Ethereum

Ethereum is like the best and worst parts of New York: Grayscale

Digital asset manager Grayscale has published a report on smart contract platforms in which it likens the Ethereum (ETH) blockchain to the best and worst parts of New York City. The report examines the granddaddy smart contract network Ethereum in comparison to newer competing blockchains such as Solana (SOL), Avalanche (AVAX), Polkadot (DOT), Cardano (ADA) and Stellar (XLM). The report comes in the wake of the firm launching a crypto fund dedicated to smart contract platforms excluding Ethereum. In a section titled “digital cities,” Grayscale analyzed Ethereum, Avalanche and Solana. The firm compared Ethereum to the Big Apple, noting that they both share similarities with issues that arise from their stature: “Ethereum is like New York City: it is vast, expensive, and congested in certain...

Ethereum targets $3,500 as Bitcoin touches a three-month high

Bitcoin raced past $48k during Monday’s trading session setting a new year-to-date high above $48,086 Ethereum’s native token Ether has today shot up to a multi-week high of $3,428.85 on the back of the broader market rally Bitcoin yesterday set a new yearly high north of $48,000 as its price reacted to bullish news of Terra acquiring more Bitcoin that will act as reserve for its TerraUSD stable coin. The price ascent means Bitcoin has erased the losses it has recorded thus far. Though it has since retreated to $47,540 at the time of writing, market data shows Bitcoin has made marginally over 11% in the last seven days. These gains have helped the Satoshi coin come off a two-month cycle of range-trading between $35,000 and $45,000. At its current price, Bitcoin has moved up by over 43% fro...

Why Bored Ape Yacht Club scares me

Last week, I wrote an article on ApeCoin, the new cryptocurrency launched to be “the primary token for all new products and services” from the Bored Ape Yacht Club (BAYC). I won’t go over previously covered ground, but to summarise it quickly, ApeCoin is an ERC-20 governance token; the thesis is that holders can vote on potential changes to Bored Ape Yacht Club, in addition to gaining access to exclusive events and merchandise, as well as use it for in-game currency. After a bit of a volatile start (who would have guessed?) the coin has gone vertical, with a market cap of $3.7 billion at time of writing. BAYC have yet again proved that everything they touch turns to gold (although Bitcoin diehards may not like the choice of words in that expression). $450 million raise Yuga Labs, the creat...

On-chain: Ethereum surges, outperforms Bitcoin and stocks

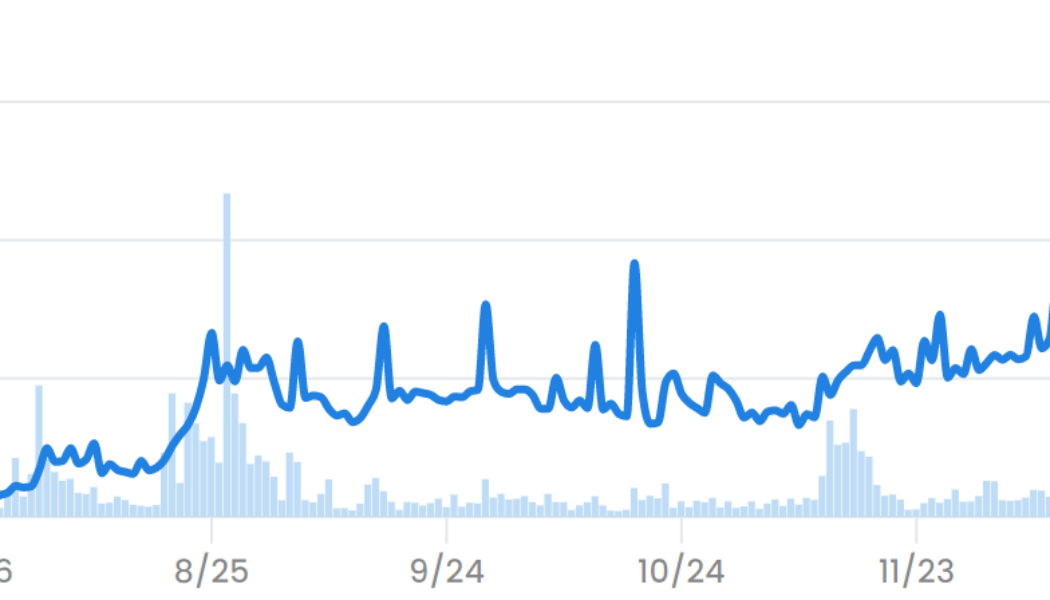

The never-ending battle of Ethereum against the psychologically-important $3K barrier continues. The DeFi king broke through the resistance earlier, meaning it is now up 16% on the week. Ethereum 7-day returns, data via CoinMarketCap Order Volume The $3K area has been a tug-of-war over the last while, and today reads no different. Data below via IntoTheBlock shows the boisterous volume on both sides of $3K, as order-books burst with bids and asks. It’s difficult to ascertain where ETH will go from here; like most financial assets, it may depend on external geopolitical developments, which have been plentiful in recent times. Order volume around the $3K barrier, data via IntoTheBlock Volume Volume provides no clue in either direction, with withdrawals from exchanges continuing to fol...

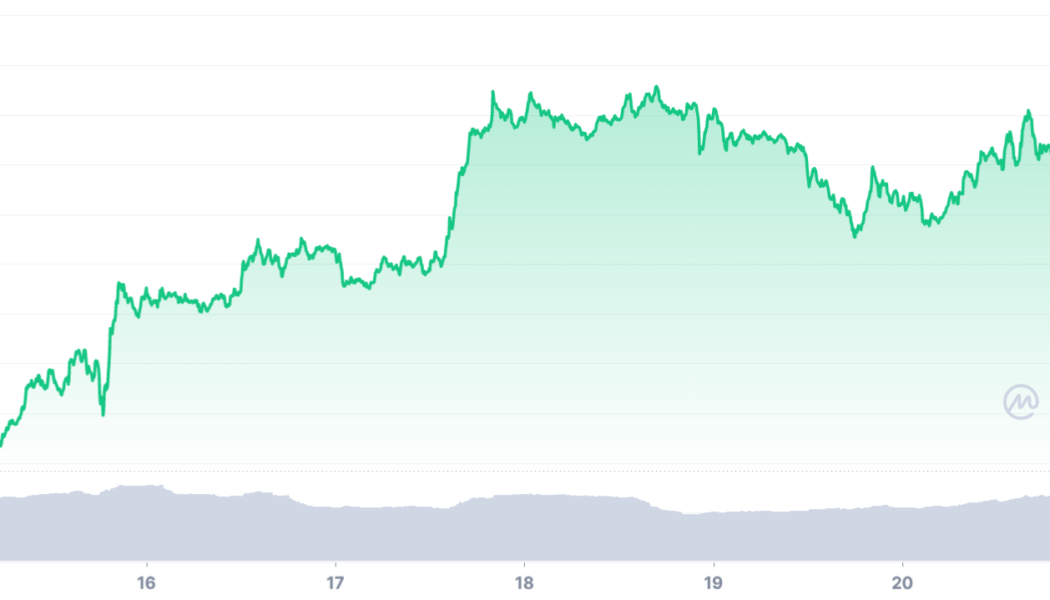

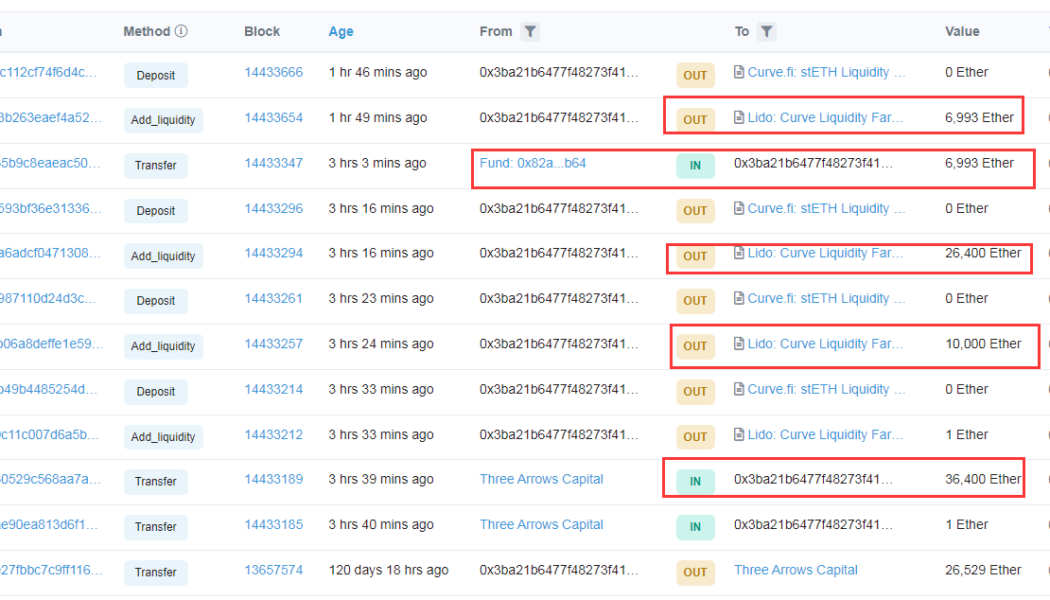

ETH price hits $3K as major crypto fund adds over $110M Ethereum to Lido’s staking pool

Ethereum’s native token Ether (ETH) rose above $3,000 on March 22 as fresh data suggests Three Arrows Capital staked at least $110 million worth of ETH into Lido’s liquidity pools. The Singapore-based hedge fund manager provided liquidity worth 36,401 ETH to Lido’s “Curve stETH pool” using a third-party Ether wallet, data from Etherscan shows. As a result, it became eligible to receive at least 36,401 stacked Ether (stETH) tokens from Lido: to ensure low slippage when un-staking those tokens for real ETH plus staking reward. Third-party Ethereum wallet that received ETH from Three Arrow Capital. Source: Etherscan.io Almost an hour later, another Ether address, marked with the word “fund,” sent 6,993 ETH (worth $21.12 million) to the ...

Price analysis 3/21: BTC, ETH, BNB, XRP, LUNA, SOL, ADA, AVAX, DOT, DOGE

Bitcoin (BTC) and most major altcoins are attempting to start the new week on a positive note by bouncing off their respective support levels. Goldman Sachs became one of the first major banks in the United States to complete an over-the-counter “cash-settled cryptocurrency options trade” with the trading unit of Michael Novogratz’s Galaxy Digital. This could encourage other major banks to consider offering OTC transactions for cryptocurrencies. It is not only select nations that are showing growth in crypto adoption. A report by cryptocurrency exchange KuCoin shows that crypto transactions in Africa have soared by about 2,670% in 2022. Bitcoin Senegal founder Nourou believes that Africa could continue its thousand plus percent growth rates in the next few years. Daily cryptocurrency marke...

Bitcoin spikes to $41.7K highs as Ethereum nears $3K reclaim

Bitcoin (BTC) saw brisk upwards action during the Wall Street trading session on March 18, conforming to predictions that higher levels would see a retest. BTC/USD 1-hour candle chart (Bitstamp). Source: TradingView Bets placed on $46,000 Data from Cointelegraph Markets Pro and TradingView followed BTC/USD as it advanced $1,650 from daily lows to nearly matching the $41,700 high from March 16. The move buoyed traders, who began to reinforce their short-term view of levels near the top of Bitcoin’s 2022 trading range being challenged. For popular trader Pentoshi, however, such a result would not mean that BTC/USD had broken its downtrend definitively. “Macro headwinds still too strong but midterm, I think we rally bc seller exhaustion before any shot at new lows or prev low...

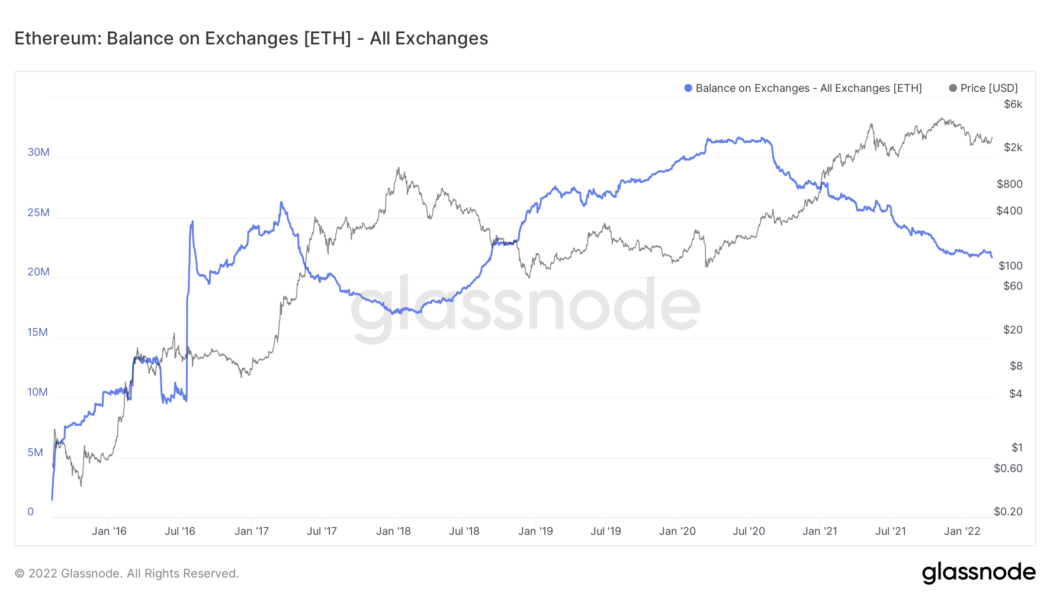

Ethereum balance on crypto exchanges falls to lowest levels since 2018

The amount of Ethereum‘s native token Ether (ETH) kept with crypto exchanges has fallen to its lowest levels since September 2018, signaling traders‘ intention to hold the tokens in hopes of a price rally in 2022. Notably, nearly 550,000 ETH — worth around $1.61 billion — have left centralized trading platforms year-to-date, according to data provided by Glassnode. The massive outflow has reduced the exchanges‘ net-Ether balance to 21.72 million ETH, down from its record high of 31.68 million ETH in June 2020. Ethereum balance on all exchanges as of March 18, 2022. Source: Glassnode Biggest weekly ETH outflow since October 2021 Interestingly, over 30% of all Ether‘s withdrawals from exchanges witnessed in 2022 appeared earlier this week, data from IntoTheBlock shows. In detail, over 180,00...

Price analysis 3/18: BTC, ETH, BNB, XRP, LUNA, SOL, ADA, AVAX, DOT, DOGE

Bitcoin (BTC) is facing a challenging environment in 2022 due to the surging inflation and geopolitical turmoil. Although gold has outperformed Bitcoin year-to-date, Bloomberg Intelligence senior commodity strategist Mike McGlone believes that Bitcoin could make a strong comeback. McGlone expects the current circumstances to “mark another milestone in Bitcoin’s maturation.” Another bullish sign for the long term is that the Bitcoin miners have been increasing their Bitcoin holdings since 2021. Compass Mining founder and CEO Whit Gibbs said to Cointelegraph that Bitcoin mining companies are “taking more of a bullish approach to Bitcoin.” Daily cryptocurrency market performance. Source: Coin360 Terraform Labs founder Do Kwon said that its stablecoin TerraUSD (UST) will be backed by mor...

Bored Ape Yacht Club continue to grow empire, launch new cryptocurrency

The juggernaut that is the Bored Ape Yacht Club shows no sign of slowing down. The founding company, Yuga Labs, announced the launch of a new cryptocurrency which will be leveraged to continue to build the ecosystem around the popular NFT collection. Aptly titled ApeCoin, it will be the “primary token for all new products and services” from the company. BAYC Success Unless you have been living under a rock, you will be familiar with the meteoric success story that is the Bored Ape Yacht Club. The cartoon monkeys are the most coveted NFTs in crypto, with the highedst floor price of 85 ETH ($238,000), above even CryptoPunks (62 ETH = $174,000). They have set the template for how to succeed, focusing not only on the art – which, akin to a lot of NFTs, is not anything especially unique – but a...

Price analysis 3/16: BTC, ETH, BNB, XRP, LUNA, SOL, ADA, AVAX, DOT, DOGE

Bitcoin (BTC) is witnessing a see-saw battle near $40,000 with both the bulls and the bears trying to gain the upper hand. The volatility could remain high as the markets await the United States Federal Reserve’s policy decision due on March 16. Analyst Willy Woo suggests that Bitcoin could witness a capitulation event based on a cost basis, a metric that indicates the transfer of Bitcoin from inexperienced to experienced traders. Such sharp declines usually suggest the formation of market bottoms. Daily cryptocurrency market performance. Source: Coin360 However, Glassnode believes that a capitulation has been avoided because the sell-offs have been absorbed by a relatively strong market. Although 82% of the short-term holders’ coins are in loss, Glassnode considers this to be a late...