Europe

FTX expands to Europe with CySEC approval

The global crypto derivatives and spot trading exchange FTX is expanding to Europe after receiving approval from the Cyprus Securities and Exchange Commission (CySEC). The new venture called FTX Europe would offer leading products of the company to the European clients via a licensed investment firm across the European economic area. The new European venture is headquartered in Switzerland along with a regional headquarters in Cyprus. Cyprus is seen as one of the reputed jurisdictions that offers a regulated medium for financial firms to access the European economic area. Thus, FTX would be able to offer its derivative crypto products as well, which is a big breakthrough, given Binance had to shut all crypto derivatives products last year across Europe. Sam Bankman Fried said their new ven...

FTX exchange looking to start operations in the European market

The crypto exchange has disclosed it has established a European division The exchange’s founder Sam Bankman-Fried has previously talked about expansion and acquisition plans Sam Bankman-Fried’s FTX has today announced a major milestone in its venture to explore new markets. The cryptocurrency exchange revealed today it has set up a Switzerland unit befittingly named FTX Europe that will be focused on serving users from Europe and the Middle East. The new unit has an additional base in Cyprus where it is licensed by the local watchdog CySEC according to the exchange’s press release. An FTX.US equivalent operating in Europe FTX previously set up a unit, FTX.US, that solely operates in the United States – a market that is widely considered stricter. The Switzerland-based unit, which comes two...

EU Commission to remove Russian banks from SWIFT cross-border network

The European Commission announced to remove a number of Russian banks from the Society for Worldwide Interbank Financial Telecommunication (SWIFT) messaging system, aimed at hindering Russia’s capacity to carry out cross-border payments. In a joint statement released by the European Commission, leaders from France, Germany, Italy, the United Kingdom, Canada, and the United States highlighted their shared interest in defending Ukraine from the war against Russia: “We will hold Russia to account and collectively ensure that this war is a strategic failure for Putin.” While condemning the Russian president Vladimir Putin’s move to lay siege across Ukraine, the EU Commission committed to undertake a series of measures to isolate Russia from the international financial system. President o...

European Parliament postpones crypto bill vote over proof-of-work

The parliament of the European Union is delaying a vote on a framework aimed at regulating cryptocurrencies amid concerns over proof-of-work mining. In a Friday Twitter thread, European Parliament economics committee member Stefan Berger said the government body had canceled a vote on the Markets in Crypto Assets, or MiCA, framework scheduled to take place on Monday. Berger said parliament needed to clarify “the question of proof-of-work” in discussions with stakeholders to ensure a proper legal framework, adding that some might misinterpret the proposal as a ban on crypto. “The discussion about MiCA indicates that individual passages of the draft report can be misinterpreted and understood as a [proof-of-work] ban,” said Berger. “It would be fatal if the EU Parliament sent the wrong signa...

Fidelity International launches Bitcoin ETP on Deutsche Boerse

Major financial services firm Fidelity International will be listing a Bitcoin exchange-traded product on the SIX Swiss Exchange and Germany’s Xetra digital stock exchange. According to a Tuesday announcement from Deutsche Boerse, a physical Bitcoin exchange-traded product, or ETP, from Fidelity International is now available for trading on the Deutsche Boerse Xetra and Frankfurt Stock Exchange under the ticker FBTC. In addition, the company reportedly said it planned to have the crypto investment vehicle listed on the SIX Swiss Exchange in the coming weeks. Fidelity Digital Assets will act as the custodian for the physically-backed Bitcoin (BTC) ETP, which will be centrally cleared with global exchange Eurex Clearing. The ETP has a total expense ratio of 0.75%. At the time of publication,...

Hungary’s central bank chief wants EU-wide crypto trading and mining ban

György Matolcsy, Governor of the Hungarian National Bank, has proposed a blanket ban on all cryptocurrency trading and mining operations across the European Union. Governor Matolcsy cited the recent crypto ban imposed by China in a blog post shared by the Hungarian central bank a.k.a. Magyar Nemzeti Bank (MNB) titled “Time has come to ban crypto trading and mining in the EU.” He also pointed out the Russian central bank’s proposal that calls for a blanket ban on domestic cryptocurrency trading and mining. Reciprocating the proposals for a crypto ban, Matolcsy said: “I perfectly agree with the proposal and also support the senior EU financial regulator’s point that the EU should ban the mining method used to produce most new bitcoin.” The governor strongly believes in cryptocurrency’s...

Legislation for a Digital Euro is imminent, EU commissioner sets timeline for early next year

Commissioner Mairead McGuinness has said the EU plans to table legislation on a CBDC early next year There is concern that the EU could get left behind if it does not work on a digital euro soon As first reported by Politico, the European Commission has resolved to coin legislation around a digital asset, leading to a bill set to be proposed in early 2023. The EU’s Commissioner for Financial Stability, Financial Services, and the Capital Markets Union Mairead McGuinness said at a recent fintech event that the commission would establish “a targeted legislative consultation” over the next few weeks. The European Central Bank (ECB) has started conducting internal trials on the digital euro designs, with a prototype expected to come towards the end of 2023. However, the consent of Eu...

Are NFTs an animal to be regulated? A European approach to decentralization, Part 1

Nonfungible tokens (NFTs) are constantly in the news. NFT platforms are springing up like mushrooms and champions are emerging, such as OpenSea. It is a real platform economy that is emerging, like those in which YouTube or Booking.com gained a foothold. But it is a very young economy — one that is struggling to understand the legal issues that apply to it. Regulators are starting to take an interest in the subject, and there is risk of a backlash if the industry does not regulate itself quickly. And, as always, the first blows are expected east of the Atlantic. In this first article devoted to the legal framework of NFTs, we will focus on the application of the digital asset regime and financial law to NFTs in France. In a second article, we will come back to the issues of liability and c...

12 of Earth’s most remote places and communities

From eastern Greenland to northern Alaska, we explore some of the most remote places on Earth Whether it’s astronomical distances, inhospitable climates or extreme terrains that define these remote and hostile lands, there’s one thing they all have in common: they are on my bucket list. That and the fact that people live there. It’s highly unlikely I’ll actually make it to many of these far-flung realms – I certainly didn’t get to Ittoqqortoormiit on my 2019 trip to Greenland – but I salute the hardcore residents who carve out an existence in the most remote places and communities on Earth. 1. Ittoqqortoormiit, Greenland Ittoqqortoormiit is located on Liverpool Land, a peninsula in eastern Greenland and one of the most remote towns in the country. It was first inhabited in 1925 b...

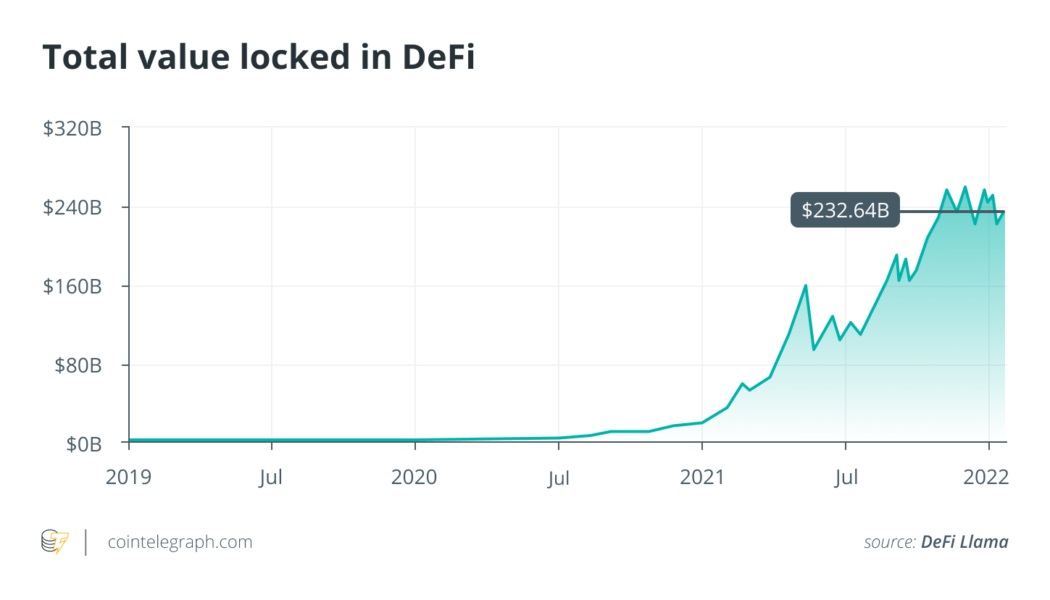

How should DeFi be regulated? A European approach to decentralization

Decentralized finance, known as DeFi, is a new use of blockchain technology that is growing rapidly, with over $237 billion in value locked up in DeFi projects as of January 2022. Regulators are aware of this phenomenon and are beginning to act to regulate it. In this article, we briefly review the fundamentals and risks of DeFi before presenting the regulatory context. The fundamentals of DeFi DeFi is a set of alternative financial systems based on the blockchain that allows for more advanced financial operations than the simple transfer of value, such as currency exchange, lending or borrowing, in a decentralized manner, i.e., directly between peers, without going through a financial intermediary (a centralized exchange, for example). Schematically, a protocol called a DApp (for decentra...

BitMEX acquires a German bank in line with its Europe expansion plans

The agreement of purchase is subject to regulatory approval by Federal Financial Supervisory Authority (BaFin) BMX Operations AG, an affiliate firm created by BitMEX Group execs yesterday, revealed plans to acquire a 268-year-old German bank, Bankhaus von der Heydt. Though financial details were not disclosed, the purchase is to be finalised by the end of Q2 this year. BMX Operations, owned by BitMEX Group CEO Alexander Höptner and CFO Stephan Lutz, said it had signed a purchase agreement with the current owner of the bank, Dietrich von Boetticher. The acquisition of the bank is, however, tentative at present as it hasn’t been given the green light by Germany’s financial regulatory authority BaFin. “Through combining the regulated digital assets expertise of Bankhaus von ...

NFTs to help brewers and farmers preserve UNESCO Belgian beer heritage

Brewers and farmers from Belgian Barrels Alliance (BBA) have partnered with Zeromint to offer nonfungible tokens (NFTs) aimed at preserving the UNESCO recognized Belgian beer culture and heritage. As a part of the partnership, Zeromint will mint and offer exclusive NFTs on the GoChain blockchain, which will be made available for international beer fans via BBA. Starting today, the organization will run several BBA NFT collection projects around sustainability and the preservation of Belgian beer heritage for the next 14 days. According to the official statement, the first Belgian Barrels NFT auction will be used to recruit 11 participants for acting in a BBA-produced movie titled Belgian Barrels: “The aim of the movie project is to further eternalize the Belgian Beer history through ...