Ethereum

Ethereum in danger of 25% crash as ETH price forms classic bearish technical pattern

Ethereum’s native token Ether (ETH) looks ready to undergo a breakdown move in May as it forms a convincing “bear pennant” structure. ETH price to $1,500? ETH’s price has been consolidating since May 11 inside a range defined by two converging trendlines. Its sideways move coincides with a drop in trading volumes, underscoring the possibility that ETH/USD is painting a bear pennant. Bear pennants are bearish continuation patterns, meaning they resolve after the price breaks below the structure’s lower trendline and then falls by as much as the height of the previous move downside (called the flagpole). ETH/USD two-hour price chart. Source: TradingView As a result of this technical rule, Ether risks closing below its pennant structure, followed by additional mo...

Price analysis 5/13: BTC, ETH, BNB, XRP, ADA, SOL, DOGE, DOT, AVAX, SHIB

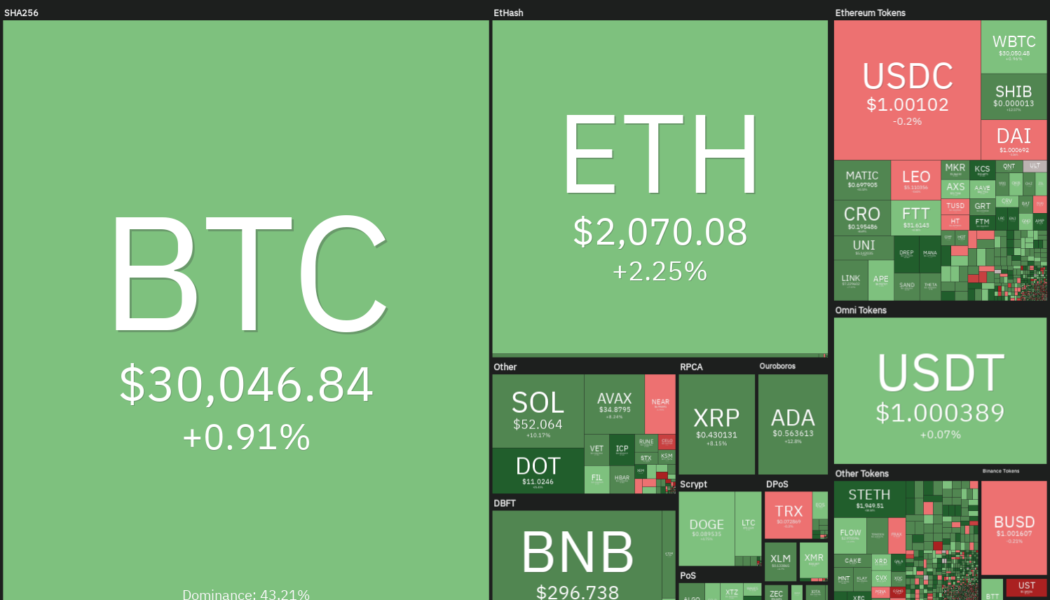

Bitcoin (BTC) rebounded sharply after dropping near its realized price of $24,000 on May 12, suggesting some bulls went against the herd and bought the dip. According to on-chain analytics platform CryptoQuant, the exchange balances declined by more than 24,335 Bitcoin on May 11 and 12, indicating that bulls may have started bottom fishing. However, macro investor Raoul Pal is not confident that a bottom has been made. In an exclusive interview with Cointelegraph, Pal said that if equity markets witness a capitulation phase, crypto markets are also likely to plunge before forming a bottom. He anticipates the current bear phase to end after the United States Federal Reserve stops hiking rates. Daily cryptocurrency market performance. Source: Coin360 Bear markets are known for sharp relief r...

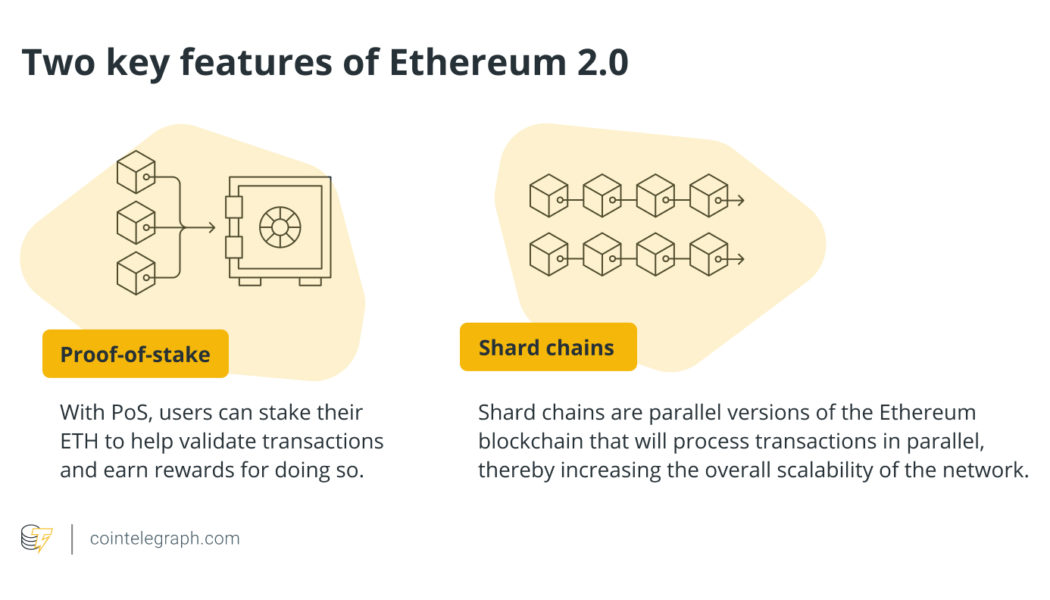

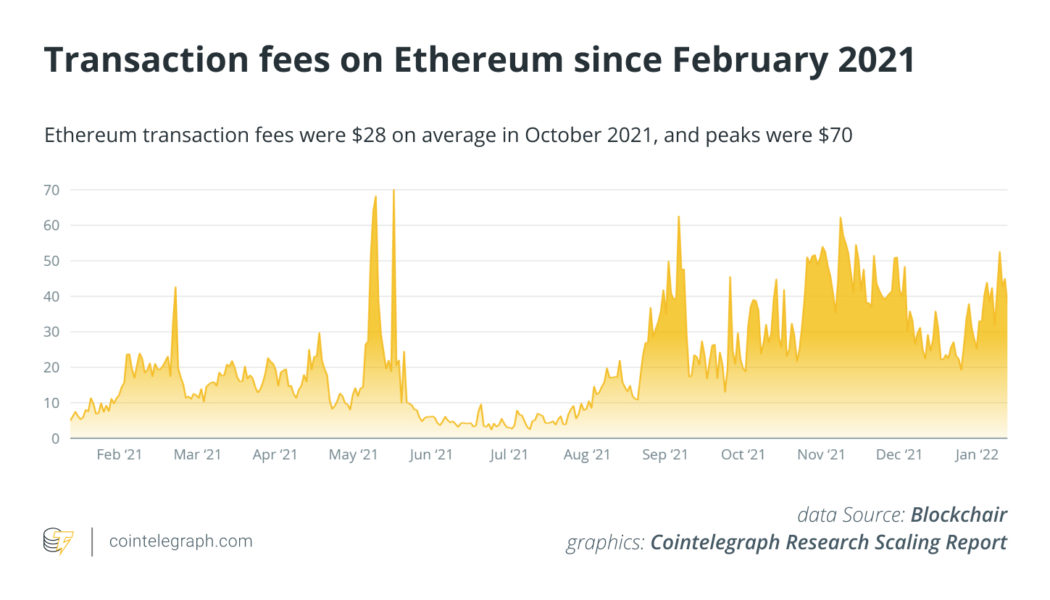

Will the Ethereum 2.0 update reduce high gas fees?

Purpose of Ethereum 2.0 The primary goal of the Ethereum 2.0 update is to improve scalability so that the network can handle more transactions without delays or high fees. While the full effects of the update will not be felt until it is fully rolled out, some of the possible use cases for Ethereum 2.0 include: Supporting the large-scale enterprise adoption of blockchain technology in private corporations and businesses; Creating more decentralized autonomous organizations (DAOs) and governance models based on smart contracts and trustless interactions; Ethereum token launches that will allow new projects to fundraise and launch their own tokens on the Ethereum network; The further expansion of nonfungible tokens (NFTs) and other digital assets that can be stored on the...

Anchor Protocol rebounds sharply after falling 70% in just two months — what’s next for ANC?

Anchor Protocol (ANC) returned to its bullish form this May after plunging by over 70% in the previous two months. Pullback risks ahead ANC’s price rebounded by a little over 42.50% between May 1 and May 6, reaching $2.26, its highest level in three weeks. Nonetheless, the token experienced a selloff on May 6 and May 7 after ramming into what appears to be a resistance confluence. That consists of a 50-day exponential moving average (50-day EMA; the red wave) and 0.786 Fib line of the Fibonacci retracement graph, drawn from the $1.32-swing low to the $5.82-swing high, as shown in the chart below. ANC/USD daily price chart. Source: TradingView A continued pullback move could see ANC’s price plunging towards its rising trendline support, coinciding with the floor near&...

Ethereum “Flippening” debate to resurface post-Merge?

Once upon a time in crypto-land, the word “Flippening” was brandished about daily. The term is slang for the much-discussed possibility of Ethereum “flipping” Bitcoin’s market cap, and hence becoming the world’s biggest cryptocurrency. But recently, there has not been as much talk about a new King, as the below Google Trend data for the search term “Flippening” shows. Regarding the price action, 1 ETH is now worth 0.06 BTC, having been close to 0.09 BTC before Christmas. As has become customary in the crypto markets, Bitcoin has held up better than its smaller counterparts, as the entire market has wobbled in 2022. However, the scale of ETH’s decline, denominated in Bitcoin, is indeed surprising, and steeper than we had seen for most of the pandemic bull run. Bitcoin Strength However...

Ethereum risks 35% drop by June with ETH price confirming ‘ascending triangle’ fakeout

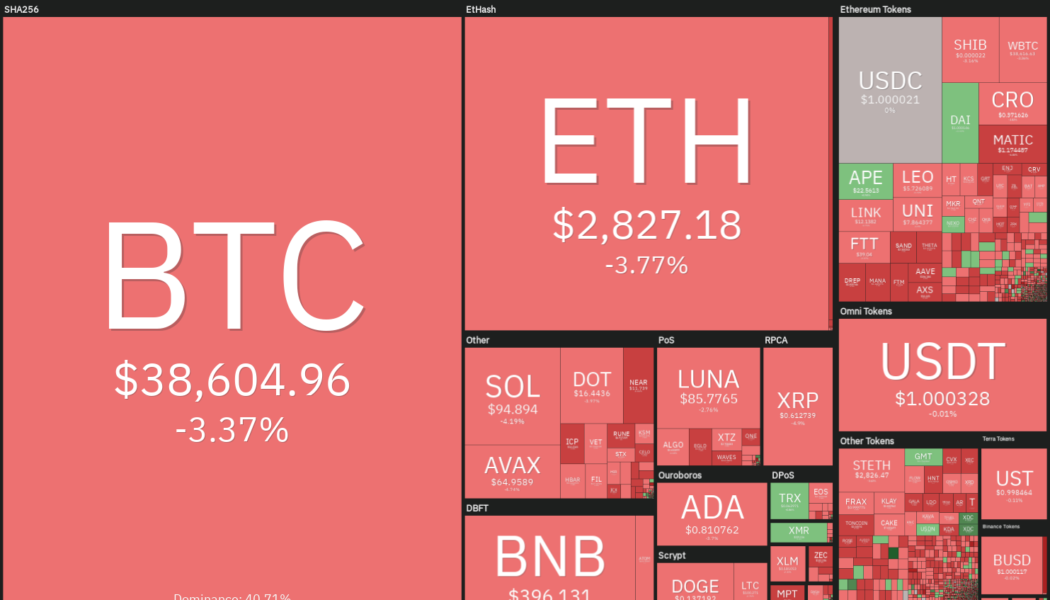

Ethereum’s native token Ether (ETH) faces the possibility of a 35% price correction in Q2 as it comes closer to breaking below its “ascending triangle” pattern. ETH price breakdown ahead? Ether’s price swung between profits and losses on May 2 while trading around $2,825, showing indecisiveness among traders about their next bias. Interestingly, the Ethereum token wobbled in the proximity of a rising trendline that constitutes an ascending triangle pattern in conjugation with a horizontal line resistance. To recap, ascending triangles are typically continuation patterns. That being said, Ether’s price was trending lower before forming its ascending triangle, raising its chances of a breakdown in the next few weeks. Another bearish sign comes from Ether&#...

Price analysis 4/29: BTC, ETH, BNB, SOL, LUNA, XRP, ADA, DOGE, AVAX, DOT

The U.S. dollar index (DXY) turned down from its 20-year high on April 29 but that has not changed the bearish price action seen in Bitcoin (BTC) and the U.S. equity markets. Equities remain under pressure and this week, Amazon stock saw its biggest intraday drop since 2014 after uncertainty over the U.S. Federal Reserve’s tightening measures placed investor sentiment back into choppy waters. If Bitcoin extends its correction, on-chain analysis platform Whalemap believes that the $25,000 to $27,000 zone may be the best place “to go all-in” on Bitcoin. Long-term investors do not appear to be panicking over the current weakness in Bitcoin and on-chain data from CryptoQuant shows that the combined BTC reserves of 21 crypto exchanges has plummeted to levels not seen since September 2...

Ethereum strives to migrate into a brighter future: Report

Ethereum 2.0 has been a highly anticipated development in the crypto industry. A recent Cointelegraph research report asks if Ethereum is still on track to defend its crown as the prime network backing the decentralized finance world. The report cuts through popular misconceptions investors may hold and offers a comparative analysis of Ethereum and its competitors. Meanwhile, the Ethereum foundation rebranded the Eth2 project at the start of this year. Is it trying to manage expectations or educate? New talk of consensus and execution layers In a blog post in January, the Ethereum foundation stated that developers had been moving away from the Eth1-Eth2 terminology since late 2021. Instead, Eth1 will now be called the “execution layer” and Eth2 the “consensus layer.” This is not a minor tw...

Could Lido Finance’s popularity put a damper on Ethereum’s decentralisation?

The high incentivisation of Lido Finance staking pools could centralise ETH supply control to the protocol. Ethereum will gain sufficient decentralisation to offset a potentially dominant Lido with the increasing adoption of competing liquid staking solutions. Lido Finance is Ethereum’s premier liquid staking protocol and has in recent months seen parabolic growth in the volume of staking deposits it receives. The spark behind the surge was the launch of the Beacon Chain, Ethereum’s PoS blockchain, to which users can’t withdraw their staked assets until launch. A leader in liquid staking, Lido Finance allows users, especially those who cannot manage their validator nodes, to put their ETH into staking pools at a 4% APR yield. Amongst other advantages, users who stake in Lido’s pools ...

Ethereum on-chain data hints at further downside for ETH price

Analyzing Ether’s (ETH) current price chart paints a bearish picture, which is largely justified by the 11% drop over the past month, but other traditional finance assets faced more extreme price corrections in the same period. The Invesco China Technology ETF (CQQ) is down 31% and the Russell 2000 declined by 8%. Ether price at FTX, in USD. Source: TradingView Currently, traders fear that losing the descending channel support at $2,850 could lead to a stronger price downturn, but this largely depends on how derivatives traders are positioned along with the Ethereum network’s on-chain metrics. According to Defi Llama, the Ethereum network’s total value locked (TVL) flattened in the last 30 days at 27 million Ether. TVL measures the number of coins deposited on smart contr...

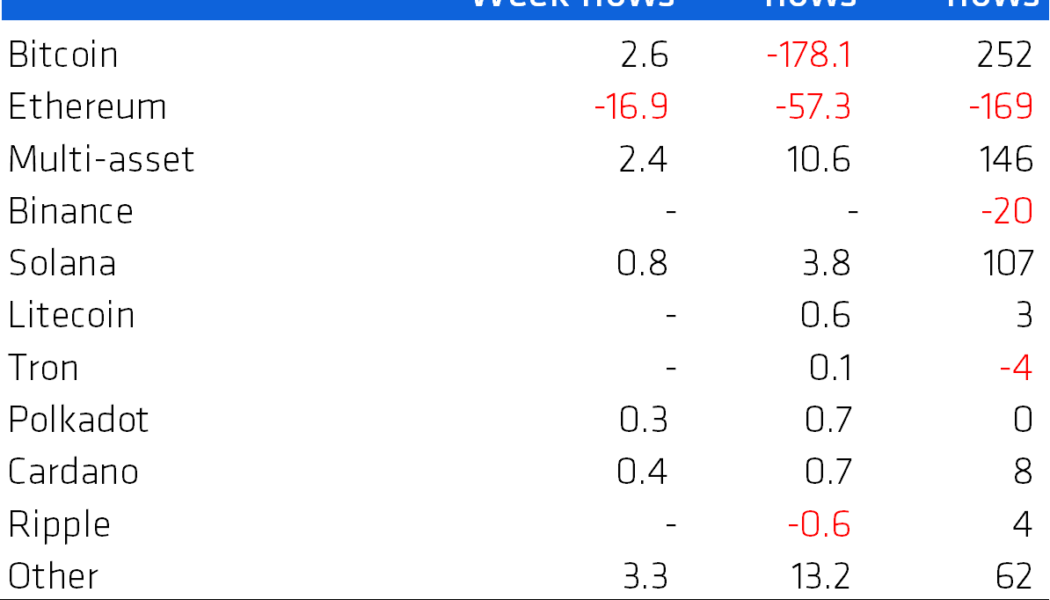

Institutional investment flows out of ETH and into competing L1 altcoins

Institutional investors have shifted their attention from Ethereum (ETH) to competing Layer 1 blockchains of late, with capital inflows for altcoin investment products increasing last week whilst Ether products posted outflows for the third week in a row. Data from CoinShares’ latest Digital Asset Fund Flows report shows that investors last week (ending April 22) loaded up on $3.5 million worth of Avalanche (AVAX), Solana (SOL), Terra (LUNA) and Algorand (ALGO) funds whilst capital outflows from Ether products totaled $16.9 million. It marks the third straight week that Ethereum products have seen outflows, bringing the total over that time to $59.3 million, equal to around 35% of the year-to-date outflows of $169 million from the second-largest blockchain. Notably, investors also favored ...