FED

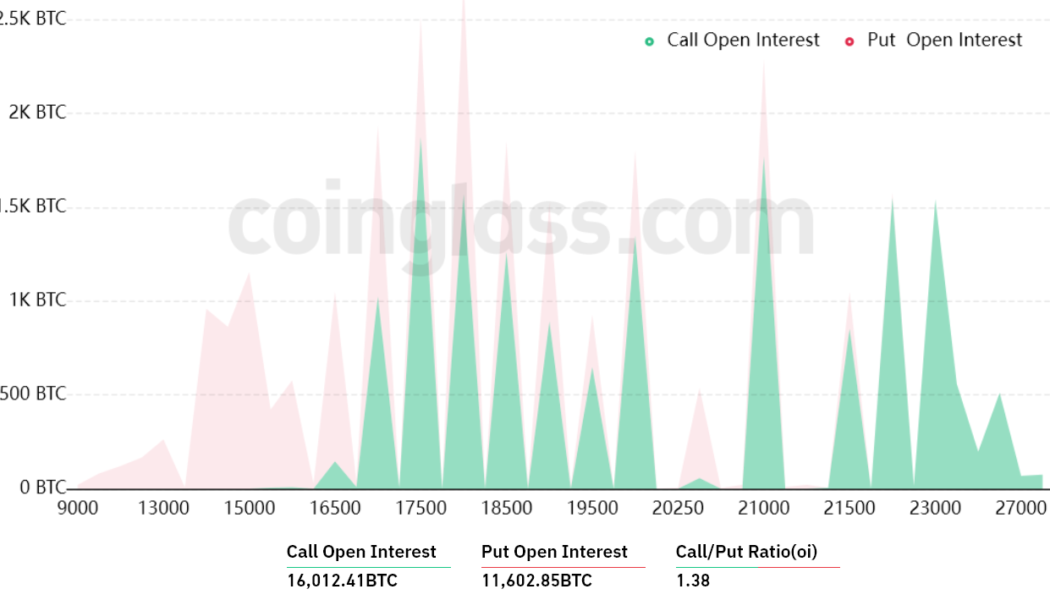

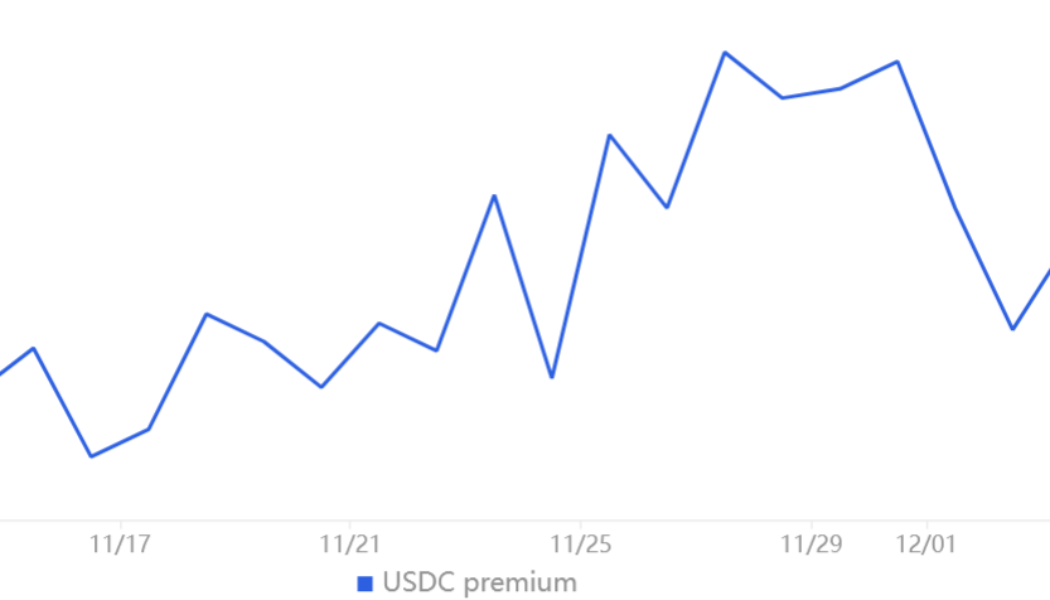

Bitcoin bears beware! BTC holds $17K as support while the S&P 500 drops 1.5%

Bitcoin (BTC) bulls regained some control on Nov. 30 and they were successful in keeping BTC price above $16,800 for the past 5 days. While the level is lower than traders’ desired $19,000 to $20,000 target, the 8.6% gain since the Nov. 21, $15,500 low provides enough cushioning for eventual negative price surprises. One of these instances is the United States stock market trading down 1.5% on Dec. 5 after a stronger-than-expected reading of November ISM Services fueled concerns that the U.S. Federal Reserve (FED) will continue hiking interest rates. At the September meeting, FED Chairman Jerome Powell indicated that the point of keeping interest rates flat “will need to be somewhat higher.” Currently, the macroeconomic headwinds remain unfavorable and this is likely to remain ...

Data challenges the DXY correlation to Bitcoin rallies and corrections ‘thesis’

Presently, there seems to be a general assumption that when the U.S. dollar value increases against other global major currencies, as measured by the DXY index, the impact on Bitcoin (BTC) is negative. Traders and influencers have been issuing alerts about this inverse correlation, and how the eventual reversal of the movement would likely push Bitcoin price higher. Analyst @CryptoBullGems recently reviewed how the DXY index looks overbought after its relative strength index (RSI) passed 78 and could be the start of a retrace for the dollar index. This is literally the only thing you need to look at: The $DXY is crazy overbought right now and due a correction. $BTC is the most oversold it ever has been on the monthly timeframe. BITCOIN AND THE DOLLAR SHARE AN INVERSE CORRELATION. $BTC will...

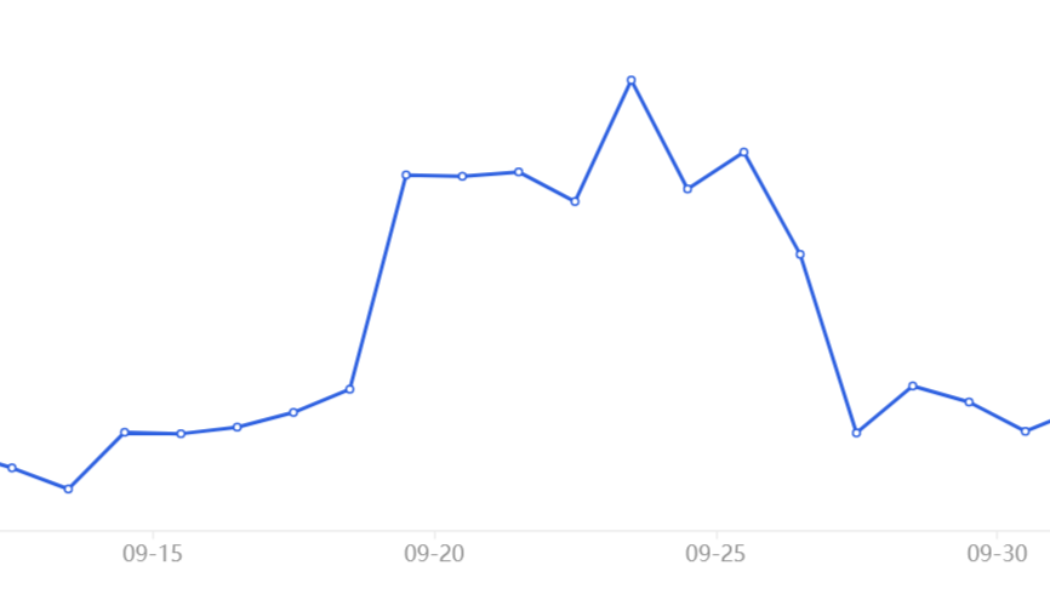

Bitcoin price taps $21.3K ahead of Fed Chair Powell Jackson Hole speech

Bitcoin (BTC) fell to daily lows on Aug. 26 as market nerves heightened into new macro triggers. BTC/USD 1-hour candle chart (Bitstamp). Source: TradingView Pre-Fed blues hit BTC markets Data from Cointelegraph Markets Pro and TradingView showed BTC/USD dipping to $21,332 on Bitstamp ahead of fresh commentary from Jerome Powell, Chair of the United States Federal Reserve. Part of the Fed’s Jackson Hole annual symposium, Powell was set to deliver a speech on the day that spectators hoped would provide new cues on economic policy going forward. With U.S. Consumer Price Index (CPI) inflation slowing since June, interest remained high over the extent of key interest rate hikes in September. Summarizing the current economic situation in the U.S., macro analyst David Hunter argued that the Fed w...

Bitcoin price dives pre-FOMC amid warning $17.6K low was not the bottom

Bitcoin (BTC) dropped to weekly lows at the Aug. 17 Wall Street open as upcoming Federal Reserve comments unsettled risk assets. BTC/USD 1-hour candle chart (Bitstamp). Source: TradingView Dollar climbs as Fed minutes due Data from Cointelegraph Markets Pro and TradingView tracked a more than 2% daily decline in BTC/USD, which hit $23,325 on Bitstamp. Already showing signs of weakness, the pair slid further as United States equities began trading, hours before the Federal Open Markets Committee (FOMC) was due to release minutes from its latest meeting. While not involving a decision on interest rates, the meeting was cued to give an insight into the Fed’s thinking in terms of the next rate tweak due in September. “The important event tonight with the FOMC minutes, through which information...

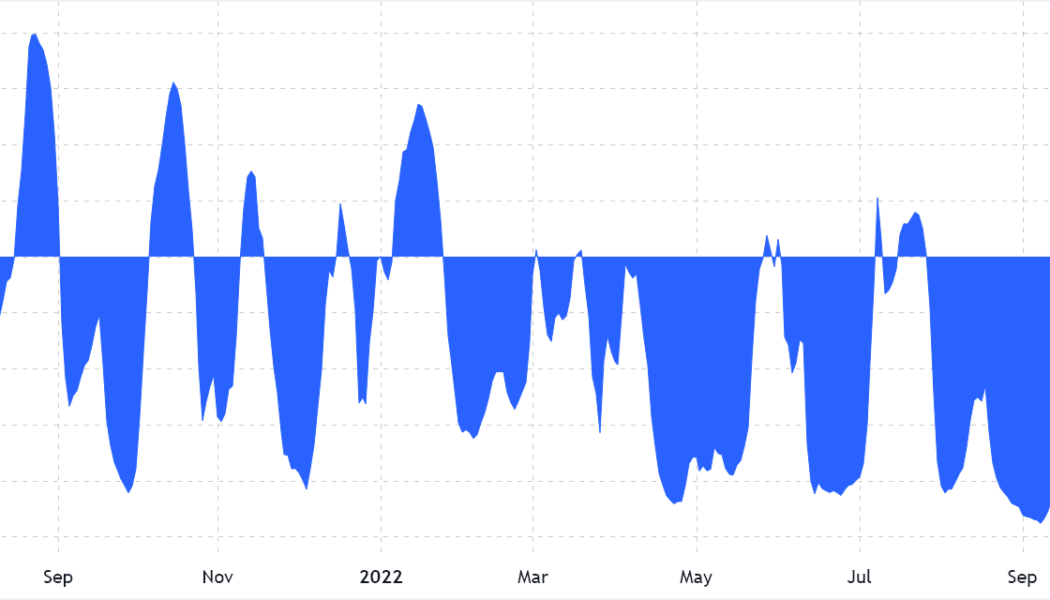

Crypto markets bounced and sentiment improved, but retail has yet to FOMO

An ascending triangle formation has driven the total crypto market capitalization toward the $1.2 trillion level. The issue with this seven-week-long setup is the diminishing volatility, which could last until late August. From there, the pattern can break either way, but Tether and futures markets data show bulls lacking enough conviction to catalyze an upside break. Total crypto market cap, USD billion. Source: TradingView Investors cautiously await further macroeconomic data on the state of the economy as the United States Federal Reserve (FED) raises interest rates and places its asset purchase program on hold. On Aug. 12, the United Kingdom posted a gross domestic product (GDP) contraction of 0.1% year-over-year. Meanwhile, inflation in the U.K. reached 9.4% in July, the highest figur...