Ethereum

Price analysis 3/4: BTC, ETH, BNB, XRP, LUNA, SOL, ADA, AVAX, DOT, DOGE

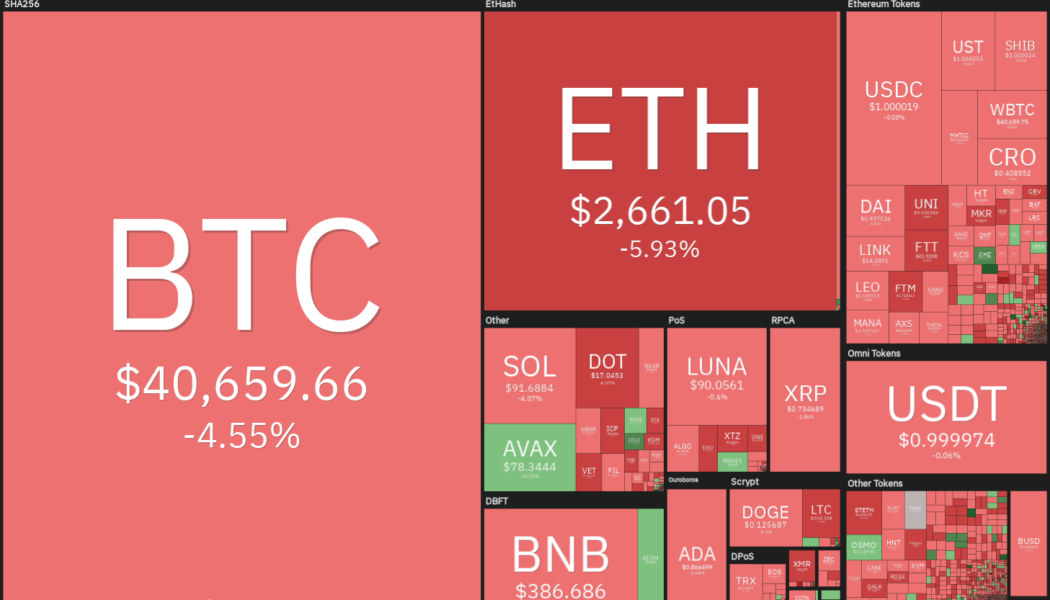

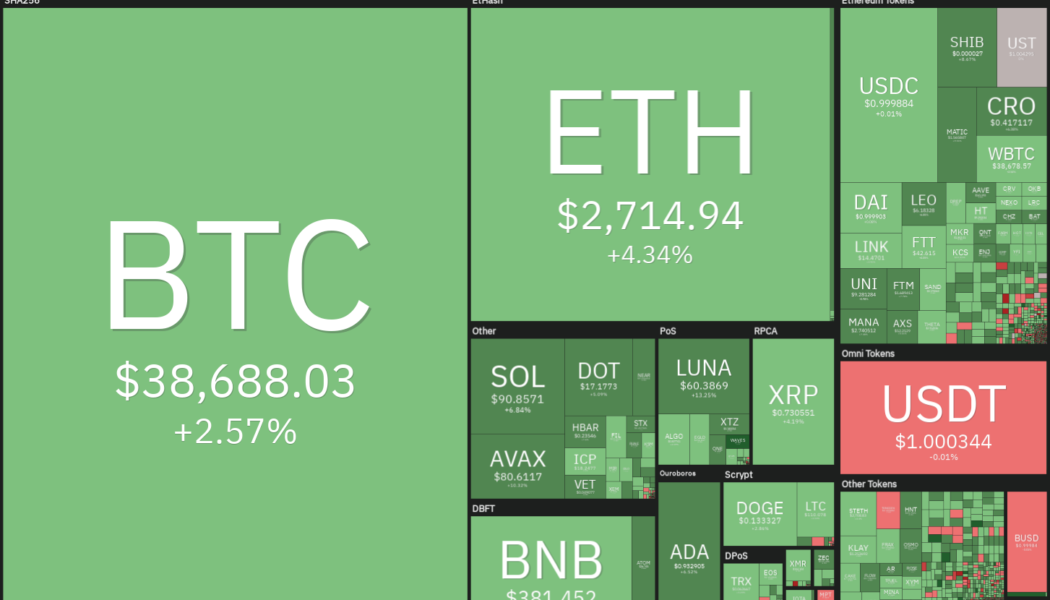

The equity markets in Europe and the United States are seeing a sea of red as traders continue to sell risky assets due to the geopolitical situation. Bitcoin (BTC) and several major cryptocurrencies are also witnessing profit-booking after the recent rise. Another reason that could be keeping investors on the edge is the upcoming Federal Open Market Committee (FOMC) meeting on March 16. A statement from Fed hair Jerome Powell on March 2 highlighted that the central bank is likely to hike rates this month. Fitch Ratings chief economist Brian Coulton expects core inflation to remain high in 2022 and the Fed to boost the “Fed fund rate to 3% by the end of 2022.” Daily cryptocurrency market performance. Source: Coin360 ExoAlpha managing partner and chief investment officer David Lifchit...

Nvidia hackers selling software unlock for graphics card crypto mining limiters

A hacking group that infiltrated Nvidia servers last month is attempting to sell software that could unlock crypto mining hash rate limiters on the firm’s flagship graphics cards. A South American hacking group going by the name LAPSUS$ claims to have stolen a terabyte of data from Nvidia servers in late February. The group is now offering software in the form of a customized driver to unlock limiters the company has put on its high-end graphics cards. Nvidia stated that it became aware of the incident on Feb. 23, and stated, according to reports on Mar. 2: “We are aware that the threat actor took employee credentials and some Nvidia proprietary information from our systems and has begun leaking it online.” The cybercriminal group has been trying to extort the California-based company thro...

Price analysis 2/28: BTC, ETH, BNB, XRP, ADA, SOL, AVAX, LUNA, DOGE, DOT

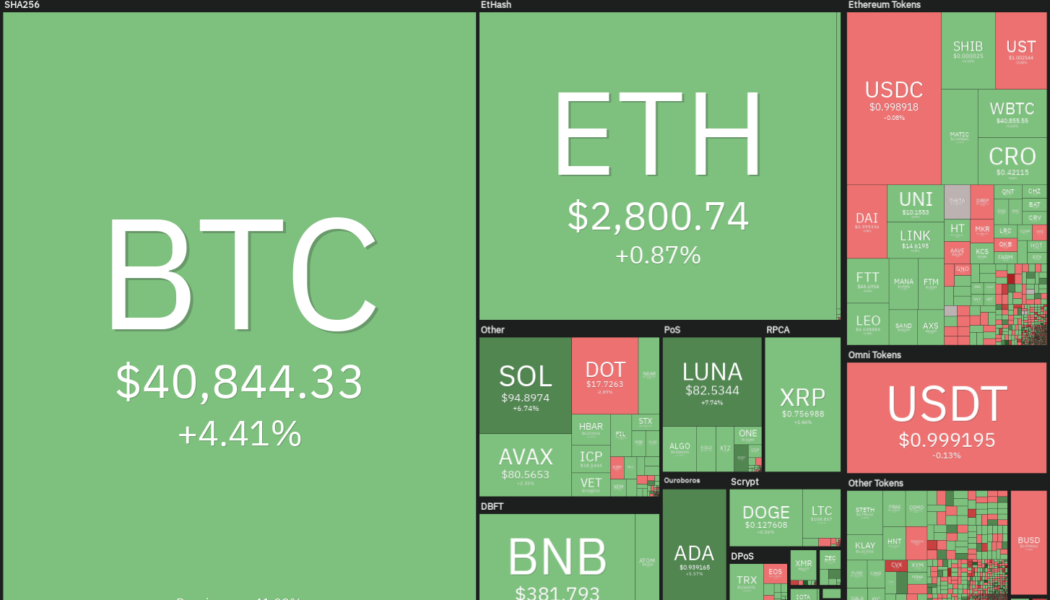

Bitcoin (BTC) soared above $40,000 on Feb. 28 even though the S&P 500 remained soft. This suggests that the correlation between Bitcoin and the U.S. equity markets may be showing the first signs of decoupling. If bulls sustain the price above $38,500 till the end of the day, Bitcoin would avoid four successive months of decline. The volatility of the past few days does not seem to have shaken the resolve of the long-term investors planning to stick with their positions. Data from on-chain analytics firm Glassnode showed that the amount of Bitcoin supply that last moved between three to five years ago soared to more than 2.8 million Bitcoin, which is a four year high. Daily cryptocurrency market performance. Source: Coin360 Interestingly, an experiment by Portuguese software developer T...

Price analysis 2/25: BTC, ETH, BNB, XRP, ADA, SOL, AVAX, LUNA, DOGE, DOT

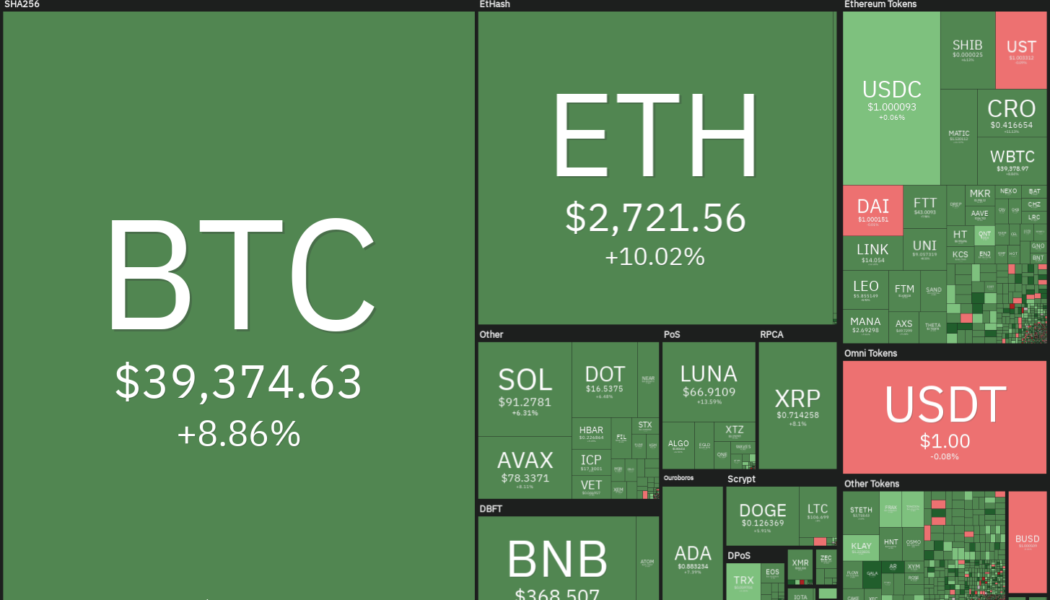

The U.S. equity markets and Bitcoin (BTC) have rebounded sharply from their Feb. 24 lows while gold has made a retreat from its recent highs. This indicates that investors may be buying risky assets and reducing exposure to assets perceived as a safe haven. Recent reports also suggest that Russian President Vladimir Putin may send a delegation to negotiate with Ukraine and this raises hope that the conflict could end sooner than analysts expect. Some analysts believe that the U.S. Federal Reserve may not raise rates aggressively in March due to the geopolitical situation. Allianz chief economic advisor Mohamed El-Erian believes that the March 50 basis point rate hike is “completely off the table.” Daily cryptocurrency market performance. Source: Coin360 Dr. Raullen Chai, the co-f...

Terra’s Mirror Protocol MIR rebounds 40% two days after crashing to record low

Mirror Protocol, a decentralized finance (DeFi) protocol built on the Terra blockchain, was hit by one of the biggest collapses in financial history this week after Vladimir Putin ordered military strikes against Ukraine. Terra tokens rally Mirror Protocol’s native token, MIR, dropped to $0.993 on Feb. 24, its worst level to date amid a selloff across the broader crypto market. But a sharp rebound ensued, taking the price to as high as $1.41 two days later, up more than 40% when measured from MIR’s record low. MIR/USD four-hour price chart. Source: TradingView Just like the drop, MIR’s upside retracement came in the wake of similar recoveries elsewhere in the crypto market. But interestingly, MIR/USD returns appeared larger than some of the highly valued digital assets, i...

Ethereum’s rejection off its bull market support band could mean an extended bear market

Benjamin Cowen, a popular crypto analyst, has expressed bearish sentiment on Ethereum The crypto strategist has predicted an extended period of market correction for the native token of the top smart contract platform Speaking in a video published on his YouTube channel on Monday, Cowen reviewed Ethereum’s recent behaviour around the bull market support band. He observed that Ethereum faced rejection at the support band, arguing that its price is becoming a cause for concern. The bull market support band is a moving average indicator that integrates the 20-week simple moving average (SMA) and the 21-week exponential moving average (EMA). Ethereum did not even actually reach the 21-week exponential moving average before it resumed the slump, which the crypto strategist labelled a show...

This Software Lets You Design Trippy Visuals of Your Music—Then Mint Them As NFTs

We know—NFT this, metaverse that. But before you grumble at this umpteenth blockchain tech platform, consider its value for music producers. VOID is a Web3-based platform that allows musicians to generate and customize kaleidoscopic visuals with their own songs. Created by Dutch developer Triptcip, the sequencing software essentially takes your music and spits out a trippy, beat-reactive mosaic. Triptcip’s visual synthesizer, VOID. Triptcip VOID, which Triptcip says is the first of its kind, aims to arm music producers with an easily accessible visual synthesis tool. Visual designers have enjoyed the spoils of the digital art revolution, but many musicians have found themselves stuck in a new kind of limbo. Without a budget to join forces with a capable designer or a trusted partner au cou...

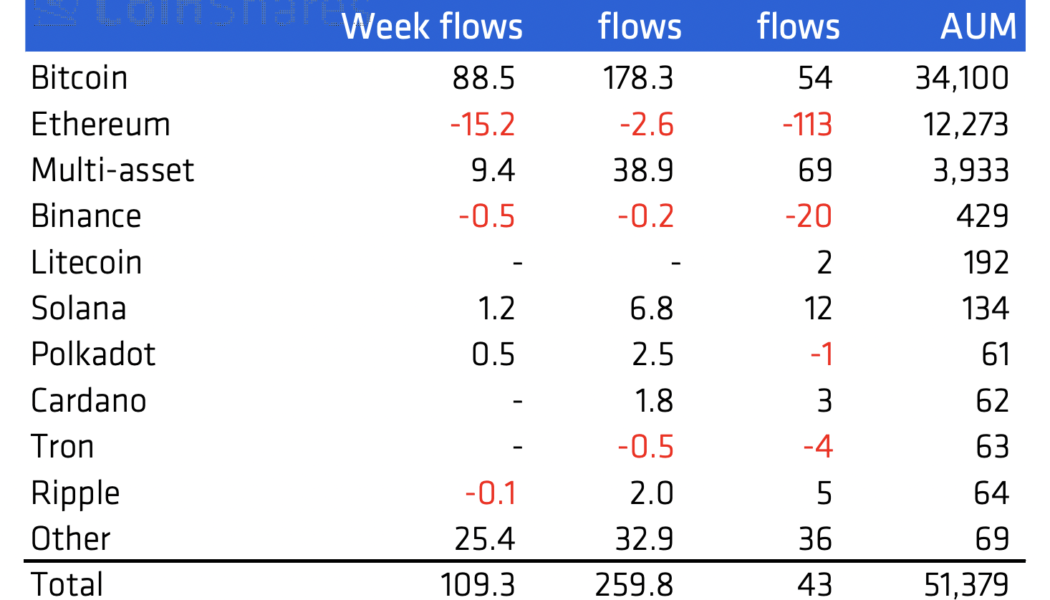

Avalanche price rallies 20% after report reveals $25M inflows into AVAX investment vehicles

Avalanche (AVAX) rallied by around 20% in the last two days as a new report revealed millions of dollars flowing into AVAX-based investment products. Penned by CoinShares, an institutional crypto fund manager, the report highlighted that Avalanche-based investment vehicles attracted about $25 million in the week ending Feb. 21, the second-biggest inflow recorded in the said period after Bitcoin’s (BTC) $89 million. Flow of assets. Source: Bloomberg, CoinShares In contrast, Ether (ETH), Avalanche’s top rival in the smart contracts sector, witnessed an outflow totaling $15 million. On the whole, Avalanche and similar cryptocurrency investment products attracted around $109 million, recording their fifth week of positive inflows in a row. AVAX rebounds against macro headwinds...

Price analysis 2/23: BTC, ETH, BNB, XRP, ADA, SOL, AVAX, LUNA, DOGE, DOT

Bitcoin (BTC) and several altcoins have bounced off their immediate support levels after buyers attempted to arrest the current decline. Bloomberg Senior Commodity Strategist Mike McGlone highlighted in a recent Tweet that Bitcoin was trading roughly 20% below its 50-week moving average and such discounted levels have “often resulted in good price support.” The bearish price action of the past few days does not seem to have deterred the institutional traders from accumulating at lower levels. According to CoinShares’ Feb. 22 “Digital Asset Fund Flows Weekly” report, institutional investors pumped about $89 million into Bitcoin funds between Feb. 14 and Feb. 18, taking the total inflows in the current month to $178.3 million. Daily cryptocurrency market performance. Source: Coin360 Crypto t...

Ethereum to $10K? Classic bullish reversal pattern hints at potential ETH price rally

Ethereum’s native token, Ether (ETH), could reach above $10,000 in the coming weeks as it paints what appears to be an “ascending triangle” technical pattern. Ether’s price technicals: Bullish signs Ascending triangles are bullish continuation setups that appear during an uptrend. Analysts confirm their presence after the price rises upward inside a rising right-angle triangle structure, thus forming a sequence of lower highs on the lower trendline with resistance in place at the upper one. As the pattern develops, volumes typically drop. So far, Ether has been forming a similar upside pattern on its weekly chart. In detail, the triangle’s lower trendline has been acting as an accumulation range since the beginning of 2021, with high selling pressure at the upper trendline, as shown b...

UK law firm Gunnercooke starts accepting crypto payments for legal services

Gunnercooke says one of its clients, Attestant, has already paid up for services in Ether Crypto adoption will also favour partners at the firm who would prefer getting paid in alternative methods As mainstream crypto adoption continues rising, more industries and sectors are trying their bit to incorporate these digital assets. In the US, a number of legal firms have been accepting crypto for a while now, including Steptoe & Johnson, Perkins Coie, Frost Brown Todd, McLaughlin & Stern, and Quinn Emanuel Urquhart & Sullivan. In the UK, law firm Gunnercooke revealed yesterday that it started accepting crypto payments in Bitcoin and Ether. The move, Gunnercooke said, made it the first among major firms in the country to do so. In taking legal fees in crypto, the firm intends to su...