Ethereum

Ethereum’s bearish U-turn? ETH price momentum fades after $1.6K rejection

Ethereum’s native token Ether (ETH) tumbled on July 26, reducing hopes of an extended price recovery. The ETH/USD pair dropped by roughly 5%, followed by a modest rebound to over $1,550. Ethereum gets rejected at $1,650 These overnight moves liquidated over $80 million worth of Ether positions in the last 24 hours, data from CoinGlass reveals. ETH/USD hourly price chart. Source: TradingView The seesaw action also revealed an underlying bias conflict among traders who have been stuck between two extremely opposite market fundamentals. The first is the euphoria surrounding Ethereum’s potential transition to proof-of-stake in September, which has helped Ether’s price to recover 45% month-to-date. However, this bullish hype is at odds with macroeconomic headwinds, namel...

Top 5 cryptocurrencies to watch this week: BTC, ETH, BCH, AXS, EOS

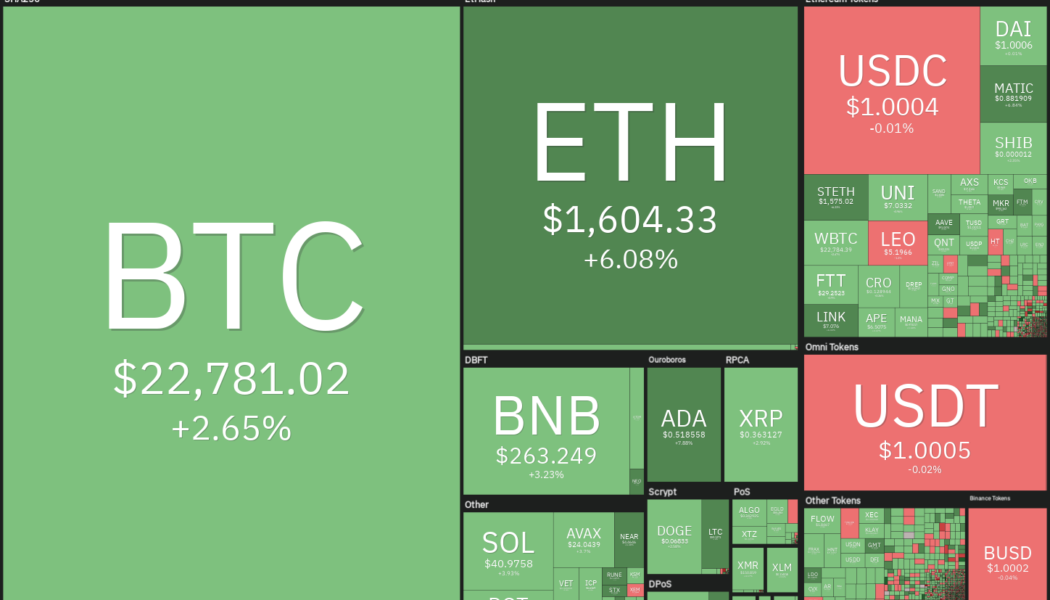

The bulls are attempting to achieve a strong weekly close for Bitcoin (BTC), while the bears are attempting to regain their advantage. Analysts are closely watching the 200-week moving average which is at $22,705 and BTC’s current setup suggests that a decisive move is imminent. Many analysts expect a weekly close above the 200-week MA to attract further buying but a break below it could signal that bears are back in the game. Although the short-term picture looks uncertain, analyst Caleb Franzen said that Bitcoin has been in an accumulation zone since May. Crypto market data daily view. Source: Coin360 Meanwhile, on-chain analytics firm CryptoQuant highlighted increasing outflows of Ether (ETH) from major exchanges, totaling $1.87 million coins on July 22. Usually, outflows fr...

Bitcoin must close above $21.9K to avoid fresh BTC price crash — trader

Bitcoin (BTC) found strength at $22,000 into July 24 with bulls still aiming for a solid green weekly close. BTC/USD 1-hour candle chart (Bitstamp). Source: TradingView Classic levels for end-of-week price focus Data from Cointelegraph Markets Pro and TradingView showed BTC/USD halting a weekend drop at $21,900 to return towards the $23,000 on the day. The pair held a trading range closely focused on key long-term trendlines, which analysts had previously described as essential to reclaim. These included the 50-day and 200-week moving averages (MAs), the latter particularly important as support during bear markets but which had acted as resistance since May. “Bullish that we perfectly held the 13d ema + horizontal 21.9k,” popular Twitter trading account CryptoMellany argued in part of her ...

Price analysis 7/22: BTC, ETH, BNB, XRP, ADA, SOL, DOGE, DOT, MATIC, AVAX

In a downtrend, when markets do not respond negatively to bearish news, it is a sign that the selling may have reached exhaustion. Reports of electric vehicle maker Tesla dumping 75% of its Bitcoin (BTC) holdings in the second quarter only caused a minor blip as lower levels attracted strong buying from the bulls. Tesla was not the only institution that sold its Bitcoin. Arcane Research analyst Vetle Lunde highlighted in a Twitter thread that large institutions have sold 236,237 BTC since May 10. It is encouraging to note that even after huge selling by institutions and the unfavorable macro environment, Bitcoin has held up quite well. Daily cryptocurrency market performance. Source: Coin360 The current bear market allows an opportunity for new traders to enter at lower levels. A repo...

Ethereum price ‘cup and handle’ pattern hints at potential breakout versus Bitcoin

Ethereum’s native token Ether (ETH) has rebounded 40% against Bitcoin (BTC) after bottoming out locally at 0.049 on June 13. Now, the ETH/BTC pair is at two-month highs and can extend its rally in the coming weeks, according to a classic technical pattern. ETH paints cup and handle pattern Specifically, ETH/BTC has been forming a “cup and handle” on its lower-timeframe charts since July 18. A cup and handle setup typically appears when the price falls and then rebounds in what appears to be a U-shaped recovery, which looks like a “cup.” Meanwhile, the recovery leads to a pullback move, wherein the price trends lower inside a descending channel called the “handle.” The pattern resolves after the price rallies to an approximately equal size to ...

Ethereum Developers Secretly Rave In Legendary Paris Gravesite Amid $2 Trillion Crypto Crash

“Leave no trace.” So said the intimate gathering of roughly 100 Ethereum developers who descended upon the Catacombs of Paris for an illegal techno rave. Amid a tumultuous macroeconomic backdrop and $2 trillion crash for the cryptocurrency industry at large, attendees entered the 65-foot deep caverns, which are said to be lined with the skeletal remains of millions of plague victims, effectively making it the world’s largest grave. Crypto developers recently congregated in Paris for the annual Ethereum Community Conference (EthCC), the largest European-based Ethereum summit, where 2,000 gathered for three days. A subset of developers visited the grim, centuries-old attraction, which was not associated with the conference. Scroll to Continue Recommended Articles...

‘The market is acting this way because there is no regulation’ says Skale Labs’ Konstantin Kladko

The recent cryptocurrency bear market has uprooted decentralized finance (DeFi) and centralized finance (CeFi) projects in the crypto space. But past performance is not always indicative of future results. For starters, Ethereum’s price has already recovered 48% in the past few days ahead of the looming Merge upgrade. At the annual Ethereum Community Conference in Paris, Cointelegraph spoke to Skale Labs’ co-founder Konstantin Kladko regarding the market crisis. Sklae Labs is a decentralized network of blockchains built on Ethereum. Currently, it’s comprised of 28 blockchains where one can send tokens seamlessly from one chain to another. Here’s what Klado has to say about the recent contagion: “The market is acting this way because there is no regulatio...

Solana and Ethereum smart contract audits, explained

As you might expect, this depends on how complex a smart contract is. According to Hacken, this can extend to $500,000 for larger projects where there are more lines of code — not least because of the additional engineering hours it’ll take. The company argues these costs pale into comparison with the economic damage that a smart contract vulnerability can bring. Hacken cites data showing that, in 2021, 80% of the incidents affecting decentralized applications related to smart contracts — with losses hitting $6.9 billion. Breaking this down even further, and we can see that the average cost per project stands at $47 million. Somehow, $500,000 looks a lot less expensive now. Overall, 60% of its clients have been based on Ethereum so far in 2022. And here&...

Price analysis 7/20: BTC, ETH, BNB, XRP, ADA, SOL, DOGE, DOT, MATIC, AVAX

Bitcoin (BTC) briefly extended its recovery above $24,000 and the altcoins continued to make smart gains on July 20, but the bullish momentum of the week experienced a brief setback after Tesla’s earnings report showed the company had sold 75% of its BTC position. Although the sharp breakout of this week is a positive sign, analysts were quick to point out that a sustained recovery depends on a strong performance from Wall Street. Analyst Venturefounder pointed out that the rally was largely macro-driven and Bitcoin’s correlation with NASDAQ remained at a historical high of 91%. Bitcoin’s sharp rally in the past few days has awakened hibernating bulls who are dishing out lofty targets. Analyst TechDev projected a target of $120,000 in 2023, while Galaxy Digital CEO Mike Novogratz tol...

What’s next for the future of Ethereum? Mihailo Bjelic from Polygon explains

With the transition to a scalable, energy light proof-of-stake blockchain (dubbed “the Merge”) at play for Ethereum, many have cast doubts on the popular coin’s future given the magnitude and complexity of the upgrade involved. But among prominent stakeholders, one particular project remains heavily bullish on Ethereum’s future, which is non-other than layer-two scaling solution Polygon. At the annual Ethereum Community Conference in Paris, Cointelegraph’s Events Manager Maria A. spoke to Polygon’s vice president of growth Mihailo Bjelic regarding the topic. Here’s what Mihailo had to say with regards to the Merge: “This is an upgrade on a live network that has millions of users, billions in capital, and tens of thousands of applications. It is never easy, but the Merge has been in t...

Will Ethereum Merge hopium continue, or is it a bull trap?

Ethereum is outperforming the broader cryptocurrency market as the highly anticipated Merge approaches, but the bigger picture is still largely bearish. Ethereum (ETH) has gained a whopping 48% over the past seven days, outperforming its big brother Bitcoin, which has only managed to achieve 19% in the same period. It’s also up 66% from its market cycle bottom of $918 on June 19, reaching its current price of $1549. However, the current Ethereum rally could be a bull trap with the macroeconomic clouds darkening. A bull trap is a signal indicating that a declining trend in a crypto asset has reversed and is heading upwards when it will actually continue downwards. The primary driver of recent momentum for the asset has been linked to announcements regarding its final switch to pr...

Bitcoin lurks by $22K as US dollar falls from peak, Ethereum gains 20%

Bitcoin (BTC) hugged $22,000 on July 19 as macro conditions slowly turned to favor risk assets. BTC/USD 1-hour candle chart (Bitstamp). Source: TradingView Stocks, crypto rise as dollar weakens Data from Cointelegraph Markets Pro and TradingView showed BTC/USD cooling volatility immediately below the crucial 200-week moving average (WMA). The Wall Street open saw further gains for United States equities in the face of a declining U.S. dollar, which extended its retracement after hitting its latest two-decade peak. The U.S. dollar index (DXY) stood at around 106.5 at the time of writing, down 2.6% from the high seen July 14. For Bitcoin analysts, it was thus a case of wait and see as markets bided their time between buy and sell levels. $BTC / $USD – Update These are the op...