Europe

Binance reportedly halts crypto derivatives service in Spain

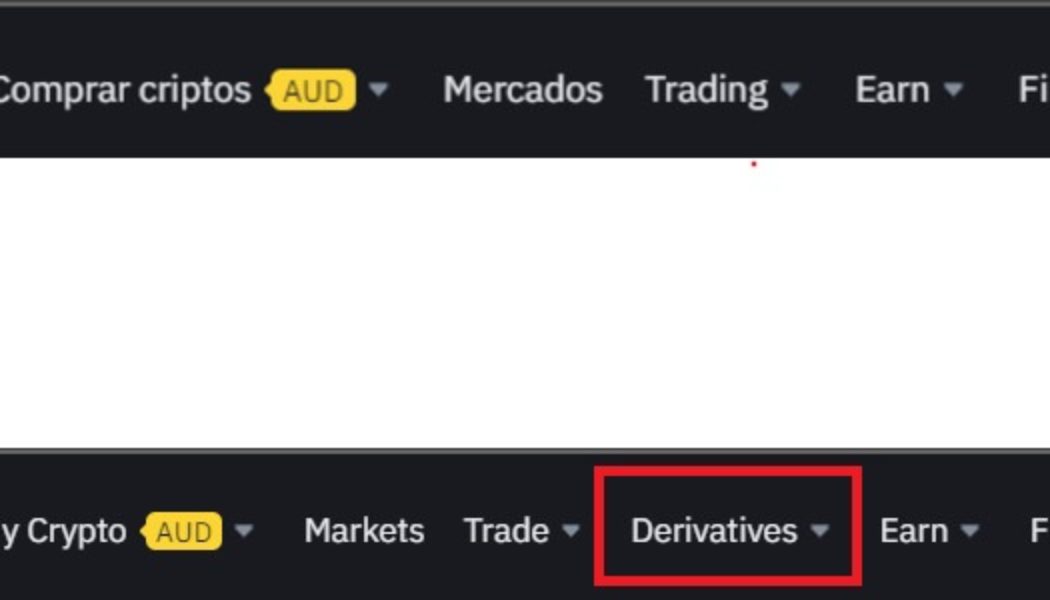

Binance stands as one of the most persistent crypto exchanges when it comes to gaining regulatory approval and operational licenses from regulators across the world. In this effort to operate as a fully licensed financial institution, the exchange has stopped offering it’s crypto derivatives services in Spain as it reportedly awaits approval from the Spanish regulator, Comisión Nacional del Mercado de Valores (CNMV). As evidenced by Binance’s official Spanish website, the crypto exchange removed the derivatives drop-down menu, which is still available on the global version. According to local news publication La Información, the move to hide derivatives offering in Spain comes as a way to comply with the requirements set by CNMV, a.k.a. the National Securities Market Commission....

Finance Redefined: DeFi protocols lost $1.6B, EU to rethink DeFi approach, and more

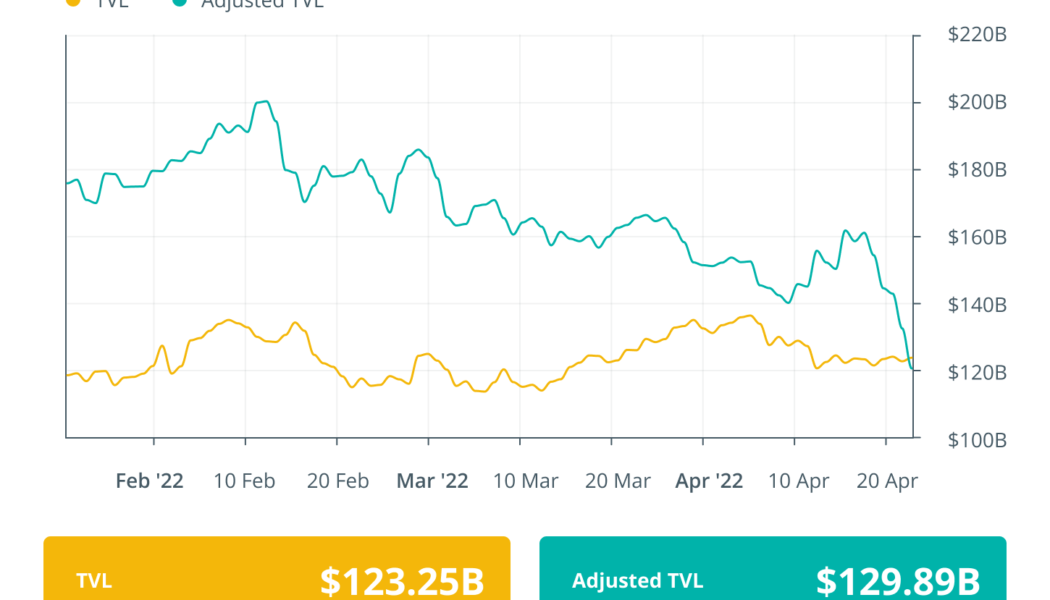

The past week in the decentralized finance (DeFi) ecosystem saw many new developments from an adoption perspective and protocol developments. The European Commission added a new chapter on DeFi, showing the growing impact of the nascent ecosystem, while a county in the United States State of Virginia wants to put its pension fund in a DeFi yield. DeFi exploits became the center of attention again as recent research shows that in the first two quarters of 2022, DeFi protocols have lost $1.6 billion to various exploits. Rari Fuze hacker, who got away with $80 million worth of funds, was offered a $10 million bounty. The DeFi tokens also made a bullish comeback toward the end of the past week. However, the overall weekly performance remained in the red. European Commission report suggests ret...

EU commissioner calls for global coordination on crypto regulation

Mairead McGuinness, the commissioner for financial services, financial stability and capital markets union at the European Commission, is calling for global regulators to work together to address potential risks in the crypto market. In a Sunday opinion piece in political media outlet The Hill, McGuinness said the European Union and the United States could help lead the world in a regulatory approach for cryptocurrencies that considers the benefits of the innovative technology while addressing “significant risks.” The EU commissioner pointed to the volatility of certain assets, the risk of insider trading, the possibility of crypto being used by Russia to evade sanctions and environmental concerns. “To make rules on crypto fully effective, crypto requires global coordination and joint inte...

Belgian financial regulator FSMA to regulate crypto exchange services

A new rule imposed by Belgium’s financial regulatory agency, the Financial Services and Markets Authority (FSMA), will now require crypto exchanges and custodial wallet services in the region to register within a sharp deadline. Starting tomorrow, May 1, legal individuals and entities that wish to provide crypto exchange services or custodial wallets in Belgium will have to register in advance, according to the information released by the FSMA. As from 1 May 2022, providers of exchange services between #virtual #currencies and legal currencies, or custody #wallet services will have to register with the #FSMA. Please consult the FAQs. https://t.co/P44mkovn5L pic.twitter.com/aAdtQ9Dqwx — FSMA (@FSMA_info) April 29, 2022 Crypto businesses in Belgium that have been already operating before thi...

Grayscale to expand crypto fund offering into Europe

Digital asset manager Grayscale Investments is planning to expand its product offerings into Europe to tap into growing institutional demand for cryptocurrencies in the region, CEO Michael Sonnenshein confirmed Tuesday. In an interview with Bloomberg, Sonnenshein said the company was holding meetings with local partners to discuss how Grayscale’s suite of products would be rolled out in the region. The company hasn’t made any definitive plans regarding which exchanges and countries would be supported initially, though Grayscale plans to launch pilot tests in several markets across the European Union. Sonnenshein explained that Grayscale would be looking at investor behaviors and local regulations in determining its product rollout. “Although the EU is unified, we don’t view the entir...

21Shares launches hybrid Bitcoin and gold ETP to enable inflation hedge

21Shares, a major issuer of cryptocurrency exchange-traded products (ETP), is launching a new ETP tracking a mix of Bitcoin (BTC) and gold. The Switzerland-based firm on Wednesday announced the launch of the 21Shares ByteTree BOLD ETP (BOLD), a new product aiming to provide inflation protection by tracking an index providing risk-adjusted exposure to both BTC and gold. Listed on the SIX Swiss Exchange, the new hybrid ETP is subject to monthly rebalances according to the inverse historic volatility of each asset. At launch, BOLD comprises 18.5% of BTC and 81.5% of gold. The new ETP was developed in collaboration with the United Kingdom-based alternative investment provider, ByteTree Asset Management. The product is positioned as the world’s first combined BTC and gold ETP. “Gold has hi...

A dozen Bitcoin ATMs installed at the largest EU electronics retailer

Austrians have “sufficient funds” for more Bitcoin ATMs — that’s the verdict that MediaMarkt, a German electronics retailer, reached following a successful Bitcoin ATM pilot in Austria. MediaMarkt has rolled out Bitcoin (BTC) ATMs in 12 branches across the country, including Seiersberg and Klagenfurt. Confinity and its spinoff ATM company, Kurant, manage over 200 Bitcoin ATMs in Austria, Germany, Spain and Greece. Kurant’s Head of Marketing & Sales, Europe, Thomas Sperneder told Cointelegraph: “MediaMarkt stores across the country have been equipped with Bitcoin vending machines. In total, these are now present in twelve markets and enable the simple and secure purchase of cryptocurrencies.” A Bitcoin ATM in Austria. Source: Kurant A successful pilot project fea...

German banking giant Commerzbank applies for crypto license

One of the largest banking institutions in Germany has confirmed it applied for a local crypto license earlier this year, marking the first time a major bank has made a move toward cryptocurrencies in the country. A spokesperson from Commerzbank confirmed to local media outlet Börsen-Zeitung on April 14 that it “applied for the crypto custody license in the first quarter of 2022.” If approved it would be authorized to offer exchange services along with custody and protection of crypto-assets. Commerzbank serves over 18 million customers and over 70,000 institutional clients, and the cryptocurrency offering will reportedly target its institutional client base. Since Jan. 1 2020 any business wishing to offer cryptocurrency services in Germany must first seek approval from the Federal Financi...

New crypto card by Nexo allows users to pay without selling Bitcoin

Major cryptocurrency loan company Nexo has officially launched a crypto-backed Mastercard card enabling users to pay for services with cryptocurrencies like Bitcoin (BTC) without selling their crypto. Nexo has partnered with Mastercard and the peer-to-peer payment startup DiPocket to launch the Nexo Card, a crypto card allowing cardholders to use their crypto as collateral rather than selling it, the firm announced to Cointelegraph on Wednesday. The card is linked to a Nexo-provided, crypto-backed credit line allowing to use of multiple assets as collateral, including but not limited to Bitcoin, Ether (ETH) and the Tether (USDT) stablecoin. “The Nexo Card functions through Nexo’s crypto-backed credit lines, which means that funds for your purchases come from your available credit lin...

Museums in the metaverse: How Web3 technology can help historical sites

Metaverse events at ancient and historical sites could soon shape up to be an alternate future for tourism. Owners of physical castles and villas who have drafted up augmented reality blueprints of their properties think their ambitious plans to attract visitors in the metaverse will work, as virtual events can help them pay the hefty maintenance bills for their aging properties and also offer a chance to change historical narratives. The metaverse tourism model was expedited by downturns in tourism brought about by COVID-19, but the industry may have already been heading that way. Currently, major metaverse platforms are clunky, difficult to use and waiting for more “real estate” development, but firms are concentrating on what could be. Brands seem to be entering the metaverse en m...

EU bans providing ‘high-value crypto-asset services’ to Russia

The Council of the European Union has cut Russians off from certain cryptocurrency services as part of a package of restrictive measures against Russian President Vladimir Putin’s “brutal aggression against Ukraine and its people.” In a Friday announcement, the EU council said it would be closing potential loopholes in using digital assets for Russian entities and individuals to evade sanctions with a “prohibition on providing high-value crypto-asset services” to the country. The action was one of three financial measures the European Commission proposed alongside banning transactions and freezing assets connected to four Russian banks as well as a “prohibition on providing advice on trusts to wealthy Russians.” Russian Prime Minister Mikhail Mishustin claimed on Thursday that Russians hol...

European Commission opens new consultation on digital euro

The European Commission is calling for financial services specialists to weigh in on the potential rollout of a digital euro. In a Tuesday notice, the European Commission’s Directorate‑General for Financial Stability, Financial Services and Capital Markets Union said it would be preparing an assessment of the central bank digital currency based on the expected impact on financial service providers, retail users, and chambers of commerce. The commission will consult with industry specialists on issues concerning the digital euro including international payments, privacy, the impact on the financial sector and financial stability, use cases alongside cash payments, and anti-money laundering and combating the financing of terrorism rules. “For a digital euro to be used as the single currency,...