ETP

Over 200K BTC now stored in Bitcoin ETFs and other institutional products

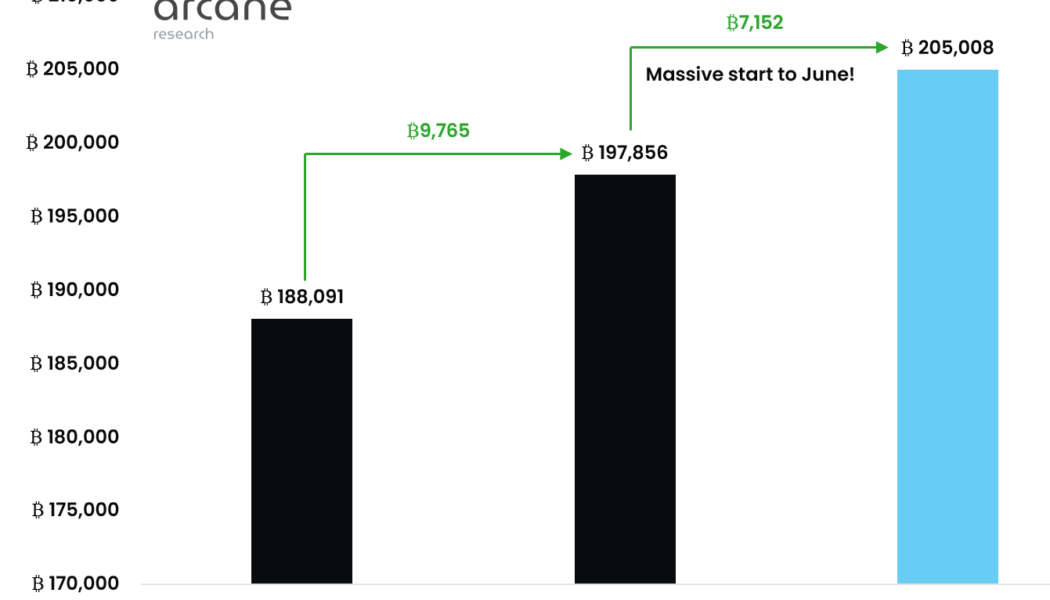

Bitcoin (BTC) investment vehicles are seeing “gargantuan” inflows this month, which is a fresh sign that traders’ appetite for BTC exposure is mounting. Data from monitoring firm Arcane Research published this week shows that Bitcoin exchange-traded products (ETPs) now have record high BTC under management. “Happier days” for Bitcoin ETPs as buyers pile in Despite BTC price action failing to draw in buyers at over 50% below all-time highs, not everyone is feeling risk-off. According to Arcane’s data, Bitcoin ETPs have seen a flurry of interest from institutional investors both this month and last. In total, Bitcoin ETPs, which include products such as the ProShares Bitcoin Strategy exchange-traded fund (ETF), now have 205,000 BTC under their control — a new record. “While the M...

What BTC price slump? Bitcoin outperforms stocks and gold for 3rd year in a row

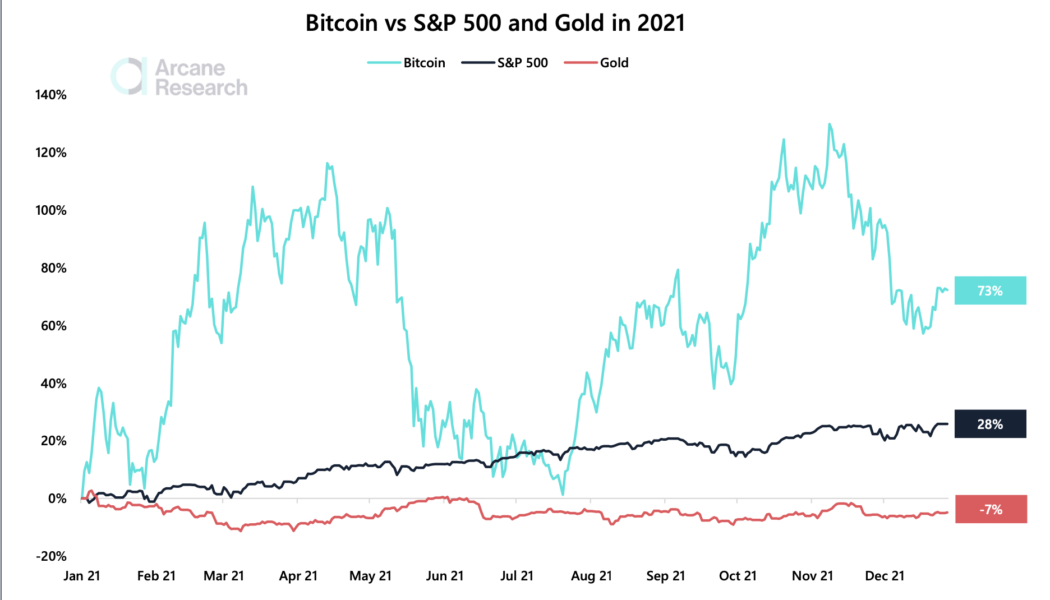

Bitcoin (BTC) may be down over 30% from its record high of $69,000, but it has emerged as one of the best-performing financial assets in 2021. BTC has bested the United States benchmark index the S&P 500 and gold. Arcane Research noted in its new report that Bitcoin’s year-to-date performance came out to be nearly 73%. In comparison, the S&P 500 index surged 28%, and gold dropped by 7% in the same period, which marks the third consecutive year that Bitcoin has outperformed the two. Bitcoin vs. S&P 500 vs. gold in 2021. Source: Arcane Research, TradingView At the core of Bitcoin’s extremely bullish performance was higher inflation. The U.S. consumer price index (CPI) logged its largest 12-month increase in four decades this November. “Most economists didn’t see the hig...