FDIC

FDIC acting chair says no crypto firms or tokens are backed by agency

Federal Deposit Insurance Corporation acting chair Martin Gruenberg said the agency does not back any crypto firms in the United States, nor does its insurance cover losses from tokens. In a Nov. 15 hearing of the Senate Banking Committee on the oversight of financial regulators, New Jersey Senator Bob Menendez said lawmakers needed to “take a serious look at crypto exchanges and lending platforms” over risky behavior. Gruenberg responded to Menendez’s questions confirming there were “no cryptocurrency firms backed by the FDIC” and “FDIC insurance does not cover cryptocurrency of any kind.” FDIC acting chair Martin Gruenberg addressing the Senate Banking Committee on Nov. 15 FDIC insurance normally protects deposits at financial institutions in the United States in the event of bank failur...

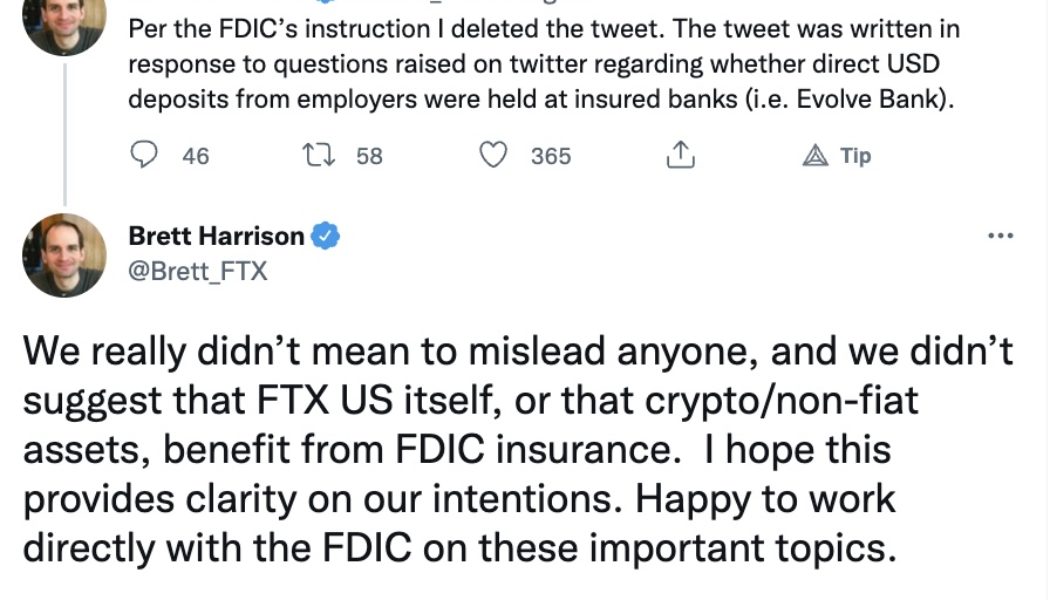

Regulators have a weak case against FTX on deposit insurance

In a cease-and-desist letter to fast-growing crypto exchange FTX, the Federal Deposit Insurance Corporation (FDIC) shed light on a now-deleted tweet from the exchange’s president, Brett Harrison, and issued a stark warning over the company’s messaging. Harrison’s original tweet said, “Direct deposits from employers to FTX US are stored in individually FDIC-insured bank accounts in the users’ names.” He added, “Stocks are held in FDIC-insured and SIPC [Security Investor Protection Corporation]-insured brokerage accounts.” Although Harrison stewarded FTX to its best-ever year in 2021, increasing revenue by 1,000%, the firm now faces the unenviable prospect of running afoul of a powerful government agency. In an attempt to clarify the situation to his 761,000 Twitter followers, Brett said, “C...

Deposits at non-bank entities, including crypto firms, are not insured — FDIC

The United States Federal Deposit Insurance Corporation, or FDIC, has issued an advisory informing the public it “does not insure assets issued by non-bank entities, such as crypto companies.” In a Friday notice, the FDIC advised banks in the U.S. that they needed to assess and manage risks in third-party relationships with crypto firms. The government agency said that while deposits at insured banks were covered for up to $250,000, no such protections applied “against the default, insolvency, or bankruptcy of any non-bank entity, including crypto custodians, exchanges, brokers, wallet providers, or other entities that appear to mimic banks.” “Some crypto companies have misrepresented to consumers that crypto products are eligible for FDIC deposit insurance coverage or that customers are F...