Ethereum

KYC to stake your ETH? It’s probably coming to the US

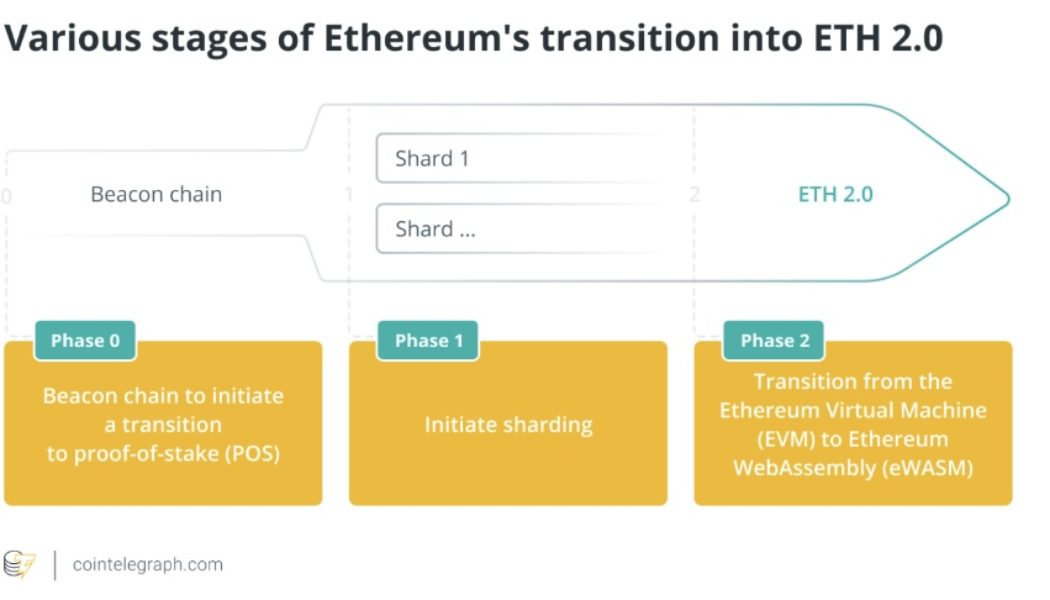

Over the last few years, the cryptocurrency industry has been a primary target for regulators in the United States. The legal battle between Ripple and the United States Securities and Exchange Commission (SEC), Nexo’s lawsuit with the securities regulators of eight states, and the scrutiny targeting Coinbase’s Lend program last year are only a few high-profile examples. This year, even Kim Kardashian had first-hand experience with regulatory scrutiny after agreeing to pay a $1.26 million fine for promoting the dubious crypto project EthereumMax. While Ethereum developers intended to pave the way for key network upgrades in the future, it seems like the recent Merge has further complicated matters between crypto projects and U.S. regulators. Ethereum: Too substantial for the cry...

Price analysis 10/14: SPX, DXY, BTC, ETH, BNB, XRP, ADA, SOL, DOGE, MATIC

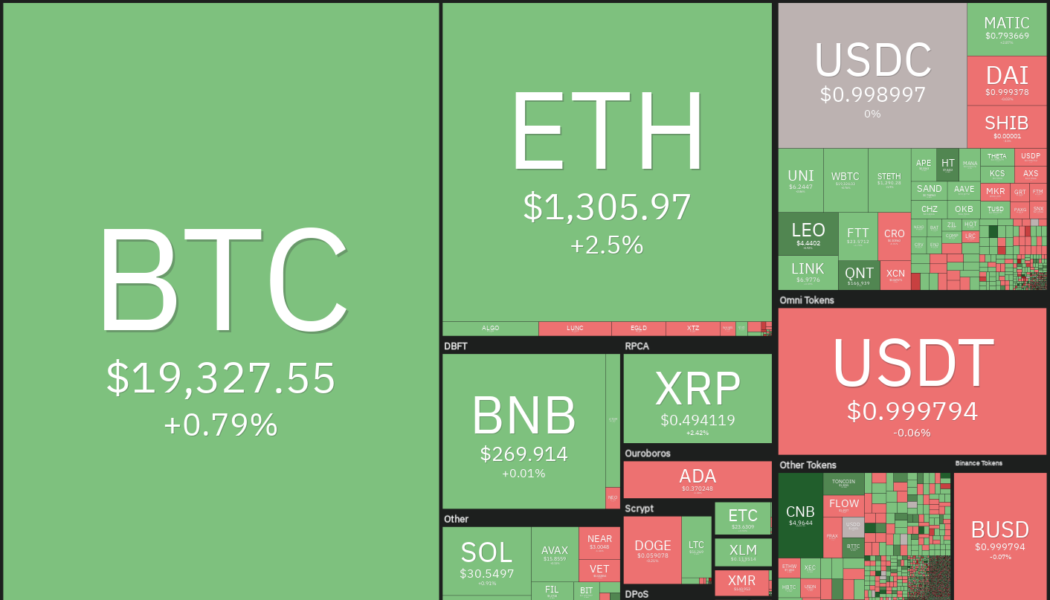

The United States Consumer Price Index (CPI) increased 8.2% annually in September, beating economists’ expectations of an 8.1% rise. The CPI print lived up to its hype and caused a sharp, but short-term increase in volatile risk assets. The S&P 500 oscillated inside its widest trading range since 2020 and Bitcoin (BTC) also witnessed a large intraday range of more than $1,323 on Oct. 13. However, Bitcoin still could not shake out of the $18,125 to $20,500 range in which it has been for the past several days. Daily cryptocurrency market performance. Source: Coin360 Both the U.S. equities markets and Bitcoin tried to extend their recovery on Oct. 14 but the higher levels attracted selling, indicating that the bears have not yet given up. Could the increased volatility culminate wit...

Federal regulators are preparing to pass judgment on Ethereum

Are regulators with the U.S. Securities and Exchange Commission gearing up to take down Ethereum? Given the saber-rattling by officials — including SEC Chairman Gary Gensler — it certainly seems possible. The agency went on a crypto-regulatory spree in September. First, at its annual The SEC Speaks conference, officials promised to continue bringing enforcement actions and urged market participants to come in and register their products and services. Gensler even suggested crypto intermediaries should break up into separate legal entities and register each of their functions — exchange, broker-dealer, custodial functions, etc. — to mitigate conflicts of interest and enhance investor protection. Next, there was an announcement that the SEC’s Division of Corporation Finance plans to add an O...

CoinShares’ Butterfill suggests ‘continued hesitancy’ among investors

Minor inflows for digital asset investment products over the last few weeks suggest a “continued hesitancy” towards crypto amongst institutional investors amid a slowdown of the U.S. economy. In the latest edition of CoinShares’ weekly “Digital Asset Fund Flows” report, Coinshares head of research James Butterfill highlighted stand-offish institutional sentiment towards crypto investment products, which saw “minor inflows” for the third week in a row. “The flows remain low implying continued hesitancy amongst investors, this is highlighted in investment product trading volumes which were US$886m for the week, the lowest since October 2020.” Between Sept. 26 and Sept. 30, investment products offering exposure to Bitcoin (BTC) saw the most inflows at just $7.7 million, with...

Price analysis 9/30: SPX, DXY, BTC, ETH, BNB, XRP, ADA, SOL, DOGE, DOT

The United States equities markets have been under a firm bear grip for a large part of the year. The S&P 500 and the Nasdaq Composite have declined for three quarters in a row, a first since 2009. There was no respite in selling in September and the Dow Jones Industrial Average is on track to record its worst September since 2002. These figures outline the kind of carnage that exists in the equities market. Compared to these disappointing figures, Bitcoin (BTC) and select altcoins have not given up much ground in September. This is the first sign that selling could be drying up at lower levels and long-term investors may have started bottom fishing. Daily cryptocurrency market performance. Source: Coin360 In the final quarter of the year, investors will continue to focus on the inflat...

Institutional appetite continues to grow amid bear market — BitMEX CEO

In a recent interview, BitMEX chief executive Alexander Höptner shared his thoughts about institutional investors who, in his view, still have an appetite for crypto and Ethereum. Speaking at the Token2049 conference in Singapore on Sept. 28, the crypto executive told Cointelegraph that there has not been a “single slowdown of institutional push into crypto” during this bear market. He added that institutions and finance industry players typically use bear markets for innovation. There is a lot more pressure to deliver in a bull market, but bear markets offer the luxury of more time. Höptner also commented that adoption for the finance industry has a long horizon which is why institutions will be buying and holding crypto assets while the opposite can currently be said for the retail secto...

Tax on income you never earned? It’s possible after Ethereum’s Merge

After much buildup and preparation, the Ethereum Merge went smoothly this month. The next test will come during tax season. Cryptocurrency forks, such as Bitcoin Cash, have created headaches for investors and accountants alike in the past. While there has been progress, the United States Internal Revenue Service rules still weren’t ready for something like the Ethereum network upgrade. Nonetheless, there seems to be an interpretation of IRS rules that tax professionals and taxpayers can adopt to achieve simplicity and avoid unexpected tax bills. How Bitcoin Cash broke 2017 tax returns Because of a disagreement over block size, Bitcoin forked in 2017. Everyone who held Bitcoin received an equal amount of the new forked currency, Bitcoin Cash (BCH). But when they received it caused some issu...

Price Analysis 9/26: BTC, ETH, BNB, XRP, ADA, SOL, DOGE, DOT, MATIC, SHIB

The United Kingdom is in focus following the British pound’s fall to a new all-time low against the United States dollar. The sell-off was triggered by the aggressive tax cuts announced by Prime Minister Liz Truss’s government. The 10-year gilt yields have soared by 131 basis points in September, on track for its biggest monthly increase since 1957, according to Reuters. The currency crisis and the soaring U.S dollar index (DXY) may not be good news for U.S. equities and the cryptocurrency markets. A ray of hope for Bitcoin (BTC) investors is that the pace of decline has slowed down in the past few days and the June low has not yet been re-tested. Daily cryptocurrency market performance. Source: Coin360 That could be because Bitcoin’s long-term investors do not seem to be panicking. Data f...

Bitcoin risks worst weekly close since 2020 as BTC price dices with $19K

Bitcoin (BTC) headed for its lowest weekly close since 2020 on Sep. 25 as a week of macro turmoil took its toll. BTC/USD 1-hour candle chart (Bitstamp). Source: TradingView Trader prepares for “important week” for BTC Data from Cointelegraph Markets Pro and TradingView showed BTC/USD trading near $19,000 with hours left to run on the weekly candle. While only down $400 since the week began, the pair offered traders little optimism amid fears that the coming days would continue the bleedout across risk assets. “The whole week traded within the monday range. Weekly close gonna be bearish, looking like a pin bar,” popular trading account Crypto Yoddha told Twitter followers in a summary post. “Also consolidating at the range low. So need a bounce first before taking a position. Ne...

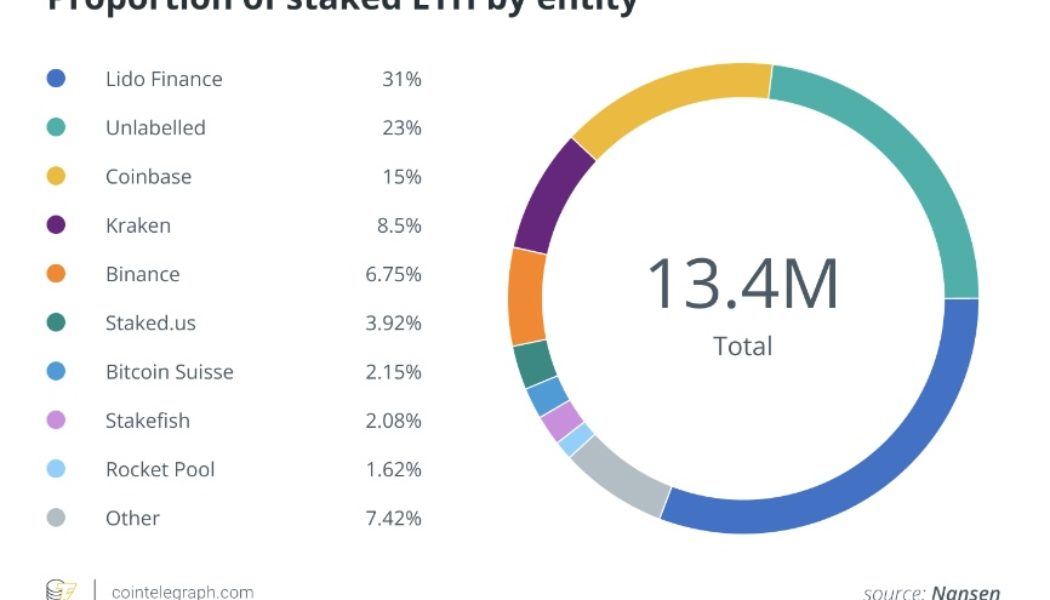

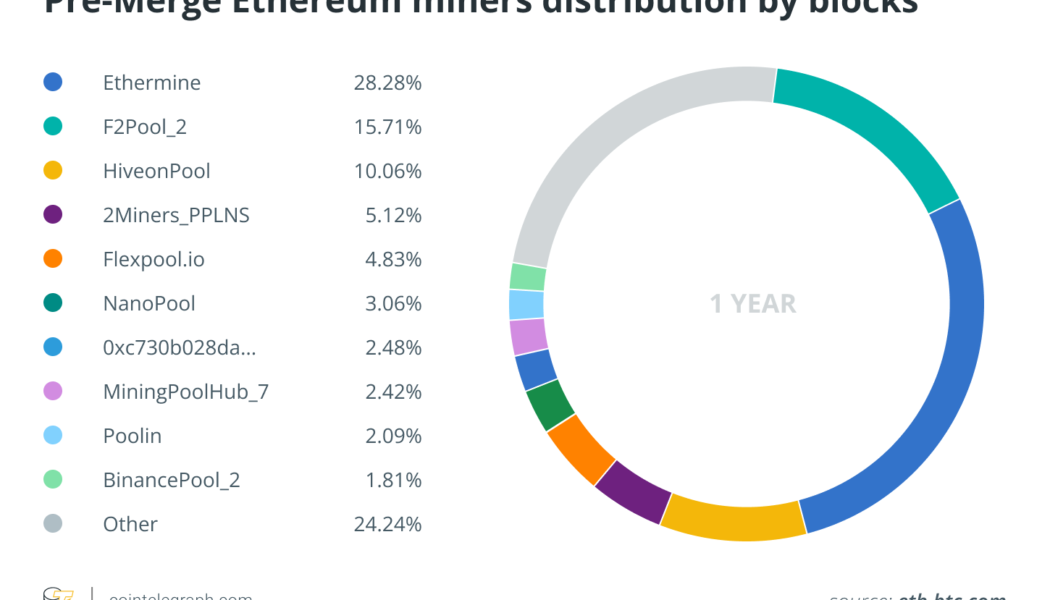

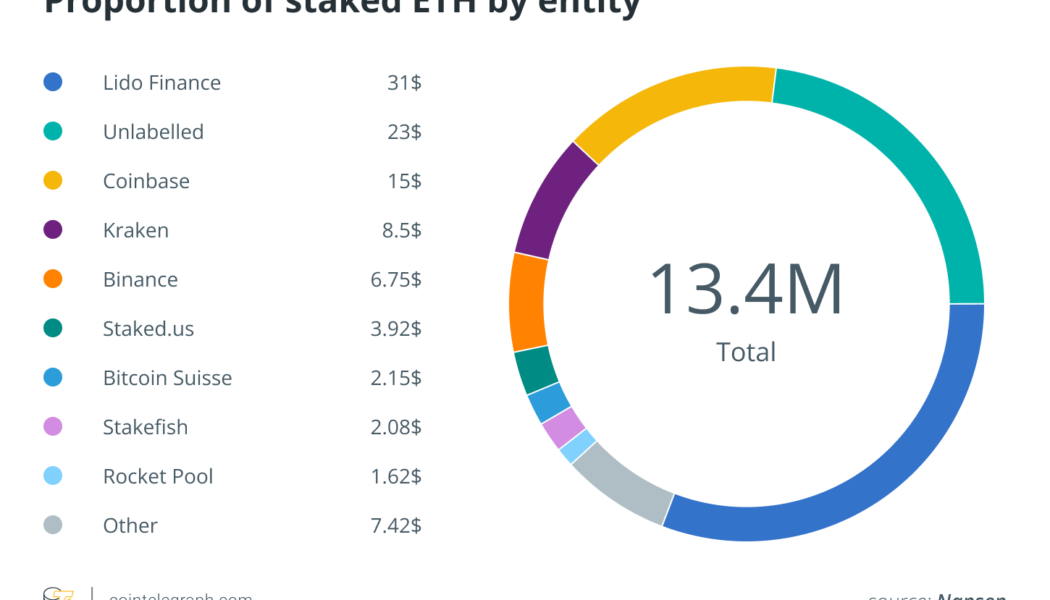

Post-Merge ETH has become obsolete

For years, various blockchain projects were rumored to be future “Ethereum killers,” projects that would unseat Ether from its throne and usurp its title as the top digital asset. That day seems to have come, though it appears it was an inside job. Lido-staked Ethereum (stETH) and other liquid staking derivatives are primed to render Ether (ETH), as an asset, obsolete. The transition from proof-of-work (PoW) to proof-of-stake (PoW) allows everyday decentralized finance (DeFi) users to benefit from rewards previously reserved for miners simply by holding stETH or any other ETH liquid-staking derivative. This has given way to a wave of interest across the industry, from individuals to institutions across centralized finance (CeFi) and DeFi. In the past month, the ETH liquid staking der...

Price analysis 9/23: SPX, DXY, BTC, ETH, BNB, XRP, ADA, SOL, DOGE, DOT

The S&P 500 index has declined about 5% this week while the Nasdaq Composite is down more than 5.5%. Investors fear that the Federal Reserve’s aggressive rate hikes could cause an economic downturn. The yield curve between the two-year and 10-year Treasury notes, which is watched closely by analysts for predicting a recession, has inverted the most since the year 2000. Among all the mayhem, it is encouraging to see that Bitcoin (BTC) has outperformed both the major indexes and has fallen less than 4% in the week. Could this be a sign that Bitcoin’s bottom may be close by? Daily cryptocurrency market performance. Source: Coin360 On-chain data shows that the amount of Bitcoin supply held by long-term holders in losses reached about 30%, which is 2% to 5% below the level that coinci...