European Union

EU crypto community has two weeks to join conversation on crypto data

The European Union’s securities regulator continues to strengthen its focus on cryptocurrency regulation, initiating a move to implement increased scrutiny of crypto transactions. The European Securities and Markets Authority (ESMA) on Tuesday issued a public tender document aiming to collect additional information about trading data on crypto transactions. The regulator is specifically looking for “crypto off-chain data” or crypto-related transactions that do not originate from a blockchain. According to ESMA, such transactions include spot and derivatives trade at centralized exchanges or over-the-counter trading platforms. “The coverage should encompass all major exchanges and crypto assets so that it provides a fair representation of the crypto market landscape,” the document reads.&nb...

How blockchain can address Austria’s energy crisis

Climate change has become one of the biggest global challenges for humanity. At the same time, the dependence on hydrocarbon energy sources such as coal, oil and natural gas is still strong. Supply lines around these energy sources are further vulnerable to geopolitical tensions. Due to the current sanctions against Russia, experts now expect rising electricity prices and negative effects on the energy market in Europe. The Austrian government understands the urgent need for the energy transition and has set the ambitious goal of being climate neutral by 2040. Alternative solutions to fossil energy have been slow to emerge and, for the most part, are not yet efficient enough on a large scale. But there are promising approaches — especially in the form of decentralized renewable energies or...

Demand for widely used euro stablecoin is huge, says DeFi expert

The market capitalization of Tether (USDT), a United States dollar-pegged stablecoin, is currently over $65 billion. USD Coin (USDC), another stablecoin backed by the U.S. dollar, clocks in near $55 billion. Some reports estimate that the total market cap of dollar-backed stablecoins is over $160 billion. Despite this success of dollar-based stablecoins, there has not been a euro stablecoin that is even remotely comparable in size. By the end of June, the U.S.-based company Circle announced that it will launch its own euro stablecoin, Euro Coin (EUROC), on the Ethereum blockchain. With a euro-based stablecoin, uncomplicated euro transfers will be possible worldwide in the future, as is currently the case with the U.S. dollar. Instead of the eurozone-based business, Circle has opted to issu...

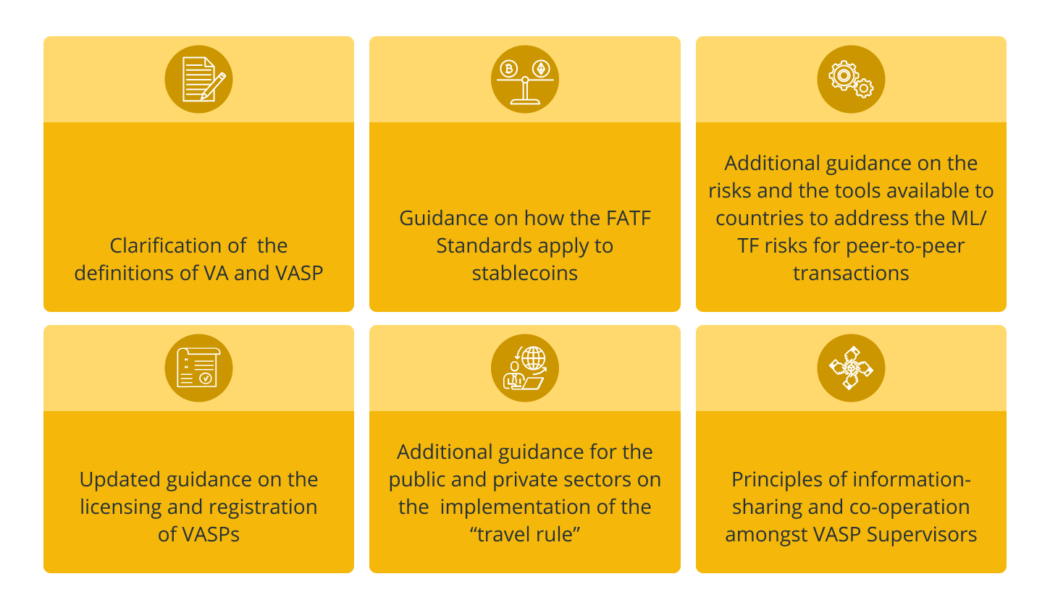

MiCA and ToFR: The EU moves to regulate the crypto-asset market

On the last day of June, the European Union reached an agreement on how to regulate the crypto-asset industry, giving the green light to Markets in Crypto-Assets (MiCA), the EU’s main legislative proposal to oversee the industry in its 27 member countries. A day earlier, on June 29, lawmakers in the member states of the European Parliament had already passed the Transfer of Funds Regulation (ToFR), which imposes compliance standards on crypto assets to crack down on money laundering risks in the sector. Given this scenario, today we will further explore these two legislations that, due to their broad scope, can serve as a parameter for the other Financial Action Task Force (FATF) members outside of the 27 countries of the EU. As it’s always good to understand not only the resul...

ECB officials prepare for ‘harmonization’ of crypto regulations: Report

The European Central Bank, or ECB, will reportedly be preparing to implement a new law by warning European Union member states about the necessity of harmonizing regulations for crypto. According to a Sunday report from the Financial Times, the ECB was concerned about possible regulatory overlap between respective central banks in the EU and crypto companies as officials prepare to implement the Markets in Crypto-Assets, or MiCA, framework. The European Parliament, European Commission, and European Council reached an agreement on June 30 to bring crypto issuers and service providers within their jurisdictional control under a single regulatory framework. Regulators from 19 EU member states will reportedly attend a supervisory board meeting in July to discuss MiCA and its possible implement...

EU officials reach agreement on AML authority for supervising crypto firms

The European Council has reached an agreement to form an anti-money laundering body that will have the authority to supervise certain crypto asset service providers, or CASPs. In a Wednesday announcement, the council said it had agreed on a partial position of a proposal to launch a dedicated Anti-Money Laundering Authority, or AMLA. According to the regulatory body, the AML body will have the authority to supervise “high-risk and cross-border financial entities” including crypto firms — “if they are considered risky.” European Parliament member Ondřej Kovařík said EU officials had also reached a “provisional political agreement” on the government body’s Transfer of Funds Regulation. Not all the details of the revision are clear at the time of publication, but Cointelegraph reported that a...

ECB head calls for separate framework to regulate crypto lending

A week after the major American crypto lending platform Celsius had to freeze the withdrawal option for its users, European Central Bank (ECB) president Christine Lagarde voiced her conviction on the necessity of tighter scrutiny over this part of the crypto market. During the testimony before the European Parliament on Monday, June 20, Christine Lagarde expressed her thoughts not only about the looming inflation in Europe and around the globe but also about the increasing activities of crypto-assets staking and lending. In Lagarde’s opinion, this trend demands additional regulatory efforts from the European Union (EU). Referring to the major regulatory package, making its way through the legislative routine, Markets in Crypto-Assets (MiCa), she even coined the term “MiCa II”: “MiCA ...

Third non-EU country, Ukraine, joins the European Blockchain Partnership

After Norway and Liechtenstein, Ukraine became the third country outside the European Union (EU) to join the European Blockchain Partnership (EBP), an initiative derived by 27 member states to deliver cross-border public services. The Ministry of Digital Transformation of Ukraine announced the country’s move to join the EBP as an observer on June 17. With the ultimate goal of integrating its digital economic space with the EU, Ukraine plans to expand its interstate blockchain network partnership with other countries. Ukraine’s intent to join the EBP dates back to July 2021, when Oleksii Zhmerenetskyi, the head of the Parliamentary group, Blockchain4Ukraine, and Konstantin Yarmolenko, the founder and CEO of Virtual Assets of Ukraine, wrote a letter to Ursula von der Leyen, the president of ...

EU commissioner reiterates need for ‘regulating all crypto-assets’

Mairead McGuinness, the Commissioner for Financial Services, Financial Stability and Capital Markets Union at the European Commission, is moving forward with a discussion on regulating cryptocurrencies amid three major events in the space. In written remarks for a speech in Brussels on Tuesday, McGuinness said the Celsius Network’s recent suspension of withdrawals, as well as the crash of Terra (originally LUNA, now LUNA Classic, or LUNC), show the need for crypto-asset regulation in the European Union. She added that ongoing concerns about crypto potentially being used to circumvent sanctions on Russia were also a factor. “Regulating all crypto-assets — whether they’re unbacked crypto-assets or so-called “stablecoins — and crypto-asset service providers is necessary...

DeFi pulls the curtain on financial magic, says EU Blockchain Observatory expert

As decentralized finance continues its victorious march — although the road is sometimes bumpy — some significant questions on its nature remain. How can DeFi applications be protected from becoming nonoperational under extreme stress? Is it really decentralized if some individuals have way more governance tokens than others? Does the anonymous culture compromise its transparency? A recent report from the EU Blockchain Observatory and Forum elaborates on these questions and many others around DeFi. It contains eight sections and covers a range of topics, from the fundamental definition of DeFi to its technical, financial and procedural risks. Conducted by an international team of researchers, the report formulates some important conclusions that will hopefully make their way to the eyes an...

Lithuania aims to tighten crypto regulation and ban anonymous accounts

In its efforts to fight money laundering risks and the possible schemes of Russian elites circumventing financial sanctions, the 2.8-million nation of Lithuania is planning to tighten its scrutiny over crypto. As the local Ministry of Finance announced on Wednesday, June 8, various ministries of the Lithuanian government approved legal amendments to anti-money laundering (AML) and countering the financing of terrorism in the crypto sector. The amendments to the current law — should they later be approved by the Seimas, Lithuania’s legislature — would stiffen the guidelines for user identification and prohibit anonymous accounts. The new regulations would also tighten up demands for exchange operators — from January 1, 2023, they will be obliged to register as a corporate body w...

A life after crime: What happens to crypto seized in criminal investigations?

Earlier this year, during the annual Queen’s Speech in the United Kingdom, Prince Charles informed the Parliament about two bills. One of them — the Economic Crime and Corporate Transparency Bill — would expand the government’s powers to seize and recover crypto assets. Meanwhile, the United States Internal Revenue Service (IRS) seized more than $3 billion worth of crypto in 2021. As digital currencies’ monetary stock grows and enforcers’ scrutiny over the maturing industry tightens, the amount of seized funds will inevitably increase. But where do these funds go, assuming they aren’t returned to the victims of scams and fraud? Are there auctions, like there are for forfeited property? Or are these coins destined to be stored on some kind of special wallet, which might end up as a perfect ...