Expiry

Bitcoin price corrected, but bulls are positioned to profit in Friday’s $580M BTC options expiry

Bitcoin (BTC) price has held above $20,700 for 4 days, fueling bulls’ hope for another leg up to $23,000 or even $25,000. Behind the optimistic move was a decline in inflationary pressure, confirmed by the December 2022 wholesale prices for goods on Jan. 18. The United States producer price index, which measures final demand prices across hundreds of categories also declined 0.5% versus the previous month. Eurozone inflation also came in at 9.2% year-on-year in December 2022, marking the second consecutive decline from October’s 10.7% record high. A milder-than-expected winter reduced the risk of a gas shortages and softened energy prices, boosting analysts’ hope of a “soft landing.” According to analysts, a soft landing would avoid a deep recession and ...

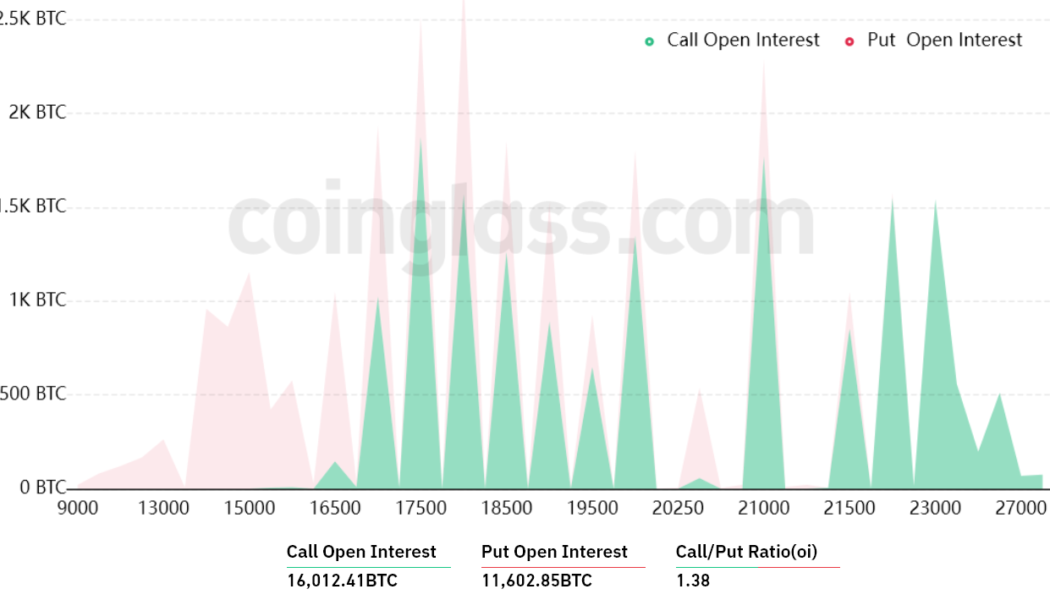

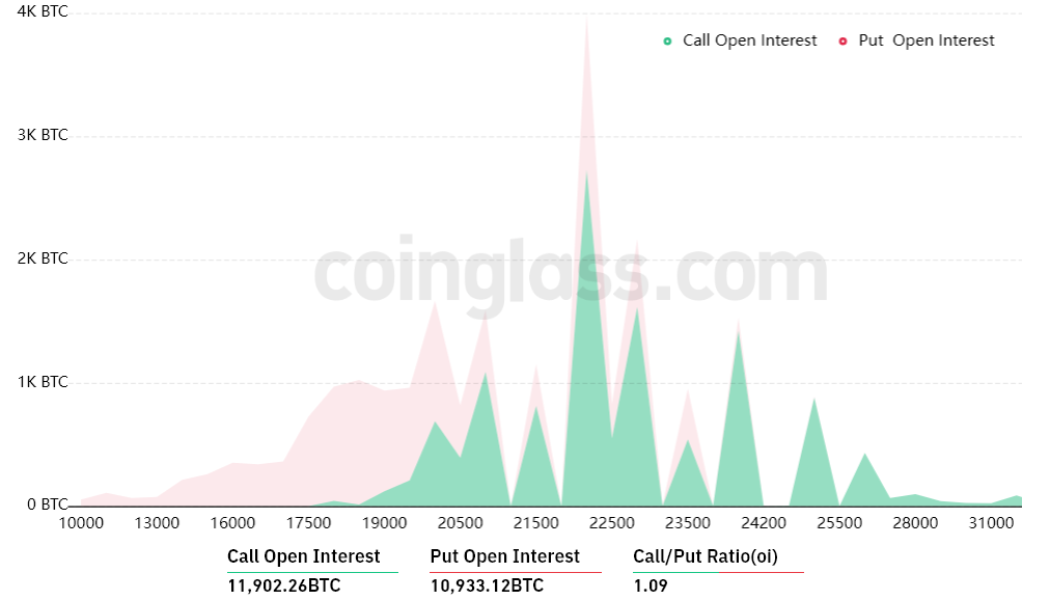

Here’s why Bitcoin price could tap $21K before Friday’s $510M BTC options expiry

Bitcoin (BTC) has been trying to break above the $20,500 resistance for the past 35 days, with the latest failed attempt on Oct. 6. Meanwhile, bears have displayed strength on four different occasions after BTC tested levels below $18,500 during that period. Bitcoin/USD price index, 12-hour chart. Source: TradingView Investors are still unsure whether $18,200 was really the bottom because the support level weakens each time it is tested. That is why it’s important for bulls to keep the momentum during this week’s $510 million options expiry. The Oct. 21 options expiry is especially relevant because Bitcoin bears can profit $80 million by suppressing BTC below $19,000. Bears placed their bets at $19,000 and lower The open interest for the Oct. 21 options expiry is $510 million, but the actu...

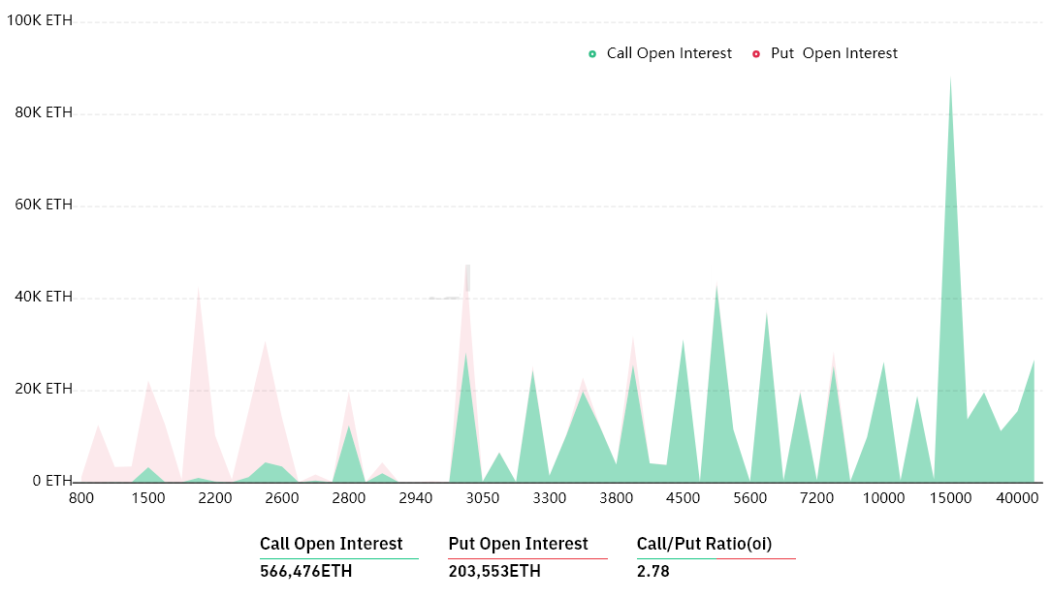

Volatility expected as $490M in ETH options expire shortly after the Ethereum Merge

Given the current state of the wider crypto market, some traders might be surprised to learn that Ether (ETH) has been trading in an ascending trend for the past 17 days. While the entire cryptocurrency market experienced a 10% decline on Sept. 13, Ether’s price held firm near the $1,570 support level. Ether/USD price index. Source: TradingView In less than 12 hours, the Ethereum network is scheduled to undergo its largest ever upgrade and the possibility of extreme volatility should not be ignored. The transition to a proof-of-stake network will be a game changer for multiple reasons, including a 98.5% cut in energy use and reduced coin inflation. During an upgrade, there is always the risk of multiple malfunctions, especially in more complex systems like the Ethereum Virtual Machin...

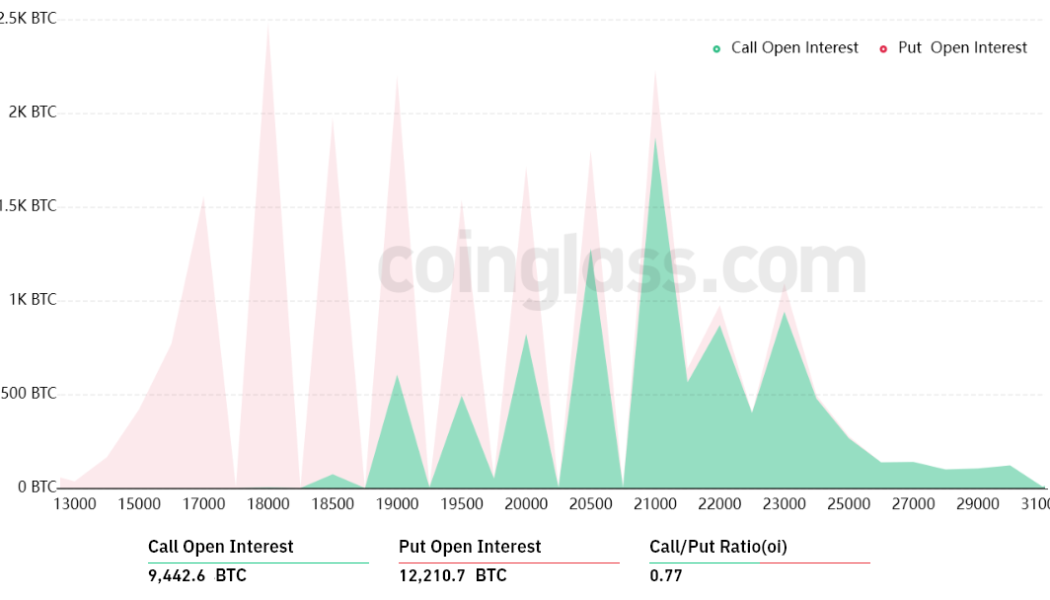

Bitcoin is pinned below $20K as the macro climate stifles hope for a sustainable BTC bull run

Bitcoin (BTC) crashed below $19,000 on Sept. 6, driving the price to its lowest level in 80 days. The movement not only completely erased the entirety of the 32% gains accrued from July until Aug. 15, it also wiped out $246 million worth of leverage long (buy) futures contracts. Bitcoin price is down for the year but it’s important to compare its price action against other assets. Oil prices are currently down 23.5% since July, Palantir Technologies (PLTR) has dropped 36.4% in 30 days and Moderna (MRNA), a pharmaceutical and biotechnology company, is down 30.4% in the same period. Inflationary pressure and fear of a global recession have driven investors away from riskier assets. By seeking shelter in cash positions, mainly in the dollar itself, this protective movement has caused the U.S....

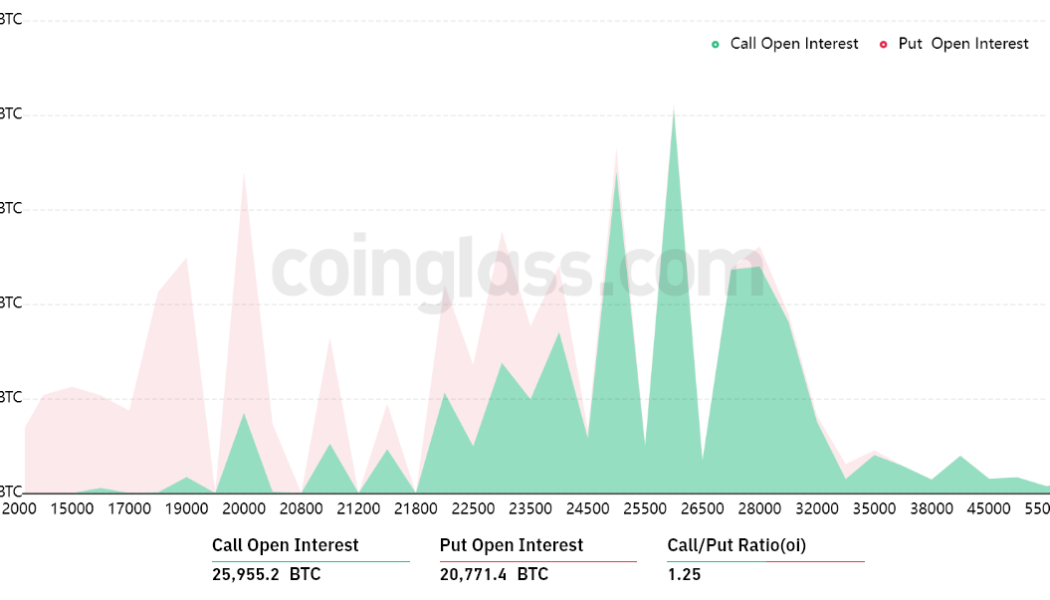

Here’s why holding $20.8K will be critical in this week’s $1B Bitcoin options expiry

Bitcoin (BTC) experienced a 16.5% correction between Aug. 15 and Aug. 19 as it tested the $20,800 support. While the drop is startling, in reality, a $4,050 price difference is relatively insignificant, especially when one accounts for Bitcoin’s 72% annualized volatility. Currently, the S&P 500’s volatility stands at 31%, which is significantly lower, yet the index traded down 9.1% between June 8 and June 13. So, comparatively speaking, the index of major U.S.-listed companies faced a more abrupt movement adjusted for the historical risk metric. At the start of this week, crypto investors’ sentiment worsened after weaker conditions in Chinese real estate markets forced the central bank to reduce its five-year loan prime rate on Aug. 21. Moreover, a Goldman Sachs investment ...

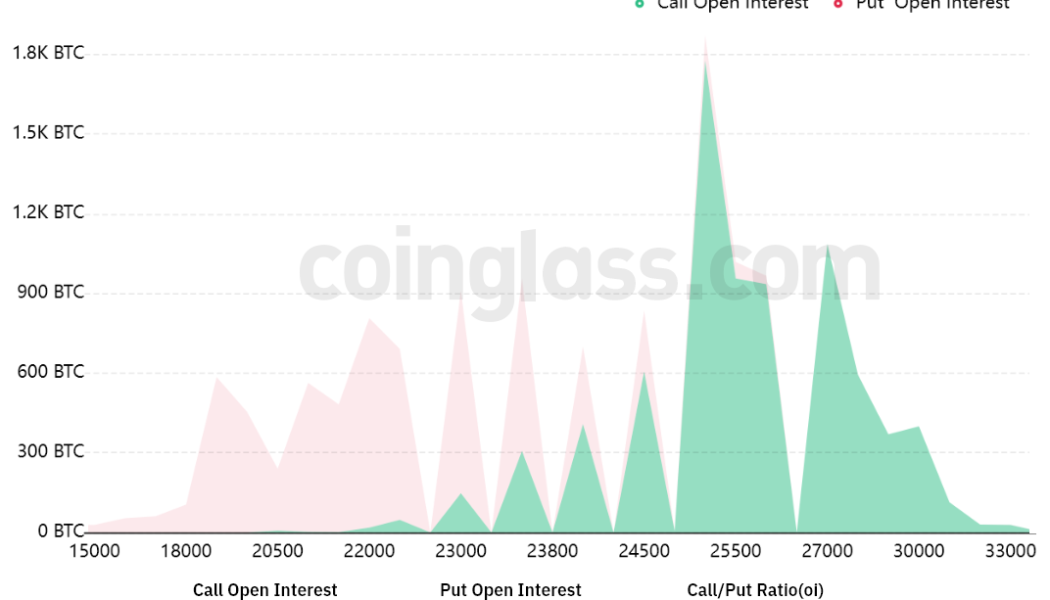

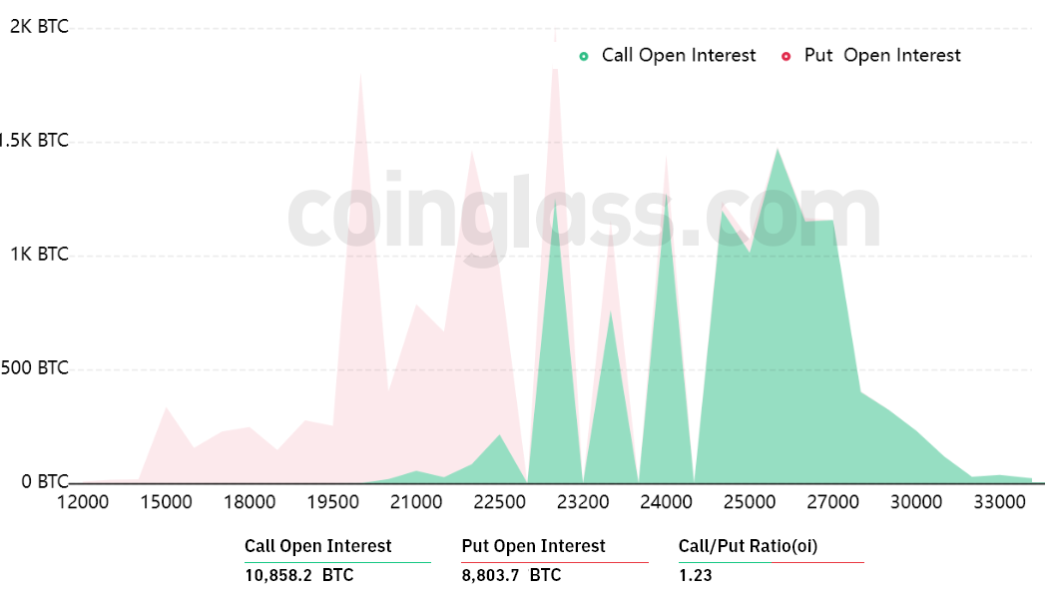

Options data shows Bitcoin’s short-term uptrend is at risk if BTC falls below $23K

Bitcoin (BTC) briefly broke above $25,000 on Aug. 15, but the excitement lasted less than an hour and was followed by a 5% retrace in the next five hours. The resistance level proved to be tougher than expected but may have given bulls false hope for the upcoming $335 million weekly options expiry. Investors’ fleeting optimism reverted to a sellers’ market on Aug. 17 after BTC dumped and tested the $23,300 support. The negative move took place hours before the release of the Federal Open Markets Committee (FOMC) minutes from its July meeting. Investors expect some insights on whether the Federal Reserve will continue raising interest rates. The negative newsflow accelerated on Aug. 16 after a federal court in the United States authorized the U.S. Internal Revenue Service (IRS) to for...

$475M in Bitcoin options expire this week — Are bulls or bears poised to win?

Bitcoin (BTC) has been posting higher lows for the past eight weeks, but during this time, BTC has not been able to flip the $24,000 resistance to support on at least three different opportunities. This is precisely why the $475 million Bitcoin options expiry on Aug. 12 might be a game changer for bulls. Considering the current regulatory pressures in play, there seems to be a good enough rationale for avoiding bullish bets, especially after the U.S. Securities and Exchange Commission pressed charges against a former Coinbase manager for illegal securities trading on July 21. The additional impact from the Terra (Luna) — now renamed Terra Classic (LUNC) — ecosystem imploding and subsequent crypto venture capital firm Three Arrows Capital (3AC) registering for bankruptcy continue to weigh o...

$1.26B in Ethereum options expire on Friday and bulls are ready to push ETH price higher

Ether’s (ETH) 53% rally between July 13 and 18 gave bulls an edge in July’s $1.26 billion monthly options expiry. The move happened as Ethereum developers set a tentative date for the “Merge,” a transition out of the burdensome proof-of-work (PoW) mining mechanism. Ether USD price index, 12-hour chart. Source: TradingView According to some analysts, by removing the additional ETH issuing used to finance the energy cost required on traditional mining consensus, Ether could finally achieve the “ultra-sound money” status. On Beacon Chain, the issuance will be around 1,600 ETH per day decreasing the inflation significantly from 13,000 ETH per day on PoW. Merge sets effects on monetary policies of Ethereum to become Ultrasound money. (10/15) pic.twitter.com/9...

Bulls or bears? Both have a fair chance in Friday’s Bitcoin options expiry

Bitcoin (BTC) briefly broke above $24,000 on July 20, but the excitement lasted less than two hours after the resistance level proved more challenging than expected. A positive is that the $24,280 high represents a 28.5% increase from the July 13 swing low at $18,900. According to Yahoo Finance, on July 19, the Bank of America published its latest fund managers survey, and the headline was “I’m so bearish, I’m bullish.” The report cited investors’ pessimism, expectations of weak corporate earnings and equity allocations being at the lowest level since September 2008. The 4.6% advance on the tech-heavy Nasdaq Composite Index between July 18 and 20 also provided the necessary hope for bulls to profit from the upcoming July 22 weekly options expiry. Global macroe...

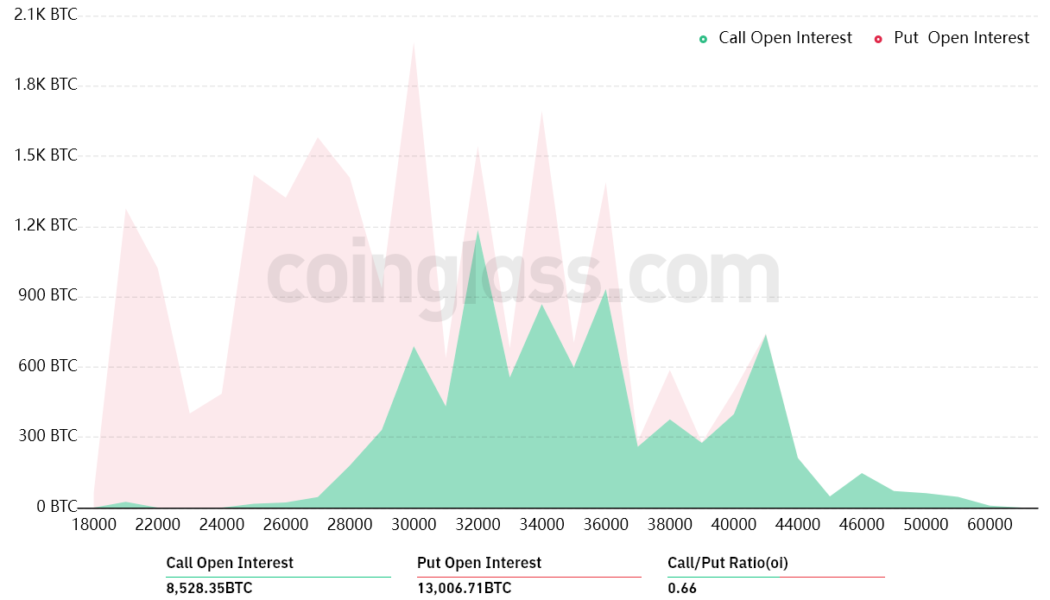

Here’s why bears aim to keep Bitcoin under $29K ahead of Friday’s $640M BTC options expiry

Over the past nine days, Bitcoin’s (BTC) daily closing price fluctuated in a tight range between $28,700 and $31,300. The May 12 collapse of TerraUSD (UST), previously the third-largest stablecoin by market cap, negatively impacted investor confidence and the path for Bitcoin’ price recovery seems clouded after the Nasdaq Composite Stock Market Index plunged 4.7% on May 18. Disappointing quarterly results from top United States retailers are amping up recession fears and on May 18, Target (TG) shares dropped 25%, while Walmart (WMT) stock plunged 17% in two days. The prospect of an economic slowdown brought the S&P 500 Index to the edge of bear market territory, a 20% contraction from its all-time high. Moreover, the recent crypto price drop was costly to leverage buyers (l...

Bitcoin pushes to $40K, but are bulls strong enough to win Friday’s $735M options expiry?

Bitcoin (BTC) price has been stuck in a falling wedge pattern for the past two months and during this time it has tested the $37,600 support on multiple instances. Adding to this “bearish” price action, BTC is down 16% year-to-date, which is in line with the Russell 2000s performance. Bitcoin/USD 1-day chart at FTX. Source: TradingView The real driver of Bitcoin’s current price action is investors’ concerns about worsening macroeconomic conditions. Professional investors are worried about the impact of the U.S. Federal Reserve’s tightening economic policies and on May 3, billionaire hedge fund manager Paul Tudor Jones said that the environment for investors is worse than ever because the monetary authority is raising interest rates when financial conditions are already worsening. On ...

Terra’s Bitcoin purchase and BlackRock comments back ETH’s surge to $3.1K

Ether (ETH) bulls have a few good reasons to celebrate the 20% gain between March 14 and March 24. The price increase surprised many and led to the first daily close above $3,000 in 34 days. Even with this move, Marc’s $2.4 billion Ether options expiry is somewhat uncertain because bears can easily profit by pushing the price below $3,000. In a letter to shareholders, Larry Fink, the CEO of BlackRock, the world’s largest asset manager, noted that the global socio-political crisis and growing inflation could make way for a global digital payment network. Moreover, cryptocurrency investors turned bullish after Terra co-founder Do Kwon reconfirmed plans for the giant $10-billion BTC allocation. On March 24, the third tranche of Tether (USDT) left a wallet thought to hold fun...

- 1

- 2