. A bull trap is a signal indicating that a declining trend in a crypto asset has reversed and is heading upwards when it will actually continue downwards. The primary driver of recent momentum for the asset has been linked to announcements regarding its final switch to pr...

Market selling might ease, but traders are on the sidelines until BTC confirms $20K as support

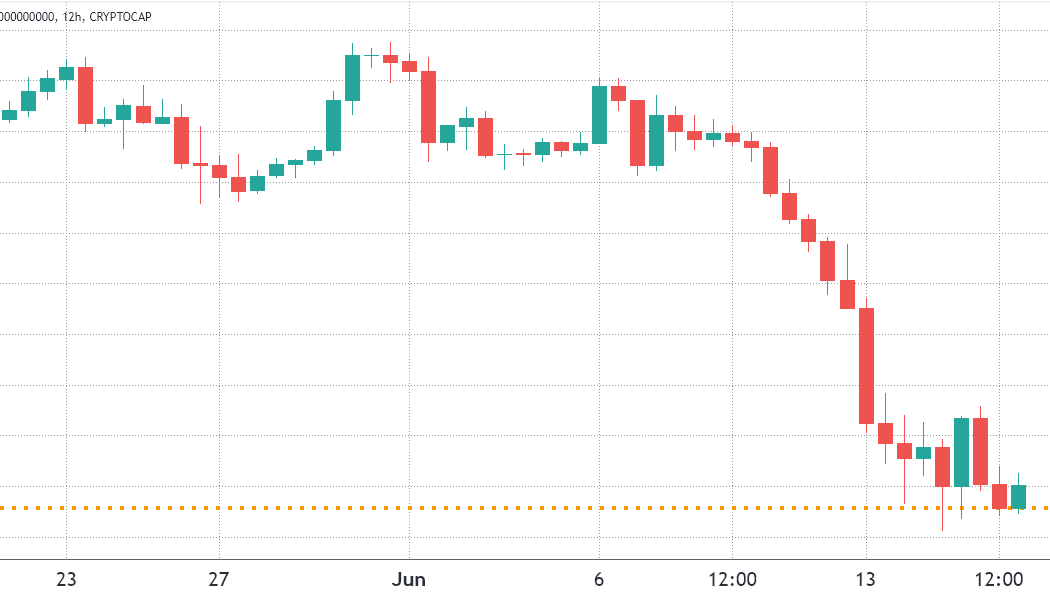

The total crypto market capitalization fell off a cliff between June 10 and 13 as it broke below $1 trillion for the first time since January 2021. Bitcoin (BTC) fell by 28% within a week and Ether (ETH) faced an agonizing 34.5% correction. Total crypto market cap, USD billion. Source: TradingView Presently, the total crypto capitalization is at $890 million, a 24.5% negative performance since June 10. That certainly raises the question of how the two leading crypto assets managed to underperform the remaining coins. The answer lies in the $154 billion worth of stablecoins distorting the broader market performance. Even though the chart shows support at the $878 billion level, it will take some time until traders take in every recent event that has impacted the market. For example, the U.S...

3 reasons why Ethereum price is pinned below $2,000

Ether’s (ETH) market structure continues to be bearish despite the failed attempt to break the descending channel resistance at $2,000 on May 31. This three-week-long price formation could mean that an eventual retest of the $1,700 support is underway. Ether/USD 4-hour price at Bitstamp. Source: TradingView On the non-crypto side, a number of equities-related factors are translating to negative sentiment in the crypto market. This week Microsoft (MSFT) lowered its profit and revenue outlook, citing challenging macroeconomic conditions. The U.S. Federal Reserve signalled in its periodic “Beige Book” that economic activity may have cooled in some parts of the country and the Fed is about to reduce its $9 trillion asset portfolio to combat persistent inflation. On the bright ...

Billionaire Bill Miller calls Bitcoin ‘insurance’ against financial catastrophe

Bill Miller the billionaire founder and Chief Investment Officer of investment firm Miller Value Partners, has said he considers Bitcoin (BTC) an “insurance policy against financial catastrophe.” Appearing on an episode of the “Richer, Wiser, Happier” podcast on May 24 Miller backed the cryptocurrency as a means for those caught in conflict to still access financial products. He used the collapse of financial infrastructure in Afghanistan after the US withdrawal in August 2021 as an example. “When the US pulled out of Afghanistan, Western Union stopped sending remittances there or taking them from Afghanistan, but if you had Bitcoin, you were fine. Your Bitcoin is there. You can send it to anybody in the world if you have a phone.” Miller said examples of how the crypto can function as ins...

Bitcoin sentiment falls into ‘fear’ as BTC price action hits $42.9K breakdown target

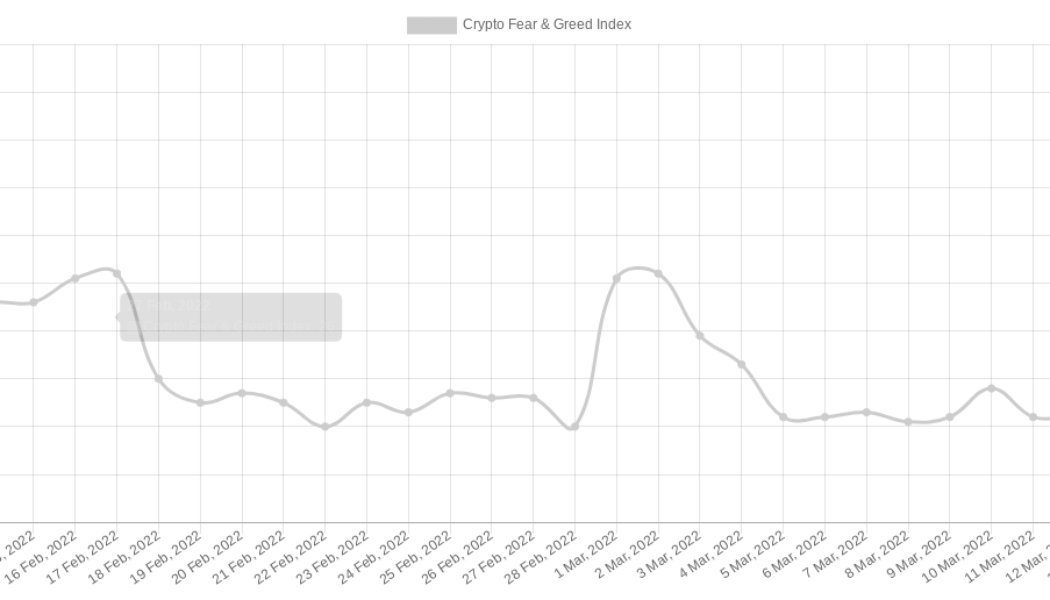

Bitcoin (BTC) kept disappointing hodlers on April 7 as the Bitcoin 2022 conference got underway to a limp BTC price performance. BTC/USD 1-hour candle chart (Bitstamp). Source: TradingView Fed prepares $95 billion monthly balance sheet shrink Data from Cointelegraph Markets Pro and TradingView followed BTC/USD as it dropped below multiple support levels to reach its lowest since March 23. Reversing at $42,741 on Bitstamp on April 7, the largest cryptocurrency was decidedly less bullish than the week prior, with analysts quick to point out contributing factors. Central bank monetary tightening, namely from the U.S. Federal Reserve, remained the favorite, this having a potential long-lasting impact across risk assets going forward. “The biggest headwind to Bitcoin and macroeconomi...

Bitcoin calls traders‘ bluff with fresh $40K fakeout as Fed decision day arrives

Bitcoin (BTC) tested traders‘ neves yet again on March 16 as a fresh spike over $40,000 ended in minutes. BTC/USD 1-hour candle chart (Bitstamp). Source: TradingView Shorts feel the burn after abrupt trip to $41,700 Data from Cointelegraph Markets Pro and TradingView showed BTC/USD suddenly surging to highs of $41,700 on Bitstamp before instantly reversing. Two hourly candles were all it took for the entire market to rise by $2,000, break significant resistance levels and come all the way back down again. The move, while recently commonplace, was not without its casualties, as evidenced by liquidations across exchanges. According to data from on-chain monitoring resource Coinglass, Bitcoin accounted for $98 million of these over the 24 hours at the time of writing. Total crypto liquid...

Two years since the Covid crash: 5 things to know in Bitcoin this week

Bitcoin (BTC) starts a new week struggling to preserve support as key macro changes appear on the horizon. In what could turn out to be a crucial week for Bitcoin and altcoins’ relationship with traditional assets, the United States Federal Reserve is set to be the main talking point for hodlers. Amid an atmosphere of still rampant inflation, quantitative easing still ongoing and geopolitical turmoil focused on Europe, there is plenty of uncertainty in the air, no matter what the trade. Add to that a failure by Bitcoin to benefit from the chaos and the result is some serious cold feet — what would it take to instil confidence? Just as it seems nothing could break the now months-old status quo on Bitcoin markets, which have been stuck in a trading range for all of 2022 so far, upcoming even...

Bitcoin drifts into weekly close while Fed rate hike looms as next major BTC price trigger

Bitcoin (BTC) upped the volatility into the weekly close on March 13 as markets braced for geopolitical and macro economic cues. BTC/USD 1-hour candle chart (Bitstamp). Source: TradingView Long-awaited Fed action set to come this week Data from Cointelegraph Markets Pro and TradingView followed BTC/USD as it again came close to testing $38,000 support during Sunday. The pair had seen a quiet end to the week on Wall Street, the weekend proving similarly calm as the status quo both within and outside crypto continued without surprises. Now, attention was already focusing beyond Sunday’s close, specifically on the upcoming decision on interest rates from the United States Federal Reserve. Due March 16, the extent of the presumed rate hike could provide temporary volatility and even...

Bitcoin casts off dip, climbs past $45K as Fed signals rate hike coming in March

Bitcoin (BTC) hit daily lows then bounced strongly on March 2 as fresh comments by the United States Federal Reserve added to macro volatility. BTC/USD 1-hour candle chart (Bitstamp). Source: TradingView Powell: March rate hike expected “appropriate” Data from Cointelegraph Markets Pro and TradingView showed BTC/USD dipping to $43,350 on Bitstamp before the Wall Street open Wednesday. A recovery ensued as trading began, however, with the pair already back above $45,000 at the time of writing. The volatility followed the release of a new statement from Fed Chair Jerome Powell, who for the first time gave concrete notice of a key rate hike coming this month. “Our monetary policy has been adapting to the evolving economic environment, and it will continue to do so,̶...