Ethereum

Price analysis 6/27: BTC, ETH, BNB, XRP, ADA, SOL, DOGE, DOT, SHIB, AVAX

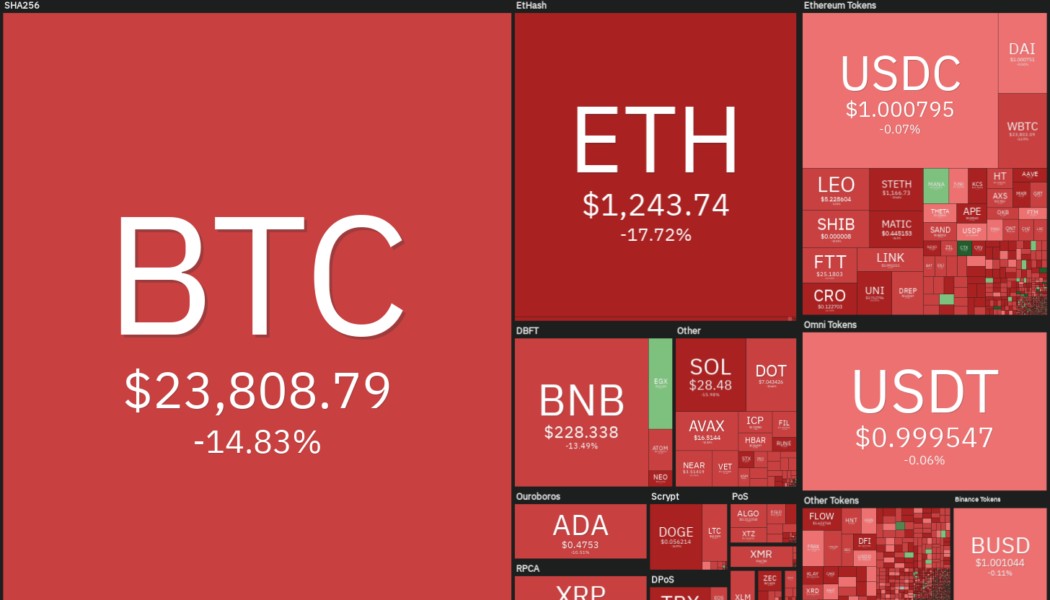

Bitcoin’s (BTC) current bear market is one of the worst, according to a report by on-chain analytics firm Glassnode. This was the first time in history that the Mayer Multiple slipped below the previous cycle’s low. Bitcoin’s fall below $20,000 on June 18 also marked the biggest loss ever booked by investors in a single day at $4.23 billion. Considering the above factors and a few other events, Glassnode believes that the capitulation in Bitcoin may have started. Bitcoin whales seem to have started their purchasing, suggesting that the bottom may be close and on June 25, analytics resource “Game of Trades” highlighted that demand from whales holding 1,000 to 10,000 Bitcoin witnessed a sharp spike in demand. Daily cryptocurrency market performance. Source: Coin360 Another sign t...

How low can Ethereum price drop versus Bitcoin amid the DeFi contagion?

Ethereum’s native token Ether (ETH) has declined by more than 35% against Bitcoin (BTC) since December 2021 with a potential to decline further in the coming months. ETH/BTC weekly price chart. Source: TradingView ETH/BTC dynamics The ETH/BTC pair’s bullish trends typically suggest an increasing risk appetite among crypto traders, where speculation is more focused on Ether’s future valuations versus keeping their capital long-term in BTC. Conversely, a bearish ETH/BTC cycle is typically accompanied by a plunge in altcoins and Ethereum’s decline in market share. As a result, traders seek safety in BTC, showcasing their risk-off sentiment within the crypto industry. Ethereum TVL wipe-out Interest in the Ethereum blockchain soared during the pandemic as developer...

Price analysis 6/24: BTC, ETH, BNB, XRP, ADA, SOL, DOGE, DOT, SHIB, LEO

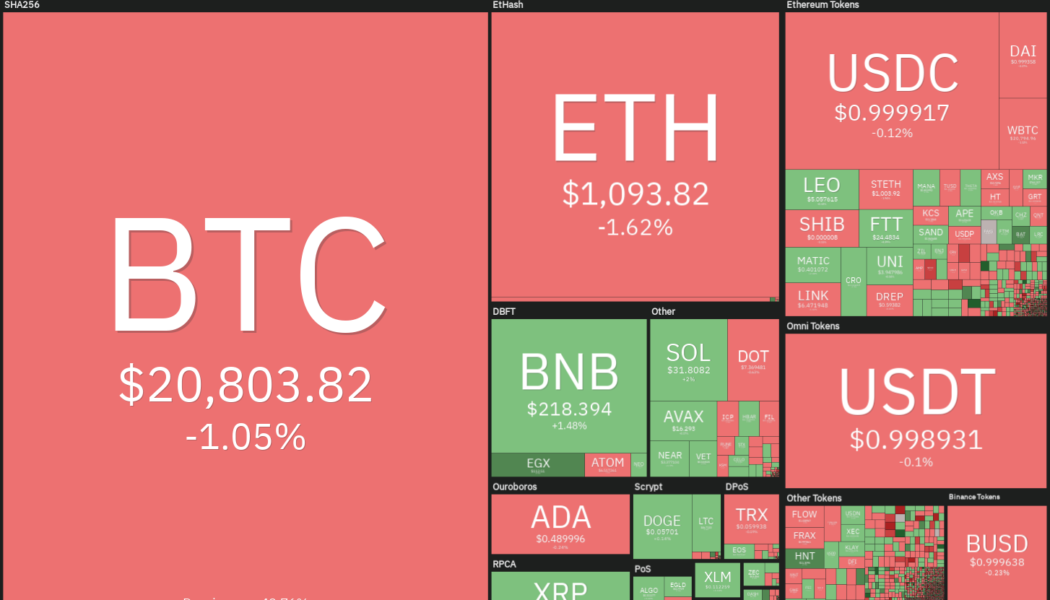

A handful of on-chain metrics suggest that Bitcoin could be close to bottoming, and if true, the eventual relief rally could induce sharp gains from altcoins. The United States equity markets and the cryptocurrency space are witnessing a relief rally this week. Supporting the rise in risky assets is the U.S. dollar index (DXY), which retreated from its multi-year high. Generally, cryptocurrencies move inverse to the price of the U.S. dollar, but this week’s bounce does not necessarily mean that bulls’ grip over the market has come to an end. Citing on-chain data, CryptoQuant senior analyst Julio Moreno, said that Bitcoin (BTC) miners may have already capitulated. Historical data suggests that miner capitulation usually precedes market bottoms. Daily cryptocurrency market perfor...

Ethereum price breaks out as ‘bad news is good news’ for stocks

Ethereum’s native token, Ether (ETH), gained alongside riskier assets as investors assessed weak U.S. economic data and its potential to cool down rate hike fears. Ether mirrors risk-on recovery ETH’s price climbed up to 8.31% on June 24 to $1,225, six days after falling below $880, its lowest level since January 2021. Overall, the upside retracement brought bulls 40% in gains, raising anticipation about an extended recovery in the future while alleviating fears of a “clean fakeout.” For instance, independent market analyst “PostyXBT” projected ETH’s price to close above $1,300 by the end of June. In contrast, analyst “Wolf” feared that bears would attempt to “push price back to $1,047,” albeit anticipating a run-up to...

Price analysis 6/22: BTC, ETH, BNB, ADA, XRP, SOL, DOGE, DOT, LEO, SHIB

Bitcoin (BTC) continues to face a tough battle near the psychological level of $20,000 as the bulls and the bears attempt to assert their supremacy. Trading firm QCP Capital said in their latest market circular that funding rates on derivatives markets were stable and bearish conditions were fading. Another ray of hope for the Bitcoin bulls is that Bitcoin miners may be capitulating as the recent decline in the price has made some mining machines unprofitable. Data from Arcane Research shows that public Bitcoin mining companies that had only sold 30% of their mined production from January to April of this year had dumped 100% of their Bitcoin production in May. Some analysts believe that miners giving up was a bullish signal. Daily cryptocurrency market performance. Source: Coin360 However...

Price analysis 6/20: BTC, ETH, BNB, ADA, XRP, SOL, DOGE, DOT, LEO, AVAX

The crypto markets have been in a strong bear phase for the past several months but JPMorgan Chase analysts expect that to change and they have projected a significant upside from the current levels. The analysts cited the rising share of all stablecoins in the total crypto market for their bullish outlook. Unperturbed by the current fall, retail traders have been adding Bitcoin (BTC) to their portfolios. The number of wallet addresses holding one Bitcoin surged by 13,091 to a record high of 865,254. Similarly, the number of addresses holding about 0.1 Bitcoin has also witnessed a sharp rise in the past 10 days, according to data from Glassnode. Daily cryptocurrency market performance. Source: Coin360 Bitcoin’s sharp recovery from the June 18 fall shows strong buying at lower levels&n...

Price analysis 6/17: BTC, ETH, BNB, ADA, XRP, SOL, DOGE, DOT, LEO, AVAX

The sharp fall in cryptocurrencies has pulled the total crypto market capitalization below $900 billion. According to CoinGoLive, 72 out of the top 100 tokens have declined in excess of 90% from their all-time highs. In comparison, the top-10 coins have outperformed during the fall, dropping an average of 79% from their all-time high. Bitcoin (BTC) is down more than 70% from its all-time high but the bulls are struggling to arrest the decline. Jurrien Timmer, director of global macro of Fidelity, highlighted that Bitcoin could be “cheaper than it looks” considering the metric of price-to-network ratio, which is similar to the price-to-earnings ratio used in the equities market to value a stock. Daily cryptocurrency market performance. Source: Coin360 Billionaire investor Mark Cuban s...

Ethereum risks another 60% drop after breaking below $1K to 18-month lows

The price of Ethereum’s native token, Ether (ETH), careened below $1,000 on June 18 as the ongoing sell-off in the crypto market continued despite the weekend. Ether reached $975, its lowest level since January 2021, losing 80% of its value from its record high in November 2021. The decline appeared amid concerns about the Federal Reserve’s 75 basis points rate hike, a move that pushed both cryptocurrencies and stocks into a strong bear market. “The Federal Reserve has barely started raising rates, and for the record, they haven’t sold anything on their balance sheet either,” noted Nick, an analyst at data resource Ecoinometrics, warnings that “there is bound to be more downside coming.” ETH/USD weekly price chart. Source: TradingView Ethereum...

Inverse Finance exploited again for $1.2M in flashloan oracle attack

Just two months after losing $15.6 million in a price oracle manipulation exploit, Inverse Finance has again been hit with a flashloan exploit that saw the attackers make off with $1.26 million in Tether (USDT) and Wrapped Bitcoin (WBTC). Inverse Finance is an Ethereum based decentralized finance (DeFi) protocol and a flashloan is a type of crypto loan that is usually borrowed and returned within a single transaction. Oracles report outside pricing information. The latest exploit worked by using a flashloan to manipulate the price oracle for a liquidity provider (LP) token used by the protocol’s money market application. This allowed the attacker to borrow a larger amount of the protocol’s stablecoin DOLA than the amount of collateral they posted, letting them pocket the difference. The at...

Ethereum crashed by 94% in 2018 — Will history repeat with ETH price bottoming at $375?

Ethereum’s native token Ether (ETH) is showing signs of bottoming out as ETH price bounced off a key support zone. Notably, ETH price is now holding above the key support level of the 200-week simple moving average (SMA) near $1,196. The 200-week SMA support seems purely psychological, partly due to its ability to serve as bottom levels in the previous Bitcoin bear markets. Independent market analyst “Bluntz” argues that the curvy level would also serve as a strong price floor for Ether where accumulation is likely. He notes: “BTC has bottomed 4x at the 200wma dating back to 2014. [Probably] safe to assume it’s a pretty strong level. Sure we can wick below it, but there [are] also six days left in the week.” ETH/USD weekly pric...

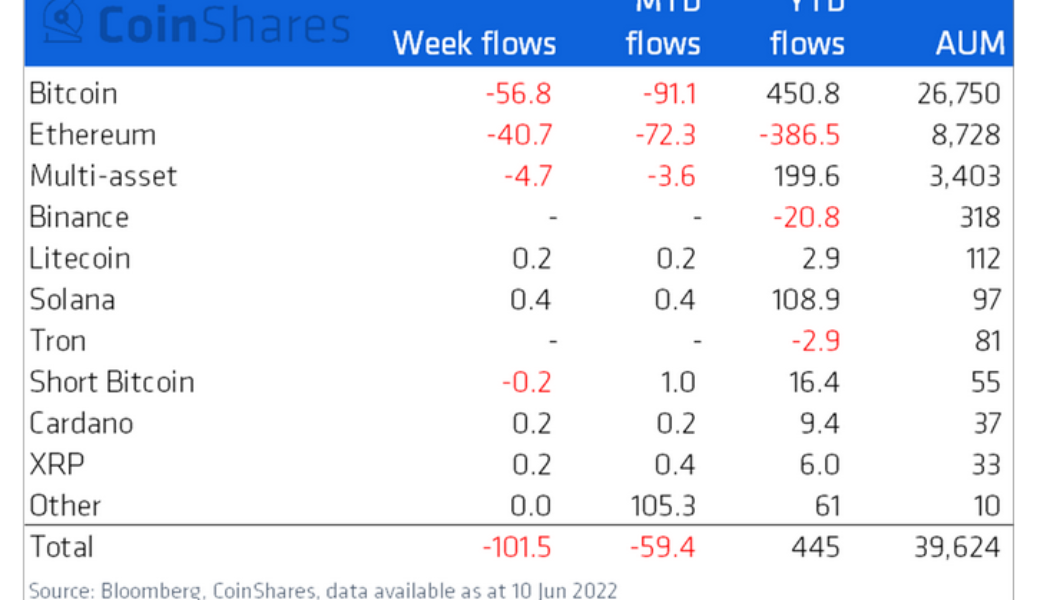

Almost $100M exits US crypto funds in anticipation of hawkish monetary policy

Institutional investors offloaded $101.5 million worth of digital asset products last week in ‘anticipation of hawkish monetary policy’ from the U.S. Federal Reserve according to CoinShares. U.S. inflation rates hit 8.6% year-on-year at the end of May, marking a return to levels not seen since 1981. As a result, the market is expecting the Fed to take considerable action to reel in inflation, with some traders pricing in three more 0.5% rate hikes by October. According to the latest edition of CoinShares’ weekly Digital Asset Fund Flows report, the outflows between June 6 and June 10 were primarily led by investors from the Americas at $98 million, while Europe accounted for just $2 million. Products offering exposure to crypto’s top two assets, Bitcoin (BTC) and Ethereum (ETH), accounted ...

Price analysis 6/13: BTC, ETH, BNB, ADA, XRP, SOL, DOGE, DOT, LEO, AVAX

The United States equities markets extended their decline to start the week on June 13. The S&P 500 hit a new year-to-date low and dipped into bear market territory, falling more than 20% from its all-time high made on Jan. 4. The cryptocurrency markets are tracking the equities markets lower and the selling pressure further intensified due to the rumored liquidity crisis of major lending platform Celsius and traders possibly selling positions to meet margin calls. This pulled the total crypto market capitalization below $1 trillion. Daily cryptocurrency market performance. Source: Coin360 The sharp declines have led some analysts to project extremely bearish targets. While anything is possible in the markets and it is difficult to call a bottom, capitulations usually tend to sta...