Ethereum

Much-anticipated EIP-1559 hardfork goes live on Polygon – What is next?

Onwards, validators will receive a priority fee instead of the total fee in transactions The core development team behind Polygon has, today, announced that it rolled out the EIP-1559 protocol on the Polygon mainnet. The milestone succeeds a fruitful upgrade on the Mumbai testnet. The Ethereum Improvement Protocol – 1559 went live on Polygon at block height 23850000 today at 2.47 am UTC. The upgrade, alternatively known as the London hardfork, will replace Polygon’s “first-price auction” fee approximation system. Following successful implementation, transactions on the Polygon network would be processed differently to find a fair price. A set base fee would be defined – the minimum amount needed to complete a transaction on the chain immediately. The set base fee would, h...

Blockchain assessment: How to assess different chains?

With so many blockchain networks appearing all the time, new or even experienced crypto enthusiasts may feel overwhelmed when it comes to deciding which are the best to invest in. In this guide, we’ll outline the most important aspects of any blockchain project, and why one should pay close attention to such details when assessing the different chains on the crypto market. Use case Arguably the most important part of any blockchain project is its use case. What is the project’s reason for existing? Is the project here to enhance payment processing? To improve on a business supply chain or to entertain users? There’s technically no such thing as an invalid use case, but some are certainly more applicable than others. For example, a project meant to assist millions in acquiring food is likel...

Price analysis 1/17: BTC, ETH, BNB, ADA, SOL, XRP, LUNA, DOT, AVAX, DOGE

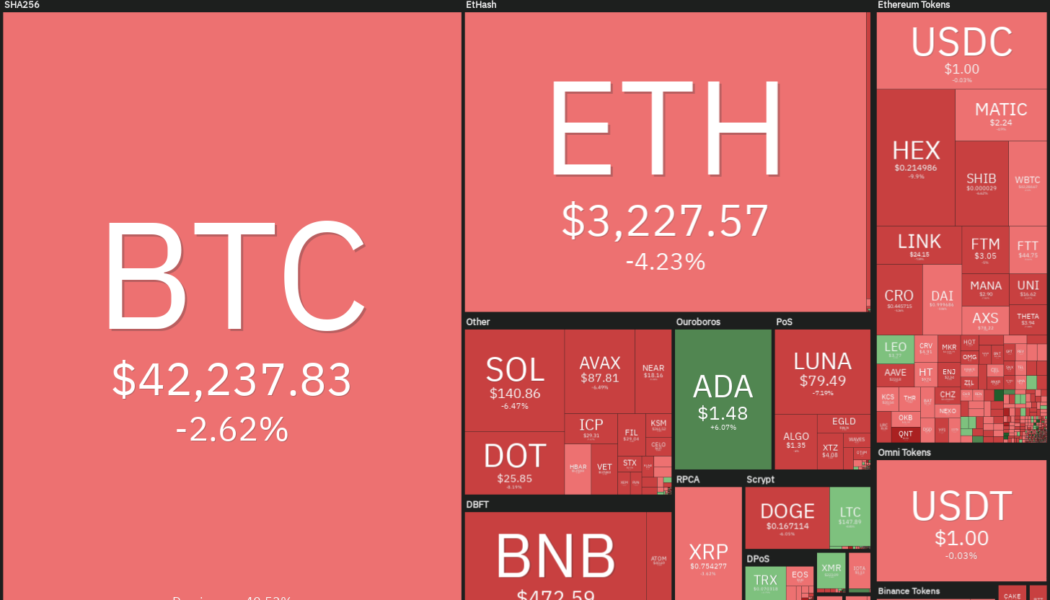

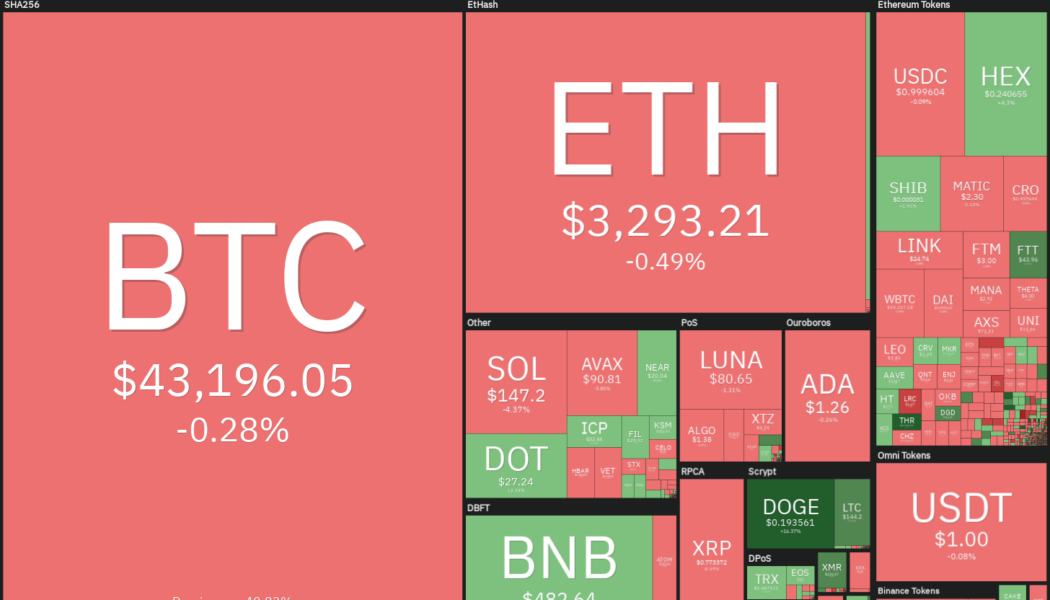

Bitcoin’s (BTC) volatility has been shrinking in the past few days. The standard deviation of daily Bitcoin returns for the last 30 and 60 days as calculated by the Bitcoin Volatility Index is at 2.63%, the least volatile it has been since November 2020. Generally, tight ranges are followed by strong price expansions. In 2020, the low volatility period in November was followed by a sharp rally in mid-December, which resulted in a supercycle that carried the price all the way to $64,854 on April 14, 2021. Daily cryptocurrency market performance. Source: Coin360 However, there is no certainty that the volatility expansion will happen only to the upside. The price could break out in either direction. Commentator Vince Prince warned that the high leverage ratio of Bitcoin could trigger a big c...

Crypto.com users report suspicious wallet activity, exchange pauses withdrawals

The exchange has not clarified the nature of the suspicious activity, but users are claiming mysterious loss of money Earlier today, Crypto.com said it was temporarily pausing withdrawals as it confirmed receiving reports from some users claiming suspicious activity in their wallets. The exchange noted that it was looking into the matter and assured users of their holdings’ safety. “We have a small number of users reporting suspicious activity on their accounts. We will be pausing withdrawals shortly, as our team is investigating. All funds are safe,” a tweet from the exchange’s Twitter account read. Some users responding to the tweet claim to have messaged the exchange about the issue hours before the announcement. For instance, Entrepreneur and jeweller Ben B...

Price analysis 1/14: BTC, ETH, BNB, SOL, ADA, XRP, LUNA, DOT, AVAX, DOGE

Bitcoin (BTC) and most major altcoins are facing selling at higher levels and buying on dips, indicating the possibility of a range formation. On-chain analysis firm Whalemap said that a “reclaim of $46,500 will look like a trend reversal,” for Bitcoin as the previous accumulation phase of 90,000 BTC was at this level. Fidelity Digital Assets said in its annual report that the “massive “ Bitcoin accumulation by Bitcoin miners suggests that the “Bitcoin cycle is far from over.” The report went on to add that more sovereign nations may “acquire Bitcoin in 2022 and perhaps even see a central bank make an acquisition.” Daily cryptocurrency market performance. Source: Coin360 Switzerland-based financial institution SEBA Bank CEO Guido Buehler said in a recent interview that if the right co...

Price analysis 1/12: BTC, ETH, BNB, SOL, ADA, XRP, LUNA, DOT, AVAX, DOGE

Bitcoin (BTC) and most major altcoins appear to have started a relief rally. Glassnode data suggests that Bitcoin addresses with a non-zero balance have risen to about 40 million, indicating increasing adoption by retail traders. Edelman Financial Engines founder Ric Edelman said that the number of Americans owning Bitcoin could rise from 24% currently to one-third by 2022. He expects this to happen as “Bitcoin is becoming more and more mainstream. People are hearing about it everywhere — it isn’t going away.” Daily cryptocurrency market performance. Source: Coin360 The investors buying Bitcoin seem to be in it for the long haul if the outflows from major exchanges are any indication. CryptoQuant data shows outflows of 29,371 BTC on Jan. 11, the highest withdrawals since Sep. 10. Could the...

Bitcoin drops below $40K for first time in 3 months as fear set to ‘accelerate’

Bitcoin (BTC) fell below the landmark $40,000 mark for the first time since September 2021 on Jan. 10, heightening a rout that began six weeks ago. BTC/USD 1-hour candle chart (Bitstamp). Source: TradingView Bollinger bands step in Data from Cointelegraph Markets Pro and TradingView showed BTC/USD encountering predictable volatility as bears finally steered the market back into the $30,000 zone. The move had been long preempted, with forecasts even calling for an identical floor to that of July — just below $30,000. “And we’re dipping into the $40K region for Bitcoin, through which the fear will only accelerate even more,” Cointelegraph contributor Michaël van de Poppe reacted. For trader and analyst Rekt Capital, the first point of support lay in the lower of the tw...

These 3 cryptocurrencies are taking an even bigger hit during Bitcoin’s price slump

The cost to purchase one Bitcoin (BTC) has dropped almost 10% in the last seven days and has been eyeing extended declines as it drops below $40,000, its interim psychological support, on Jan. 10. BTC/USD weekly price chart. Source: TradingView Nonetheless, the losses suffered by Bitcoin still appear less than that of some of its top crypto rivals’ performances. For instance, Cardano (ADA), the seventh-largest cryptocurrency by market valuation, has dropped by nearly 11% to around $1.15 in the last seven days. Similarly, Ripple (XRP), the eighth-largest by market capitalization, has dipped by around 10% to nearly $0.75 in the same period. Meanwhile, some cryptocurrencies listed among the top 50 digital assets have experienced bigger losses between 15% and 30% in the last week. They i...

Ethereum developers disagree with JP Morgan’s prediction of loss of dominance

The analyst team had predicted that Ethereum’s market share would continue shrinking Last Wednesday, JPMorgan Chase & Co. research analysts in a team led by Nikolaos Panigirtzoglou said Ethereum’s dominance is at risk of getting chopped off by competing blockchain ecosystems. JP Morgan’s projection According to Bloomberg, analysts from the American investment bank said in a note that Ethereum’s market share could remain on the path of decline until the final phase, sharding, arrives. Labelled the most critical stage for scaling, it is not expected to arrive until 2023. Evidently, Ethereum has seen a decline in dominance in the decentralised finance niche. At the start of 2021, it locked almost 100% of the total DeFi value, a figure which declined to about 7...

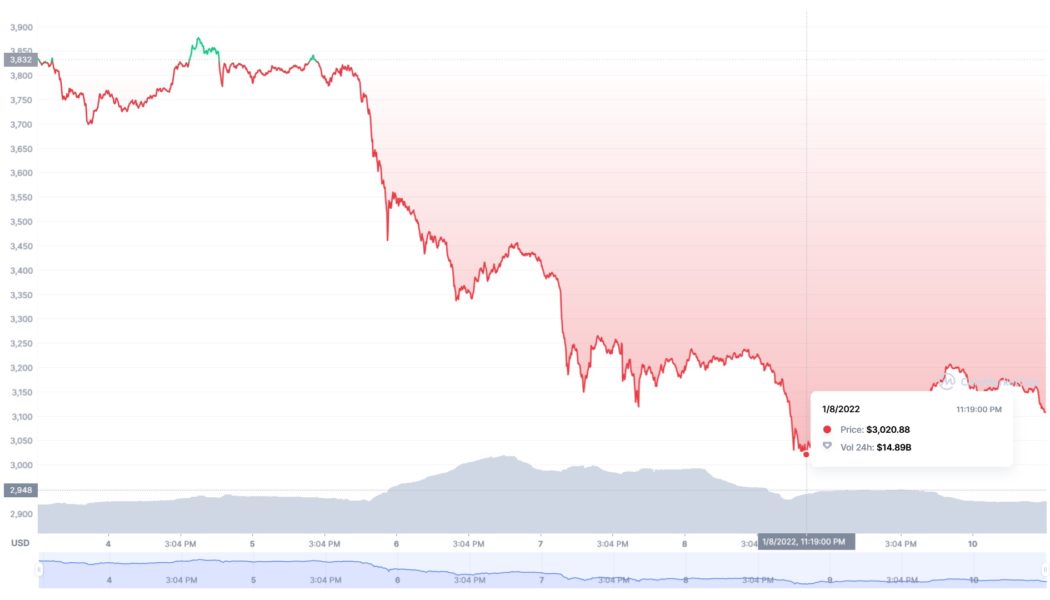

Crypto strategist Justin Bennett sees $3,000 as Ethereum’s turning point

Bennett revealed that he intends to buy ETH at around $3,000 as he expects the market to turn around that point Crypto analyst Justin Bennett has predicted what he expects to see from Ethereum this month, even as crypto markets dwindle and continue on a downward trend. Last Friday, Bennett outlined in a video that Ethereum must recover towards a crucial level over the next few weeks, which he defined as the region around $4,000. The crypto strategist noted that he sees this as a necessity for Ether to have a chance at restoring a major bullish run. “As long as ETH is below $4,000, you have to be a little bit careful. If we do see Ethereum over the coming weeks and months reclaim this area up here at $4,000 on a weekly and monthly closing basis, then yes, I do think we’re going ...

Arbitrum network suffers minor outage due to hardware failure

The Ethereum layer-two network Arbitrum has suffered its second outage in less than five months following a hardware failure. Arbitrum is back online at the time of writing but the team did report some downtime during the late hours of Jan. 9. The timing of the tweets suggests that the network was down for around seven hours. At the time, the Offchain Labs platform reported that it was experiencing some issues with the sequencer which prevented transactions from being processed for the period. We are currently experiencing Sequencer downtime. Thank you for your patience as we work to restore it. All funds in the system are safe, and we will post updates here. — Arbitrum (@arbitrum) January 9, 2022 On Jan. 10, Arbitrum released a post mortem explaining what had occurred to cause the brief o...