European Union

Chairman of the Digital Euro Association: ‘The primary aim of the digital euro is still not clear’

The European Central Bank (ECB) is planning to launch a prototype of the digital euro in 2023. In the next five years, Europe could have its own central bank digital currency (CBDC) up and running. However, there are still many questions surrounding the prospective digital currency. In what form could it be issued? Is the ECB too late to the CBDC party, especially compared to other central banks such as that of the People’s Republic of China? To address these and other questions, Cointelegraph auf Deutsch spoke with Jonas Gross, chairman of the Digital Euro Association (DEA) and member of the expert panel of the European Blockchain Observatory and Forum. New digital cash Gross said that compared to digital cash issued by a commercial bank, central bank money carries fewer risks. A commerci...

EU commissioner calls for global coordination on crypto regulation

Mairead McGuinness, the commissioner for financial services, financial stability and capital markets union at the European Commission, is calling for global regulators to work together to address potential risks in the crypto market. In a Sunday opinion piece in political media outlet The Hill, McGuinness said the European Union and the United States could help lead the world in a regulatory approach for cryptocurrencies that considers the benefits of the innovative technology while addressing “significant risks.” The EU commissioner pointed to the volatility of certain assets, the risk of insider trading, the possibility of crypto being used by Russia to evade sanctions and environmental concerns. “To make rules on crypto fully effective, crypto requires global coordination and joint inte...

Grayscale to expand crypto fund offering into Europe

Digital asset manager Grayscale Investments is planning to expand its product offerings into Europe to tap into growing institutional demand for cryptocurrencies in the region, CEO Michael Sonnenshein confirmed Tuesday. In an interview with Bloomberg, Sonnenshein said the company was holding meetings with local partners to discuss how Grayscale’s suite of products would be rolled out in the region. The company hasn’t made any definitive plans regarding which exchanges and countries would be supported initially, though Grayscale plans to launch pilot tests in several markets across the European Union. Sonnenshein explained that Grayscale would be looking at investor behaviors and local regulations in determining its product rollout. “Although the EU is unified, we don’t view the entir...

EU officials considered Bitcoin trading ban to enforce proposed mining ban

European Union (EU) officials discussed banning Bitcoin trading during a debate on a proposal to ban Proof of Work mining according to documents obtained through a freedom of information request. According to a report, published by German digital culture organization Netzpolitik, officials from the EU went as far as suggesting that an all out ban on trading Bitcoin (BTC) should be enforced in order to curb its overall energy consumption. The most worrying comments from the crypto community’s perspective came from a document that detailed the minutes from an EU meeting with Sweden’s financial supervisor and an environmental protection agency in which officials suggested that regulators pressure the Bitcoin community to switch to a Proof of Stake (PoS) mechanism, instead of its current...

EU officials considered Bitcoin trading ban to enforce proposed mining ban

European Union (EU) officials discussed banning Bitcoin trading during a debate on a proposal to ban Proof of Work mining according to documents obtained through a freedom of information request. According to a report, published by German digital culture organization Netzpolitik, officials from the EU went as far as suggesting that an all out ban on trading Bitcoin (BTC) should be enforced in order to curb its overall energy consumption. The most worrying comments from the crypto community’s perspective came from a document that detailed the minutes from an EU meeting with Sweden’s financial supervisor and an environmental protection agency in which officials suggested that regulators pressure the Bitcoin community to switch to a Proof of Stake (PoS) mechanism, instead of its current...

EU bans providing ‘high-value crypto-asset services’ to Russia

The Council of the European Union has cut Russians off from certain cryptocurrency services as part of a package of restrictive measures against Russian President Vladimir Putin’s “brutal aggression against Ukraine and its people.” In a Friday announcement, the EU council said it would be closing potential loopholes in using digital assets for Russian entities and individuals to evade sanctions with a “prohibition on providing high-value crypto-asset services” to the country. The action was one of three financial measures the European Commission proposed alongside banning transactions and freezing assets connected to four Russian banks as well as a “prohibition on providing advice on trusts to wealthy Russians.” Russian Prime Minister Mikhail Mishustin claimed on Thursday that Russians hol...

European Commission opens new consultation on digital euro

The European Commission is calling for financial services specialists to weigh in on the potential rollout of a digital euro. In a Tuesday notice, the European Commission’s Directorate‑General for Financial Stability, Financial Services and Capital Markets Union said it would be preparing an assessment of the central bank digital currency based on the expected impact on financial service providers, retail users, and chambers of commerce. The commission will consult with industry specialists on issues concerning the digital euro including international payments, privacy, the impact on the financial sector and financial stability, use cases alongside cash payments, and anti-money laundering and combating the financing of terrorism rules. “For a digital euro to be used as the single currency,...

How blockchain intelligence can prevent Russia from evading sanctions

As pointed out by Caroline Malcolm, head of international policy at Chainalysis, the transparent nature of blockchain technology makes it relatively easy for crypto intelligence companies to track funds related to sanctioned entities. “We’re in quite a unique position because of the transparency and the permanency and the immutability of that public record,” explained Malcolm in an exclusive Cointelegraph interview. Governments around the world have expressed concerns that Russia could use crypto to evade sanctions imposed as a response to its military offensive against Ukraine. Addressing those concerns, Malcolm pointed out that in the last few years there has been substantial improvement in the crypto industry’s Anti-Money Laundering and counter-terrorism framewor...

US and EU double down on measures against Russia potentially using crypto to evade sanctions

The United States and the European Union have announced new actions targeting Russia’s economy and wealthy individuals as a report suggests Vladimir Putin’s allies have attempted to circumvent sanctions using cryptocurrency in foreign countries. In a Friday announcement, the White House said leadership from the United States, Canada, France, Germany, Italy, Japan, the United Kingdom and the European Union will take additional actions aimed at economically isolating Russia in response to President Vladimir Putin’s military invasion of Ukraine. The announcement includes banning imports of many Russian goods, banning the export of luxury goods to Russia and guidance for the U.S. Treasury Department to monitor the country’s attempts to evade existing sanctions. “Treasury’s expansive actions ag...

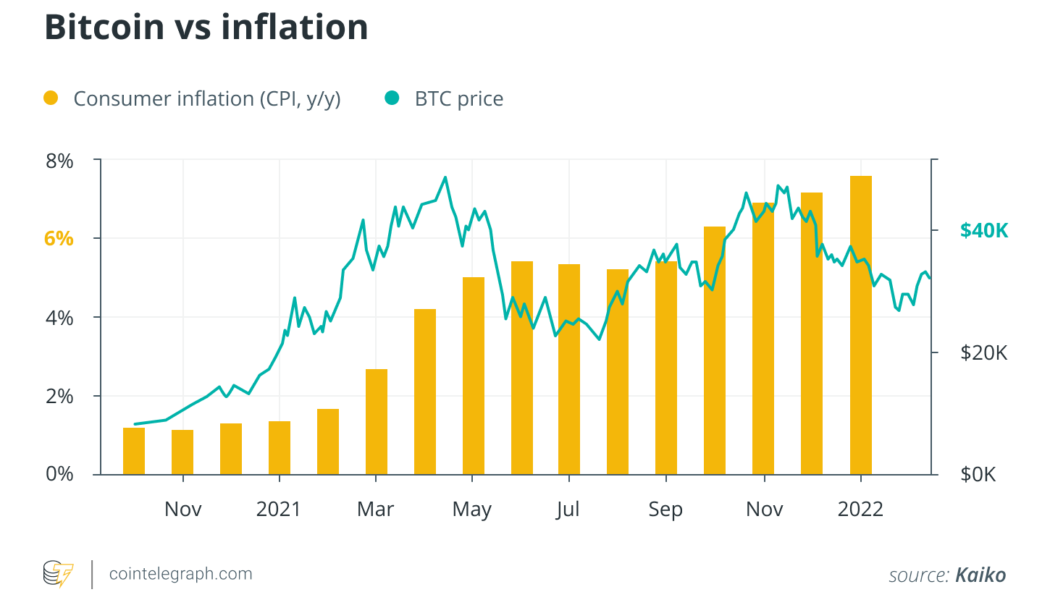

Inflation spikes in Europe: What do Bitcoiners, politicians and financial experts think?

Rising prices are grabbing headlines all over the world. Across the pond in the United States, inflation recently broke a 40-year record. The situation is severe in Europe, with prices rising over 5% across the Eurozone and 4.9% in the United Kingdom. While prices rise, Bitcoin (BTC) is flatlining at around $39,000. It poses many questions: Is Bitcoin an effective hedge against rising prices, what role can Bitcoin play in a high inflation environment and did Bitcoiners know that inflation was coming? Experts from the world of Bitcoin, finance and even European politics responded to these questions, sharing their views with Cointelegraph about the alarming price rises in Europe. From data analysts Kaiko’s monthly report, the Bitcoin price marched ahead of inflation, implying...

European Parliament will hold vote on crypto bill without PoW provision

The parliament of the European Union has scheduled a vote on a framework aimed at regulating cryptocurrencies after addressing concerns over proof-of-work mining. In a Monday Twitter thread, European Parliament Committee on Economics and Monetary Affairs member Stefan Berger said the committee will vote on the Markets in Crypto Assets, or MiCA, framework on March 14 following the submission of a final draft of the bill. As the rapporteur — the person appointed to report on proceedings related to the bill — Berger said the legislation will no longer include text that some had interpreted as a possible ban on proof-of-work crypto mining. “With MiCA, the EU can set global standards,” said Berger. “Therefore, all those involved are now asked to support the submitted draft & to vote for MiC...

FTX expands to Europe with CySEC approval

The global crypto derivatives and spot trading exchange FTX is expanding to Europe after receiving approval from the Cyprus Securities and Exchange Commission (CySEC). The new venture called FTX Europe would offer leading products of the company to the European clients via a licensed investment firm across the European economic area. The new European venture is headquartered in Switzerland along with a regional headquarters in Cyprus. Cyprus is seen as one of the reputed jurisdictions that offers a regulated medium for financial firms to access the European economic area. Thus, FTX would be able to offer its derivative crypto products as well, which is a big breakthrough, given Binance had to shut all crypto derivatives products last year across Europe. Sam Bankman Fried said their new ven...