Ethereum

Polygon (MATIC) sees a strong oversold bounce after $250B crypto market rebound

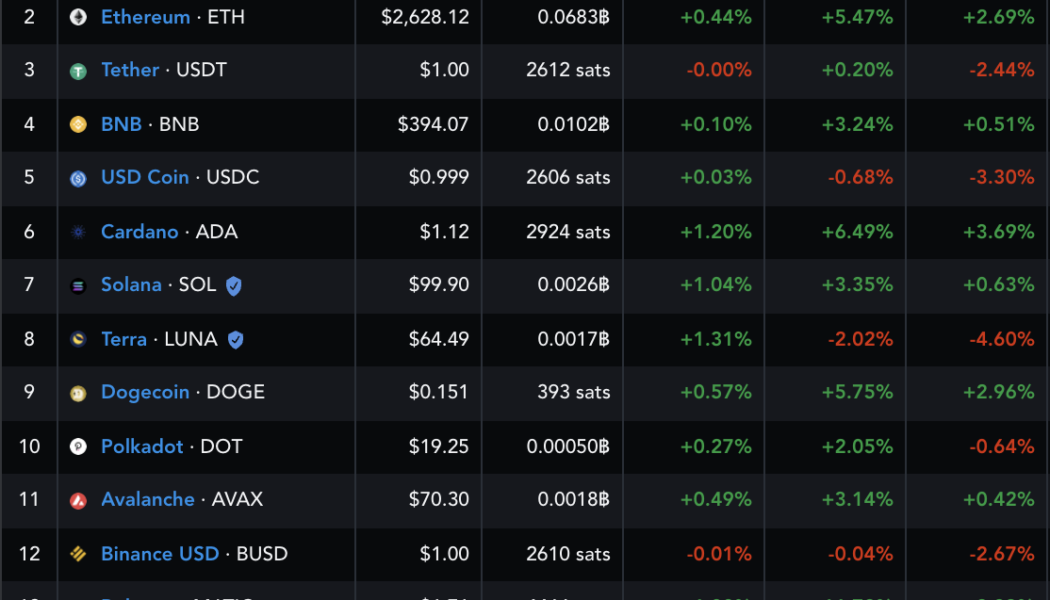

Polygon (MATIC) emerged as one of the best performers among high-ranking cryptocurrencies on Jan. 26 as the price rose nearly 17% to reach an intraday high at $1.825. The gains surfaced amid a synchronous rebound across the crypto market that started on Jan. 24. In detail, investors and traders poured in over $250 billion across digital assets, benefiting Bitcoin (BTC), Ether (ETH) and many others in the process. Performance of the top-fifteen cryptocurrencies in the last 15 days. Source: TradingView Polygon, a secondary scaling solution for the Ethereum blockchain, also cashed in on the crypto market rebound. The valuation of its native token, MATIC, rose from as low as $9.77 billion on Jan.24 to as high as $13.58 billion two days later. Meanwhile, its price jumped from $1....

Price analysis 1/26: BTC, ETH, BNB, ADA, SOL, XRP, LUNA, DOGE, DOT, AVAX

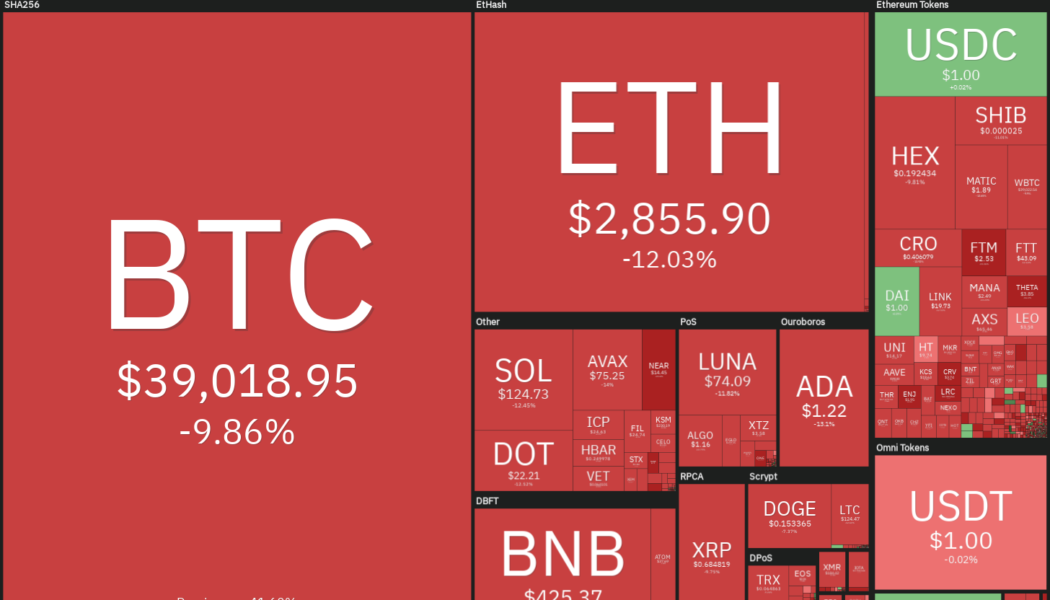

Bitcoin (BTC) and most major altcoins have bounced off their strong support levels but could the rally sustain to the extent that traders feel confident that a bottom in place? Bloomberg Intelligence senior commodity strategist Mike McGlone said that Bitcoin’s price is “about 30% below its 20-week moving average,” roughly at the same position, which had led to bottom formations in March 2020 and July 2021. Although Bitcoin has corrected sharply in January, the exchanges’ balances dropped from 2.428 million Bitcoin on December 28 to 2.366 million Bitcoin on Jan. 24, according to data from CryptoQuant. This indicates that investors may be stashing away their recent purchases safely. Daily cryptocurrency market performance. Source: Coin360 However, it may not be a V-shaped recovery for ...

Here is why ARK Invest believes Bitcoin will trade at $1 million by 2030

Cathie Wood’s investment management firm ARK Invest has laid bold predictions for Bitcoin and Ethereum in a recently published outlook report Disruptive innovation-oriented investment firm ARK Invest has predicted that Bitcoin’s market capital will reach $28.5 trillion by 2030. The firm’s analyst Yassine Elmandjra noted in its annual research report that the price of a bitcoin will surge to $1.36 million by then. He justified the prediction by pointing out that the crypto asset’s usage is only in its nascent stage. “Bitcoin’s market capitalisation still represents a fraction of global assets and is likely to scale as nation-states adopt as legal tender. According to our estimates, the price of one bitcoin could exceed $1 million by 2030,” Elmandjra...

Eth2 is no more after Ethereum Foundation ditches name in rebrand

The Ethereum Foundation has removed all references to Eth1 and Eth2 in favor of calling the original blockchain the “execution layer” and the upgraded Proof of Stake chain the “consensus layer.” Ethereum’s long-awaited transition from a Proof-of-work mining model to a Proof-of-Stake (PoS) consensus mechanism is expected to go live around in the second or third quarter of this year. Announcing the change the foundation cited a number of rationales including a “broken mental model for new users,” scam prevention, inclusivity and staking clarity. In a Jan.24 blog post, the Ethereum Foundation noted that the branding of Eth2 failed to concisely capture what was happening to the network via its series of upgrades: “One major problem with the Eth2 branding is that it creates a broken mental mode...

Bitcoin and Ethereum selloffs are coming to an end soon, says Mad Money’s Jim Cramer

Cramer suggested that Bitcoin could see a recovery like last year’s – a rally that pushed Bitcoin north to the November all-time high In a recent instalment of the Mad Money show, CNBC’s Jim Cramer analysed the markets, as predicted by Tom DeMark. Creator of the Symbolik financial markets analysis tool, Tom DeMark is not just any other head in market matters. With a long-running career in objective and mechanically-driven market indicators, he is credited with several past accurate predictions in the crypto market. Bitcoin and Ethereum set to embark on an uptrend Jim Cramer told viewers that the two leading crypto-assets, Bitcoin and Ethereum, could hit a trend exhaustion bottom this week. After days of massive selloffs that pushed markets to seek lower prices, Cramer pre...

Green shoots? Institutional crypto funds see first inflows in 5 weeks

After five weeks of constant outflows, institutional investment is finally trickling back into crypto funds with BTC the asset of choice and ETH falling out of favor. In its weekly Digital Asset Fund Flows report published on Jan. 24, crypto investment firm CoinShares observed inflows for some institutional products. It is the first time in five weeks that there has been a net positive inflow as $14.4 million re-entered the space with investors buying the dip. The researchers reported that these inflows came during a period of significant price weakness, adding that this suggests investors “are seeing this as a buying opportunity” at current price levels. Capital continued to flow out from CoinShares own BTC fund, however, 21Shares and ProShares registered minor gains. Most of the inflows ...

ADA sinks below $1.00 after market sell-off knocks off accrued gains

Cardano’s native token ADA is currently trading over 66% below its all-time high set five months ago The recent market slump that started during Friday’s morning session has taken a huge chunk out of the cryptocurrency sector’s circulating value. Bitcoin, Ethereum and Binance Coin down more than 5% on the day Bitcoin (BTC) plunged below $38k on Friday before seeing more dips and dropping below $35k. Down approximately 6.4% in the last 24 hours, it is now trading at $33,653.05 as per data from coinmarkecap. Ethereum (ETH) price, which broke above $3,200 on Thursday’s trading session, is down 27.54% over the last seven days. The second-largest crypto-asset sunk below the $2,400 critical level on Saturday, bottoming around $2,330. On the day, the token has lost 11.21% ...

How to pick or analyze altcoins?

What are altcoins? The word “altcoin” is derived from “alternative” and “coin.” Altcoins refer to all alternatives to Bitcoin. Altcoins are cryptocurrencies that share characteristics with Bitcoin (BTC). For example, Bitcoin and altcoins have a similar basic framework. Altcoins also function like peer-to-peer (P2P) systems and share code, much like Bitcoin. Of course, there are also marked differences between Bitcoin and altcoins. One such difference is the consensus mechanism used by these altcoins to validate transactions or produce blocks. While Bitcoin uses the proof-of-work (PoW) consensus mechanism, altcoins typically use proof-of-stake (PoS). There are different altcoin categories, and they can best be defined by their consensus mechanisms and unique functionalities. Here are the mo...

Bearish chart pattern hints at $70 Solana (SOL) price before a possible oversold bounce

Solana (SOL) price may fall to $70 a token in the coming weeks as a head and shoulders setup emerged on the daily timeframe and possibly points toward a 45%+ decline. The chart below shows that SOL price rallied to nearly $217 in September 2021, dropped to a support level near $134 and then moved to establish a new record high of $260 in November 2021. Earlier this week, the price fell back to test the same $134-support level before breaking to a 2022 low at $87.73. SOL/USD weekly price chart featuring head and shoulders setup. Source: TradingView This phase of price action appears to have formed a head and shoulders setup, a bearish reversal pattern containing three consecutive peaks, with the middle one around $257 (called the “head”) coming out to be higher than the oth...

Price analysis 1/21: BTC, ETH, BNB, ADA, SOL, XRP, LUNA, DOT, AVAX, DOGE

Bitcoin (BTC) and most major altcoins continue to witness a bloodbath on Jan. 21 and the result of the most recent downturn has been a $200 billion reduction in market capitalization. A new report by Huobi Research, in collaboration with Blockchain Association Singapore, forecast Bitcoin to enter a bear market in 2022. The liquidity tightening measures undertaken by the U.S. Federal Reserve and other central banks across the world and the regulatory action by authorities could play spoilsport and keep crypto prices under check. Daily cryptocurrency market performance. Source: Coin360 The calls for a bear market have not shaken up the resolve of MicroStrategy CEO Michael Saylor who is determined to hold on to the company’s Bitcoin holdings. Saylor said in a recent interview...

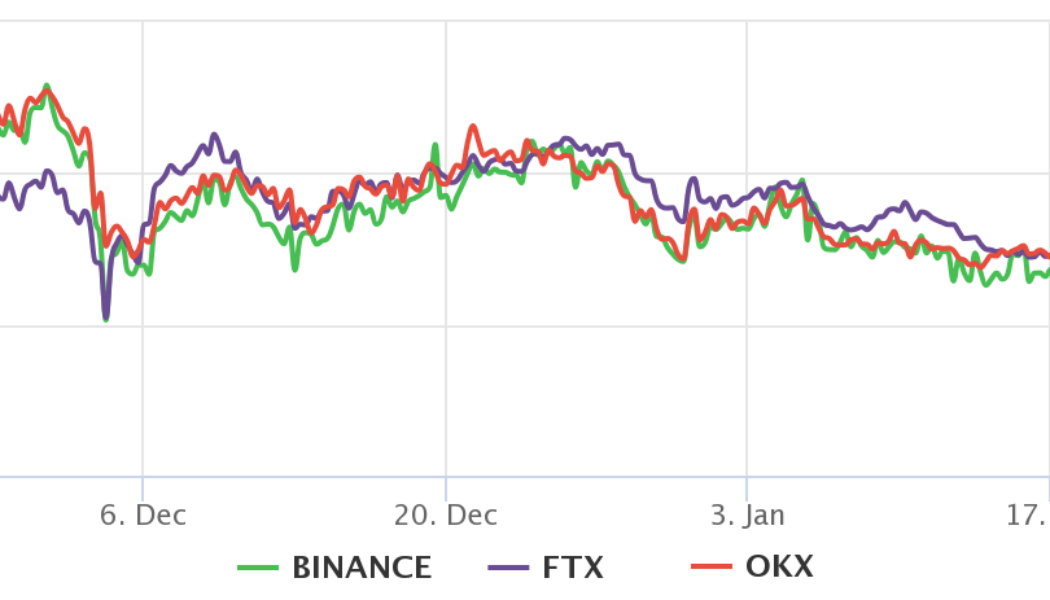

Crypto market sees red ahead of weekend – Bitcoin and Ether down more than 7.50% on the day

For the second time in two weeks, Bitcoin has fallen below $40k, this time coming closest to the $38k support The crypto market crashed during today’s morning session in its entirety, with dollar-pegged stablecoins being the only survivors. Data provided by CoinMarketCap indicates that Bitcoin, which had gained towards $43,000 on Thursday, fell to a six-month low of $38,560. At the time of publication, the pioneer crypto coin is trading below $39k, having shed 7.68% in the last 24 hours. Along with Bitcoin, Ethereum is also feeling the blow to the market. In the past 24 hours, the second most valuable digital asset dipped to a $2,827.7o low. At the time of press, the coin is changing hands slightly above that figure, at $2,880.22, but still down 8.34% on the day. Altcoins in the red ...