Ethereum

Price analysis 7/18: BTC, ETH, BNB, XRP, ADA, SOL, DOGE, DOT, MATIC, AVAX

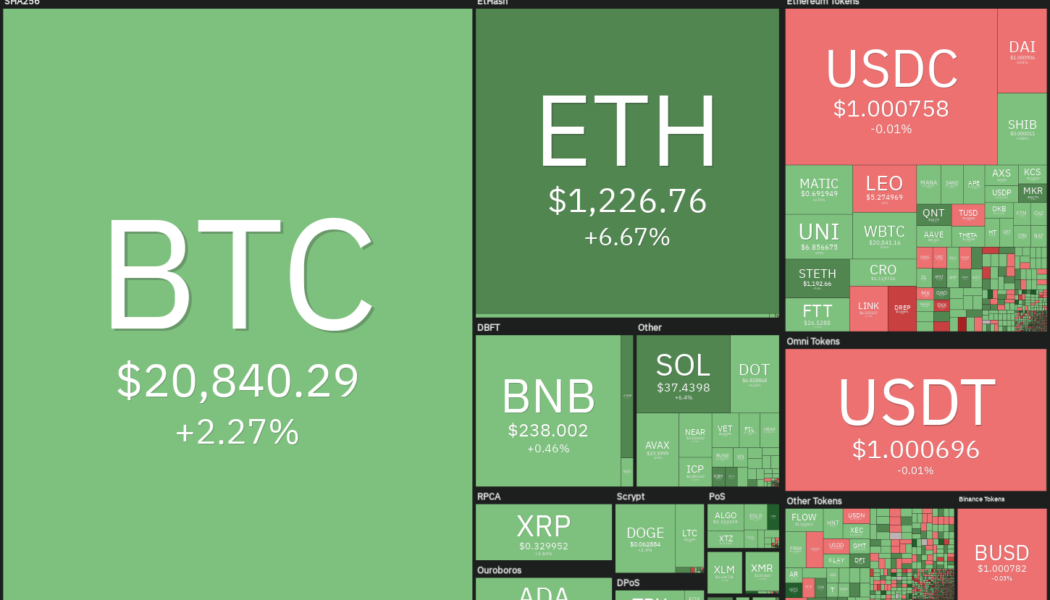

Bitcoin (BTC) rose above $22,000 and Ether (ETH) traded above $1,500 on July 18, indicating that bulls are gradually returning to the cryptocurrency markets. This pushed the total crypto market capitalization above $1 trillion for the first time since June 13, raising hopes that the worst of the bear market may be behind us. In another positive sign, more than 80% of the total Bitcoin supply denominated in the United States dollar has been dormant for at least three months, according to crypto intelligence firm Glassnode. During previous bear markets, such an occurrence preceded the end of the bear phase. Daily cryptocurrency market performance. Source: Coin360 However, a report by Grayscale Investments voices a different opinion. It suggests that the current bear market in Bitcoin started...

Price analysis 7/15: BTC, ETH, BNB, XRP, ADA, SOL, DOGE, DOT, SHIB, AVAX

The recovery in the cryptocurrency markets is being led by Bitcoin (BTC), which has risen above the $21,000 level. However, BlockTrends analyst Caue Oliveira said that on-chain data shows a decline in “whale activity” since the month of May, barring the flurry of activity during the Terra (LUNA) — since renamed Terra Classic (LUNC) — collapse. A survey conducted in China shows that most participants believe that Bitcoin could fall much further. About 40% of the participants said they would buy Bitcoin if the price dropped to $10,000. Only 8% of the voters showed interest in buying Bitcoin if it drops to $18,000. Daily cryptocurrency market performance. Source: Coin360 Millionaire investor Kevin O’Leary told Cointelegraph that crypto markets are likely to witness “massive volatility” and en...

Top 5 cryptocurrencies to watch this week: BTC, ETH, MATIC, FTT, ETC

The United States equities markets recovered from their intra-week lows last week, suggesting demand exists at lower levels. On similar lines, Bitcoin (BTC) also recovered from $18,910 last week, indicating that traders may be getting back into risky assets. However, analysts remain divided in their opinion on the recovery in Bitcoin. While some believe that the relief rally is a bull trap, others expect the up-move to retest the crucial resistance at the 200-week moving average ($22,626). Crypto market data daily view. Source: Coin360 The current bear phase has damaged sentiment as seen from the Crypto Fear and Greed Index, which has remained in the “extreme fear” zone since May 6. According to Philip Swift, creator of on-chain analytics platform LookIntoBitcoin, the time spent...

Ethereum traders gauge fakeout risks after 40% ETH price rally

Ethereum’s native token Ether (ETH) saw a modest pullback on July 17 after ramming into a critical technical resistance confluence. Merge-led Ethereum price breakout ETH’s price dropped by 1.8% to $1,328 after struggling to move above two strong resistance levels: the 50-day exponential moving average (5-day EMA; the red wave) and a descending trendline (black) serving as a price ceiling since May. ETH/USD daily price chart. Source: TradingView Previously, Ether rallied by over 40% from $1,000 on July 13 to over $1,400 on July 16. The jump appeared partly due to euphoria surrounding “the Merge” slated for September. Meanwhile, a golden cross’s appearance on Ethereum’s four-hour chart also boosted Ether’s upside sentiment among technical a...

Lido DAO most ‘overbought’ since April as LDO price rallies 150% in two weeks — what’s next?

The price of Lido DAO (LDO) dropped heavily a day after its key momentum oscillator crossed into “overbought” territory. LDO undergoes overbought correction LDO’s price plunged to as low as $1.04 on July 16 from $1.32 on July 15, amounting to a 20%-plus decline. The token’s sharp downside move took its cues from multiple bearish technical indicators, including its daily relative strength index (RSI) and its 100-day exponential moving average (EMA). LDO’s latest plunge came after it rallied over 150% in just two weeks, a move that simultaneously pushed its daily RSI above 70 on July 15, thus turning it overbought. An overbought RSI signals that the rally may be nearing an end while readying for a short-term pullback. Meanwhile, more downside cues for the ...

Price analysis 7/13: BTC, ETH, BNB, XRP, ADA, SOL, DOGE, DOT, SHIB, LEO

The United States Consumer Price Index soared to 9.1% in June, exceeding expectations of an 8.8% rise year-on-year. Currently, the Fed funds futures point to an 81 basis points rate hike for July, suggesting that some participants anticipate a 100 basis points hike. Several on-chain indicators have been pointing to a likely bottom in Bitcoin (BTC) but the analysts from market intelligence firm Glassnode are not convinced that the low has been made. In “The Week On-Chain” report on July 11, the analysts said that the market may have to fall further “to fully test investor resolve, and enable the market to establish a resilient bottom.” Daily cryptocurrency market performance. Source: Coin360 While the short term remains bearish, strategists are confident about its long-term prospects. ...

Institutional investor sentiment about ETH improves as Merge approaches

Ethereum prices may have dipped again today, but there are signs that professional investors are warming to the asset as the highly anticipated Merge draws closer. In its digital asset fund flows weekly report, fund manager CoinShares reported that Ethereum-based products saw inflows for the third consecutive week. There was an inflow of $7.6 million for institutional Ethereum funds, whereas those for Bitcoin continued to outflow with a loss of $1.7 million. Referring to the Ethereum funds CoinShares stated: “The inflows suggest a modest turnaround in sentiment, having endured 11 consecutive weeks of outflows that brought 2022 outflows to a peak of US$460M.” It added that the change in sentiment may be due to the increasing probability of the Merge happening later this year. The Merge is a...

Price analysis 7/4: BTC, ETH, BNB, XRP, ADA, SOL, DOGE, DOT, LEO, SHIB

The crypto markets have remained relatively stable over the weekend and on July 4, which is a holiday for the United States financial markets due to Independence Day. Although Arthur Hayes, former CEO of derivatives platform BitMEX, was expecting a “mega crypto dump” around July 4, it has not materialized. The drop in Bitcoin’s (BTC) volatility in the past few days has resulted in the squeezing of the Bollinger Band’s width. This indicates a possible increase in volatility in the next few days, according to popular analyst Matthew Hyland. Daily cryptocurrency market performance. Source: Coin360 Meanwhile, crypto investors seem to be waiting for clues from the U.S. equities markets and the U.S. dollar. Bitcoin’s correlation coefficient with the dollar in the week ending July 3 slumped to 0....

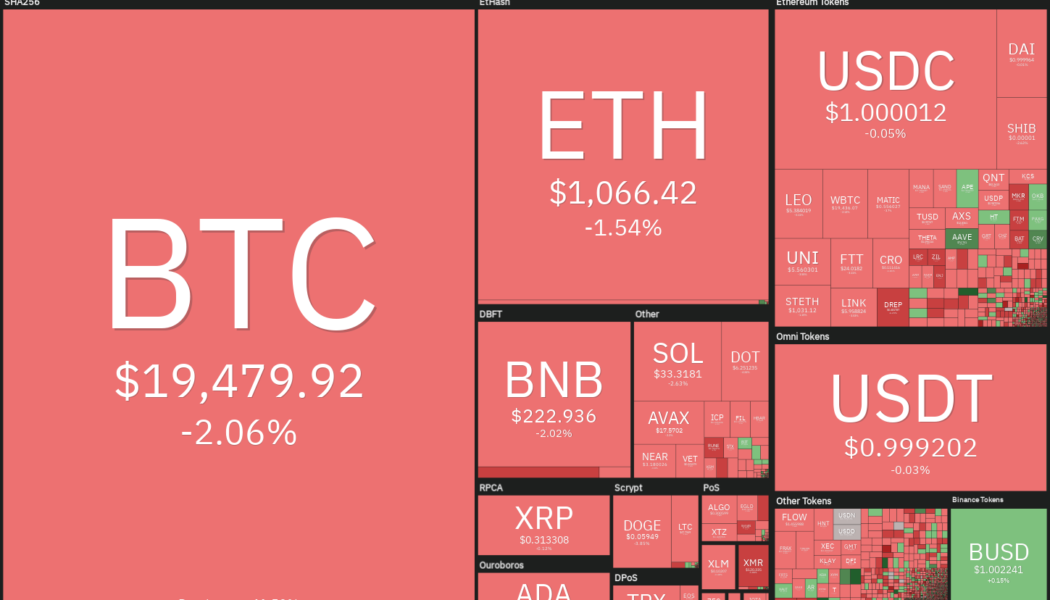

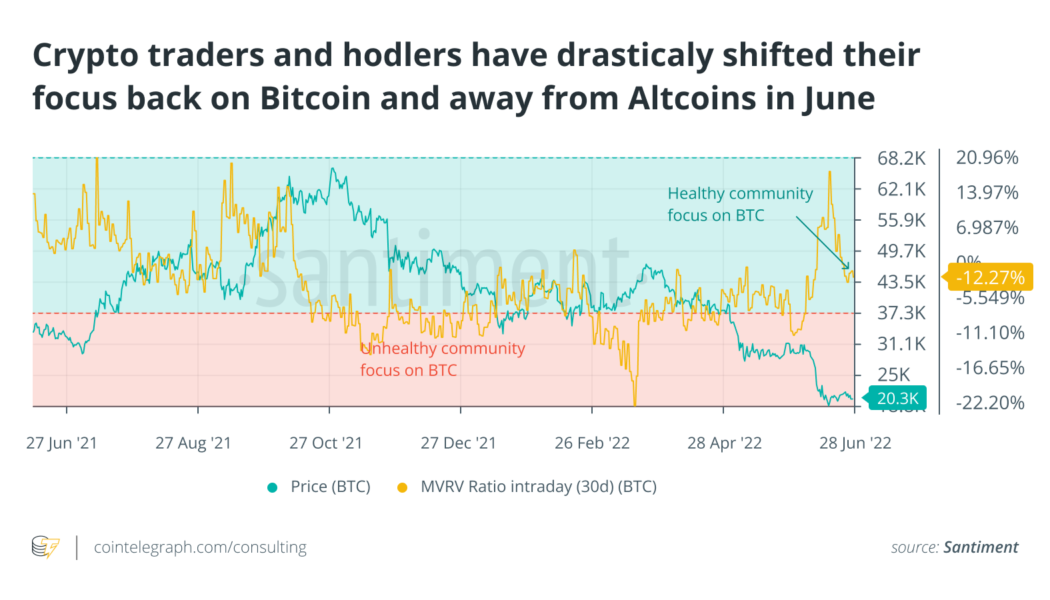

June gloom takes on a new meaning in another 2022 down month

The market cap of Bitcoin (BTC) dropped another 33% in June, which is now beginning to numb the Twitter community. On the upside, many crypto traders who wanted out did so fairly aggressively from March to May. But, the less optimistic news is that the stagnancy in address activity may need to change for prices to get a running start on recovery. Unlike April and May, the altcoin pack didn’t struggle tremendously more than Bitcoin. BTC’s 33% drop was pretty middle of the road in terms of corrections. In a vacuum, crypto bulls would prefer seeing altcoins continuing to lag, pushing more traders back toward Bitcoin as a relative “safe haven.” Nevertheless, June was a tale of two halves. June 1-15 saw a massive 25% further downswing for Bitcoin. Comparatively, June 16-30 was looking up until ...

Price analysis 7/1: BTC, ETH, BNB, XRP, ADA, SOL, DOGE, DOT, LEO, SHIB

Bitcoin dropped 56.2% in the second quarter of 2022, according to crypto analytics platform Coinglass. That makes it Bitcoin’s worst quarter since the third quarter of 2011 when BTC price fell by 67%. A large part of the damage was done in the month of June when Bitcoin plunged 37%, the worst monthly drawdown since September 2011. It is not all gloom and doom for crypto investors. On June 29, JPMorgan strategist Nikolaos Panigirtzoglou said that the “Net Leverage metric” suggests that crypto’s deleveraging may be on its last legs. The eagerness of crypto companies with stronger balance sheets to bail out crypto firms in distress is also a positive sign. Daily cryptocurrency market performance. Source: Coin360 Another positive view on Bitcoin came from Deutsche Bank analysts. In a recent re...

Ethereum fork a success as Sepolia testnet gears up to trial the Merge

The difficulty bomb-delaying Gray Glacier hard fork went live on Ethereum on Thursday without a hitch according to the network’s core devs including Ethereum Foundation’s Tim Beiko. The Sepolia testnet is also set to run through its Merge trial over the next few days and is the second last testnet to go through the trial before the official Merge. According to Etherscan, the Gray Glacier hard fork was initiated on block number 15050000 at roughly 6:54 am ET, June 30. The hard fork will now delay the difficulty bomb by roughly 700,000 blocks or 100 days, giving devs until mid-October to complete the long-awaited Merge. Ethereum Foundation community manager Tim Beiko promptly went to note on Twitter later that day that at 20 blocks past the fork, all monitored notes remained in sync, st...

Terra’s LUNA2 skyrockets 70% in nine days despite persistent sell-off risks

The price of Terra (LUNA2) has recovered sharply nine days after falling to its historic lows of $1.62. On June 27, LUNA2’s rate reached $2.77 per token, thus chalking up a 70% recovery when measured from the said low. Still, the token traded 77.35% lower than its record high of $12.24, set on May 30. LUNA2’s recovery mirrored similar retracement moves elsewhere in the crypto industry with top crypto assets Bitcoin (BTC) and Ether (ETH) rising by approximately 25% and 45% in the same period. LUNA2/USD four-hour price chart versus BTC/USD. Source: TradingView LUNA2 price rally could trap bulls The recent bout of buying in the LUNA2 market could trap bulls, given it has come as a part of a broader correction trend. In detail, LUNA2 appears to be forming a “bear flag&#...