Ethereum

Ethereum risks another 10% drop versus Bitcoin as $15.4M exits ETH investment funds

Ethereum’s Merge on Sep. 15 turned out to be a sell-the-news event, which looks set to continue. Notably, Ether (ETH) dropped considerably against the U.S. dollar and Bitcoin (BTC) after the Merge. As of Sep. 22, ETH/USD and ETH/BTC trading pairs were down by more than 20% and 17%, respectively, since Ethereum’s switch to Proof-of-Stake (PoS. ETH/USD and ETH/BTC daily price chart. Source: TradingView What’s eating Ether bulls? Multiple catalysts contributed to Ether’s declines in the said period. First, ETH’s price fall against the dollar appeared in sync with similar declines elsewhere in the crypto market, driven by Federal Reserve’s 75 basis points (bps) rate hike. Second, Ethereum faced a lot of flak for becoming too centralized ...

Price analysis 9/21: BTC, ETH, BNB, XRP, ADA, SOL, DOGE, DOT, MATIC, SHIB

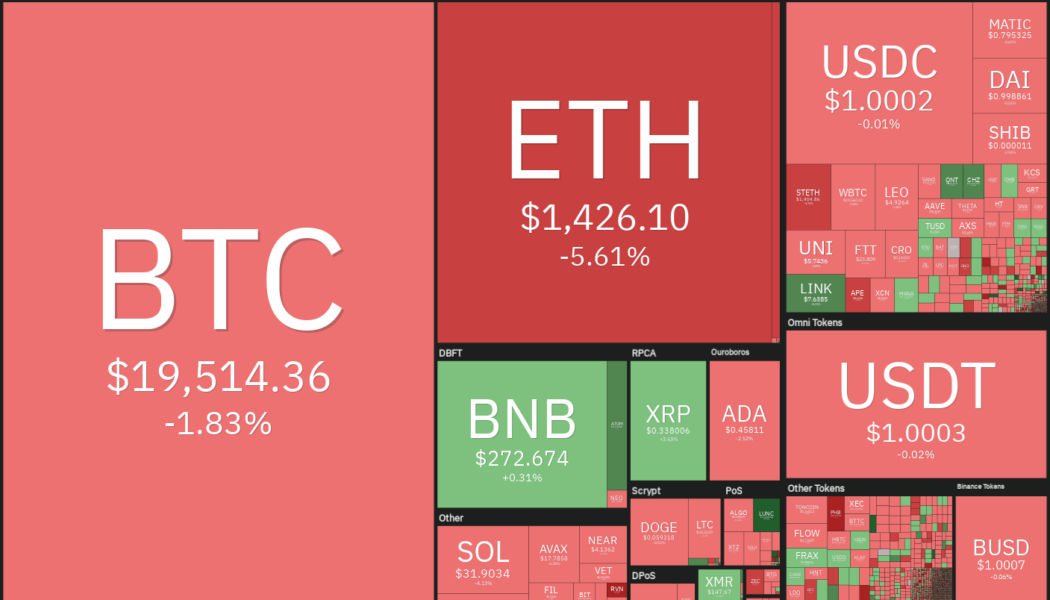

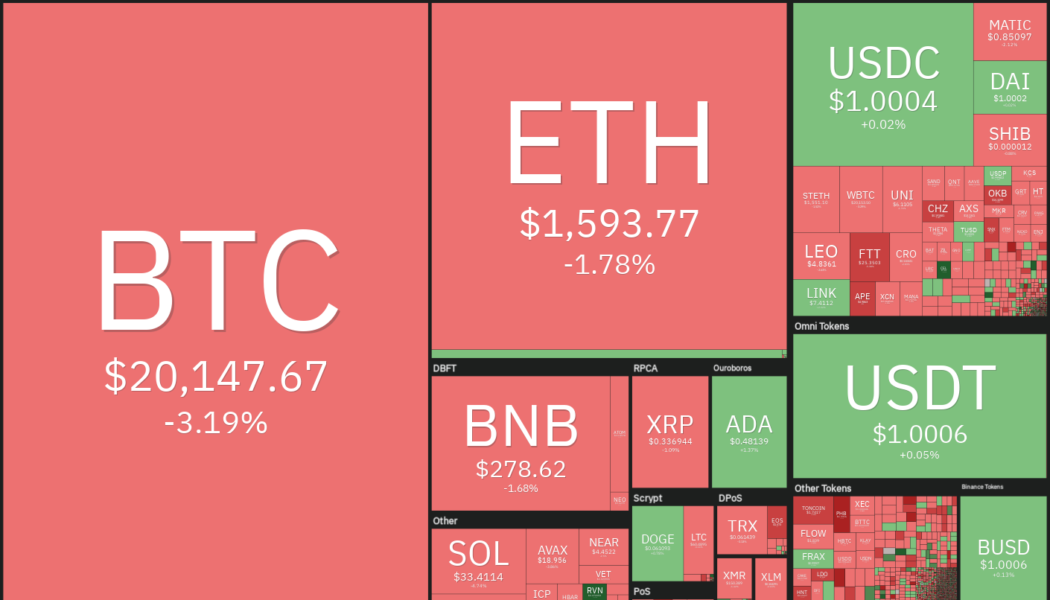

The Federal Reserve hiked rates by 75 basis points on Sept. 21 and Fed Chair Jerome Powell projected another 125 basis points increase before the end of the year. If that happens, it will take the benchmark rate to 4.4% by the end of the year, which is sharply higher than the June estimates of 3.8%. The Fed also intimated that it only expects rate cuts to be considered in 2024. The expectation of higher rates pushed the 2-year Treasury to 4.1%, its highest level since 2007. This could attract several investors who are looking for safety in this uncertain macro environment. Higher rates are also likely to reduce the appeal of risky assets such as stocks and cryptocurrencies and may delay the start of a new uptrend. Daily cryptocurrency market performance. Source: Coin360 Even though Bitcoin...

Are there too many cryptocurrencies?

The cryptocurrency industry has grown at a staggering pace. There are now almost 21,000 different coins in existence, across a variety of subsectors. From metaverses to decentralized finance, investors are spoiled for choice. But a burning question, especially among crypto skeptics, is this: Are there too many cryptocurrencies? We’ve repeatedly seen how new altcoins can be created in the blink of an eye. Tokens popped up hours after Will Smith slapped Chris Rock at the Oscars — pumping and dumping on low liquidity. And following the death of Queen Elizabeth, the markets were flooded by a flurry of “memecoins” bearing her name. Some critics felt this was in poor taste and argued it was “a bad look for crypto.” Despite the proliferation of thousands of cry...

White hat finds huge vulnerability in ETH to Arbitrum bridge: Wen max bounty?

A self-described white hat hacker has uncovered a “multi-million dollar vulnerability” in the bridge linking Ethereum and Arbitrum Nitro and received a 400 Ether (ETH) bounty for their find. Known as riptide on Twitter, the hacker described the exploit as the use of an initializing function to set their own bridge address, which would hijack all incoming ETH deposits from those trying to bridge funds from Ethereum to Arbitrum Nitro. Riptide explained the exploit in a Medium post on Sept. 20: “We could either selectively target large ETH deposits to remain undetected for a longer period of time, siphon up every single deposit that comes through the bridge, or wait and just front-run the next massive ETH deposit.” The hack could have potentially netted tens or even hundreds of millions worth...

Ethereum miners dump 30K ETH, stonewalling ‘ultra sound money’ deflation narrative

Ethereum’s switch to proof-of-stake (PoS) on Sept. 15 failed to extend Ether’s (ETH) upside momentum as ETH miners added sell pressure to the market. On the daily chart, ETH price declined from around $1,650 on Sept. 15 to around $1,350 on Sept. 20, an almost 16% drop. The ETH/USD pair dropped in sync with other top cryptocurrencies, including Bitcoin (BTC), amid worries about higher Federal Reserve rate hikes. ETH/USD daily price chart. Source: TradingView Ethereum remains inflationary The Ether price drop on Sept. 15 also coincided with an increase in ETH supply, albeit not immediately post-Merge. $ETH is now Ultra Sound Money pic.twitter.com/fKz6VmoWdR — DavidHoffman.eth (@TrustlessState) September 15, 2022 Roughly 24 hours later, the supply change flipped positi...

ETHW confirms contract vulnerability exploit, dismisses replay attack claims

Post-Ethereum Merge proof-of-work (PoW) chain ETHW has moved to quell claims that it had suffered an on-chain replay attack over the weekend. Smart contract auditing firm BlockSec flagged what it described as a replay attack that took place on Sept. 16, in which attackers harvested ETHW tokens by replaying the call data of Ethereum’s proof-of-stake (PoS) chain on the forked Ethereum PoW chain. According to BlockSec, the root cause of the exploit was due to the fact that the Omni cross-chain bridge on the ETHW chain used old chainID and was not correctly verifying the correct chainID of the cross-chain message. Ethereum’s Mainnet and test networks use two identifiers for different uses, namely, a network ID and a chain ID (chainID). Peer-to-peer messages between nodes make use of network ID...

Price analysis 9/16: SPX, DXY, BTC, ETH, BNB, XRP, ADA, SOL, DOGE, DOT

The World Bank has warned of a possible global recession in 2023. In a press release on Sept. 15, the bank said that the current pace of rate hikes and policy decisions is unlikely to be enough to bring inflation down to pre-pandemic levels. Ray Dalio, the billionaire founder of Bridgewater Associates said in a blog post on Sept. 13 that if rates were to rise to about 4.5% in the United States, it would “produce about a 20 percent negative impact on equity prices.” The negative outlook for the equity markets does not bode well for the cryptocurrency markets as both have been closely correlated in 2022. Daily cryptocurrency market performance. Source: Coin360 The macroeconomic developments seem to be worrying cryptocurrency investors who sent 236,000 Bitcoin (BTC) to major cryptocurren...

Bitcoin price loses $20K, ETH price drops 8% after ‘monumental’ Ethereum Merge

Bitcoin (BTC) spent a second day threatening $20,000 support on Sept. 15 as markets processed the Ethereum (ET Merge. BTC/USD 1-hour candle chart (Bitstamp). Source: TradingView BTC stuck between price magnets’ Data from Cointelegraph Markets Pro and TradingView showed BTC/USD spiking below $20,000 again overnight to recover marginally above the boundary for a brief period. The largest cryptocurrency broadly failed to regain lost ground after surprise United States inflation data on Sep. 13 sent risk assets into a tailspin. Down 13.5% versus the week’s top at the time of writing, Bitcoin offered little inspiration to traders who were still eyeing further losses. Yes, we could pump from here. No, the bottom is not in. pic.twitter.com/dXYKngcQtR — Material Indicators (@MI_Algos) S...

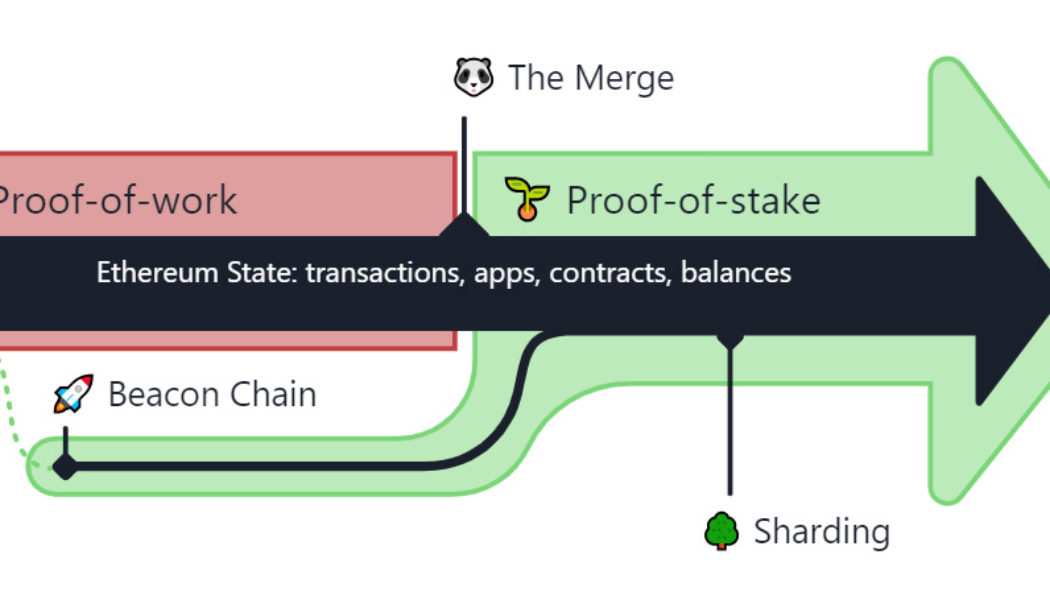

Only 10 hours to the Ethereum Merge: Here’s what you need to know

Ethereum’s long-awaited transition from proof-of-work (PoW) to proof-of-stake (PoS) is upon us as the Merge looms in less than 10 hours. There’s plenty to consider for the wider cryptocurrency space — and here’s what you need to know. What is the Merge? The Ethereum blockchain will transition away from its energy-intensive consensus mechanism PoW as its execution layer merges with the new PoS consensus layer known as the Beacon Chain. The Beacon Chain went live in December 2020, allowing ecosystem participants to deposit or “stake” ETH to become the new validators of the network, in doing so replacing PoW miners that had previously put in the work to process transactions, produce blocks and secure the network. In its simplest form, the Merge will make the Ethe...

Price analysis 9/14: BTC, ETH, BNB, XRP, ADA, SOL, DOGE, DOT, MATIC, SHIB

The United States equities markets and the cryptocurrency markets had been rising leading up to the Sept. 13 release of the August consumer price index data, but the rally fell apart once the data showed inflation rising, rather than falling. The negative data dashed any hope of a Federal Reserve pivot in the near term and it triggered a sharp decline in risky assets. The market capitalization of U.S. stocks plunged by about $1.6 trillion on Sept. 13 and the market cap of the cryptocurrency markets slipped below $1 trillion. Daily cryptocurrency market performance. Source: Coin360 Statistician and independent market analyst Willy Woo, believes that Bitcoin (BTC) may have to fall further before it reaches the maximum pain experienced during previous bottoms. Woo expects Bitcoin price to dec...