Europe

EU officials reach agreement on AML authority for supervising crypto firms

The European Council has reached an agreement to form an anti-money laundering body that will have the authority to supervise certain crypto asset service providers, or CASPs. In a Wednesday announcement, the council said it had agreed on a partial position of a proposal to launch a dedicated Anti-Money Laundering Authority, or AMLA. According to the regulatory body, the AML body will have the authority to supervise “high-risk and cross-border financial entities” including crypto firms — “if they are considered risky.” European Parliament member Ondřej Kovařík said EU officials had also reached a “provisional political agreement” on the government body’s Transfer of Funds Regulation. Not all the details of the revision are clear at the time of publication, but Cointelegraph reported that a...

Poorest countries in the world – ranked

African nations dominate the ranking of the poorest countries in the world based on the latest data from the World Bank We all have preconceptions about places. Take Ethiopia for example. As children of the eighties, Kia and I were only too aware of the struggles Ethiopia has faced historically: political unrest, civil war and, of course, famine. It was easy then to imagine a vast desolate dust bowl ahead of our visit in 2017. Ethiopia is perceived by many as a representation of wider Africa: still developing, still struggling. In reality, it is a land of lush mountains, dazzling architecture and jaw-dropping natural wonders. There is poverty, but there is also hope. Our visit prompted us to ask if Ethiopia still ranked as one of the poorest countries in the world. Data from the Worl...

ECB head calls for separate framework to regulate crypto lending

A week after the major American crypto lending platform Celsius had to freeze the withdrawal option for its users, European Central Bank (ECB) president Christine Lagarde voiced her conviction on the necessity of tighter scrutiny over this part of the crypto market. During the testimony before the European Parliament on Monday, June 20, Christine Lagarde expressed her thoughts not only about the looming inflation in Europe and around the globe but also about the increasing activities of crypto-assets staking and lending. In Lagarde’s opinion, this trend demands additional regulatory efforts from the European Union (EU). Referring to the major regulatory package, making its way through the legislative routine, Markets in Crypto-Assets (MiCa), she even coined the term “MiCa II”: “MiCA ...

Third non-EU country, Ukraine, joins the European Blockchain Partnership

After Norway and Liechtenstein, Ukraine became the third country outside the European Union (EU) to join the European Blockchain Partnership (EBP), an initiative derived by 27 member states to deliver cross-border public services. The Ministry of Digital Transformation of Ukraine announced the country’s move to join the EBP as an observer on June 17. With the ultimate goal of integrating its digital economic space with the EU, Ukraine plans to expand its interstate blockchain network partnership with other countries. Ukraine’s intent to join the EBP dates back to July 2021, when Oleksii Zhmerenetskyi, the head of the Parliamentary group, Blockchain4Ukraine, and Konstantin Yarmolenko, the founder and CEO of Virtual Assets of Ukraine, wrote a letter to Ursula von der Leyen, the president of ...

EU commissioner reiterates need for ‘regulating all crypto-assets’

Mairead McGuinness, the Commissioner for Financial Services, Financial Stability and Capital Markets Union at the European Commission, is moving forward with a discussion on regulating cryptocurrencies amid three major events in the space. In written remarks for a speech in Brussels on Tuesday, McGuinness said the Celsius Network’s recent suspension of withdrawals, as well as the crash of Terra (originally LUNA, now LUNA Classic, or LUNC), show the need for crypto-asset regulation in the European Union. She added that ongoing concerns about crypto potentially being used to circumvent sanctions on Russia were also a factor. “Regulating all crypto-assets — whether they’re unbacked crypto-assets or so-called “stablecoins — and crypto-asset service providers is necessary...

DeFi pulls the curtain on financial magic, says EU Blockchain Observatory expert

As decentralized finance continues its victorious march — although the road is sometimes bumpy — some significant questions on its nature remain. How can DeFi applications be protected from becoming nonoperational under extreme stress? Is it really decentralized if some individuals have way more governance tokens than others? Does the anonymous culture compromise its transparency? A recent report from the EU Blockchain Observatory and Forum elaborates on these questions and many others around DeFi. It contains eight sections and covers a range of topics, from the fundamental definition of DeFi to its technical, financial and procedural risks. Conducted by an international team of researchers, the report formulates some important conclusions that will hopefully make their way to the eyes an...

Lithuania aims to tighten crypto regulation and ban anonymous accounts

In its efforts to fight money laundering risks and the possible schemes of Russian elites circumventing financial sanctions, the 2.8-million nation of Lithuania is planning to tighten its scrutiny over crypto. As the local Ministry of Finance announced on Wednesday, June 8, various ministries of the Lithuanian government approved legal amendments to anti-money laundering (AML) and countering the financing of terrorism in the crypto sector. The amendments to the current law — should they later be approved by the Seimas, Lithuania’s legislature — would stiffen the guidelines for user identification and prohibit anonymous accounts. The new regulations would also tighten up demands for exchange operators — from January 1, 2023, they will be obliged to register as a corporate body w...

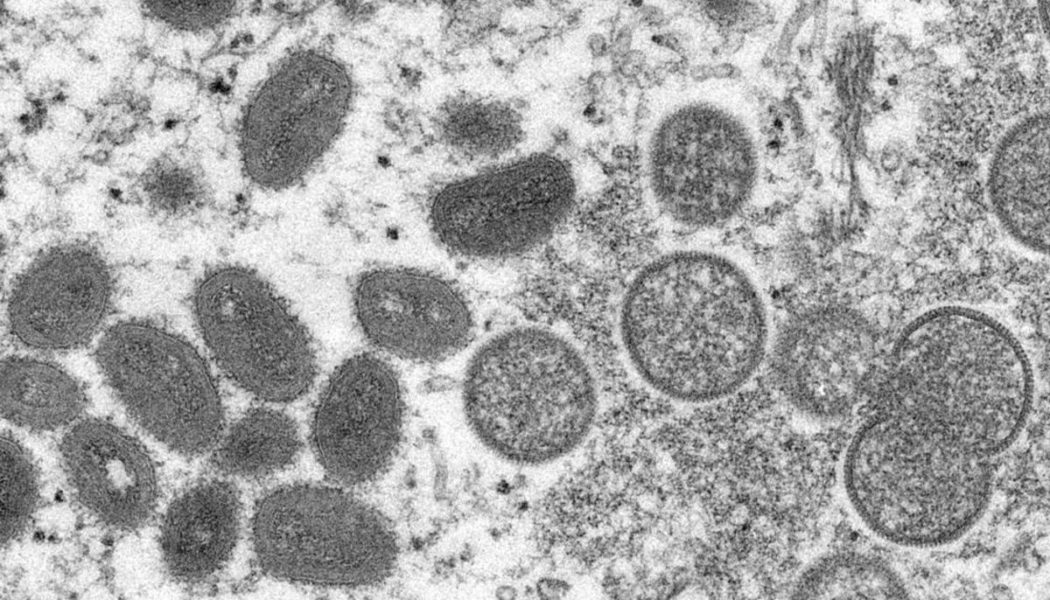

WHO Advisor Suggests Monkeypox Spread by European Raves

Dr. David Heymann, former head of the World Health Organization’s (WHO) emergencies department and now a leading advisor, suggested that sexual transmission at two raves in Spain and Belgium may have spurred the recent outbreak of Monkeypox. However, names and details of the events were not shared. “We know monkeypox can spread when there is close contact with the lesions of someone who is infected, and it looks like sexual contact has now amplified that transmission,” Heymann told The Associated Press. Symptoms of Monkeypox—similar to past cases of smallpox though clinically less severe—include fevers, chills, muscle pains, headaches, and lesions on the face or genitals. The recovery period is usually a few weeks and does not require hospitalization. In the past, Monkeypox has typically s...

Asset manager Grayscale announces maiden ETF in Europe

The Grayscale Future of Finance UCITS ETF tracks the Bloomberg Grayscale Future of Finance Index The ETF will list on the Borsa Italiana, London Stock Exchange (LSE), and Deutsche Börse Xetra Digital asset management firm Grayscale on Monday issued a press release revealing that it is stretching its offering to European investors by listing its first European EFT. The Grayscale Future of Finance UCITS ETF will be a stark indicator of the evolution of Grayscale to the next level. The first in Europe The ETF offering is planned to get listed on the Borsa Italiana, London Stock Exchange (LSE), and Deutsche Börse Xetra under the ticker GFOF. It is structured to allow investors to interact with firms at the intersection of virtual assets, technology, and finance. The new offering will tra...

Digital euro could come as soon as 2026 — ECB official

Fabio Panetta, an executive board member of the European Central Bank, or ECB, has said that a digital euro could come within four years, potentially designed with a person-to-person payment solution. In a Monday speech at the National College of Ireland, Panetta said the ECB could start the development and testing of solutions toward providing a digital euro for members of the European Union in 2023, a phase that could take up to three years. He added that making the digital currency legal tender and for use in P2P payments could help promote adoption. Panetta also commented on the recent market volatility for cryptocurrencies, with TerraUSD (UST) depegging from the U.S. dollar and the price of many major coins including Bitcoin (BTC) dropping. According to the ECB official, stablecoins, ...

Chairman of the Digital Euro Association: ‘The primary aim of the digital euro is still not clear’

The European Central Bank (ECB) is planning to launch a prototype of the digital euro in 2023. In the next five years, Europe could have its own central bank digital currency (CBDC) up and running. However, there are still many questions surrounding the prospective digital currency. In what form could it be issued? Is the ECB too late to the CBDC party, especially compared to other central banks such as that of the People’s Republic of China? To address these and other questions, Cointelegraph auf Deutsch spoke with Jonas Gross, chairman of the Digital Euro Association (DEA) and member of the expert panel of the European Blockchain Observatory and Forum. New digital cash Gross said that compared to digital cash issued by a commercial bank, central bank money carries fewer risks. A commerci...

Head of Bitstamp’s European arm becomes latest CEO of global crypto exchange

Bitstamp, one of the oldest crypto exchanges in the world, has announced the appointment of Jean-Baptiste (JB) Graftieaux as its new global CEO following the departure of Julian Sawyer. In a Monday announcement, Bitstamp said Sawyer, who first became CEO of the crypto exchange in October 2020, “has decided to pursue other opportunities.” Graftieaux took over the position on May 7, having been the Bitstamp Europe CEO since May 2021. According to the exchange, Graftieaux has 20 years of experience in “crypto, payments, and financial sectors,” having first joined Bitstamp in November 2014 as the firm’s chief compliance officer following five years at PayPal. “JB was with Bitstamp in its early days, and has admirably led our European business over the past year,” said Bitstamp’s board of direc...