Ethereum

Cardano and Ripple tokens will crash out of the top 10 chart in 2022: Arcane Research

The blockchain research firm also predicts Bitcoin to continue recording better returns than the S&P 500 index in the incoming year Crypto market analytics company Arcane has laid out its 2022 predictions for various digital assets and the industry at large. The research firm compiled a report highlighting numerous predictions around various aspects, including token prices, regulations, and the performance of different crypto coins. Most notably, Arcane crowned Binance coin as the winner of 2021, explaining that it crushed both Ethereum and Bitcoin in returns. Here’s a look at the other major predictions: The fate of Ripple (XRP) and Cardano (ADA) According to the research firm, the two alts will slip and lose their spot among the top 10 coins by market cap next year. Arcane note...

Price analysis 12/27: BTC, ETH, BNB, SOL, ADA, XRP, LUNA, AVAX, DOT, DOGE

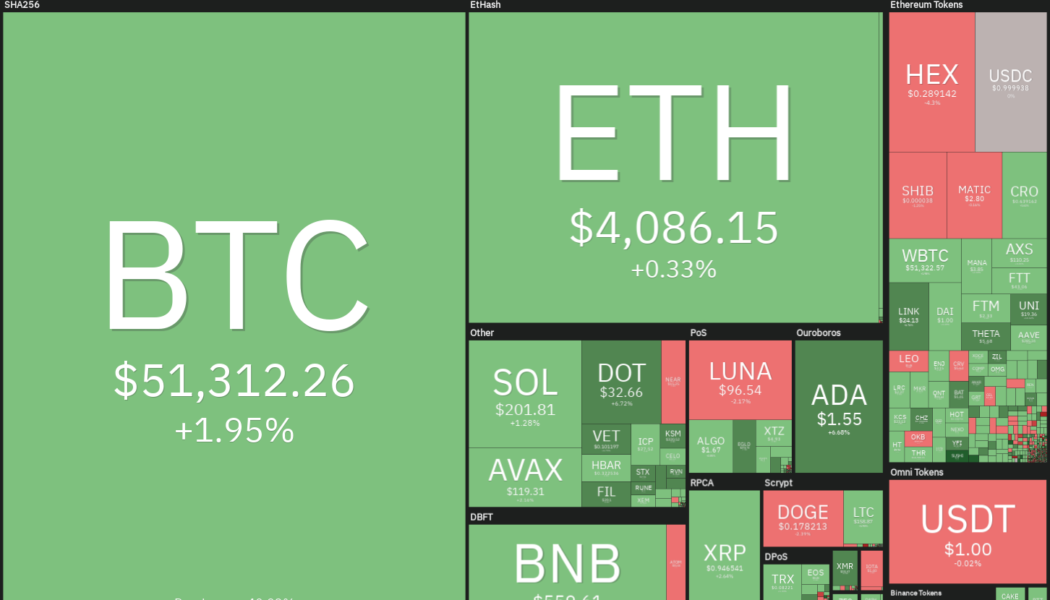

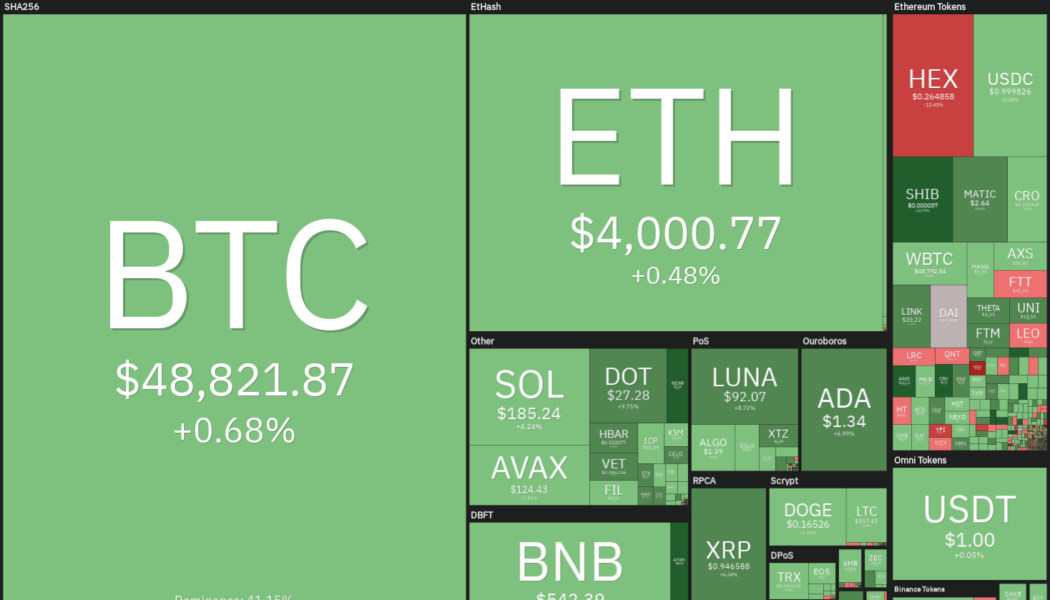

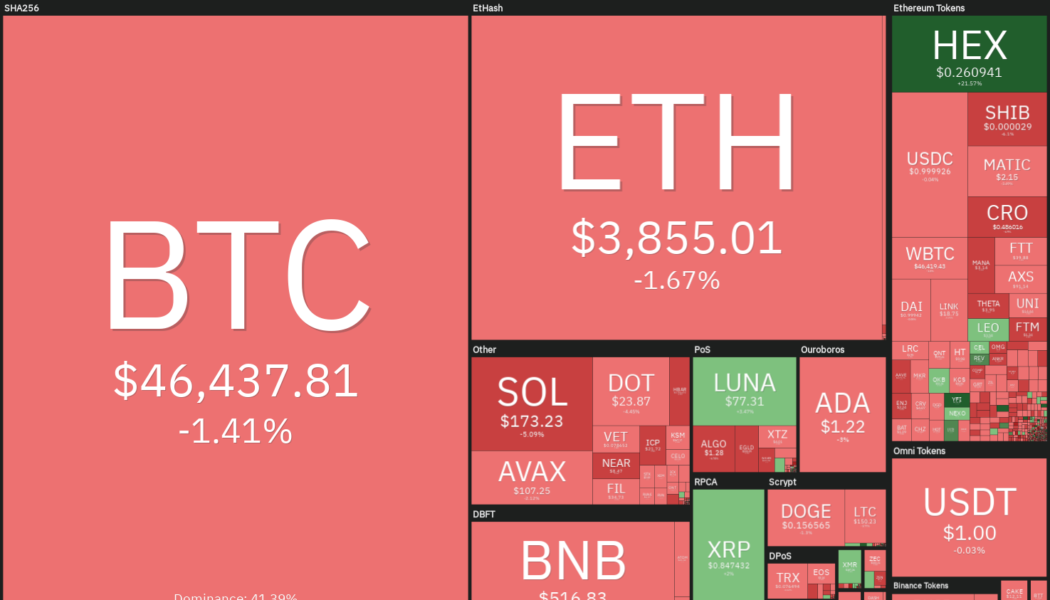

Bitcoin (BTC) and most major altcoins have bounced off their immediate support levels, indicating that the sentiment is improving and traders are buying on minor dips. Billionaire and Mexico’s third-richest person Ricardo Salinas Pliego said in his Christmas and New Year message to stay away from fiat money, terming it as “fake money made of paper lies.” Instead, he advised people to “invest in Bitcoin.” Veteran trader Peter Brandt warned that “chart pattern breakouts should be viewed with great suspicion” during the thinly traded holiday period in the last half of December. Daily cryptocurrency market performance. Source: Coin360 Analysts remain bullish for 2022. Crypto analyst and pseudonymous Twitter user DecodeJar believes that Bitcoin could surpass $100,000 and reach the conservative ...

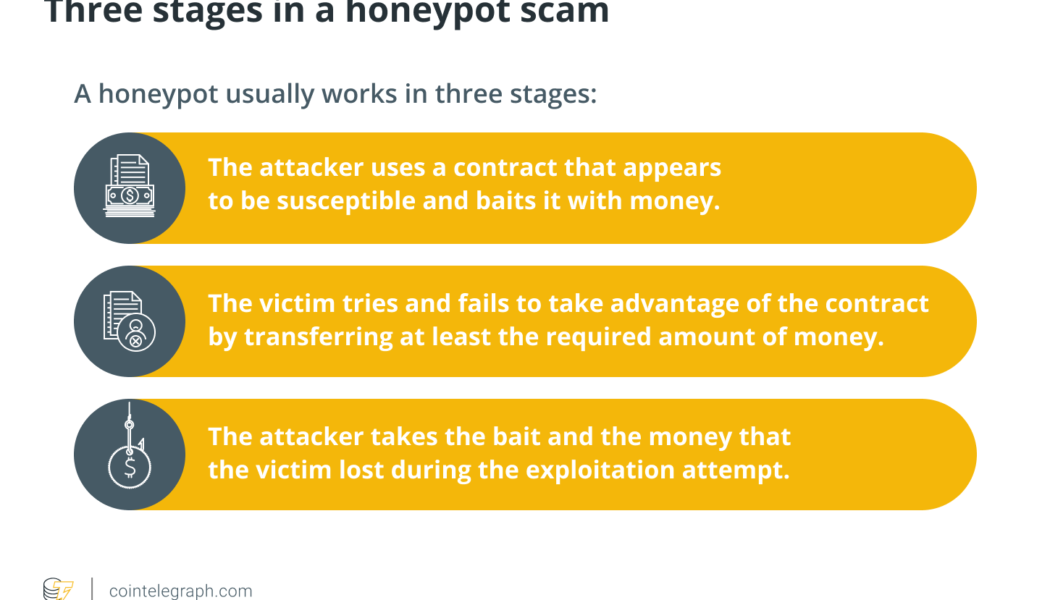

What is a honeypot crypto scam and how to spot it?

What is a crypto honeypot and why is it used? Smart contracts programs across a decentralized network of nodes can be executed on modern blockchains like Ethereum. Smart contracts are becoming more popular and valuable, making them a more appealing target for attackers. Several smart contracts have been targeted by hackers in recent years. However, a new trend appears to be gaining traction; namely, attackers are no longer looking for susceptible contracts but are adopting a more proactive strategy. Instead, they aim to trick their victims into falling into traps by sending out contracts that appear to be vulnerable but contain hidden traps. Honeypots are a term used to describe this unique sort of contract. But, what is a honeypot crypto trap? Honeypots are smart contracts that appear to ...

From DeFi year to decade: Is mass adoption here? Experts Answer, Part 3

Tristan is the core contributor to Zeta Markets, an under-collateralized DeFi derivatives platform, providing liquid derivatives trading to individuals and institutions alike. “We’ve seen a Cambrian explosion in the DeFi ecosystem in 2021, with peak TVL approaching $300 billion vs the 2020 peak of $21 billion. This sounds like the growth surely has to slow. Yet, DeFi still represents just a fraction of CeFi trading volumes. At Zeta, we see a clear opportunity for more and more CeFi infrastructure to be built on-chain in a permissionless manner. This will unlock innovative products that have previously been impossible to implement. The following has already started to happen: Composability trumps the siloed products of CeFi, which has created really powerful network effe...

Price analysis 12/24: BTC, ETH, BNB, SOL, ADA, XRP, LUNA, AVAX, DOT, DOGE

Bitcoin (BTC) bounced back above the psychological level at $50,000 and the S&P 500 hit a new all-time closing high on Dec. 23, suggesting that the panic selling caused due to the omicron variant is subsiding and the much-awaited “Santa rally” may have started. Data from on-chain analytics firm Glassnode shows that about 100,000 Bitcoin are going from “liquid” to “illiquid” state every month, which means that the coins are being sent to addresses “with little history of spending.” This suggests accumulation by investors. Daily cryptocurrency market performance. Source: Coin360 In another sign that investors are not dumping their coins on small corrections, data from CryptoRank shows that the total Bitcoin on crypto exchanges has dropped from 9.5% of the total Bitcoin supply in October ...

Price analysis 12/22: BTC, ETH, BNB, SOL, ADA, XRP, LUNA, AVAX, DOT, DOGE

Bitcoin (BTC) is attempting to break above the psychologically critical level at $50,000 and close the year on a strong note. The up-move in Bitcoin has led to a sharp recovery in the value of the Crypto Fear & Greed Index from 27 to 45 within a day, signaling improving sentiment. BlockFi co-founder Flori Marquez said in a recent interview that new talent, regulatory clarity and higher crypto prices could lead to a feeling of FOMO, boosting crypto adoption in 2022. Marquez added that the “majority of Blockfi’s clients—when they receive a BTC reward, they’re not selling that for cash.” Daily cryptocurrency market performance. Source: Coin360 In another positive news that could boost crypto adoption further, popular internet browser Opera announced an integration with Polygon (MATIC), ex...

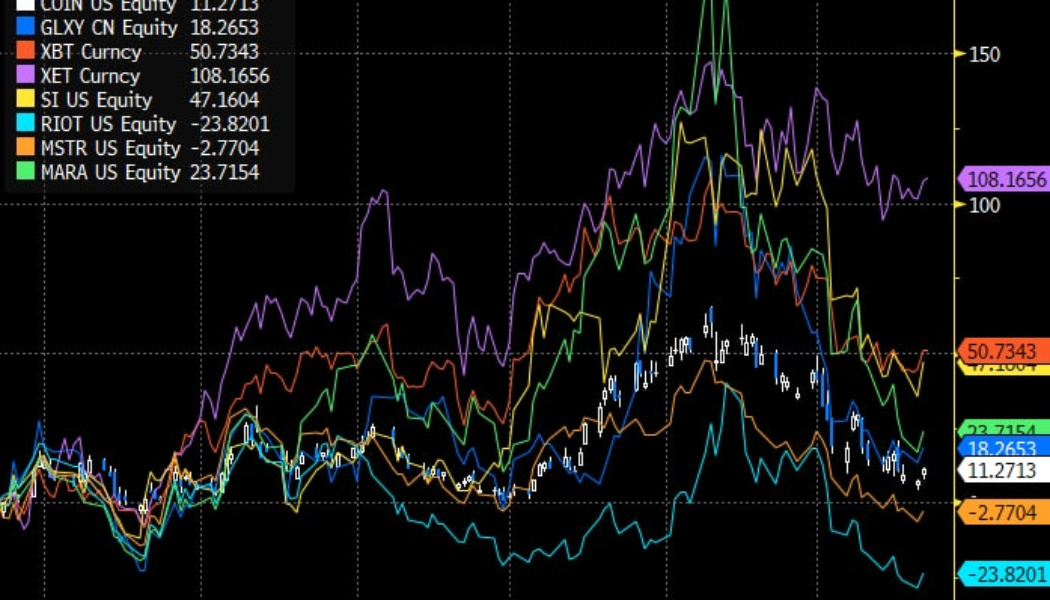

Missed out on hot crypto stocks in 2021? It paid just to buy Bitcoin and Ethereum, data shows

Bitcoin (BTC) may have fluctuated in price this year, but BTC remains a better play than the biggest crypto stocks. New data currently circulating shows that for all the growth in the industry surrounding Bitcoin, it still pays simply to buy and hold. Stocks fail to compete with BTC, ETH Looking at the stock performance of firms with the largest BTC allocations on their balance sheets, it becomes immediately apparent that it was more profitable to hold BTC than those equities — at least this year. “Buying crypto stocks to outperform coins is hard,” Three Arrows Capital CEO Zhu Su commented alongside comparative performance data from Bloomberg. Both Bitcoin and Ether (ETH) have fared significantly better than stocks from companies, such as MicroStrategy (MSTR) and Coinbase (COIN), despite t...

Price analysis 12/20: BTC, ETH, BNB, SOL, ADA, XRP, LUNA, AVAX, DOT, DOGE

Bitcoin (BTC) continues to lose ground in December, a signal that traders may be locking in their gains before the end of the year. The lack of a Santa rally in the U.S. equity markets indicates that the risk-off sentiment prevails due to the uncertainty regarding the spread of the COVID-19 omicron variant in several parts of the world. Even after the sharp drop in Bitcoin’s price, the demand from institutional investors remains tepid, and data shows that the largest institutional Bitcoin product, the Grayscale Bitcoin Trust (GBTC), is trading at a discount of more than 20%. Daily cryptocurrency market performance. Source: Coin360 Veteran trader Peter Brandt said that “high volume panic capitulations” usually signal a bottom in Bitcoin and that has not yet happened during the current decli...

From DeFi year to decade: Is mass adoption here? Experts Answer, Part 1

Dominik is the co-founder and chairman of the Iota Foundation, an open-source distributed ledger and cryptocurrency designed for the Internet of Things. “The biggest difference between crypto in 2017 and crypto in 2022 is the establishment of tangible business models and use cases within our ecosystem thanks to DeFi. We no longer have to wait for external parties such as large companies to drive adoption. We can do it ourselves with applications that introduce much-needed innovation to the base level of our economy — finance. 2021 has been a tremendous year for early-stage validation and growing excitement toward DeFi’s potential. But it’s still early stages. DeFi isn’t yet comparable to fintech companies like Revolut or N26 (2 million to 5...

Avalanche eyes 60% rally as AVAX price breaks out of bull flag

Avalanche (AVAX) strengthened its case for a potential upside run towards $160 in the coming sessions as it broke out of a classic bullish pattern earlier this week. Dubbed “bull flag,” the pattern emerges when the price consolidates lower/sideways between two parallel trendlines (flag) after undergoing a strong upside move (flagpole). Later, in theory, the price breaks out of the channel range to continue the uptrend and tends to rise by as much as the flagpole’s height. AVAX went through a similar price trajectory across the last 30 days, containing a roughly 100% flagpole rally to nearly $150, followed by over a 50% flag correction to $72, and a breakout move above the flag’s upper trendline (around $85) on Dec. 15. AVAX/USD daily price chart featuring Bull Flag ...

Host of popular cryptocurrency trading YouTube series “Coin Bureau” says Polygon (MATIC) could triple in this cycle

Polygon (MATIC) has seen large swings in 2021. It started the year on a monster bull run that took it to $2.4544 in March. It then nose-dived to $0.6901 in July and then started another that it has maintained to date amid several small pullbacks. During the same period, Polygon has also made several milestones including the recent acquisition of the zero-knowledge (ZK) protocol developer, Mir, for $400 million. The acquisition is expected to add to Polygon’s strengths as it seeks to aggregate various Ethereum-based blockchains and allow them to communicate with one other. To that end, Guy, the host of the highly popular cryptocurrency trading YouTube series “Coin Bureau,” said that the price of Polygon (MATIC) could double or triple in the course of the current cycle depending on how well ...