Ethereum

FTX hacker is now the 35th largest holder of ETH

The hacker that exploited the now-bankrupt FTX exchange last week made a tidy fortune that has propelled them to Ether (ETH) whale status. Just a day after the embattled FTX exchange filed for Chapter 11 bankruptcy, its wallets were drained for more than $663 million in various crypto assets, according to blockchain intelligence company Elliptic. Elliptic suspected $477 million of this was stolen, with a large chunk of those tokens being then converted into ETH, while $186 million worth of more than a hundred different tokens was believed to be moved into secure storage by FTX itself. As reported by Cointelegraph on Nov. 15, the attacker was still draining wallets four days later in what analysts called “on-chain spoofing.” According to blockchain security firm Beosin, the attacker has con...

What are crypto whale trackers and how do they work?

There are dedicated solutions to track the actions of crypto whales. These solutions can provide analytics on whale actions and, in some instances, can also make investment/trading decisions for the user. Crypto traders and investors constantly track the amount of cryptocurrencies going in and out of exchanges. When a cryptocurrency like Bitcoin or Ether (ETH) is moved in large quantities into an exchange, it is expected to see some sell action resulting in a fall in price. Conversely, if cryptocurrencies flow out of exchanges into wallets, it is considered a precursor to a rise in price. This is because when exchanges have a high net outflow of cryptocurrencies, they have reduced supply resulting in an increase in price. Oftentimes, a whale could buy cryptocurrencies on an exchange and mo...

Ethereum flashes a classic bullish pattern in its Bitcoin pair, hinting at 50% upside

Ethereum’s native token, Ether (ETH), looks poised to log a major price rally versus its top rival, Bitcoin (BTC), in the days leading toward early 2023. Ether has a 61% chance of breaking out versus Bitcoin The bullish cues emerge primarily from a classic technical setup dubbed a “cup-and-handle” pattern. It forms when the price undergoes a U-shaped recovery (cup) followed by a slight downward shift (handle) — all while maintaining a common resistance level (neckline). Traditional analysts perceive the cup and handle as a bullish setup, with veteran Tom Bulkowski noting that the pattern meets its profit target 61% of all time. Theoretically, a cup-and-handle pattern’s profit target is measured by adding the distance between its neckline and lowest point to the neckline level. The Ether-to...

Bitcoin hits new 6-week high as Ethereum liquidates $240M more shorts

Bitcoin (BTC) attempted to retake $21,000 on Oct. 29 as weekend trading began on a strong footing. BTC/USD 1-hour candle chart (Bitstamp). Source: TradingView Dollar lurks as BTC price rebounds Data from Cointelegraph Markets Pro and TradingView followed BTC/USD as it rebounded overnight to local highs of $21,078 on Bitstamp — enough to clinch new six-week highs. The pair had seen a consolidatory phase ensue after its first trip to the $21,000 mark, the first time it had traded above $21,000 since Sep. 13. The subsequent retracement was modest in character, Bitcoin not even testing $20,000 before reversing higher once more. The end of the Wall Street trading week saw BTC price action follow United States equities, the S&P 500 and Nasdaq Composite Index finishing Oct. 28 up 2.5% and 2.9...

How to earn passive crypto income with Ethereum?

The cryptocurrency market is incredibly volatile, which can be both good and bad for investors and traders. Volatility creates opportunities for making profits, but it can also lead to losses. Passive income strategies, however, could be handy in offsetting these losses. Passive income strategies offer investors and traders opportunities to earn profits, even during challenging market conditions such as bear markets. For those investing in Ether (ETH), or any crypto in general, earning passive crypto income provides a way to cover market crashes and downturns. Hodling used to be the primary way to earn interest on one’s crypto assets. But, with the rise of decentralized finance (DeFi) protocols, there are now many ways to earn interest on Ether and DeFi protocols. This article is a g...

Ethereum sets record ETH short liquidations, wiping out $500 billion in 2 days

Ether (ETH) is setting liquidation records this week as a comparatively modest price uptick reveals how bearish the market has become. Data from on-chain analytics platform CryptoQuant confirmed that United States dollar-denominated short liquidations hit a new all-time high on Oct. 25. Two days, half a billion dollars of ETH shorts It is not just Bitcoin (BTC) causing the bears severe pain this week — data from exchanges also shows that Ethereum shorters have suffered heavy losses. ETH/USD delivered fairly impressive gains on Oct. 25-26, rising from lows of $1,337 to highs of $1,593 on Bitstamp before retracing, according to data from Cointelegraph Markets Pro and TradingView. ETH/USD 1-day candle chart (Bitstamp). Source: TradingView While nothing unusual for crypto and for altcoins, in ...

Nifty News: LooksRare the latest NFT market to sack royalties, Twitter’s tweeting tiles and more

Nonfungible token (NFT) marketplace LooksRare is the latest in a string of NFT markets to do away with enforcing creator royalties by default, following the likes of Magic Eden and X2Y2. The platform tweeted on Oct. 27 that it would not be supporting creator royalties by default, instead choosing to share 25% of its protocol fees with NFT creators and collection owners. Buyers can still choose to pay royalties when purchasing an NFT but it will be on an opt-in basis. Explaining the changes, it said 0.5% of its 2% protocol fee would go to collections, as long as that collection has a receiving address for the funds. LooksRare said the willingness of buyers to pay royalties has “eroded” as a result of many NFT markets now moving to a zero-royalty model adding that these disadvantage cre...

Ethereum’s Merge won’t stop its price from sinking

Ethereum’s long-awaited Merge took place in September, shifting it from a legacy proof-of-work (POW) model to the sustainable proof-of-stake (PoS) consensus algorithm. Many observers expected Ether’s (ETH) price to respond positively as its daily emissions declined 90% with the halt of mining operations. However, the expected price surge never occurred. In fact, Ether has been down by over 7% since the upgrade. So why didn’t the Merge drive up the coin’s price? Post-merge ETH monetary policy Ethereum’s monetary policy was simply to reduce the token’s supply to 1,600 ETH per day. The PoW model, an equivalent of 13,000 ETH were emitted daily as mining rewards. However, this has been wholly eliminated post-Merge, as mining operations are no longer valid on the PoS model. Therefore, only...

HK and Singapore’s mega-rich are eyeing crypto investments: KPMG

Hong Kong and Singapore’s wealthy elite appear to be looking at digital assets with fervor, after a new report from KPMG suggesting over 90% of family offices and high-net-worth individuals (HNWI) are interested in investing in the digital assets space or have already done so. According to an Oct. 24 report from KPMG China and Aspen Digital titled “Investing in Digital Assets,” as much as 58% of family offices and HNWI of respondents in a recent survey are already investing in digital assets, and 34% “plan to do so.” The survey took the pulse from 30 family offices and HNWIs in Hong Kong and Singapore with most respondents managing assets between $10 million to $500 million. KPMG said the large crypto uptake among the ultra-wealthy has increased confidence in the sector, spurred...

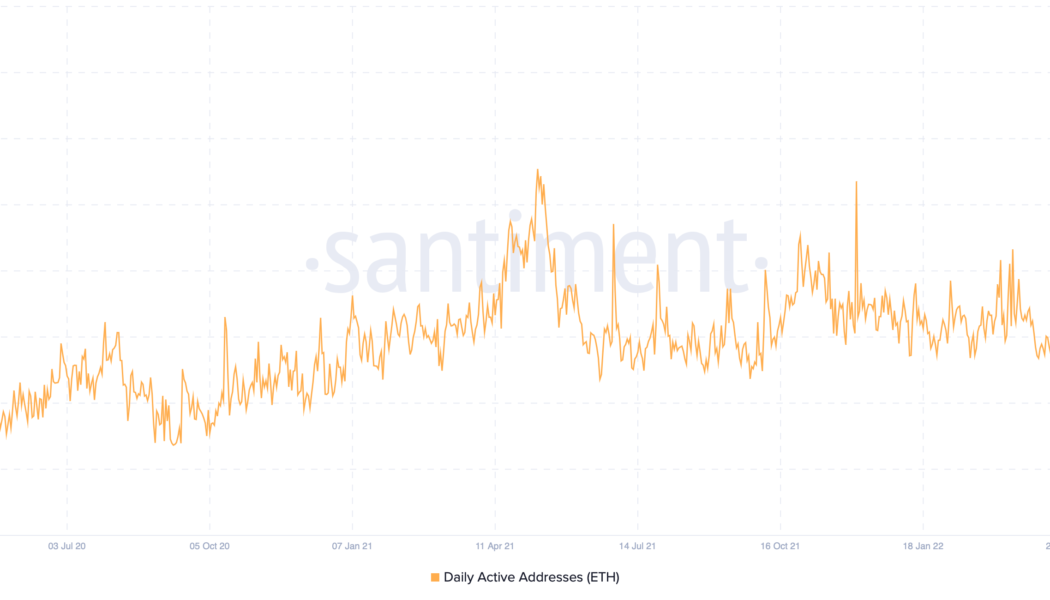

Will ETH price crash to $750? Ethereum daily active addresses plunge to 4-month lows

Ethereum has witnessed a substantial drop in its daily active address (DAA) count over the last four months, raising fears about more downside for Ether (ETH) price in the coming weeks. Stagnant Ethereum price spooks investors The number of Ether DAA dropped to 152,000 on Oct. 21, its lowest level since June, according to data provided by Santiment. In other words, the plunge showed fewer unique Ethereum addresses interacting with the network. Ethereum daily active address count on a daily timeframe. Source: Santiment Interestingly, the drop comes after Ether’s 80%-plus correction from its November 2021 high of around $4,850. This coincidence could mean two things: Ethereum users decided to leave the market and/or paused their interaction with the blockchain network after the market’s...

Price analysis 10/21: SPX, DXY, BTC, ETH, BNB, XRP, ADA, SOL, DOGE, MATIC

The 10-year Treasury yield in the United States rose to its highest level since 2008. Although this type of rally is usually negative for risky assets, the U.S. stock markets recovered ground after the Wall Street Journal reported that some officials of the Federal Reserve were concerned about the pace of the rate hikes and the risks of over-tightening. While it is widely accepted that the U.S. will enter a recession, a debate rages on about how long it could last. On that, Tesla CEO Elon Musk recently said on Twitter that the recession could last “probably until spring of ‘24,” and added that it would be nice to spend “one year without a horrible global event.” Daily cryptocurrency market performance. Source: Coin360 Bitcoin’s (BTC) price has witnessed a massive drop from its all-time hig...

$4.5T asset manager Fidelity offers ETH custody and trading to clients

Fidelity Digital Assets, the crypto wing of $4.5 trillion asset manager Fidelity Investments, is set to offer Ether (ETH) custody and trading services to its institutional clients later this month. According to an email to Fidelity’s customers shared on Twitter, the crypto arm announced new “Institutional Ethereum capabilities” for institutional investors starting on Oct. 28, 2022. Fidelity Digital Assets just sent an email to customers announcing that Ethereum will be available for purchase this month. pic.twitter.com/3V0GCrOt5z — Bruce Fenton (@brucefenton) October 19, 2022 The post states that investors will be able to buy, sell and transfer ETH, “using the same model provided for bitcoin investments today.” “With the Ethereum Merge completed, many investors are looking at Et...